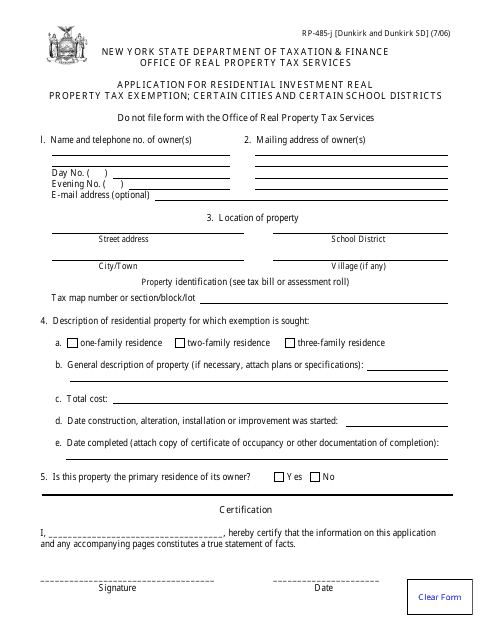

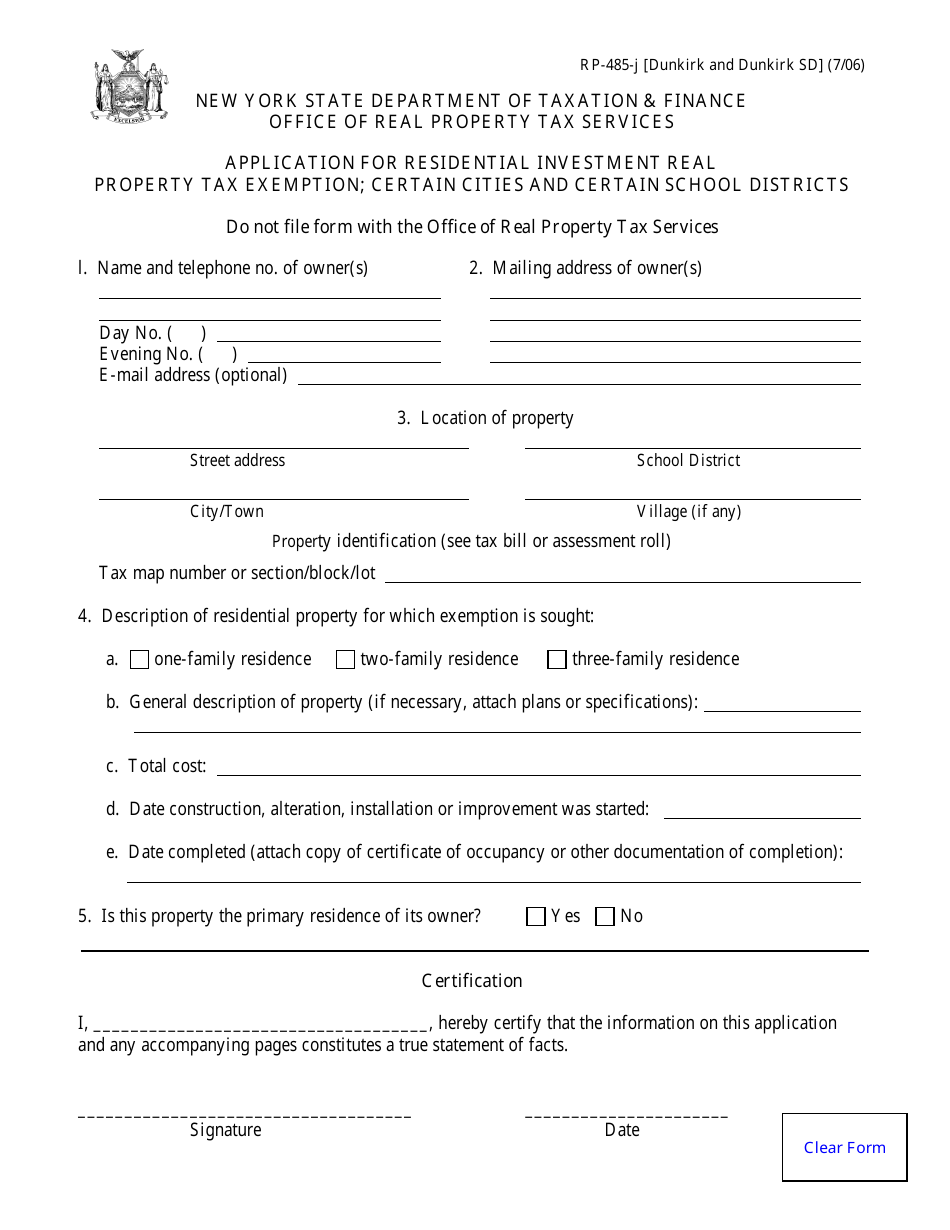

Form RP-485-J (DUNKIRK / DUNKIRK SD) Application for Residential Investment Real Property Tax Exemption; Certain Cities and Certain School Districts - City of Dunkirk, New York

What Is Form RP-485-J (DUNKIRK/DUNKIRK SD)?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. The form may be used strictly within City of Dunkirk. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-485-J?

A: Form RP-485-J is an application for Residential InvestmentReal Property Tax Exemption for certain cities and certain school districts.

Q: What is the purpose of Form RP-485-J?

A: The purpose of Form RP-485-J is to apply for a tax exemption for residential investment real property in the City of Dunkirk, New York.

Q: Who is eligible for the tax exemption?

A: Certain cities and certain school districts, such as the City of Dunkirk in New York, have programs that provide tax exemptions for residential investment real property. You should check the specific requirements for eligibility.

Q: How can I obtain a copy of Form RP-485-J?

A: You can obtain a copy of Form RP-485-J by contacting the relevant authorities in the City of Dunkirk, New York.

Q: What are the benefits of the tax exemption?

A: The tax exemption allows eligible residential investment real property owners to receive a reduction or exemption from property taxes, providing potential financial savings.

Q: Are there any deadlines for submitting Form RP-485-J?

A: You should check with the City of Dunkirk, New York for any specific deadlines for submitting Form RP-485-J.

Q: Can I use Form RP-485-J for properties in other cities or school districts?

A: No, Form RP-485-J is specific to the City of Dunkirk, New York. Other cities and school districts may have their own forms and application processes.

Q: Is the tax exemption guaranteed if I submit Form RP-485-J?

A: No, approval of the tax exemption is not guaranteed. The application will be reviewed and assessed for eligibility by the relevant authorities in the City of Dunkirk, New York.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-J (DUNKIRK/DUNKIRK SD) by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

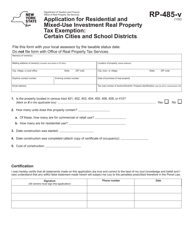

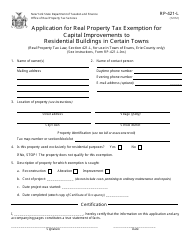

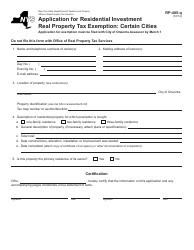

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

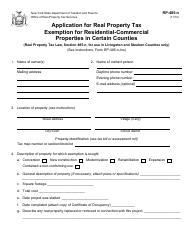

![Document preview: Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578659/form-rp-485-j-utica-application-for-residential-investment-real-property-tax-exemption-city-of-utica-new-york.png)

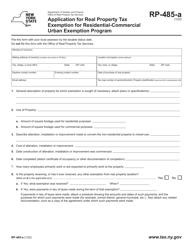

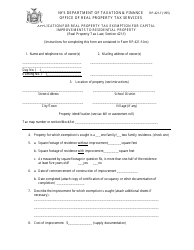

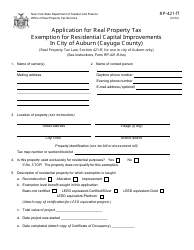

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

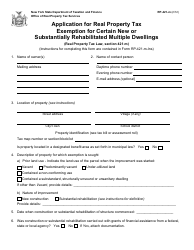

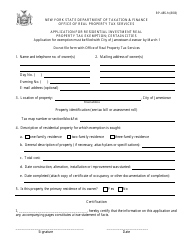

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

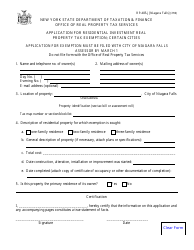

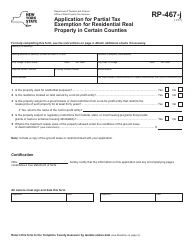

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york.png)

![Document preview: Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)