Free Bookkeeping Templates

What Is Bookkeeping?

Bookkeeping refers to a process of keeping unabridged records of all financial operations of the business. You can always examine your records to learn more about the financial transactions of the past, add and update the information to document how much money you have earned, and see what debts and liabilities you still have to deal with.

If you are wondering what is bookkeeping and how to properly record money your business spends, our guide of documents will tell you how to run your business smoothly, safeguard it from financial troubles, and learn bookkeeping without seeking professional bookkeeping services.

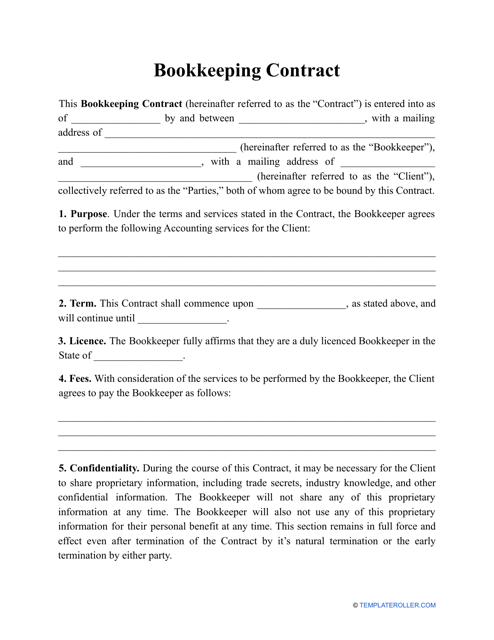

Is your business in need of a bookkeeper? Are you a bookkeeper looking to sell your services to a company? This document gives you the perfect format to market your products or services while providing guarantees for any produced work.

What Is the Difference Between Bookkeeping and Accounting?

Despite the considerable overlap between accounting and bookkeeping, there is a significant difference. Bookkeeping refers to the process of recording business transactions while accounting allows you to interpret, classify, and report the data you have at your disposal.

How to Do Bookkeeping?

Whether you decide to pay for bookkeeping services or draft the documentation yourself, you can see our library of templates below to know more about bookkeeping basics and keep track of all financial transactions your company is involved in.

Payroll Forms

Payroll will allow your organization to make sure every employee is paid the correct amount of wages on time:

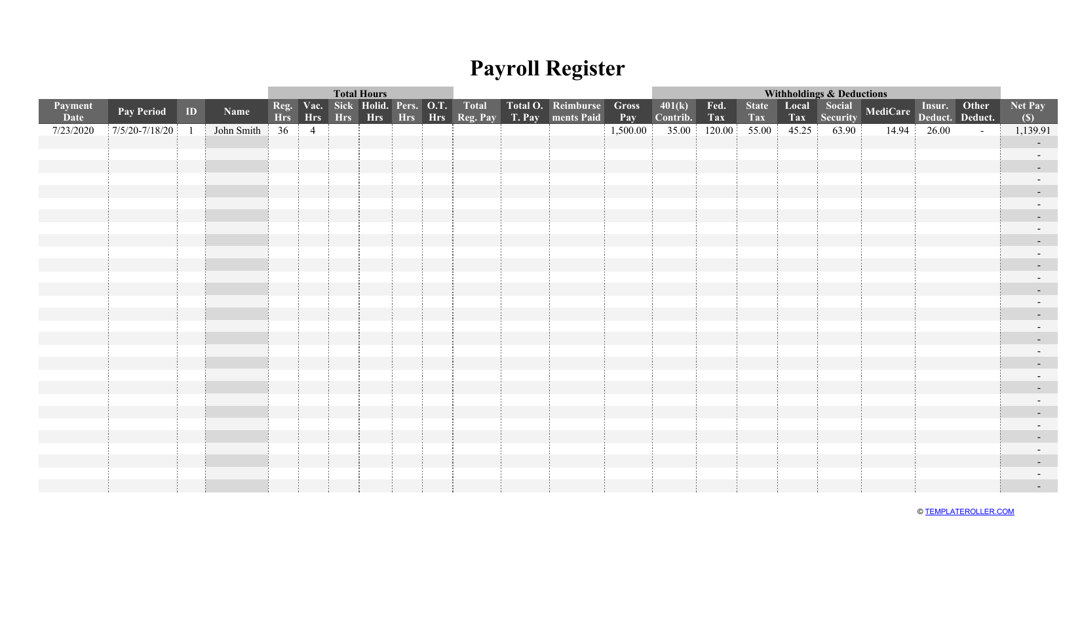

- A Payroll Register is a table that lists all salaried employees and indicates the total amounts of their gross pay and deductions;

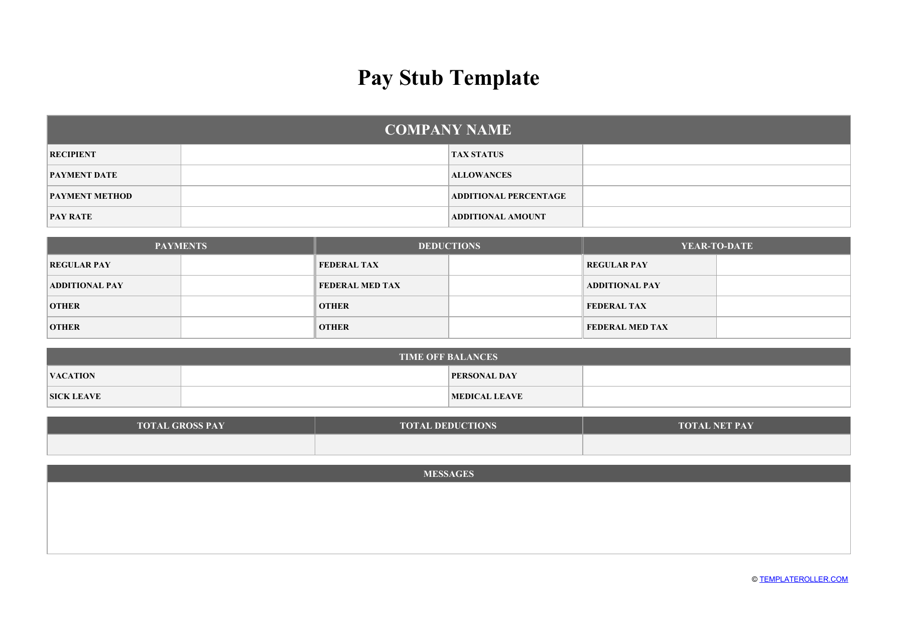

- A Pay Stub, always given with a paycheck, contains the information about the payment given to the employee for their work;

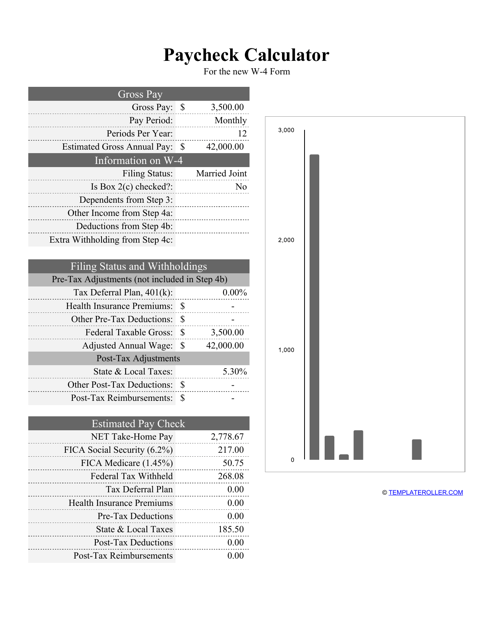

- A Paycheck Calculator is a financial tool that will help you to estimate the pay to your employees after you determine accurate tax withholdings and deduct necessary amounts from their salaries;

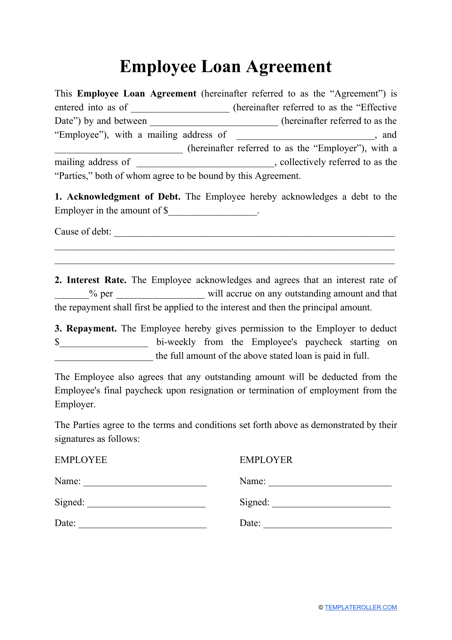

- An Employee Loan Agreement refers to the employer’s consent to give an advance to the employee prior to the payday.

Petty Cash Forms

Complete these Petty Cash Forms to handle small expenditures of your business:

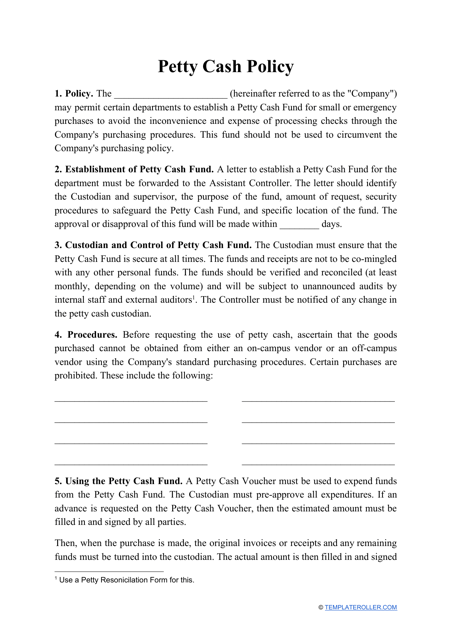

- A Petty Cash Policy determines the rules and regulations of dealing with Petty Cash inside your company;

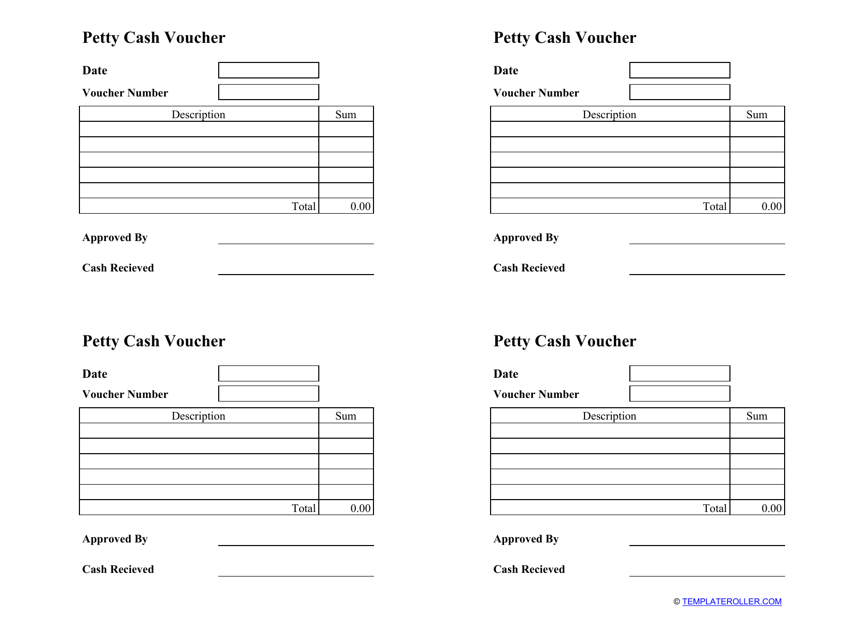

- A Petty Cash Voucher is prepared to document one transaction that involves money from the cash fund;

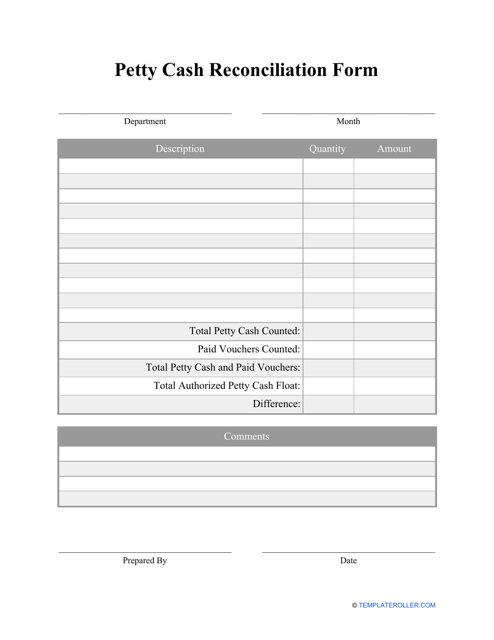

- Petty Cash Reconciliation is necessary to discover any faults and errors in your calculations so that your financial records can be kept in order.

Accounting Records

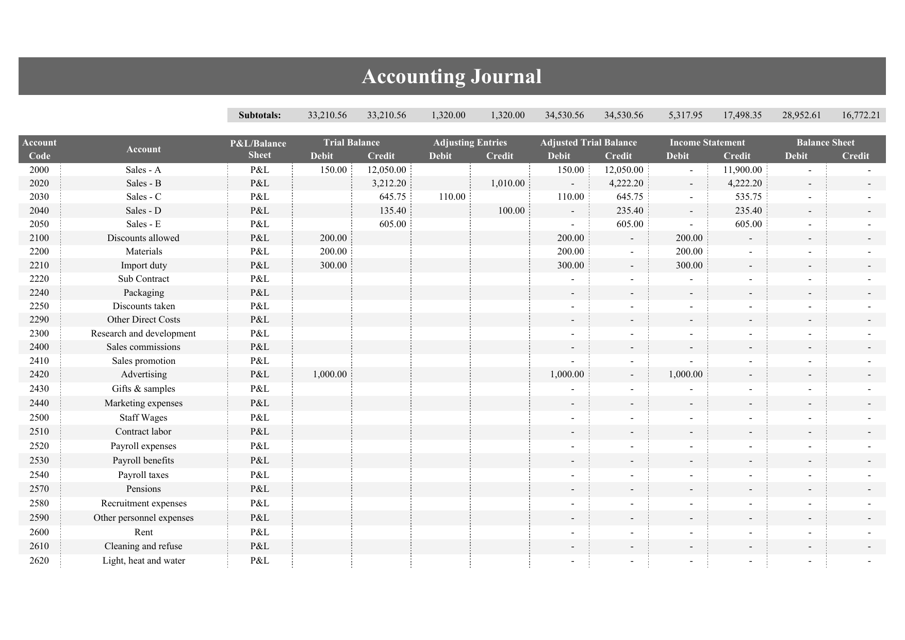

To document all your business transactions, including electronic payments to and from your company, use these Accounting Records to create balance records:

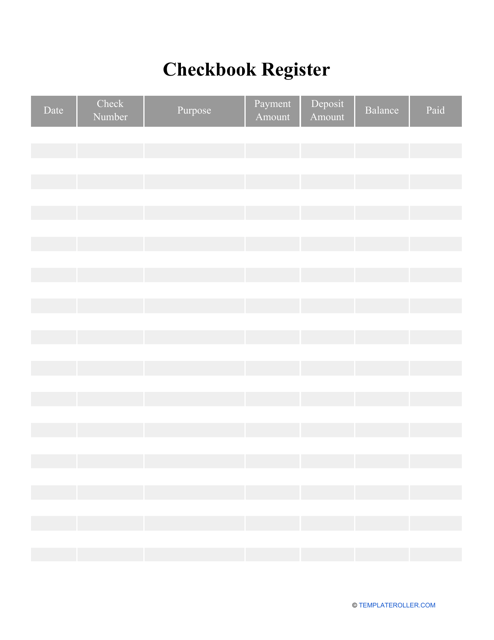

- A Checkbook Register is created for the internal use of the organization – it demonstrates all the deposits and withdrawals to and from your accounts;

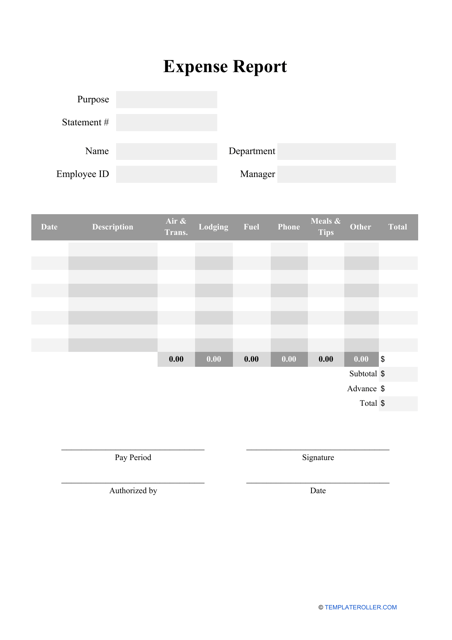

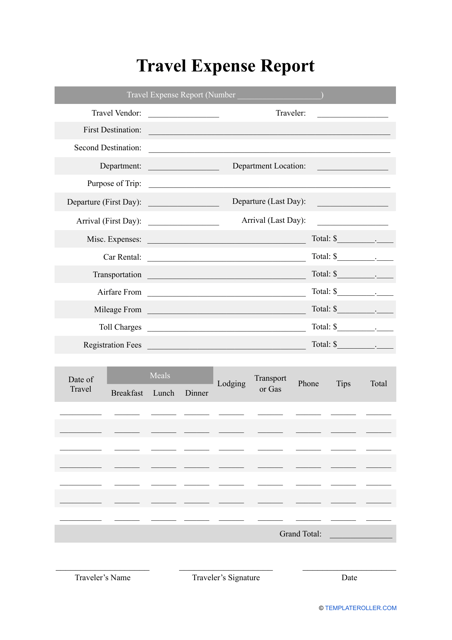

- An Expense Report records all the business costs the company has encountered during the reporting period;

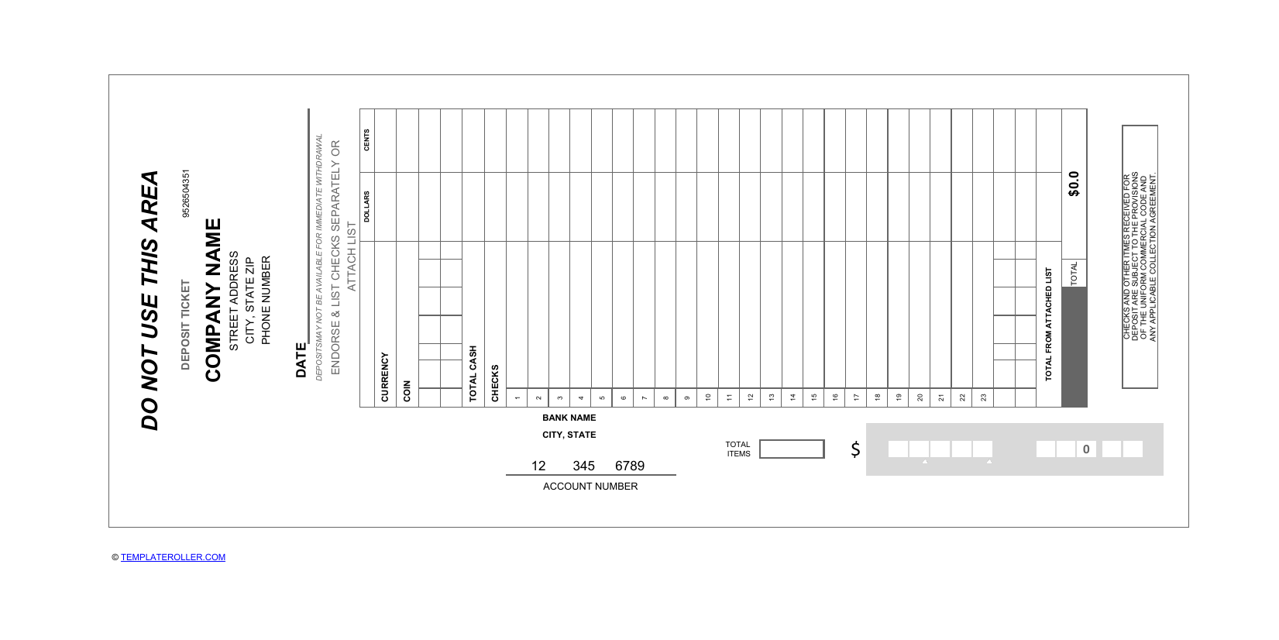

- A Deposit Slip is completed by bank customers who deposit their funds to bank accounts to show the amount of money they deposit;

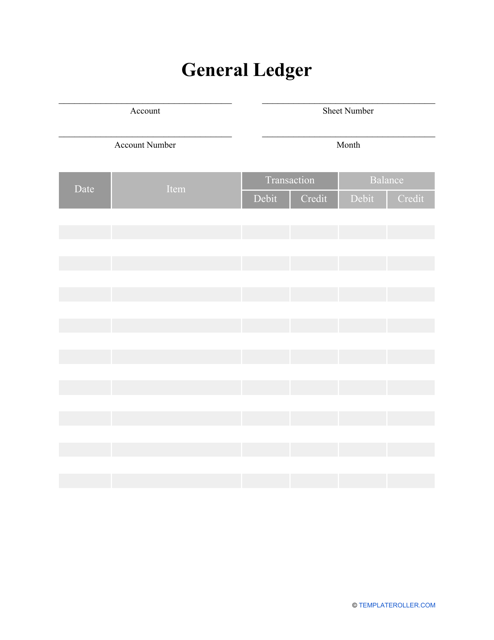

- A General Ledger is one of the main bookkeeping documents that stores and summarizes transactions of the company;

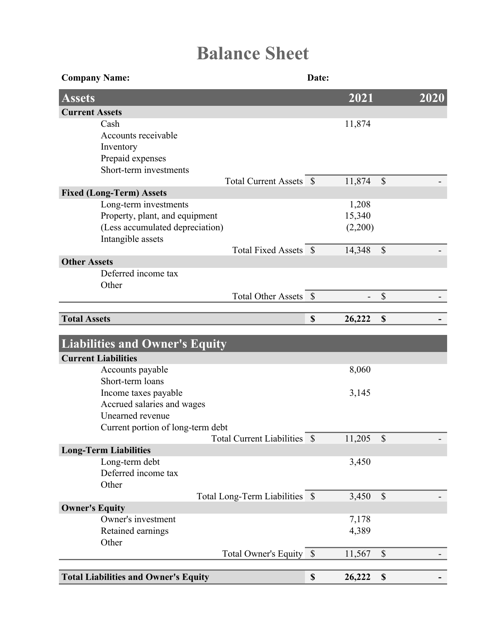

- A Balance Sheet is one of the main financial statements of any organization – it shows the company’s assets, debts, and equity;

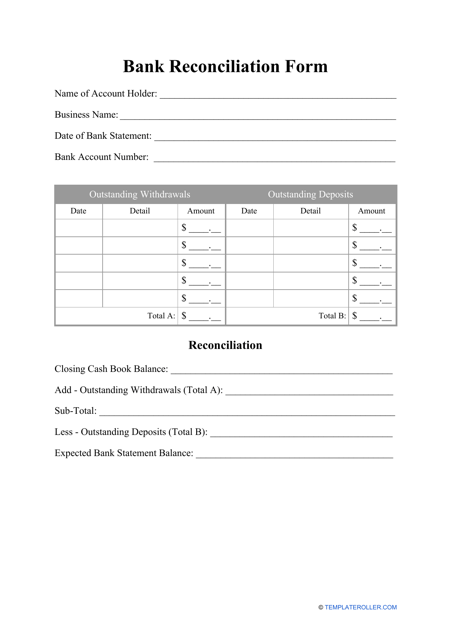

- A Bank Reconciliation Form will let you match the Balance Sheet you created with the balance you have on your bank account.

Accounts Payable and Receivable

These forms can be used to keep track of your Accounts Payable and Receivable (the money you owe and money owed to you) and various credit transactions. Most of these templates can be completed by individuals and entities alike:

- Bill Trackers indicate all the bill payments you need to handle during the upcoming month or year;

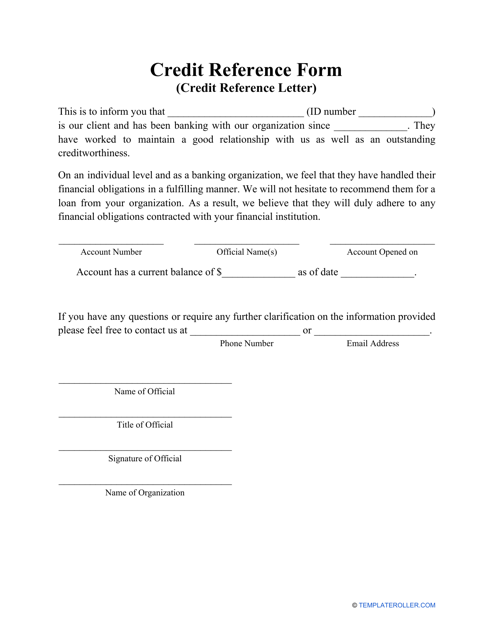

- A Credit Reference Request is prepared by a financial institution that needs confirmation of the financial trustworthiness of their client who asks for a loan;

- A Credit Reference Form verifies the identity of the prospective borrower and convinces the lender that this individual or company can be trusted with a loan;

- An Accounting Journal details all the financial transactions of the company – write them down in chronological order for your own use and for potential audits;

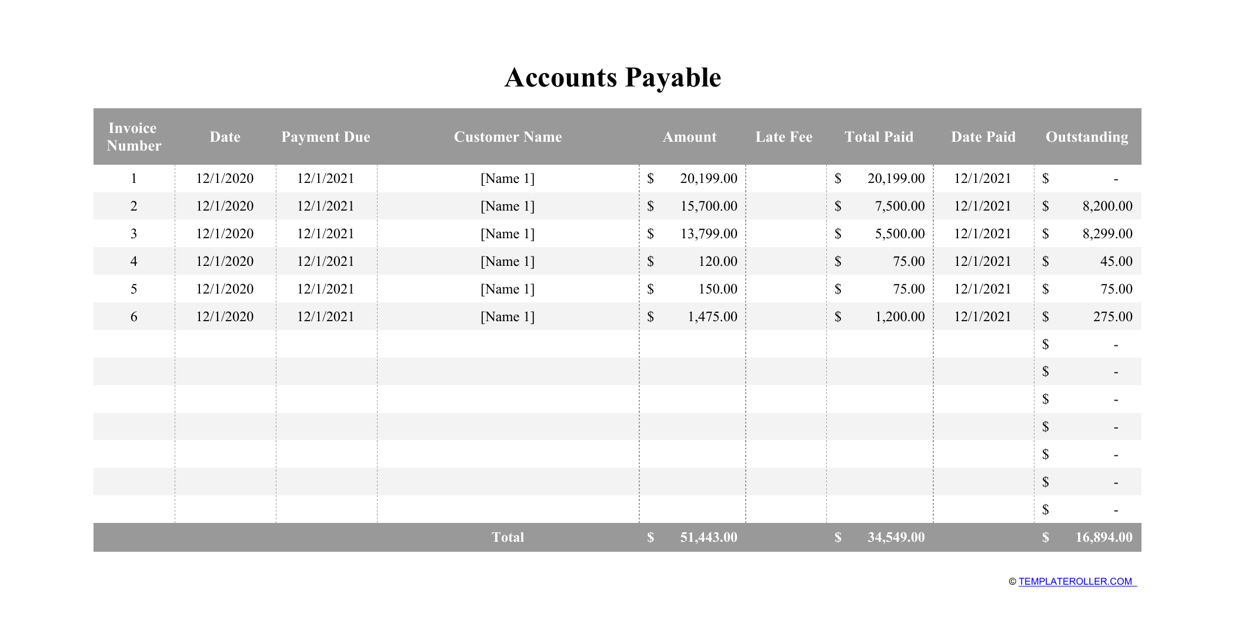

- Accounts Payable is a document that records all the money you owe to business partners and suppliers for goods and services already provided to you;

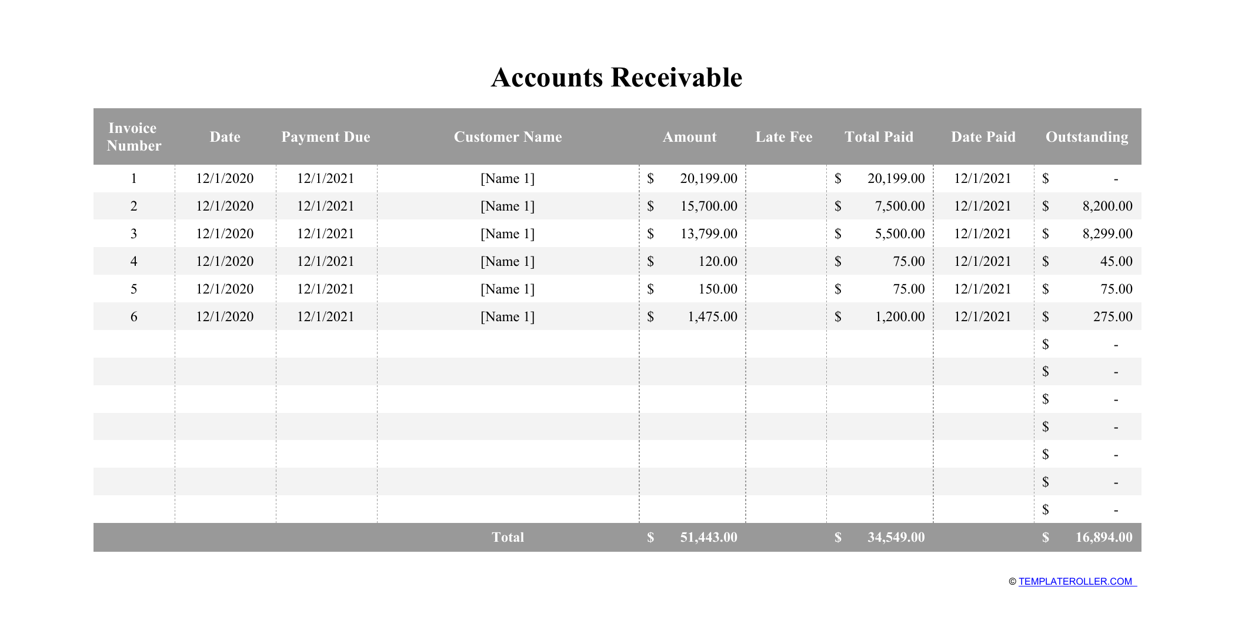

- An Accounts Receivable states amounts of money and names of clients and counterparts that owe money to your business on credit;

- A Payment Request Letter is a formal statement that asks your customer or borrower to return money for a payment that is past due;

- A Debt Collection Letter serves as a notice to a borrower from a creditor who requires payments for services provided or loans administered;

- A Demand Letter notifies the recipient about the demand of their creditor or business partner – usually, it is needed to stop the violation of rights of the individual or entity that sent the letter;

- A Past Due Notice reminds the debtor they still owe money and offers payment options when the invoice is overdue;

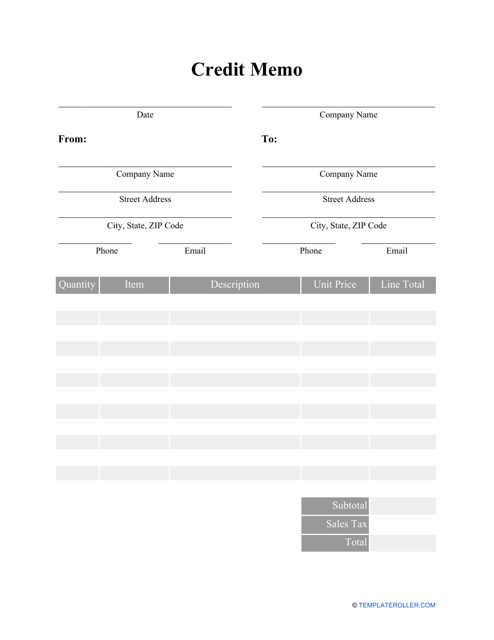

- A Credit Memo allows reducing the sum of money the customer owes to a provider of goods and services;

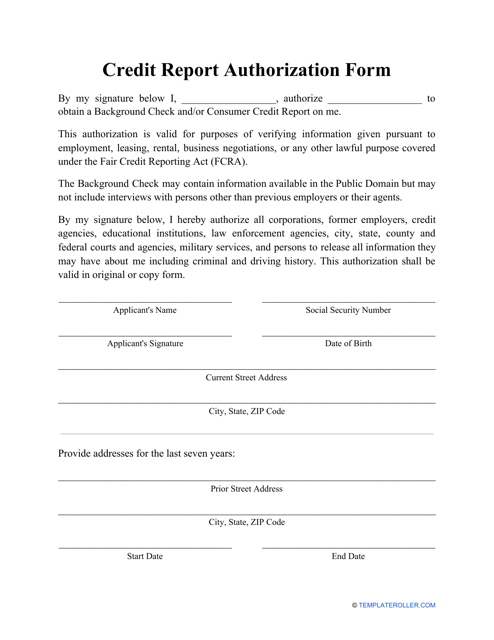

- A Credit Report Authorization records the consent of a potential borrower required by the lender who needs to perform a background check on the borrower’s creditworthiness.

How to Do Bookkeeping for Small Business?

There are six main steps for any small business that requires accurate bookkeeping:

- Create business accounts – use any of the forms above to start tracking your operations.

- Record every transaction – some of them must be documented in various spreadsheets and ledgers because later you will have to report your financial activity to authorities.

- Reconcile and balance your records – all the totals must match.

- Prepare financial reports – a Balance Sheet, along with other financial statements, will show how and when your entity spends its money.

- Follow the schedule – once a month or, better, a week check all the documents, invoices, and receipts.

- Store the documentation securely – make copies of forms and templates to safeguard your business.

Related Forms and Templates:

Related Articles

Documents:

27

This contract contains the consent of an employer to provide a loan to an employee, which will be further deducted from the employee's payroll.

This document is created by a company in order to provide guidelines for employees on how to use employer given petty cash.

This form is completed in order to ask any company or financial institution you have worked with at some point in time for a reference required to obtain credit from a third party.

You may use this Expense Report as a financial statement to record expenses incurred during various business operations.

This accounting document contains the deposits and checks of an organization and allows comparing the remainder on an entity's balance sheet to the amount on its bank account.

Use this template to provide consent to a potential lender to learn more about the prospective borrower's credit history.

This document contains a complete record of all credit and debit operations, incoming and outgoing transactions associated with the bank account.

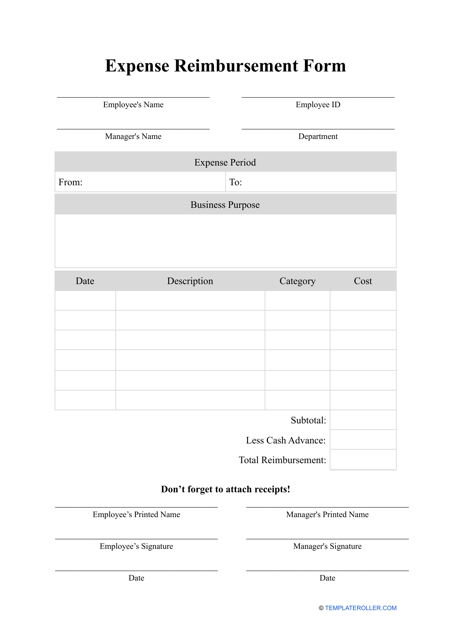

This form compiles and manages all business-related expenses in order to avoid any irregularities in a company's records.

This form is completed by the retailer in order to reduce the amount of money owed by a customer from a sales invoice that was issued earlier.

A person can use this typed or handwritten document to confirm the lending capacity of a prospective borrower.

This document contains a set of numbered accounts used to keep track of a business's financial transactions and to prepare financial reports.

This is a document that contains an official record that an employee got paid from their employer.

This is a document that is used by bank clients to deposit funds, such as cash or checks, into their bank accounts.

This is a small document that can be used to record payment with money taken from a petty cash fund.

This is an accounting tool that allows financial departments of any organization to determine the correct wages of all of their employees.

You can utilize this template to see how effectively your organization collects the financial assets provided to other companies and individuals.

This XLS template is a financial statement that is used for reporting a company's assets, liabilities, and shareholders' equity.

This ledger will help you calculate are amounts due to vendors or suppliers for assets or services that you received but have not paid for yet.

This report is usually represented as an electronic spreadsheet or online application and indicates a worker's payroll information for a certain period of time.

This document acts as a record of cash inflow and outflow to help a business track its spending compared to its income.

This is a document that is supposed to be used when employees are required to provide information about their business travel expenses to their employers.

Individuals may use this structured document that organizes their bills over a monthly period and helps the person who drafted it to pay the bills on time and avoid penalties or fines.

Individuals may use this type of tracker to make a list of all the bills they must deal with throughout the year and allows them to keep track of all the expenditures to avoid fines and penalties.

This is a written form used to keep an accurate record of all pf your medical costs and payments you have not dealt with whether you have a one-time medical emergency or a chronic illness.

Use this form to recover back costs incurred while performing work on behalf of your employer.

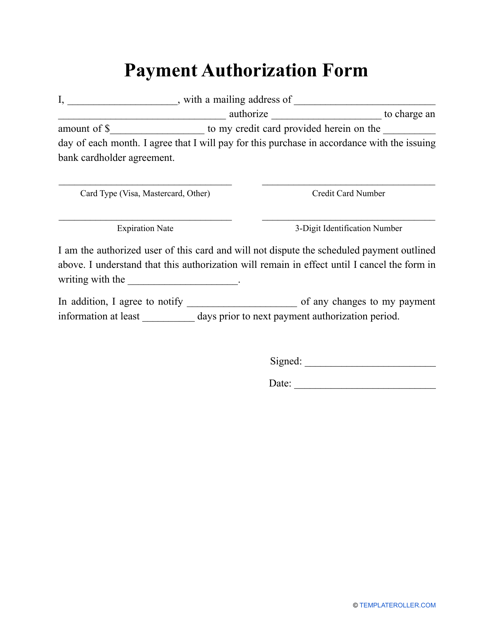

This document gives a company the permission to charge their customer (or their credit or debit card) recurring payments for a fixed amount of time.

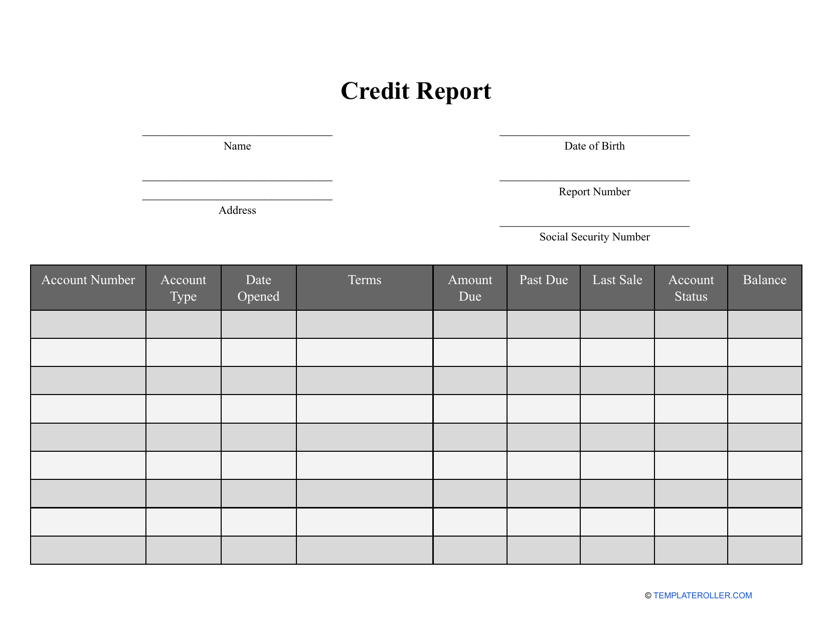

This type of template can be used to outline an individual's financial background and help potential lenders and credit card companies see how they have managed to repay debt in the past.