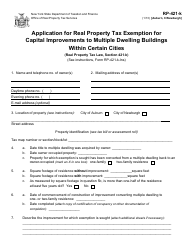

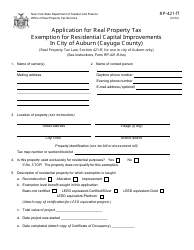

Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York

This document contains official instructions for Form RP-421-I [ALBANY] , Application for Multiple Dwelling Buildings Within Certain Cities - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form RP-421-I?

A: Form RP-421-I is an application for real property tax exemption for capital improvements to multiple dwelling buildings within certain cities in Albany, New York.

Q: Who can use Form RP-421-I?

A: Owners of multiple dwelling buildings within certain cities in Albany, New York can use Form RP-421-I to apply for a real property tax exemption for capital improvements.

Q: What is the purpose of Form RP-421-I?

A: The purpose of Form RP-421-I is to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities in Albany, New York.

Q: Is there a deadline for submitting Form RP-421-I?

A: Yes, there is a deadline for submitting Form RP-421-I. The specific deadline may vary, so it is important to check the instructions and guidelines provided with the form.

Q: What information is required in Form RP-421-I?

A: Form RP-421-I requires information about the property, the improvements made, and supporting documentation.

Q: Is there a fee for submitting Form RP-421-I?

A: There is no fee for submitting Form RP-421-I.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.

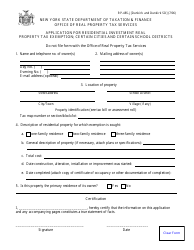

![Form RP-421-I [ALBANY] Printable Pdf](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/instructions-for-form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-albany-new-york_big.png)

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/page_1_thumb.png)

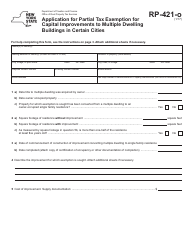

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York, Page 2](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/page_2_thumb.png)

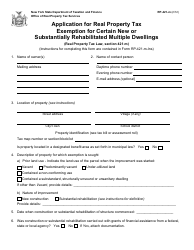

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York, Page 1](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/page_1_thumb_950.png)

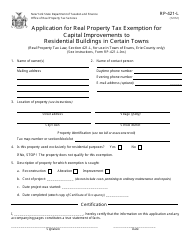

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York, Page 2](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/page_2_thumb_950.png)

![Document preview: Instructions for Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349853/instruction-for-form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)

![Document preview: Instructions for Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349862/instruction-for-form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

![Document preview: Instructions for Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349864/instruction-for-form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

![Document preview: Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york.png)

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)