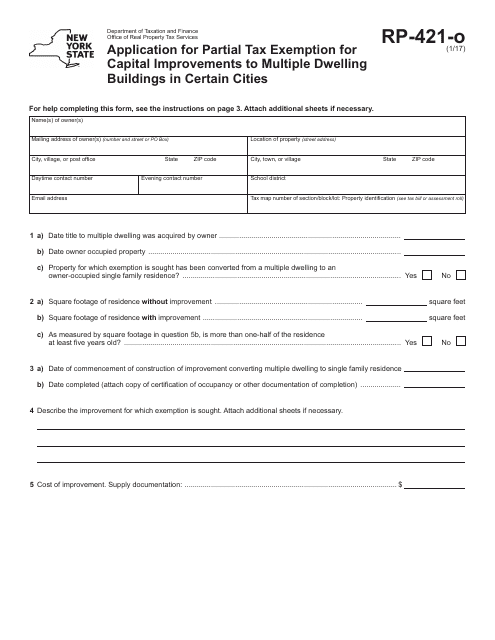

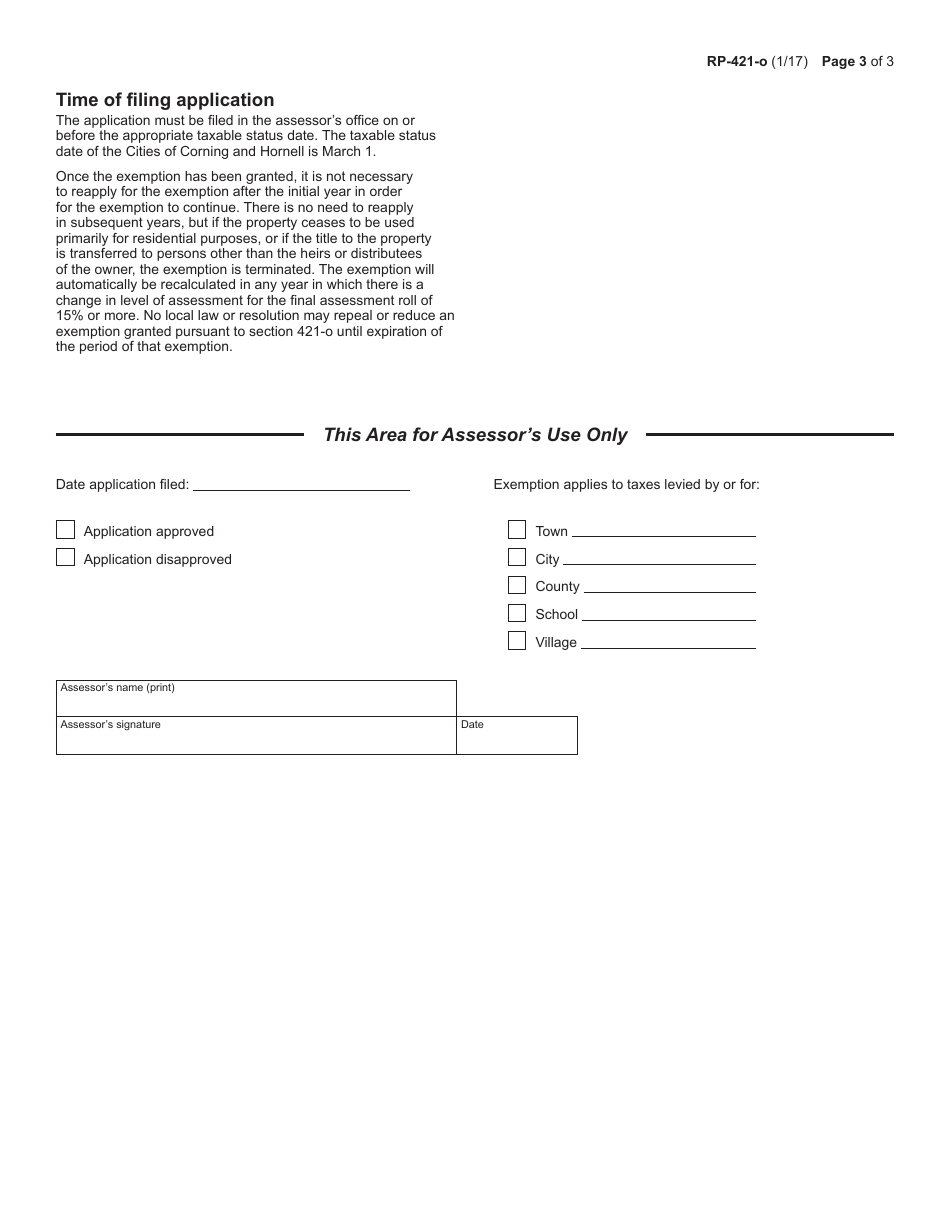

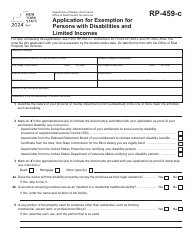

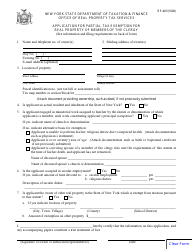

Form RP-421-O Application for Partial Tax Exemption for Capital Improvements to Multiple Dwelling Buildings in Certain Cities - New York

What Is Form RP-421-O?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP-421-O?

A: RP-421-O is an application for partial tax exemption for capital improvements to multiple dwelling buildings in certain cities in New York.

Q: Who can apply for RP-421-O?

A: Owners of multiple dwelling buildings in certain cities in New York can apply for RP-421-O.

Q: What is the purpose of RP-421-O?

A: The purpose of RP-421-O is to provide a tax exemption for capital improvements made to multiple dwelling buildings in certain cities in New York.

Q: Which cities in New York are eligible for RP-421-O?

A: Certain cities in New York are eligible for RP-421-O, but the specific cities may vary. Refer to the application for a list of eligible cities.

Q: What types of capital improvements are eligible for the tax exemption?

A: Various types of capital improvements, such as renovations and upgrades, may be eligible for the tax exemption. Details can be found in the application instructions.

Q: Are there any deadlines for submitting the RP-421-O application?

A: Yes, there are usually specific deadlines for submitting the RP-421-O application. Check the application instructions or contact your local tax authority for the deadline.

Q: What documents are required to accompany the RP-421-O application?

A: The specific documents required may vary, but typically you will need to provide information about the property and the planned capital improvements. Refer to the application instructions for a detailed list of required documents.

Q: Is there a fee to submit the RP-421-O application?

A: There may be a fee associated with submitting the RP-421-O application. Check the application instructions or contact your local tax authority for information about any applicable fees.

Q: How long does it take to process the RP-421-O application?

A: The processing time for the RP-421-O application can vary depending on the local tax authority. Contact them directly for an estimate of the processing time.

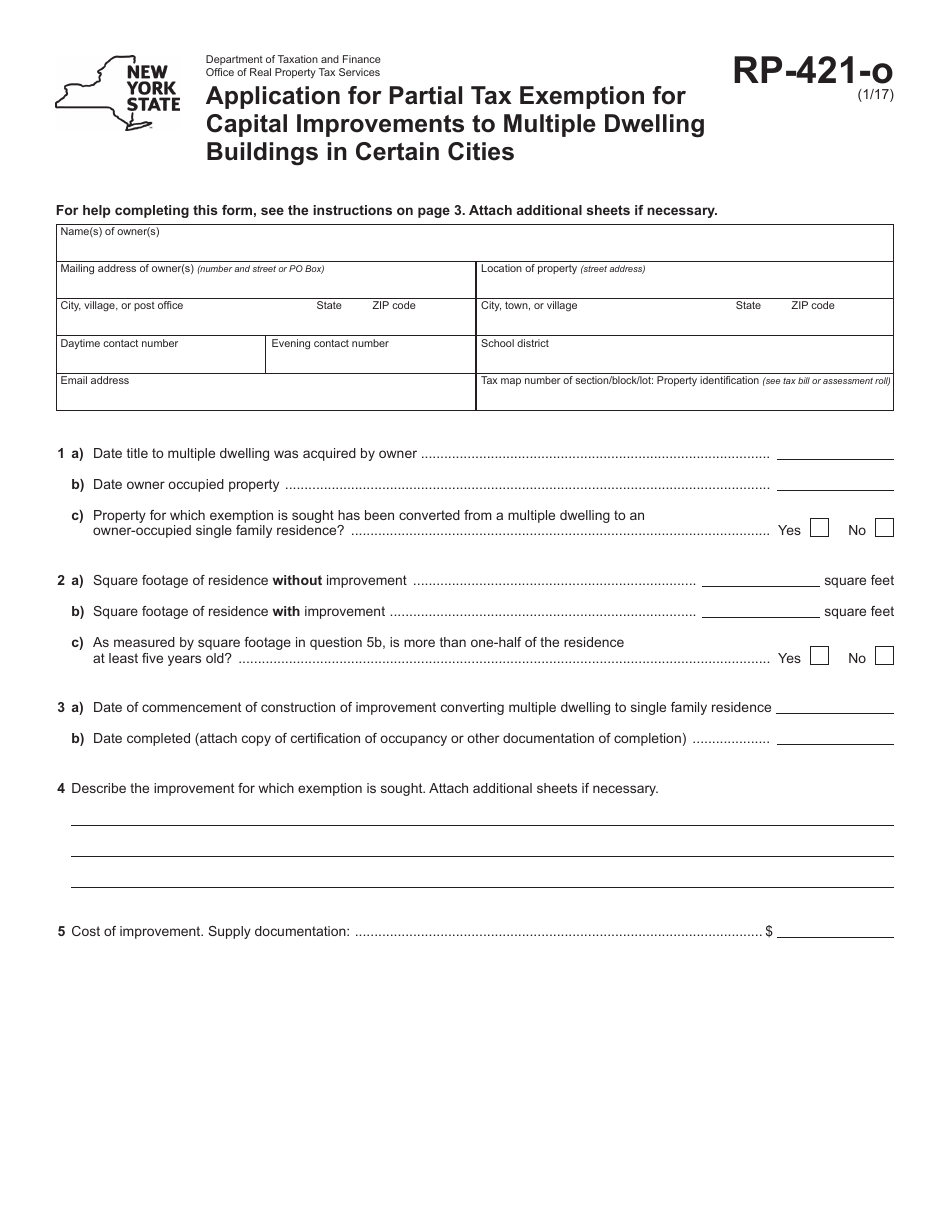

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-421-O by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

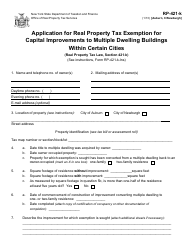

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

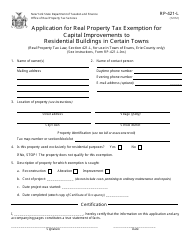

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

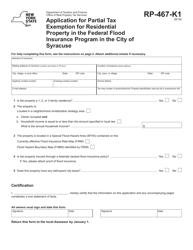

![Document preview: Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york.png)