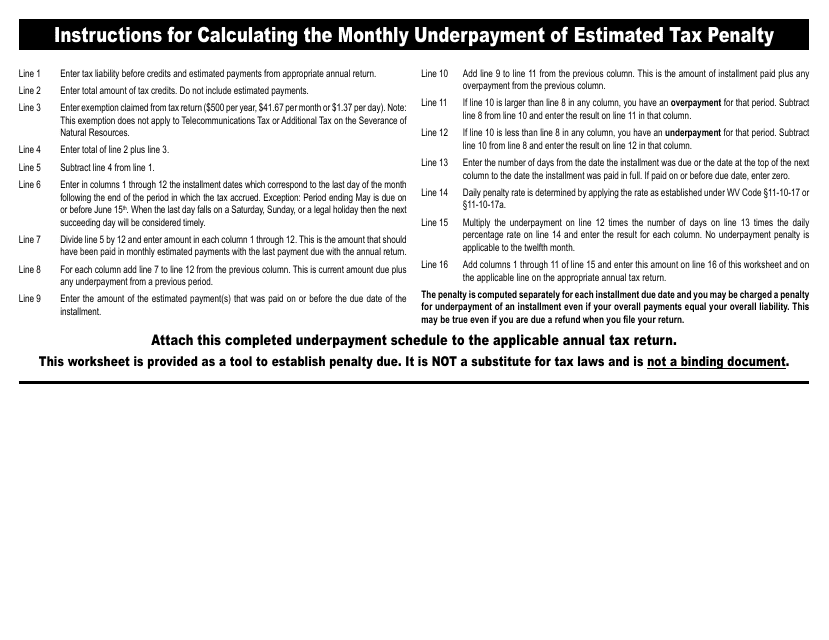

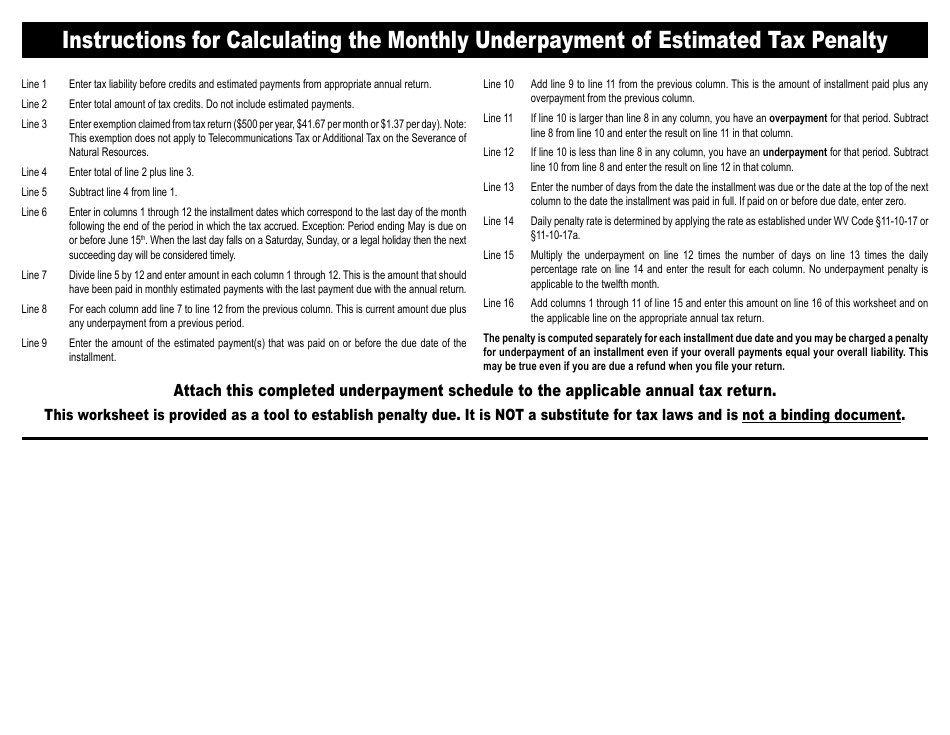

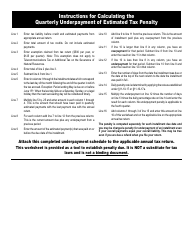

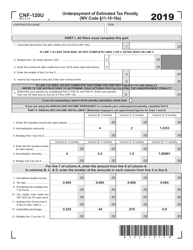

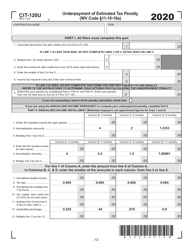

Instructions for Calculating the Monthly Underpayment of Estimated Tax Penalty - West Virginia

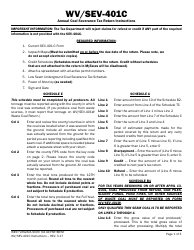

This document was released by West Virginia State Tax Department and contains the most recent official instructions for Calculating the Monthly Underpayment of Estimated Tax Penalty .

FAQ

Q: What is the penalty for underpayment of estimated tax in West Virginia?

A: The penalty for underpayment of estimated tax in West Virginia is calculated based on the amount of tax owed and the number of days the tax is underpaid.

Q: How can I calculate the monthly underpayment of estimated tax penalty in West Virginia?

A: To calculate the monthly underpayment of estimated tax penalty in West Virginia, you need to determine the underpayment amount, calculate the interest, and divide it by the number of months the tax is underpaid.

Q: What factors are considered when calculating the penalty?

A: The penalty amount depends on the underpayment amount and the number of days the tax is underpaid.

Q: How do I determine the underpayment amount?

A: The underpayment amount is the difference between the tax owed and the estimated tax payments made.

Q: What is the interest rate used to calculate the penalty?

A: The interest rate used to calculate the penalty is determined by the West Virginia State Tax Commissioner.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the West Virginia State Tax Department.