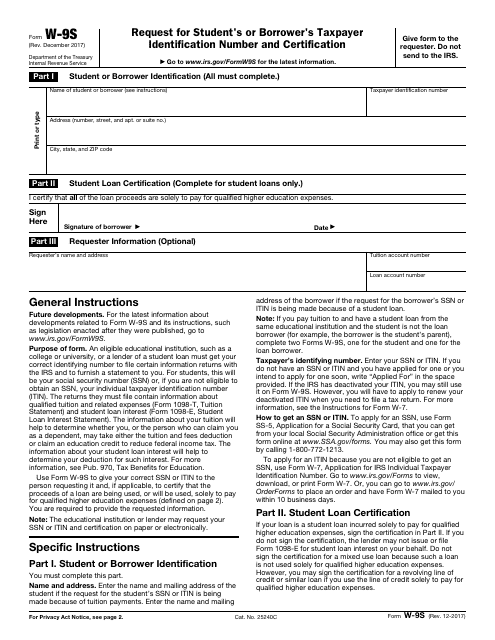

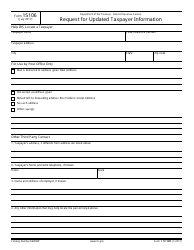

IRS Form W-9S Request for Student's or Borrower's Taxpayer Identification Number and Certification

What Is IRS Form W-9S?

IRS Form W-9S, Request for Student's or Borrower's Taxpayer Identification Number and Certification , is an application requested from students to provide their taxpayer information to an educational institution (a college or university) or a lender of a student loan. This form also certifies that the loan is being used (or will be used) exclusively to pay for qualified higher education expenses (if applicable).

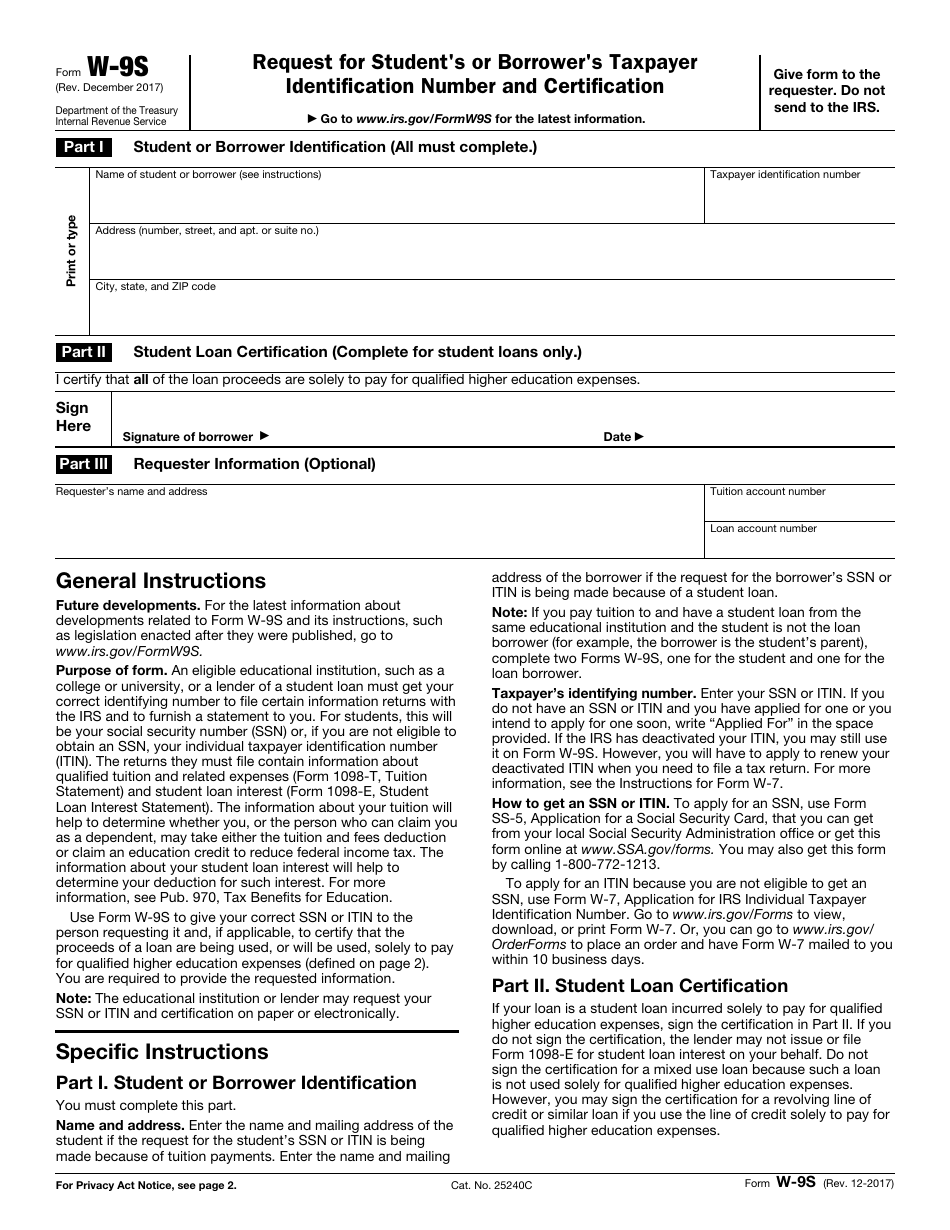

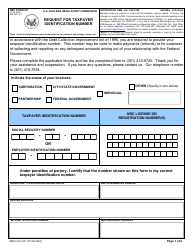

Form W-9S is used by a requester to get the correct Taxpayer Identification Number (TIN) from a student or a borrower in order to use it to file certain information returns with the International Revenue Service (IRS) . The form itself looks like a one-page document where a recipient must fill out their full name, address, TIN, and signature. A W-9S Tax Form also contains a Student Loan Certification (which is only applicable for student loans) and general instructions for the requester and the recipient. The newest version of the form was last released on December 1, 2017 .

How to Get a W-9S Form?

A W-9S Tax Form is usually provided by a requester, however a student or a borrower can download it themselves. A fillable version of Form W-9S is available for download below.

Who Needs to Fill Out a W-9S Form?

Form W-9S is supposed to be filled out by a student who got a request from a university or college, or a lender of a student loan. However, when a student is not a loan borrower (for example, if a loan to pay for qualified higher education expenses was borrowed by a student's parent), then the form is supposed to be filled in by the borrower and the student both, each of them fills in their own copy of the document.

How to Submit a W-9S Form?

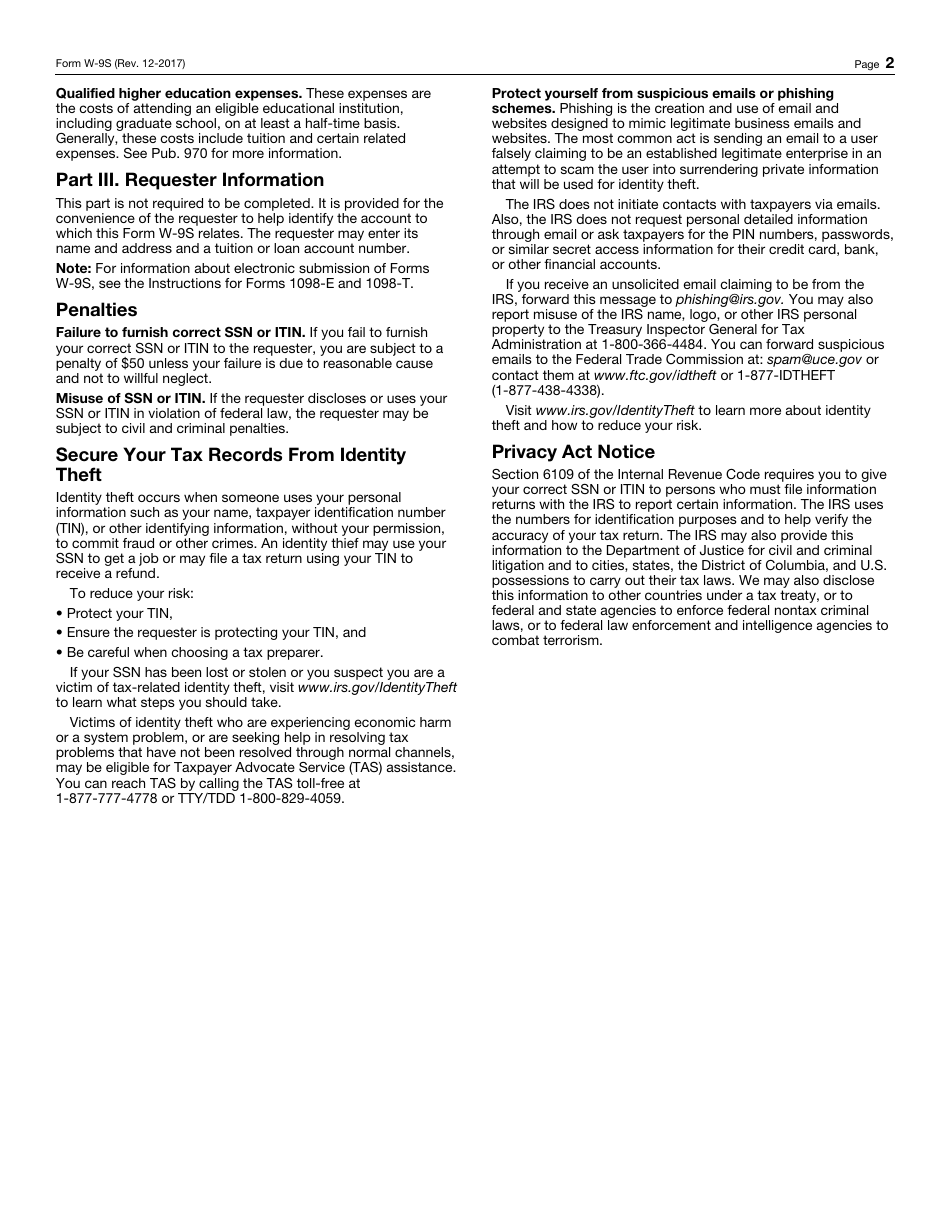

According to IRS instructions, a W-9S must be sent directly to the requester, not to the IRS. Usually the form is supposed to be sent by mail, however a requester can establish a system to submit the form electronically (or by fax). The requirements for the electronic system are provided in the Instructions for the Requester of Form W-9 (Request for Taxpayer Identification Number and Certification) and include clauses such as (but not limited to):

- Electronic system must guarantee that the information received by it is the information sent;

- Electronic system must provide the same information as the paper version of the document;

- Electronic system must be able to provide a hard copy of the document (if the IRS requests it);

- Electronic system must guarantee that the person submitting the information is the person identified on the form.

W-9S Related Forms

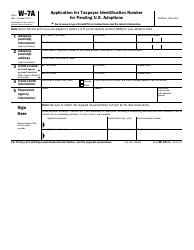

- Form W-9, Request for Taxpayer Identification Number and Certification. This form was constituted especially for students and loan borrowers. Form W-9 is an application which is requested by an individual or entity to get your taxpayer identification number in order to file an information return with the IRS;

- Form W-9(SP). This form is exactly the same as Form W-9, but it has been translated into Spanish and has the same legal force.