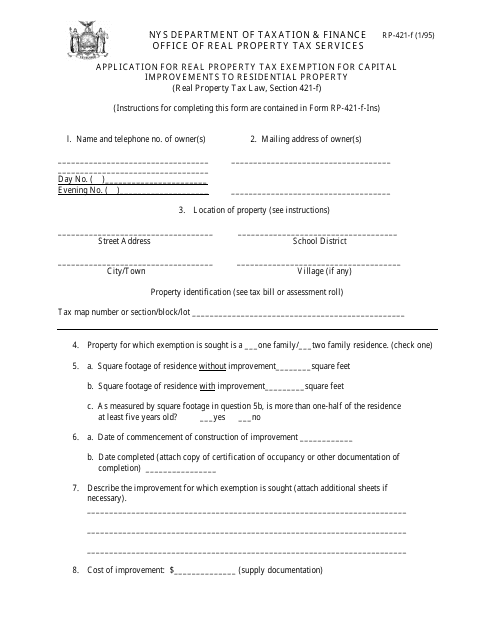

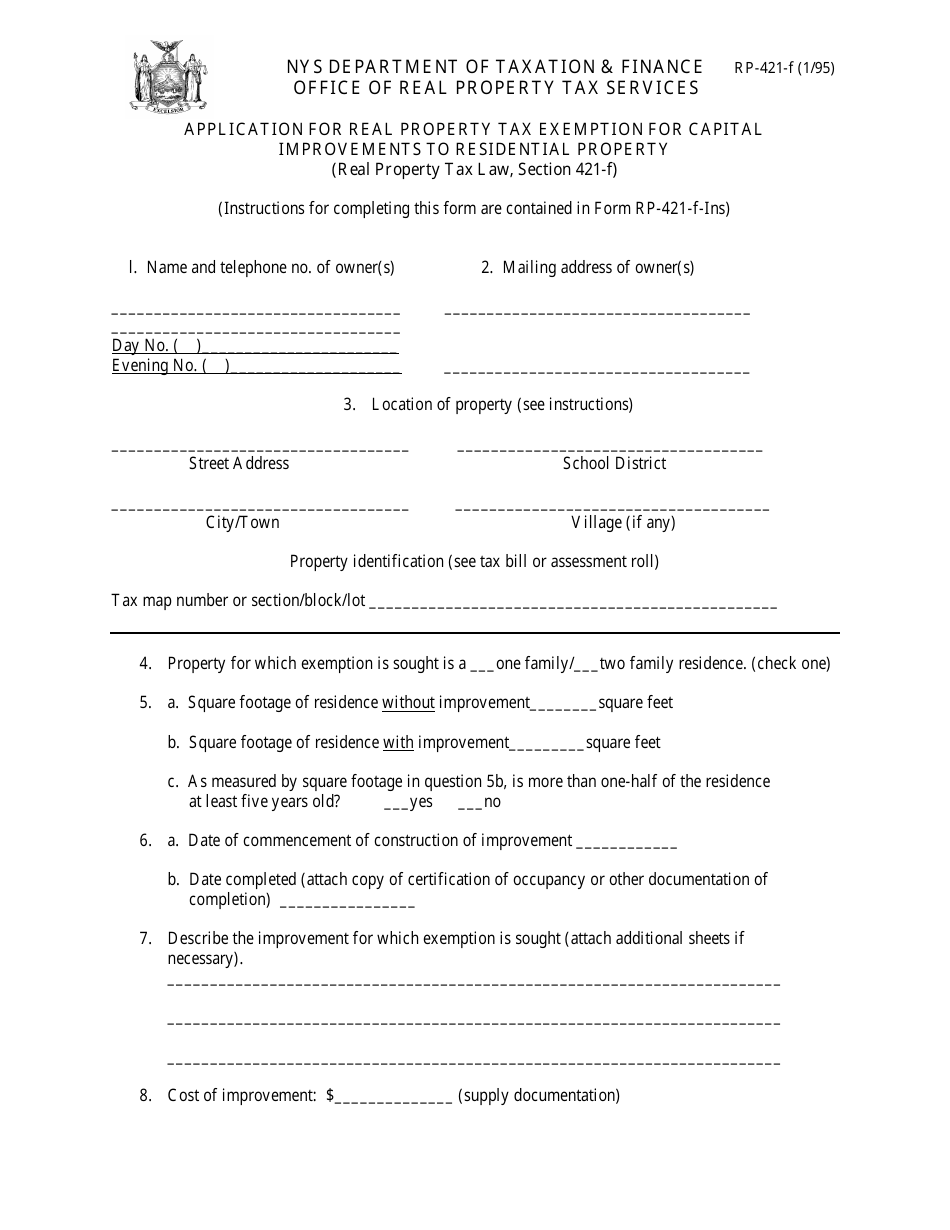

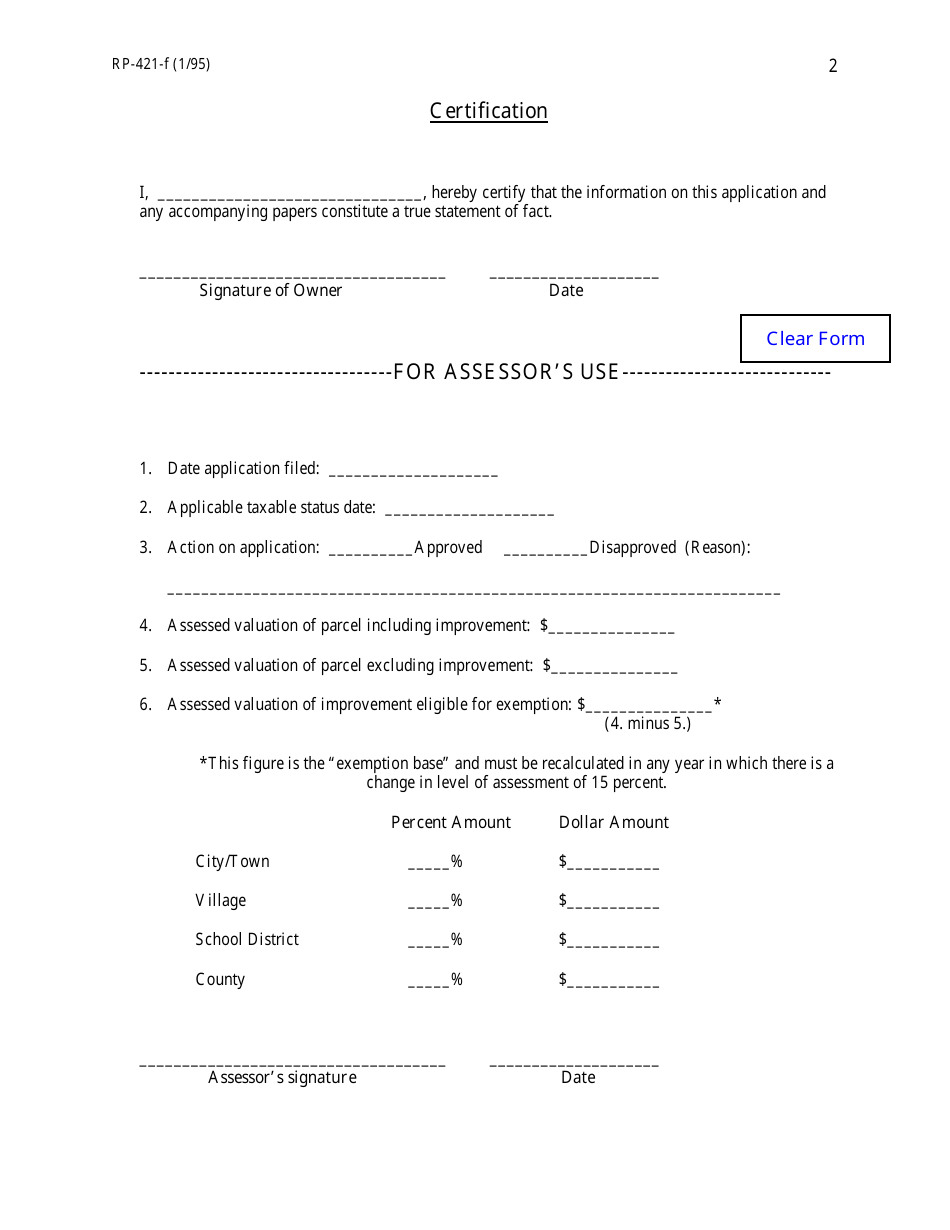

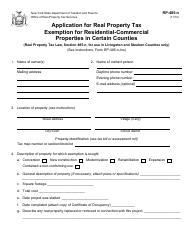

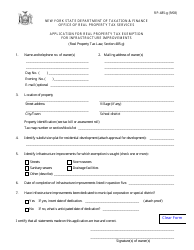

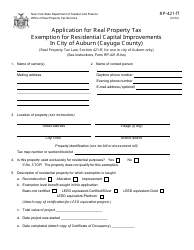

Form RP-421-F Application for Real Property Tax Exemption for Capital Improvements to Residential Property - New York

What Is Form RP-421-F?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-421-F?

A: Form RP-421-F is an application used to request a real property tax exemption for capital improvements to residential property in New York.

Q: Who can use Form RP-421-F?

A: Property owners in New York who have made capital improvements to their residential property.

Q: What is a real property tax exemption?

A: A real property tax exemption allows property owners to reduce or eliminate the amount of property taxes they owe.

Q: What are capital improvements?

A: Capital improvements are substantial renovations or additions made to a property that enhance its value.

Q: How do I apply for a real property tax exemption?

A: You can apply for a real property tax exemption by filling out and submitting Form RP-421-F to the appropriate tax authority in your area.

Q: What supporting documents are required with the application?

A: Supporting documents may include building permits, contractor invoices, and evidence of payment for the capital improvements.

Q: Is there a deadline to submit the application?

A: Yes, the application must be submitted within 12 months of the completion of the capital improvements.

Q: Can I apply for multiple tax exemptions using Form RP-421-F?

A: No, Form RP-421-F is specifically for applying for a real property tax exemption for capital improvements to residential property.

Q: Is there a fee to apply for a real property tax exemption?

A: There is generally no fee to apply for a real property tax exemption, but individual tax authorities may have their own requirements.

Form Details:

- Released on January 1, 1995;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-421-F by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

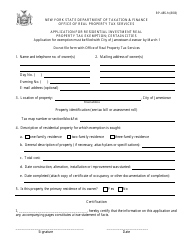

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

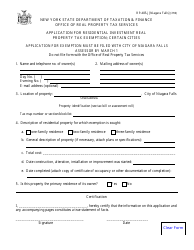

![Document preview: Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york.png)

![Document preview: Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york.png)

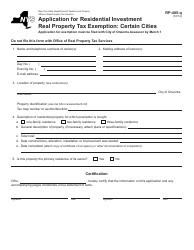

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)