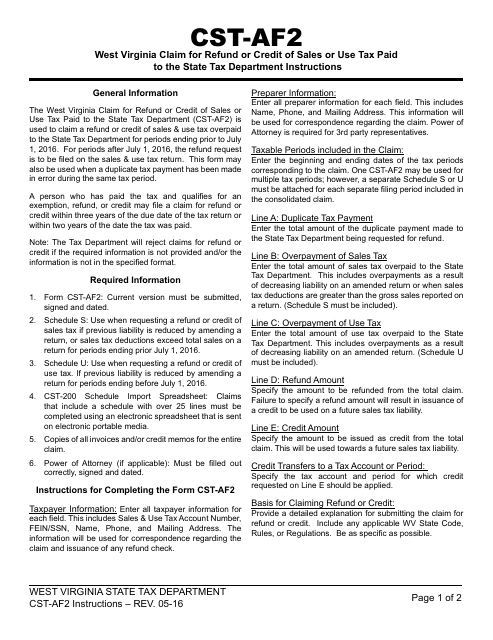

Instructions for Form WV / CST-AF2 West Virginia Claim for Refund or Credit of Sales or Use Tax Paid to the State Tax Department - West Virginia

This document contains official instructions for Form WV/CST-AF2 , West Virginia Claim for Refund or Credit of Sales or Use Tax Paid to the State Tax Department - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Form WV/CST-AF2?

A: Form WV/CST-AF2 is a form used to claim a refund or credit for sales or use tax paid to the West Virginia State Tax Department.

Q: Who can use Form WV/CST-AF2?

A: Any individual or business that has paid sales or use tax to the West Virginia State Tax Department can use Form WV/CST-AF2 to claim a refund or credit.

Q: What is the purpose of Form WV/CST-AF2?

A: The purpose of Form WV/CST-AF2 is to provide a way for individuals and businesses to recover or offset sales or use tax that they have already paid.

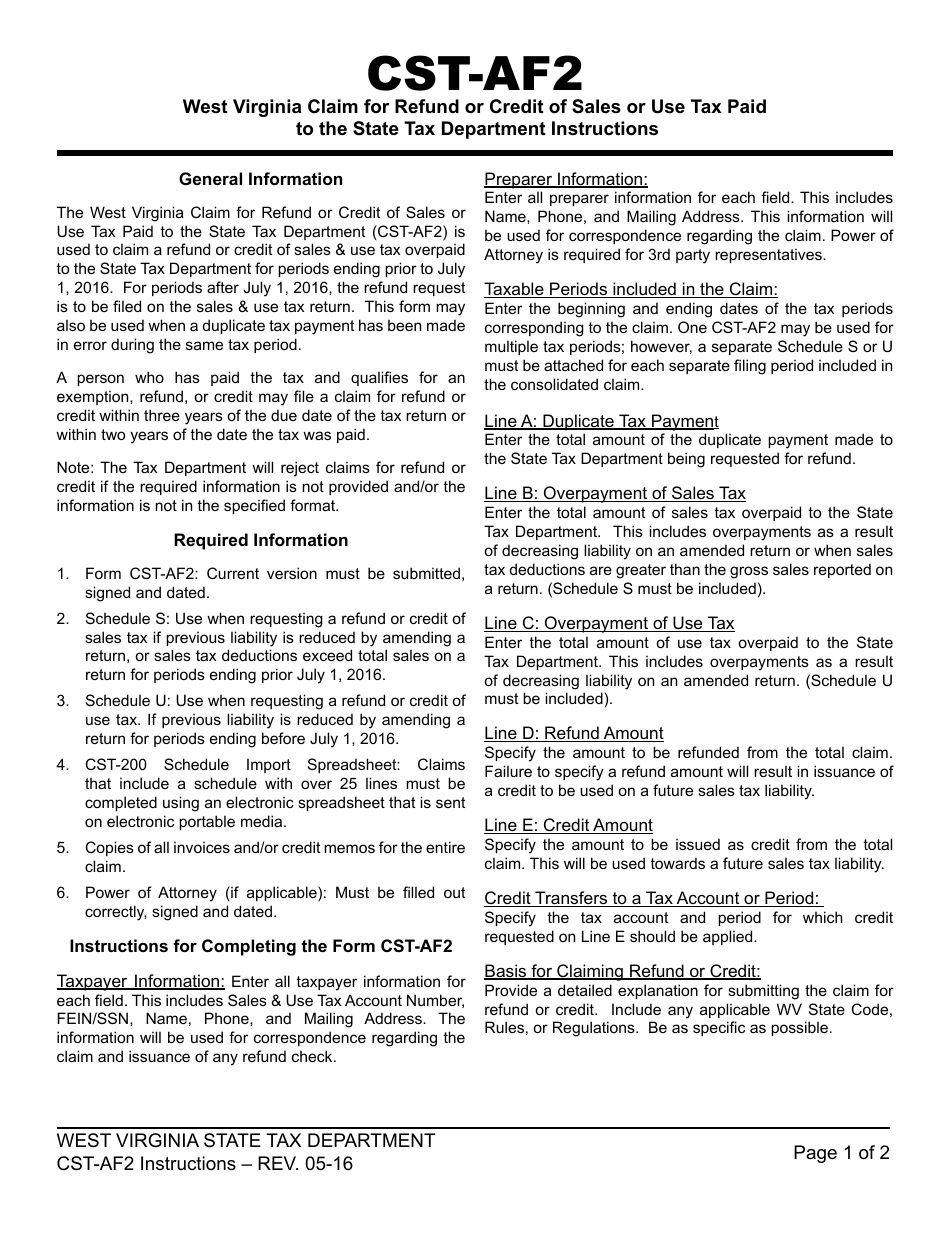

Q: What information do I need to complete Form WV/CST-AF2?

A: To complete Form WV/CST-AF2, you will need to provide information such as your name, address, tax account number, and details about the sales or use tax you are seeking a refund or credit for.

Q: Are there any deadlines for filing Form WV/CST-AF2?

A: Yes, Form WV/CST-AF2 must be filed within three years from the date of the overpayment of the tax or within three years from the date the tax was due, whichever is later.

Q: How long does it take to process a claim submitted on Form WV/CST-AF2?

A: The processing time for a claim submitted on Form WV/CST-AF2 can vary, but the West Virginia State Tax Department aims to process most claims within a reasonable timeframe.

Q: Are there any fees associated with filing Form WV/CST-AF2?

A: No, there are no fees associated with filing Form WV/CST-AF2.

Q: What should I do if I have additional questions about Form WV/CST-AF2?

A: If you have additional questions about Form WV/CST-AF2, you can contact the West Virginia State Tax Department directly for assistance.

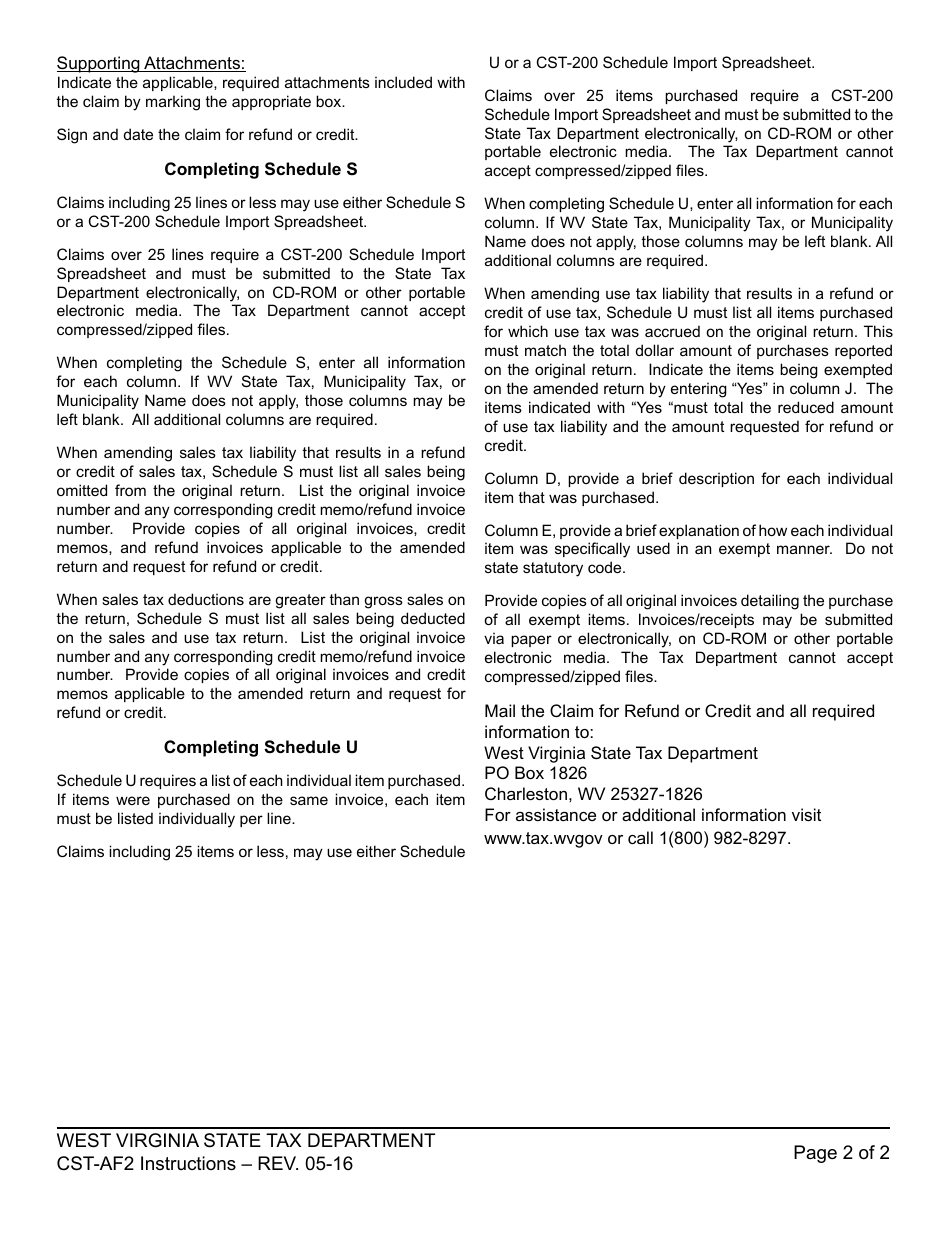

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.