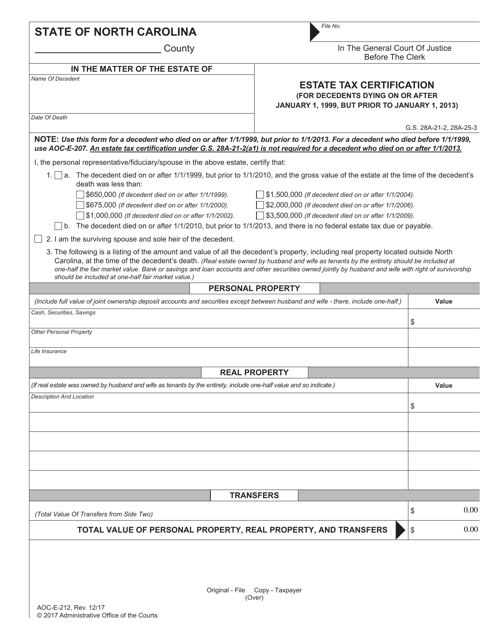

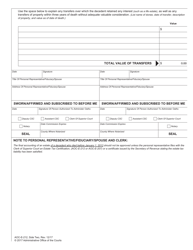

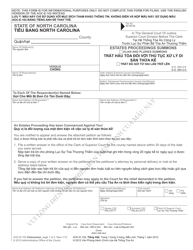

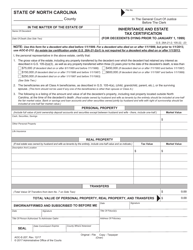

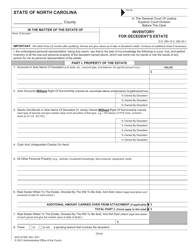

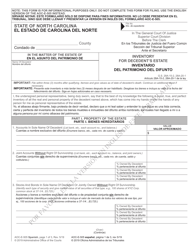

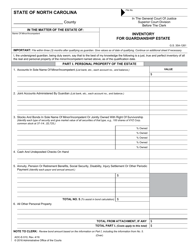

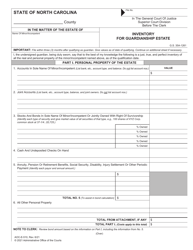

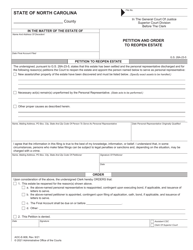

Form AOC-E-212 Estate Tax Certification (For Decedents Dying on or After January 1, 1999, but Prior to January 1, 2013) - North Carolina

What Is Form AOC-E-212?

This is a legal form that was released by the North Carolina Court System - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AOC-E-212?

A: AOC-E-212 is an estate tax certification form.

Q: Who should use AOC-E-212?

A: This form should be used by individuals who are filing estate tax certifications for decedents who died between January 1, 1999, and January 1, 2013 in North Carolina.

Q: When should I use AOC-E-212?

A: You should use AOC-E-212 if the decedent died between January 1, 1999, and January 1, 2013 and you need to file an estate tax certification in North Carolina.

Q: What is the purpose of AOC-E-212?

A: The purpose of AOC-E-212 is to certify the estate tax liability of a decedent who passed away between January 1, 1999, and January 1, 2013 in North Carolina.

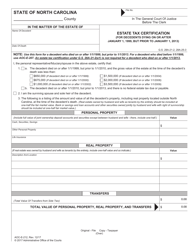

Q: What information do I need to complete AOC-E-212?

A: You will need various information related to the decedent's estate, including the decedent's personal information, details of their assets and liabilities, and information about the estate's executor or administrator.

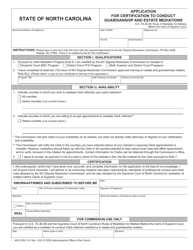

Q: Are there any instructions for completing AOC-E-212?

A: Yes, instructions for completing AOC-E-212 can be found on the second page of the form itself.

Q: Is there a deadline for filing AOC-E-212?

A: Yes, AOC-E-212 must be filed within nine months from the decedent's date of death.

Q: Are there any fees associated with filing AOC-E-212?

A: Yes, there is a filing fee for submitting AOC-E-212, which varies depending on the value of the estate.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

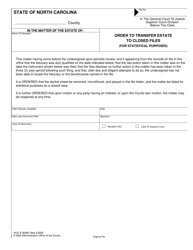

Download a fillable version of Form AOC-E-212 by clicking the link below or browse more documents and templates provided by the North Carolina Court System.