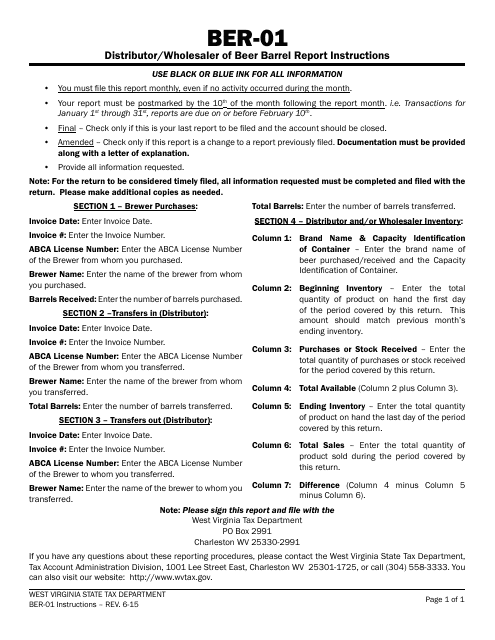

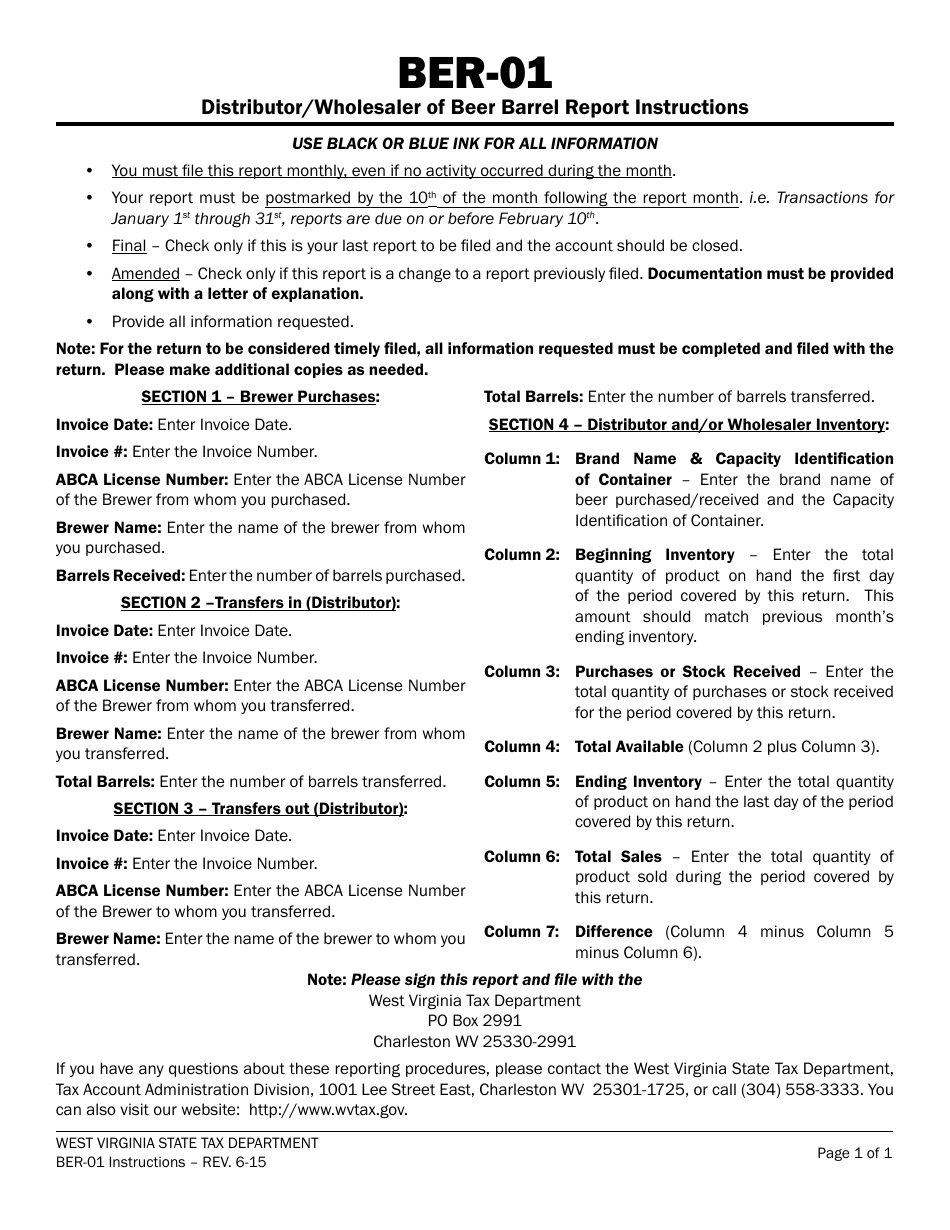

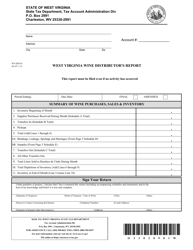

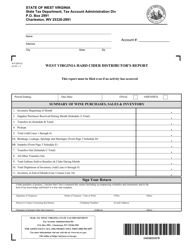

Instructions for Form WV / BER-01 Distributor / Wholesaler of Beer Barrel Report - West Virginia

This document contains official instructions for Form WV/BER-01 , Distributor/Wholesaler of Beer Barrel Report - a form released and collected by the West Virginia State Tax Department. An up-to-date fillable Form WV/BER-01 is available for download through this link.

FAQ

Q: What is Form WV/BER-01?

A: Form WV/BER-01 is a report for distributors and wholesalers of beer in West Virginia.

Q: Who needs to file Form WV/BER-01?

A: Distributors and wholesalers of beer in West Virginia need to file Form WV/BER-01.

Q: What is the purpose of Form WV/BER-01?

A: Form WV/BER-01 is used to report beer barrel transactions in West Virginia.

Q: How often do I need to file Form WV/BER-01?

A: Form WV/BER-01 needs to be filed on a monthly basis.

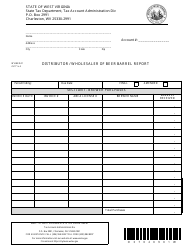

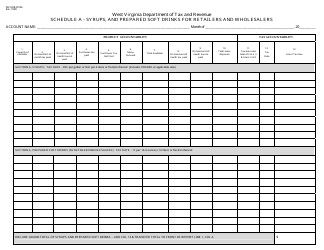

Q: What information do I need to provide on Form WV/BER-01?

A: You need to provide information about the beer barrels sold or received, including the brand, size, quantity, and date of the transaction.

Q: Are there any deadlines for filing Form WV/BER-01?

A: Yes, Form WV/BER-01 must be filed by the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form WV/BER-01?

A: Yes, there are penalties for late filing of Form WV/BER-01, including a penalty of $50 per day for each day the report is late.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.