This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-9

for the current year.

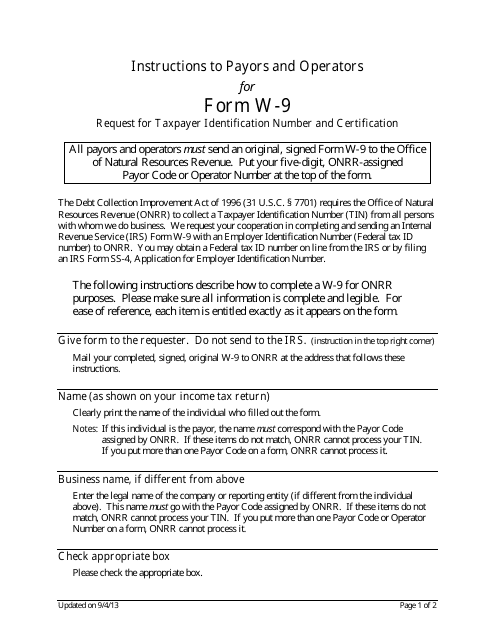

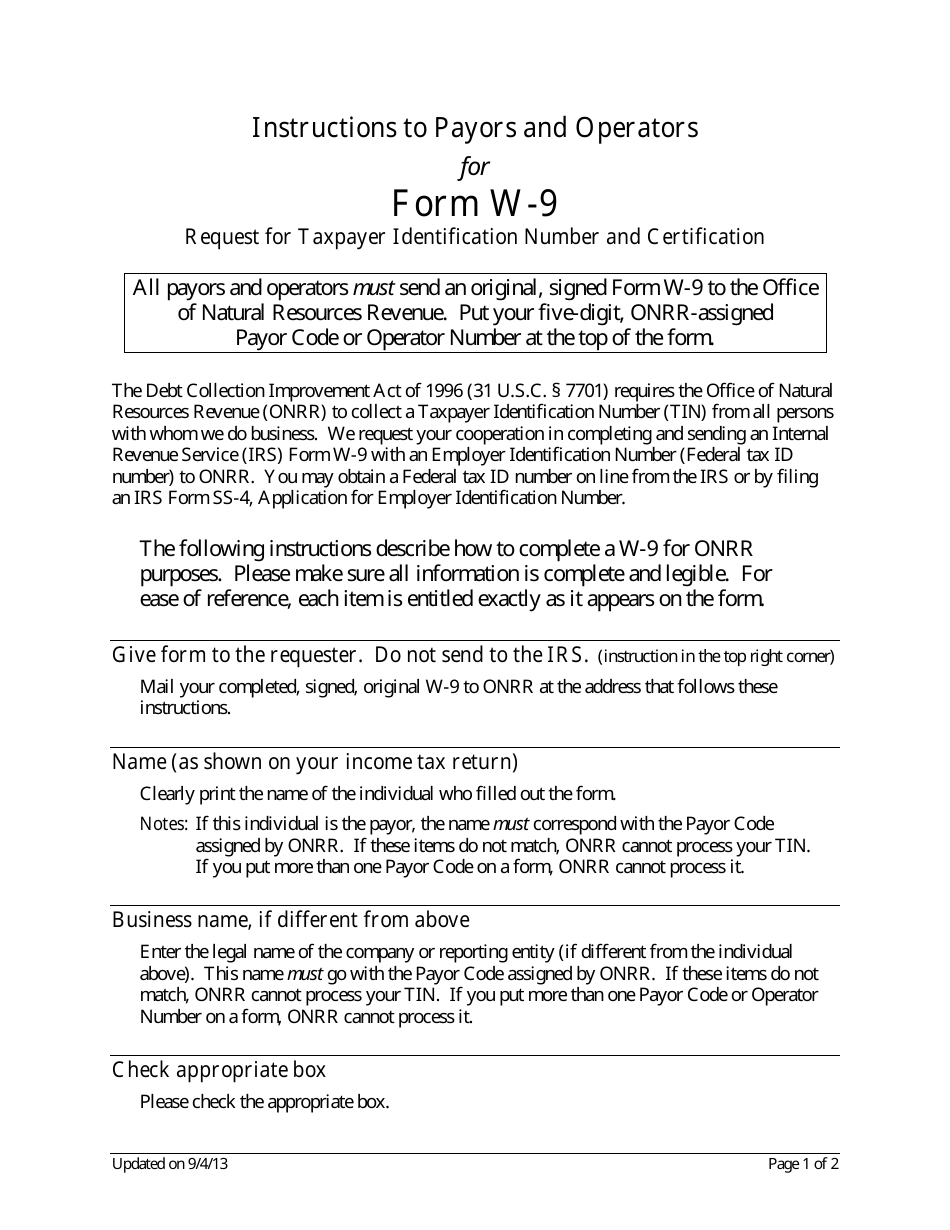

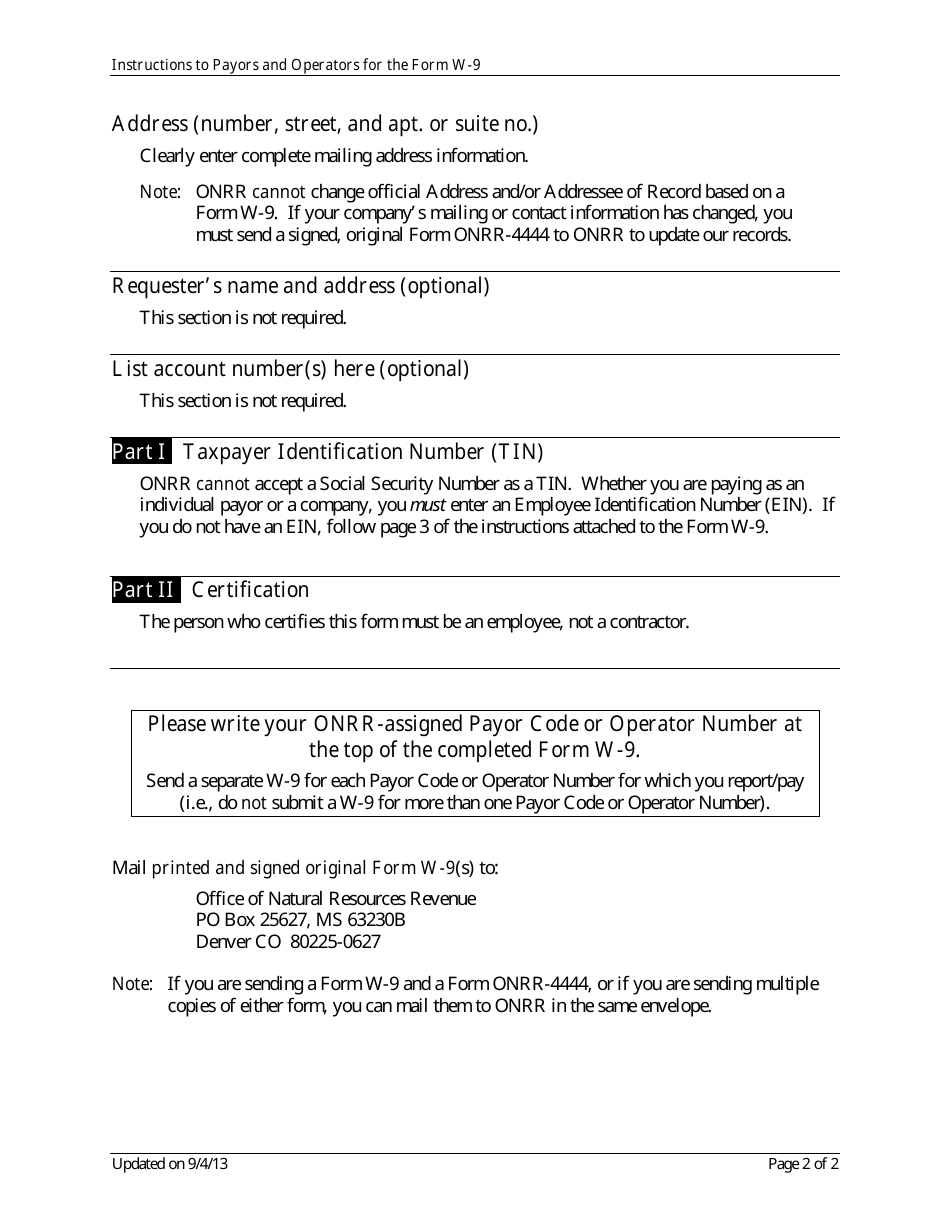

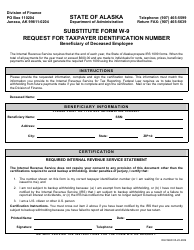

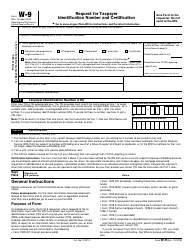

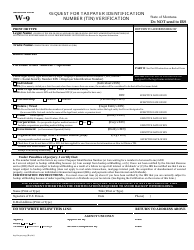

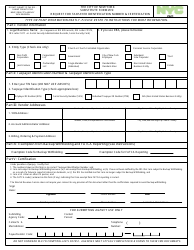

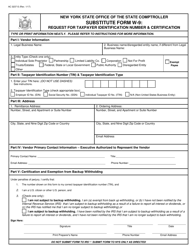

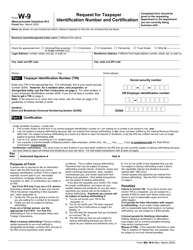

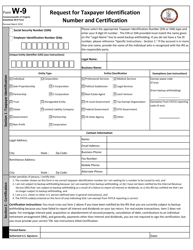

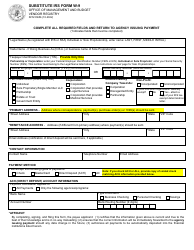

Instructions for IRS Form W-9 Request for Taxpayer Identification Number and Certification (Instructions to Payors and Operators)

This document contains official instructions for IRS Form W-9 , Request for Taxpayer Identification Number and Certification (Instructions to Payors and Operators) - a form released and collected by the U.S. Department of the Interior - Office of Natural Resources Revenue.

FAQ

Q: What is Form W-9?

A: Form W-9 is a document used by payors and operators to request the taxpayer identification number (TIN) and certification from a U.S. resident or business entity.

Q: Who needs to complete Form W-9?

A: Any U.S. resident or business entity that is requested by a payor or operator to provide their taxpayer identification number (TIN) and certification needs to complete Form W-9.

Q: What information is required on Form W-9?

A: Form W-9 requires the individual or business entity to provide their name, address, TIN (usually the Social Security Number or Employer Identification Number), date of signature, and certification.

Q: Why is Form W-9 important?

A: Form W-9 is important because it helps payors and operators to accurately report payments made to individuals or business entities to the Internal Revenue Service (IRS). It is used for tax reporting purposes.

Q: How should Form W-9 be submitted?

A: Form W-9 is typically submitted directly to the payor or operator who requested it, either electronically or by mail. It is not submitted to the IRS.

Q: Are there any penalties for not providing Form W-9?

A: Yes, if you are requested to provide Form W-9 and fail to do so, the payor or operator may be required to withhold a percentage of your payments for tax purposes.

Q: Do I need to complete Form W-9 for every payor or operator?

A: Yes, you generally need to complete a separate Form W-9 for each payor or operator who requests it.

Q: Can I refuse to provide a TIN on Form W-9?

A: No, providing a valid TIN on Form W-9 is required by law. Failure to do so may result in penalties.

Q: Do I need to submit a new Form W-9 each year?

A: No, you generally do not need to submit a new Form W-9 each year, unless your information has changed or you are requested to do so by a payor or operator.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of the Interior - Office of Natural Resources Revenue.