Free Accounting Records and Forms

What Are Accounting Records?

Accounting Records refer to a compilation of documents that contain main information about the company’s financial records. Each business must maintain accurate records, including evidence of monetary transactions, accounting journals, invoices, receipts, ledgers, etc. Retain all financial information related to the operations of your organization for years to be able to carry out internal inspections and to be prepared for audits. Keep Accounting Records in order for these reasons:

- Extract verified data from the records;

- Stay on top of things when dealing with clients and business partners – do not rely on their statements, try to match the details you are given with your documentation;

- Prepare spreadsheets and table to see whether you are generating income or losing funds;

- Find crucial information quickly by sorting all documents in chronological order;

- Plan to file taxes in advance – with proper records, you can fill out your tax return quicker. Additionally, you might be able to claim tax deductions and allowances to save money;

- Comply with the legal requirements. At any point in time, your business activities may be assessed by appropriate authorities – do not meet them empty-handed.

How Do You Maintain Accounting Records?

Regardless of the type of your organization and its priorities, you will require the following documents at different points of your financial performance:

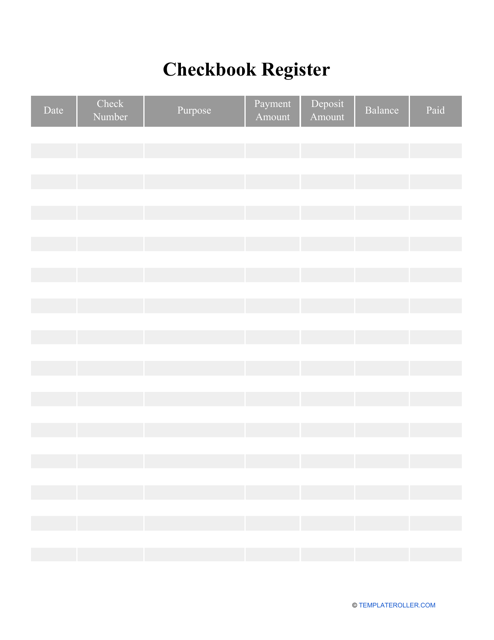

- Checkbook Register. This document represents a comprehensive overview of all outgoing and incoming transactions of your financial account.

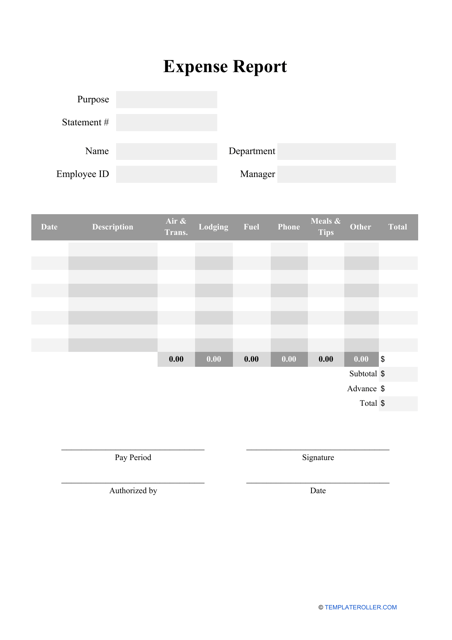

- Expense Report. Usually filled out by employees and presented to the financial department of the company, this statement lists all the business-related expenses that must be reimbursed to employees once it is submitted.

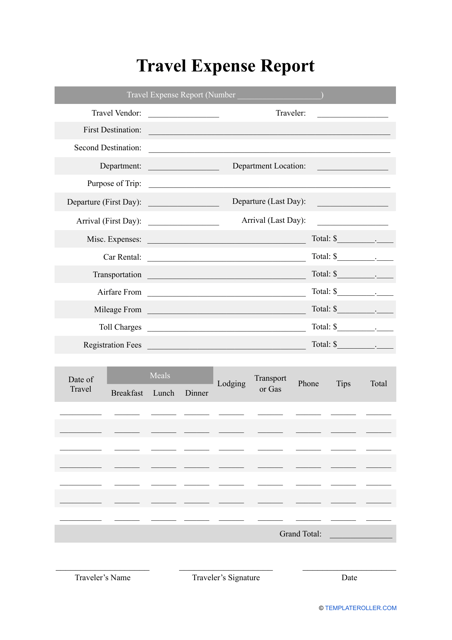

- Travel Expense Report. This form is used by employees that are required to provide information about their business travel expenses to their employers.

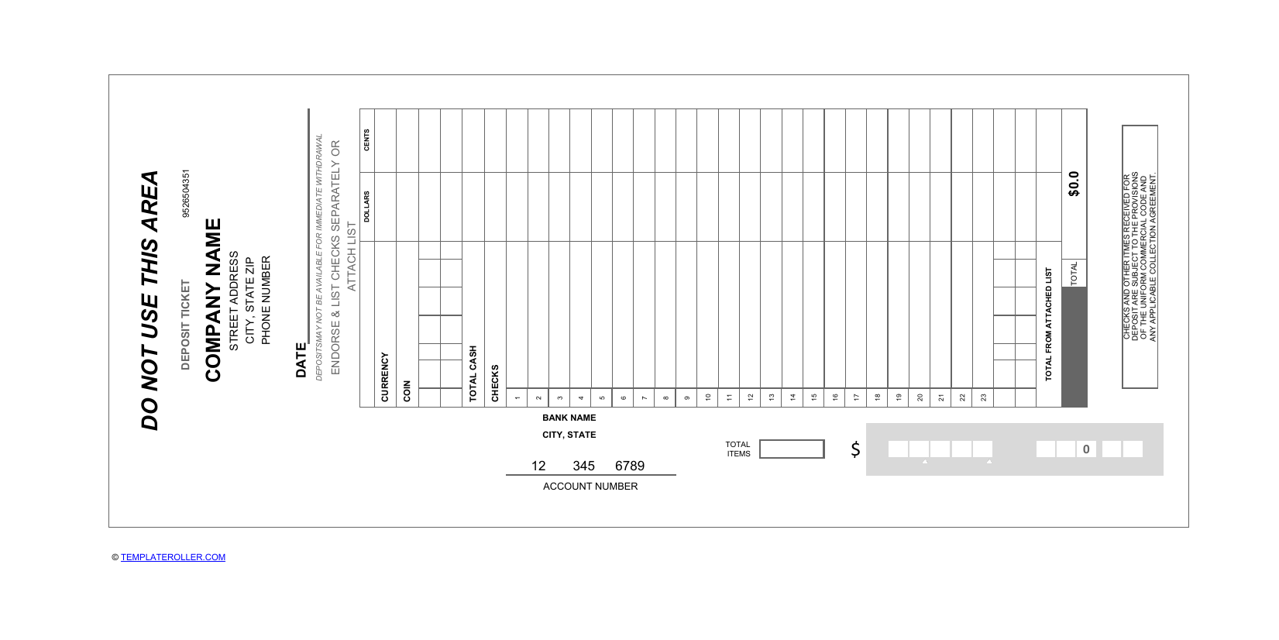

- Deposit Slip. Whenever you deposit money into your bank account, you need to complete a short form that states how many funds you have deposited and indicates your name and contact details.

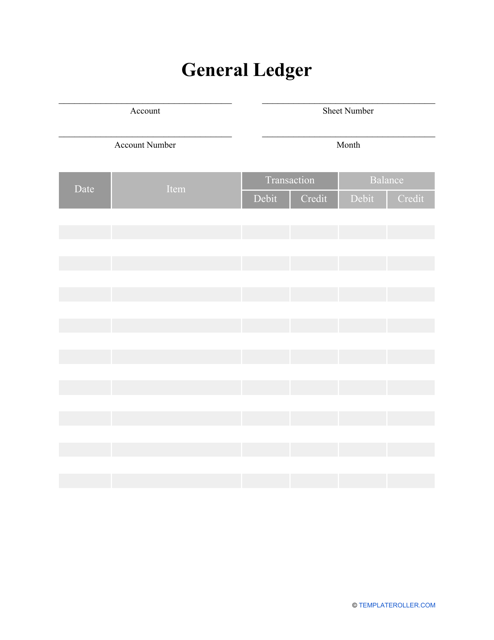

- General Ledger. This bookkeeping instrument will sort and store all the transactions your organization has been a part of.

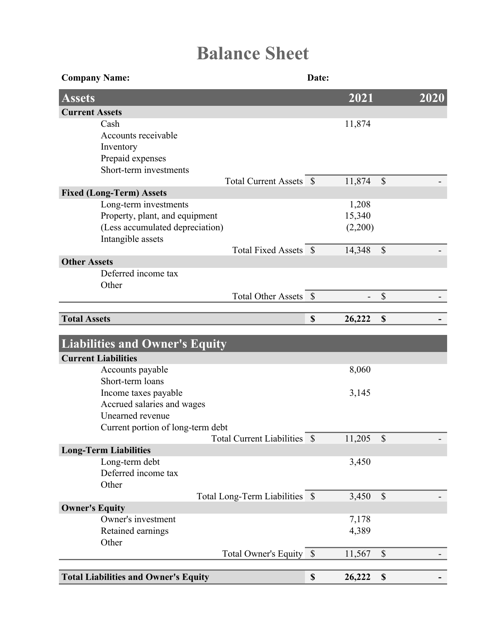

- Balance Sheet. One of the key financial statements of any business, this document will balance your assets, debts, and shareholders’ equity.

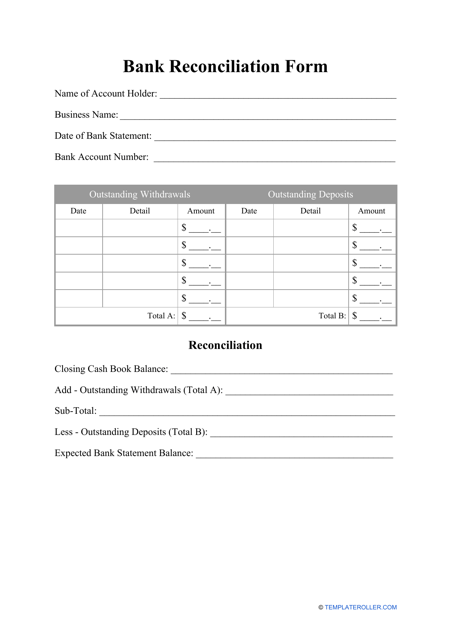

- Bank Reconciliation Form. Compose this statement to match the financial balance of your company with the balance from the statement provided to you by your bank, determine whether you need to make any amends, and discover discrepancies.

Here are some tips that will help you manage your Accounting Records better:

- Set up an organized filing system to keep track of all incoming and outcoming documents. You can create a paper trail by printing all statements and records and make an electronic copy to be safe;

- Keep your invoices and slips using a unified method – sort them by the name of your business partners and clients, by date, or by location. It is preferable to use several methods simultaneously;

- Create a separate banking account to deal with your business transactions. When the time comes to reconcile any mismatches, you will be able to handle this problem in a shorter amount of time;

- Inspect your records regularly to figure out issues and omissions and resolve them on the spot.

Related Tags and Topics:

Related Articles

Documents:

19

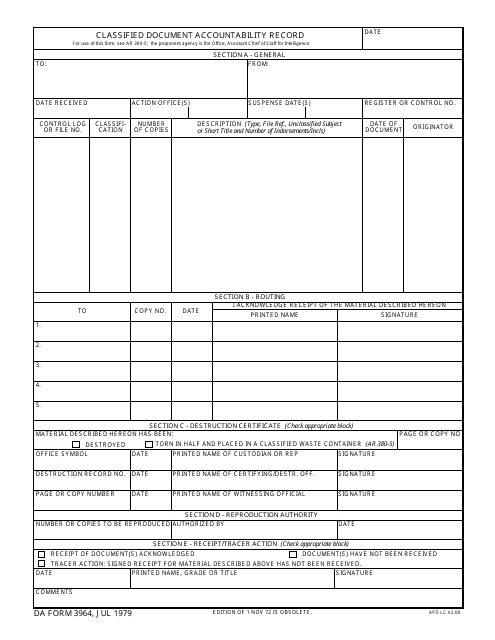

This is an official form used by the Department of the Army Information Security Program and designed as a single-entry active or inactive document-control register.

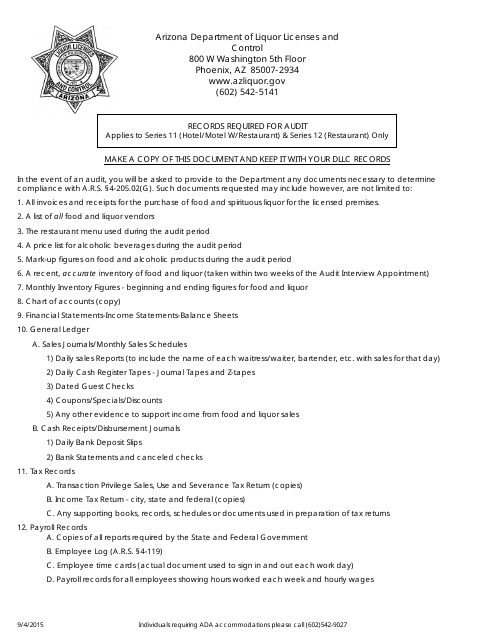

This document lists the records that are required for an audit in Arizona.

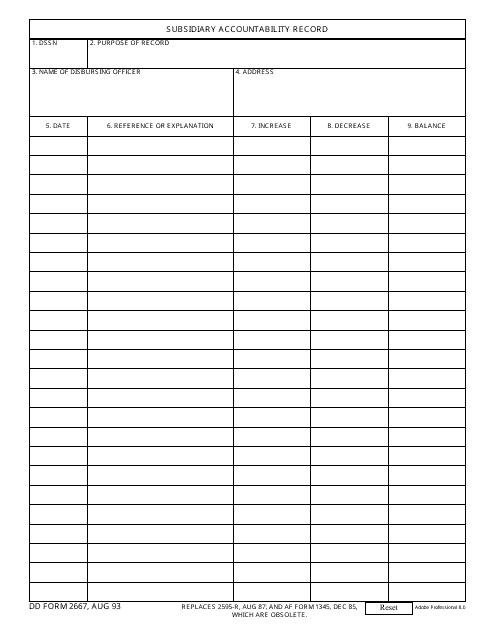

This document is used for maintaining a record of subsidiary accountability for Department of Defense (DOD) assets. It helps track and manage the usage and distribution of these assets.

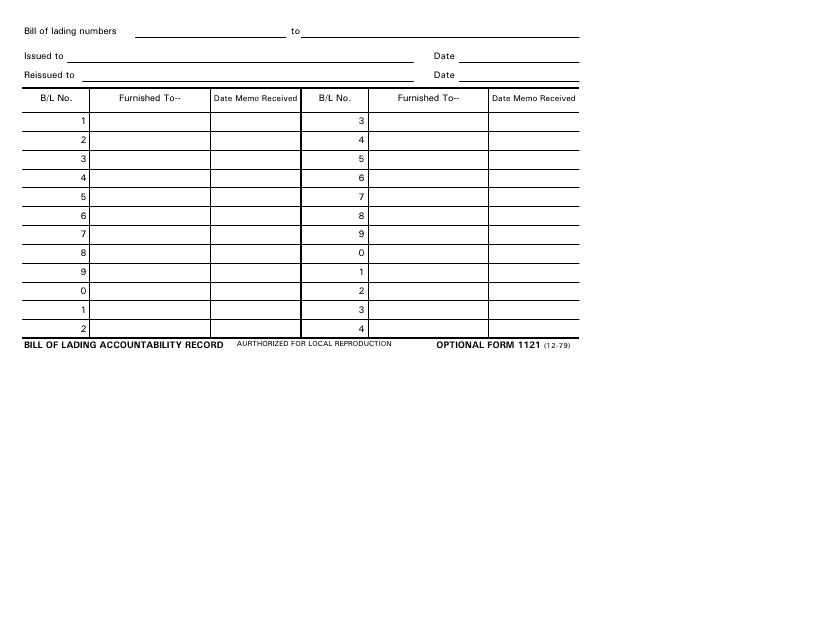

This form is used for keeping a record of accountability for bill of lading transactions.

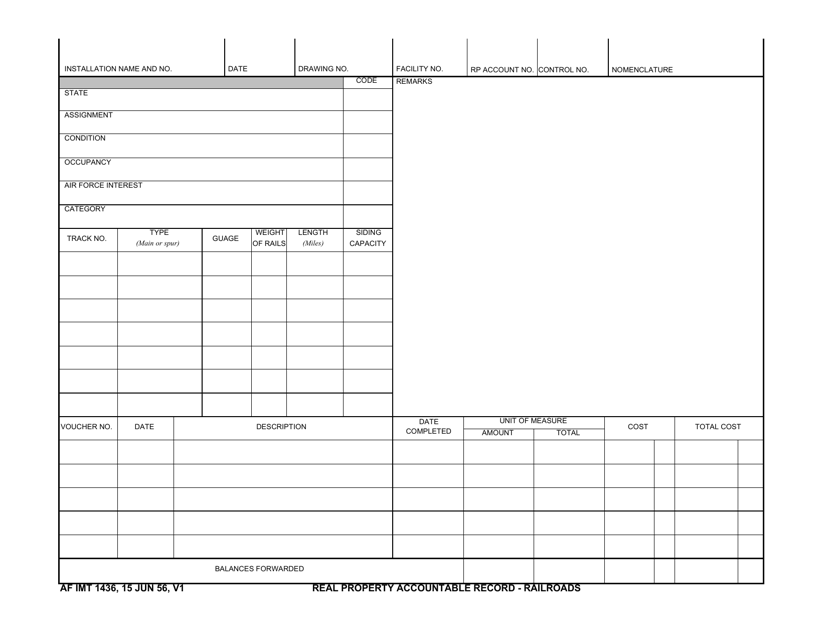

This form is used for keeping a record of real property accountable for railroads.

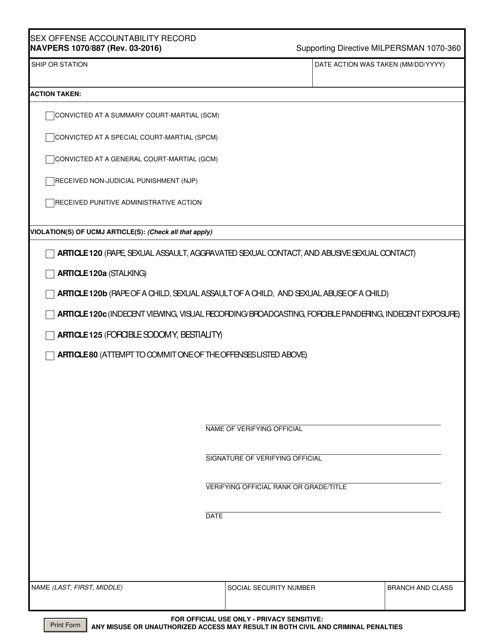

This document is used for recording sex offense accountability information.

You may use this Expense Report as a financial statement to record expenses incurred during various business operations.

This accounting document contains the deposits and checks of an organization and allows comparing the remainder on an entity's balance sheet to the amount on its bank account.

This document contains a complete record of all credit and debit operations, incoming and outgoing transactions associated with the bank account.

This document contains a set of numbered accounts used to keep track of a business's financial transactions and to prepare financial reports.

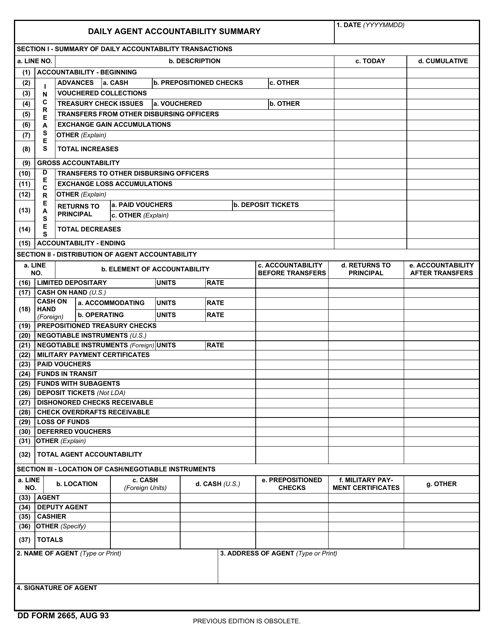

This Form is used for daily tracking and accounting of agents in a military or government agency. It ensures that all agents are accounted for and their movements and actions are recorded.

This is a document that is used by bank clients to deposit funds, such as cash or checks, into their bank accounts.

This XLS template is a financial statement that is used for reporting a company's assets, liabilities, and shareholders' equity.

This is a document that is supposed to be used when employees are required to provide information about their business travel expenses to their employers.

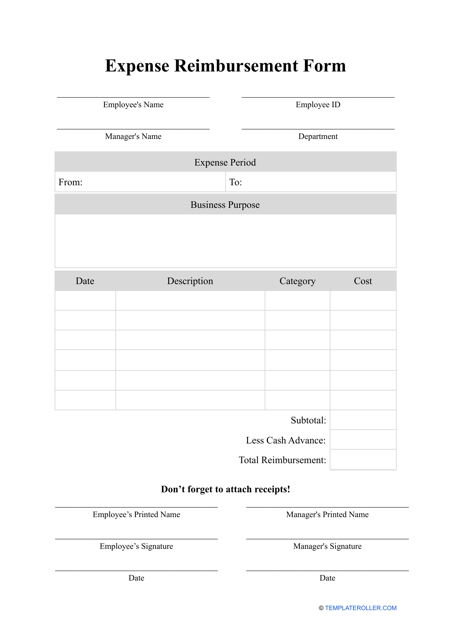

Use this form to recover back costs incurred while performing work on behalf of your employer.

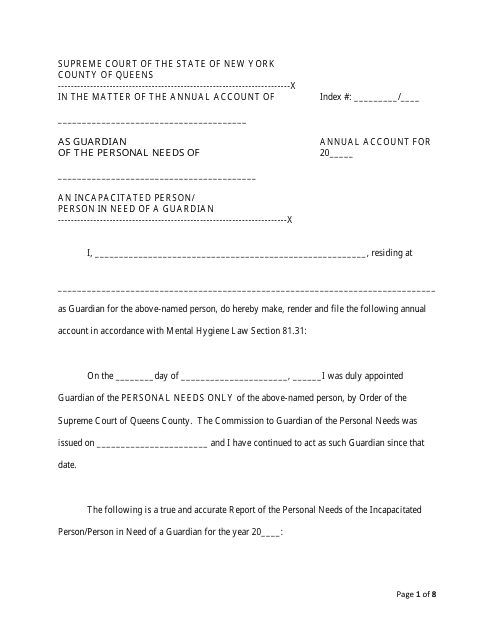

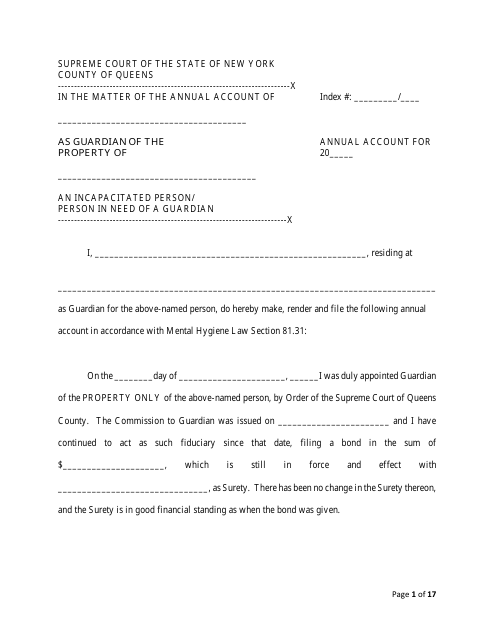

This document is used for filing annual accounts in New York. It provides a summary of a company's financial activities for the year.

This document presents a yearly financial report for Queens County, New York, detailing revenue, expenditure, financial operations, and any changes in financial positions over a year. It's primarily intended for investors, government officials, and citizens to assess the county's financial status.