Instructions for Agency Guide for IRS Form W-9 and Edison 1099 Locations - Tennessee

This document was released by Tennessee Department of Finance & Administration and contains the most recent official instructions for Agency Guide for IRS Form W-9 and Edison 1099 Locations .

FAQ

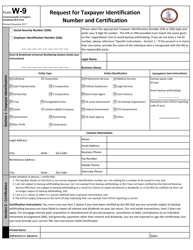

Q: What is IRS Form W-9?

A: IRS Form W-9 is a form used to request taxpayer identification number and certification from independent contractors or freelancers.

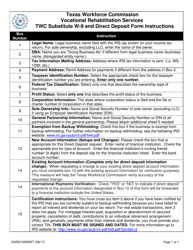

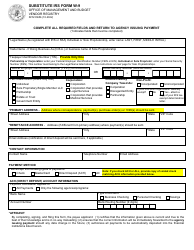

Q: What is Edison 1099?

A: Edison 1099 is a tax document used to report income earned by independent contractors or freelancers.

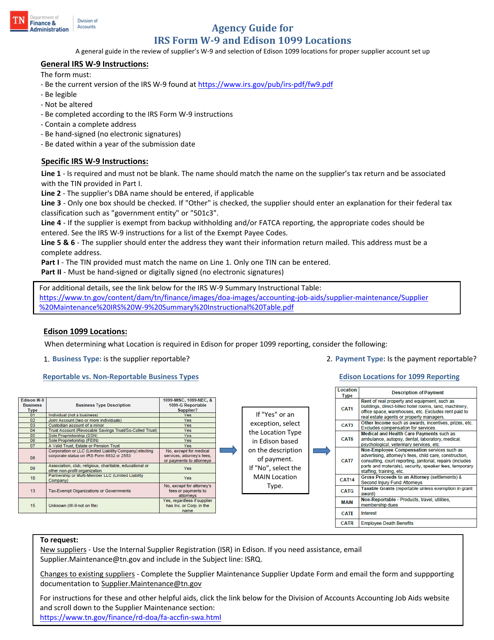

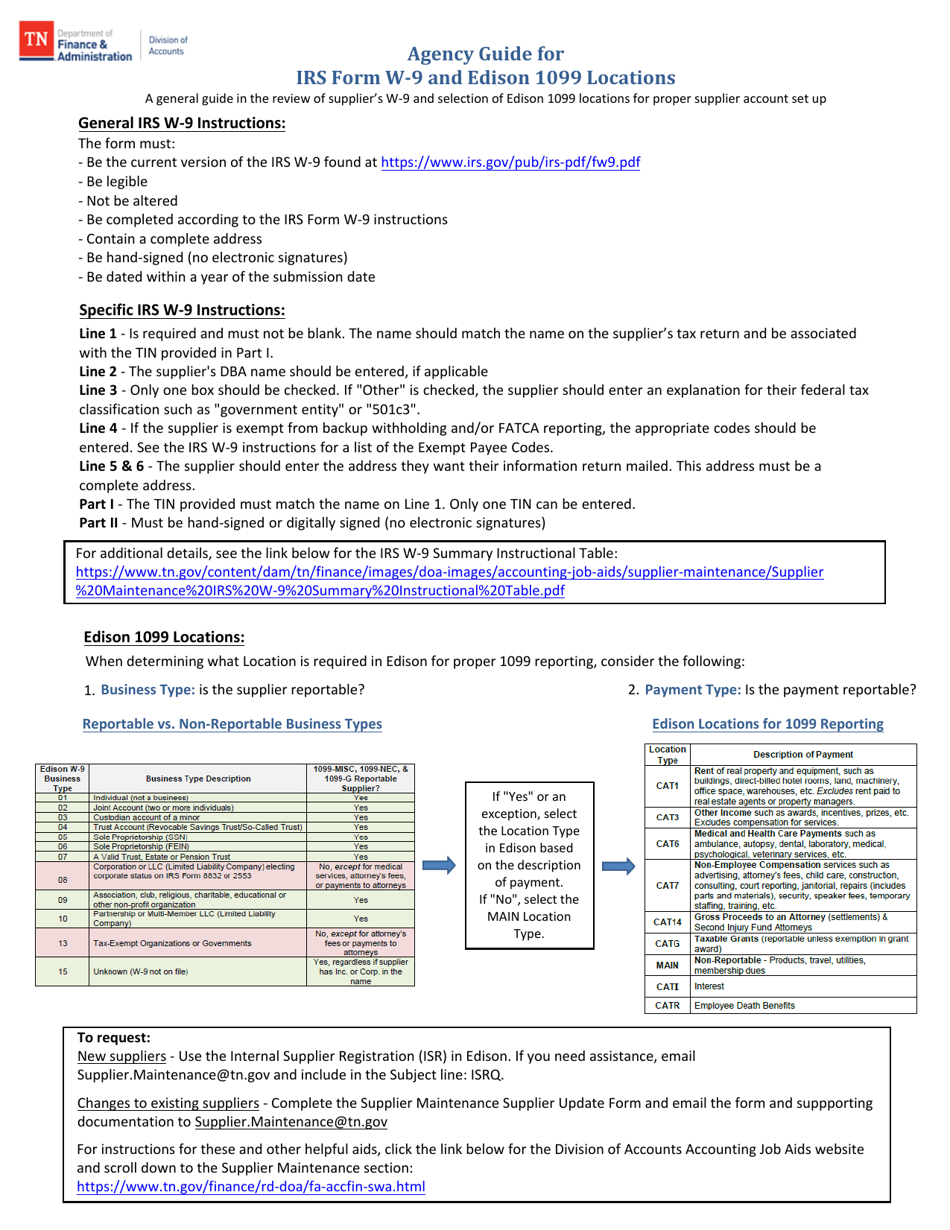

Q: What is the purpose of the Agency Guide?

A: The Agency Guide provides instructions and guidelines for completing IRS Form W-9 and Edison 1099 for Tennessee locations.

Q: Who needs to fill out IRS Form W-9?

A: Independent contractors or freelancers who receive payment for services rendered need to fill out IRS Form W-9.

Q: What information is required on IRS Form W-9?

A: IRS Form W-9 requires the individual's name, taxpayer identification number (e.g. Social Security Number or Employer Identification Number), address, and certification.

Q: What information is included on an Edison 1099?

A: An Edison 1099 includes the individual's name, taxpayer identification number, address, and the amount of income earned.

Q: Are there any penalties for providing incorrect information on IRS Form W-9?

A: Yes, providing incorrect information on IRS Form W-9 can result in penalties imposed by the IRS.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Tennessee Department of Finance & Administration.