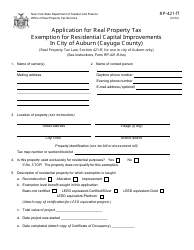

Instructions for Form RP-421-K Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Auburn, Newburgh Cities, New York

This document contains official instructions for Form RP-421-K , Application for Multiple Dwelling Buildings Within Certain Cities - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-421-K is available for download through this link.

FAQ

Q: What is Form RP-421-K?

A: Form RP-421-K is an application for real property tax exemption for capital improvements to multiple dwelling buildings within certain cities in New York, specifically Auburn and Newburgh.

Q: Who is eligible to file Form RP-421-K?

A: Owners of multiple dwelling buildings located in Auburn and Newburgh cities in New York are eligible to file Form RP-421-K if they have made capital improvements to their properties.

Q: What is the purpose of Form RP-421-K?

A: The purpose of Form RP-421-K is to apply for a real property tax exemption on the increased assessed value resulting from eligible capital improvements made to multiple dwelling buildings in Auburn and Newburgh cities in New York.

Q: What are capital improvements?

A: Capital improvements refer to permanent improvements made to a property that enhance its value, such as renovations, additions, or upgrades.

Q: Are there any deadlines for filing Form RP-421-K?

A: Yes, there are specific deadlines for filing Form RP-421-K. It is recommended to check the instructions and guidelines provided by the New York State Department of Taxation and Finance for the current year's deadline.

Q: Is there a fee associated with filing Form RP-421-K?

A: There is no fee associated with filing Form RP-421-K.

Q: How long does it take to process Form RP-421-K?

A: The processing time for Form RP-421-K may vary. It is recommended to contact the Assessor's Office of the respective city for information on the estimated processing time.

Q: What supporting documents are required with Form RP-421-K?

A: Supporting documents may vary, but typical requirements include detailed cost information, contracts, permits, and other relevant documentation proving the capital improvements made to the property.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.

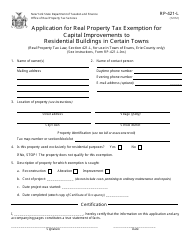

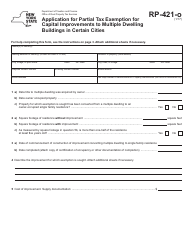

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

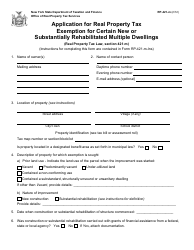

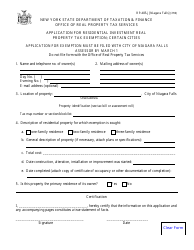

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

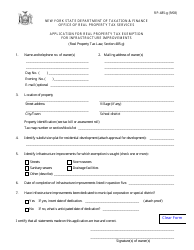

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

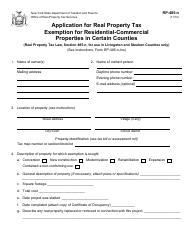

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

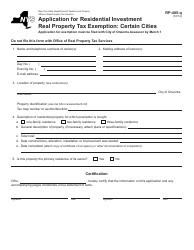

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

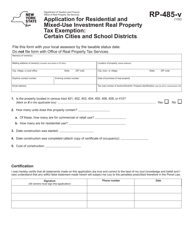

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)