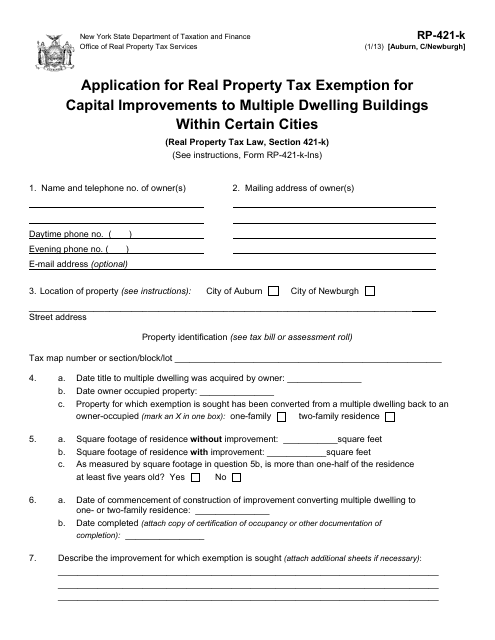

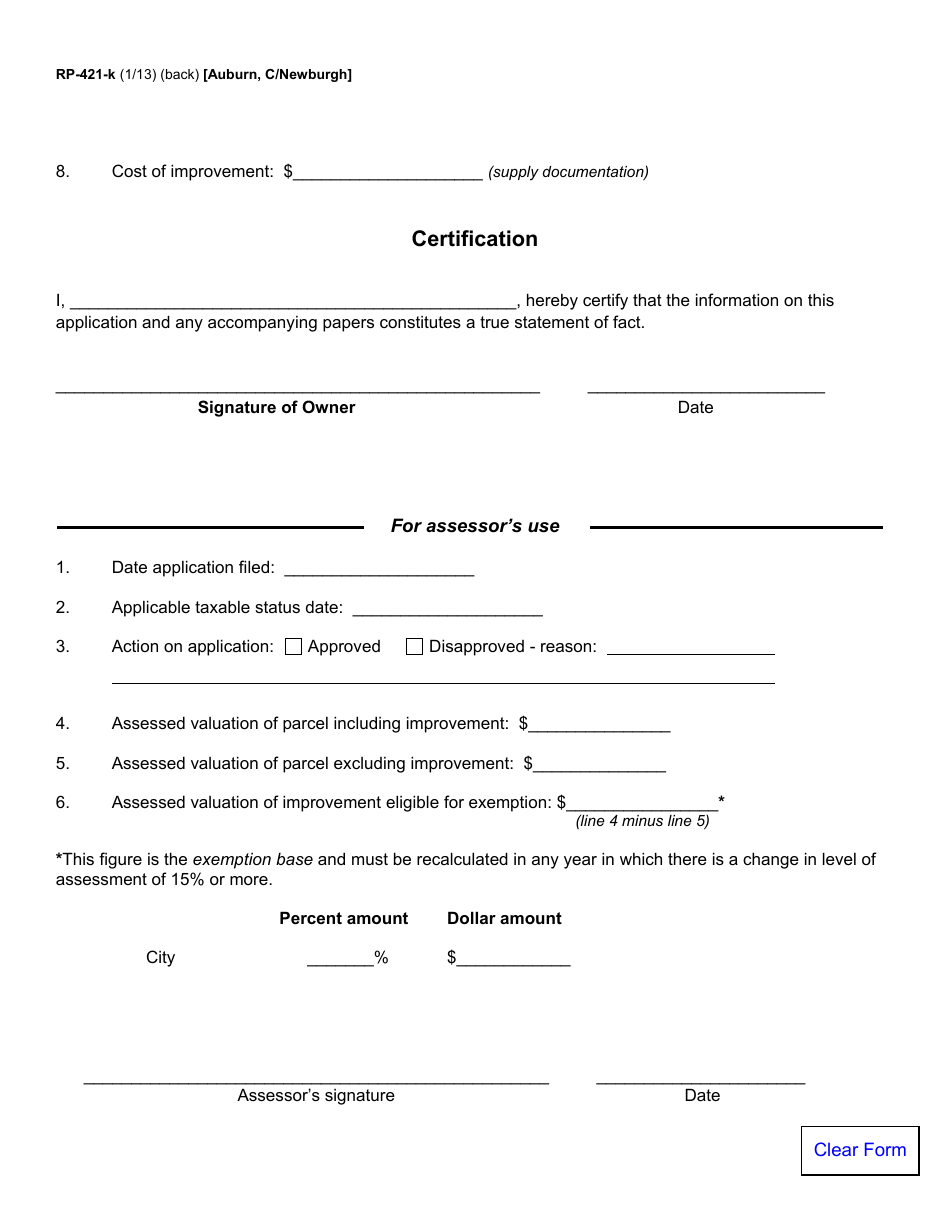

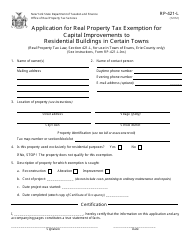

Form RP-421-K Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Auburn, Newburgh Cities, New York

What Is Form RP-421-K?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. The form may be used strictly within Auburn, Newburgh Cities. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RP-421-K application?

A: The RP-421-K application is an application for real property tax exemption for capital improvements to multiple dwelling buildings within certain cities in New York, specifically Auburn and Newburgh.

Q: What is the purpose of the RP-421-K application?

A: The purpose of the RP-421-K application is to apply for a tax exemption on capital improvements made to multiple dwelling buildings.

Q: Which cities in New York are eligible for the RP-421-K application?

A: The RP-421-K application is eligible for certain cities in New York, including Auburn and Newburgh.

Q: What types of properties are eligible for the RP-421-K tax exemption?

A: The RP-421-K tax exemption is applicable for capital improvements made to multiple dwelling buildings.

Q: Are there any eligibility requirements for the RP-421-K tax exemption?

A: Yes, there are eligibility requirements for the RP-421-K tax exemption. These requirements vary based on the specific city and program guidelines.

Q: What are the benefits of the RP-421-K tax exemption?

A: The RP-421-K tax exemption provides a tax reduction or exemption for capital improvements made to multiple dwelling buildings, helping to incentivize property owners to invest in these improvements.

Q: Can I apply for the RP-421-K tax exemption retroactively?

A: No, the RP-421-K tax exemption generally cannot be applied retroactively. It is important to apply before making the capital improvements in order to be eligible for the exemption.

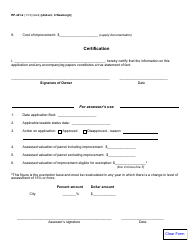

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-421-K by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

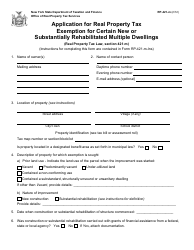

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

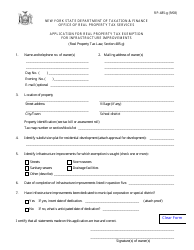

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)