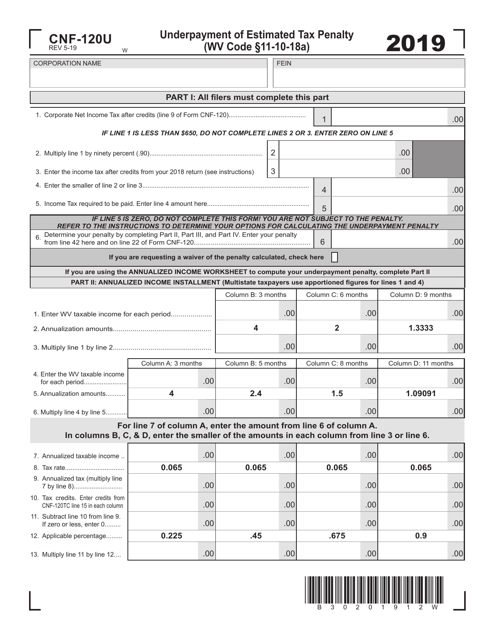

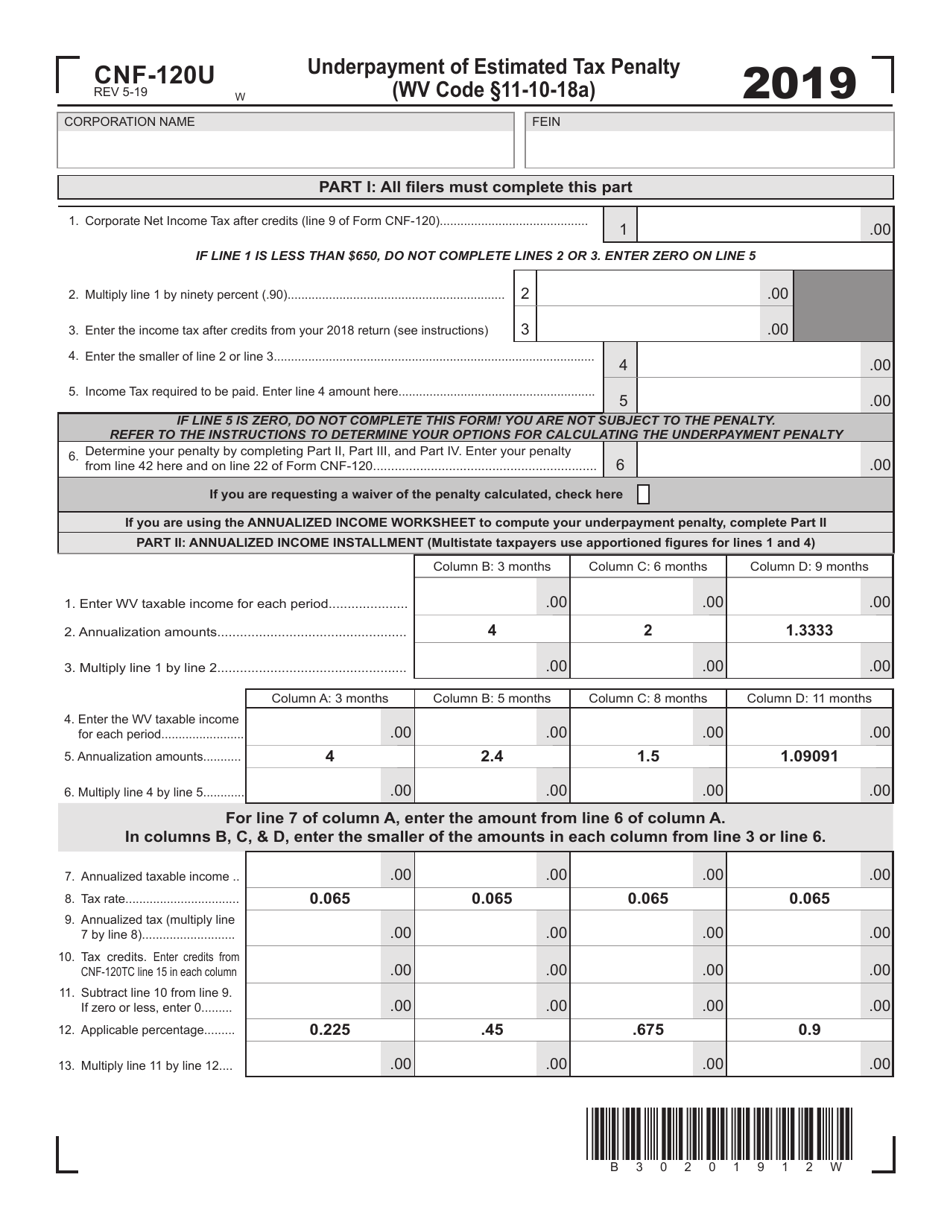

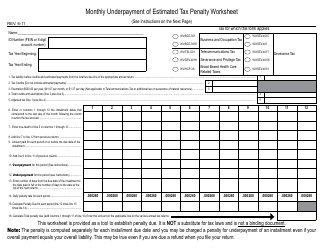

Form CNF-120U Underpayment of Estimated Tax Penalty - West Virginia

What Is Form CNF-120U?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNF-120U?

A: Form CNF-120U is the underpayment of estimated tax penalty form for West Virginia.

Q: Who needs to file Form CNF-120U?

A: Individuals and businesses in West Virginia who have underpaid their estimated state tax liability may need to file Form CNF-120U.

Q: What is the purpose of Form CNF-120U?

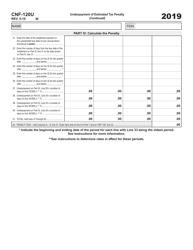

A: The purpose of Form CNF-120U is to calculate and report any underpayment penalties for failing to pay the estimated state tax liability.

Q: When is Form CNF-120U due?

A: Form CNF-120U is generally due by the same date as the West Virginia income tax return, which is April 15th.

Q: Are there any exceptions to the underpayment penalty?

A: Yes, there are exceptions to the underpayment penalty. For example, if your total tax liability for the year is less than $500, you may be exempt from the penalty.

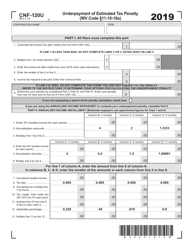

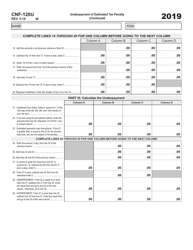

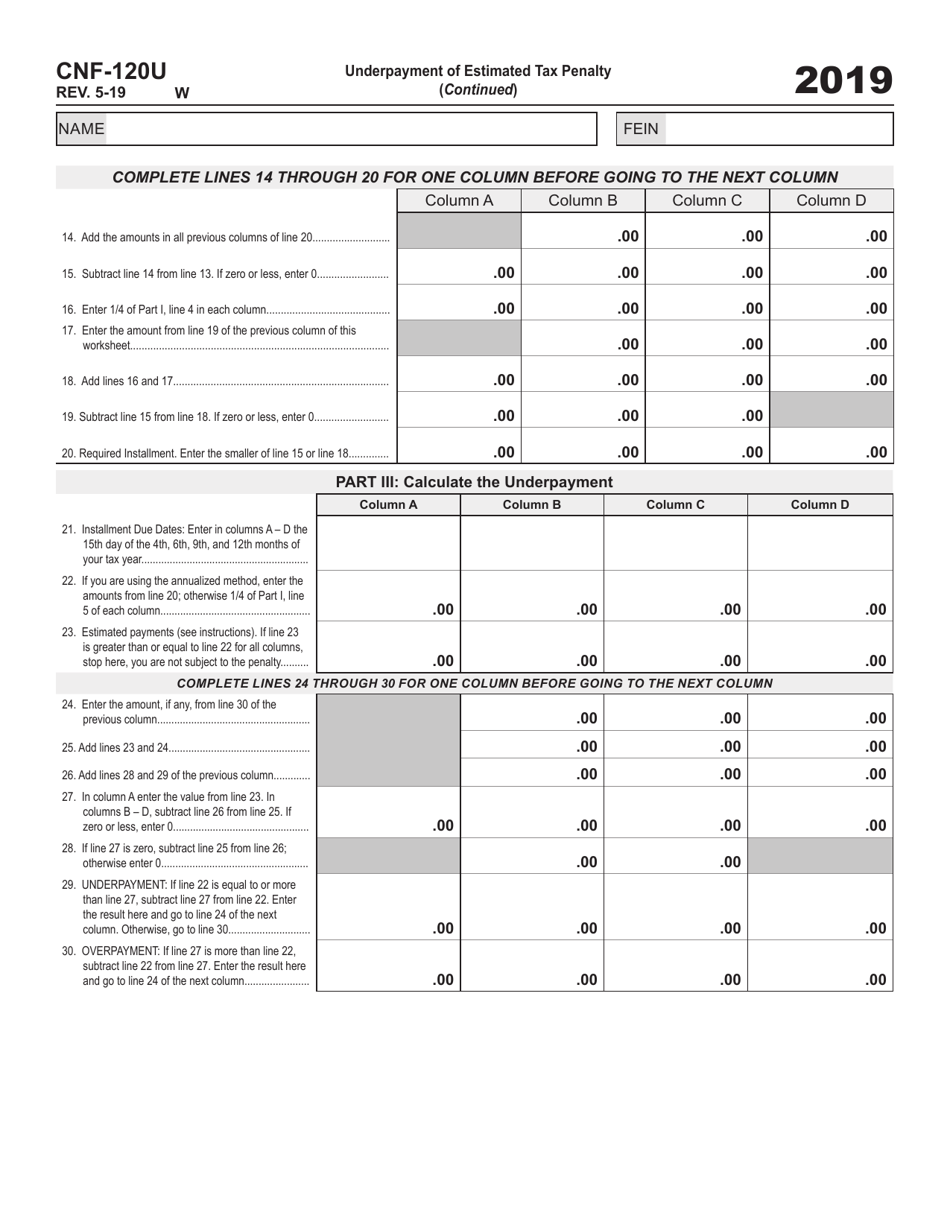

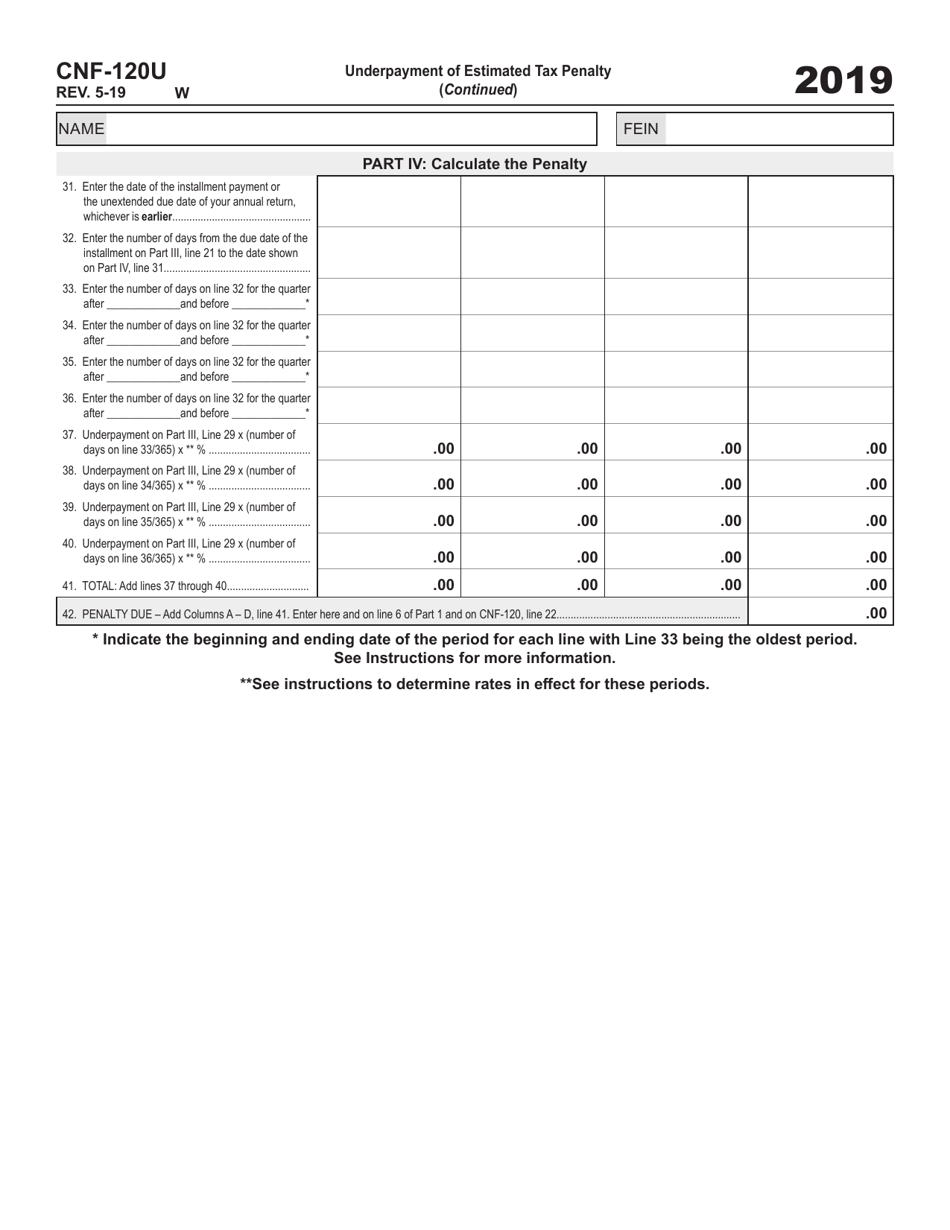

Q: How do I complete Form CNF-120U?

A: Form CNF-120U requires you to provide your personal and financial information, calculate the underpayment penalty, and include the payment with your tax return.

Q: What happens if I don't file Form CNF-120U?

A: If you are required to file Form CNF-120U and fail to do so, you may incur penalty and interest charges on top of your unpaid tax liability.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120U by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.