Free Accounts Payable and Receivable Templates

What Is Accounts Payable and Receivable?

The total accounts balance of your company records all financial transactions of your company and is of great importance in managing the money flow of your business. Accounts Payable and Accounts Receivable are opposite concepts – the difference between Accounts Payable and Receivable lies in the nature of these accounts:

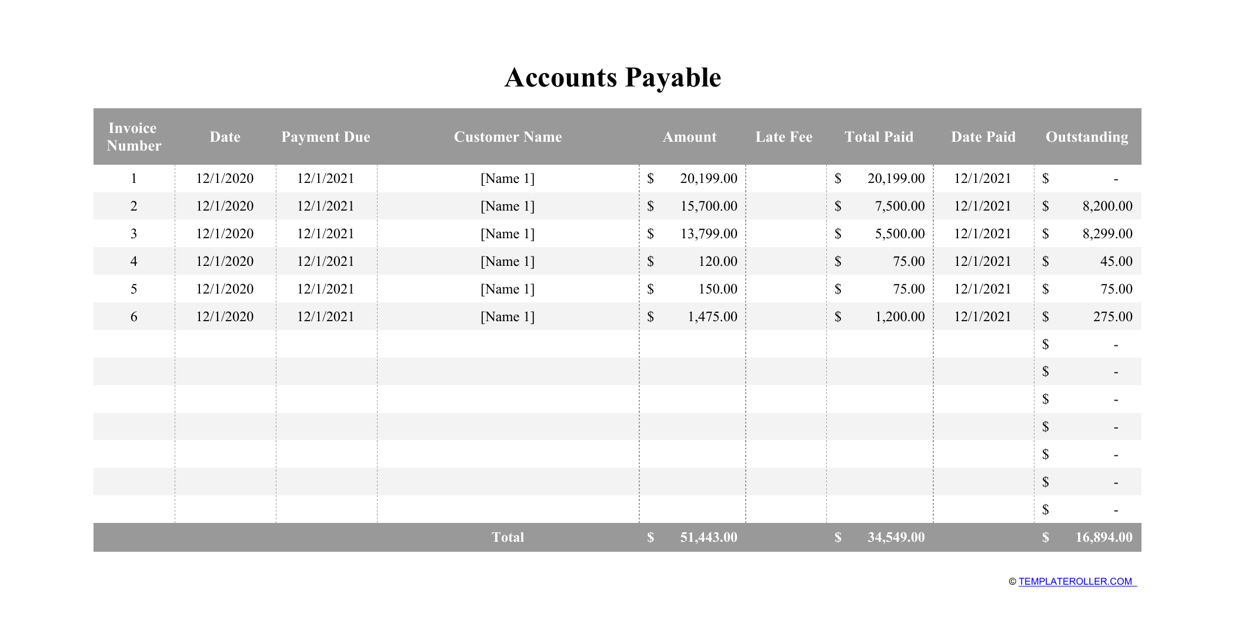

- Accounts Payable represents current liabilities and debts (for instance, rent payments the company must send to the owner of their office space.

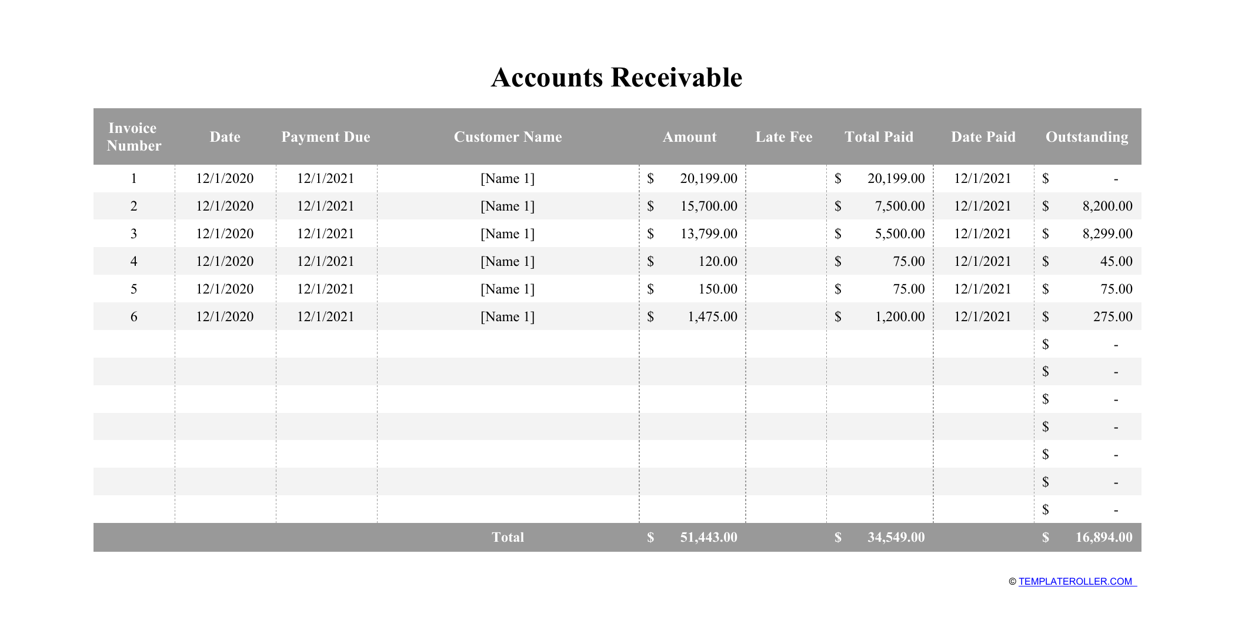

- Accounts Receivable includes current assets of the organization (for example, service bill a customer has to pay for services rendered).

The two concepts are intertwined, they cannot be documented and analyzed separately. Just like you need to pay your debts on time, you have to collect payments from other parties and balance your finances. Use Accounts Payable and Accounts Receivable to refer to the two sides of any transaction and indicate the outgoing and incoming money flow to maintain proper records of your company.

How Do You Manage Accounts Payable and Receivable?

Here are some tips for you on how to manage your accounts:

- Always be precise about payment deadlines and penalties in case of a failure to pay;

- Send invoices and other documentation right after you finalize the transaction;

- Review your records regularly to see which companies and individuals are constantly in default;

- Offer discounts to counterparts and clients that proved their professionalism to you;

- Remind your customers and partners about their outstanding payments.

To stay on top of Accounts Payable and Receivable and keep track of all money outflows and inflows, you can use our library of templates to document all your receipts, invoices, orders, and financial statements.

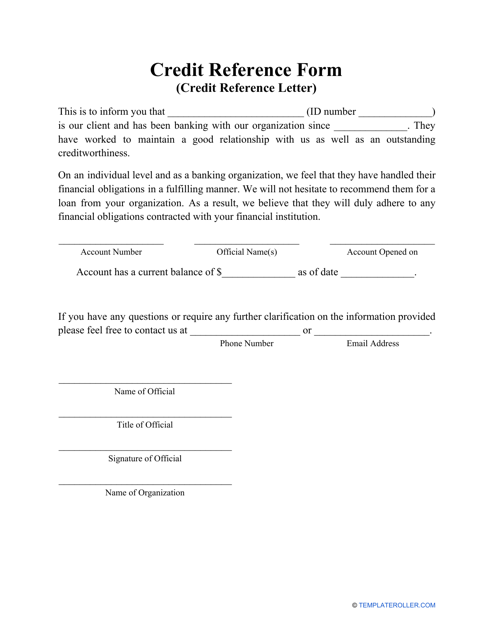

- Credit Reference Form. This letter, composed by the business partner or financial institution that has had a professional relationship with a potential borrower, will confirm their creditworthiness to a prospective lender.

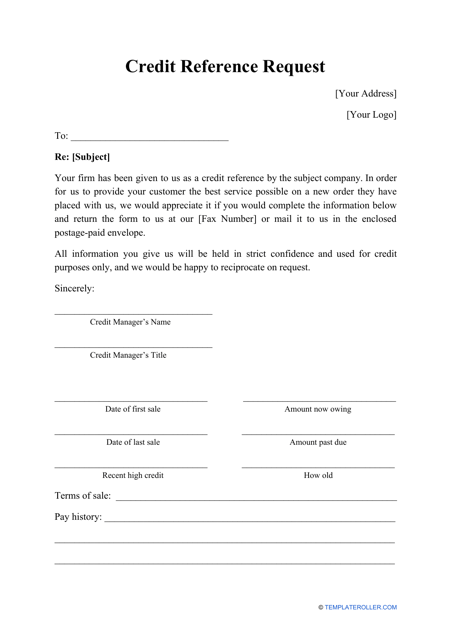

- Credit Reference Request Form. It can be prepared to ask borrower’s counterparts and banks that have worked with them in the past about their reputation and verify the borrower’s ability to pay back the debt.

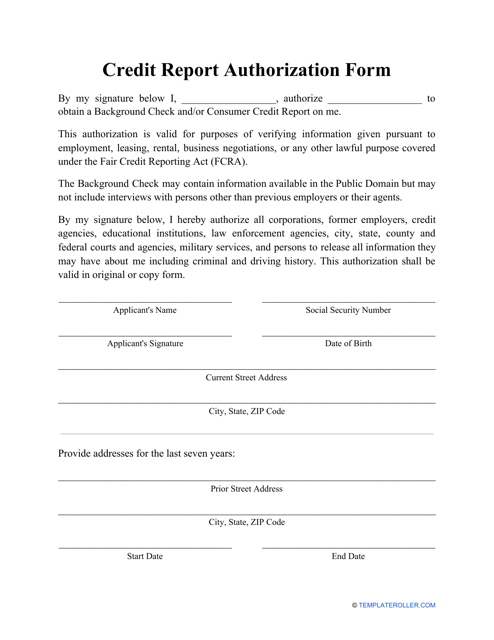

- Credit Report Authorization Form. Lenders obtain the consent of potential borrowers to learn more about their financial background.

- Bill Tracker. Businesses and households alike can benefit from this financial tool that reminds them when to pay monthly bills and states their amounts.

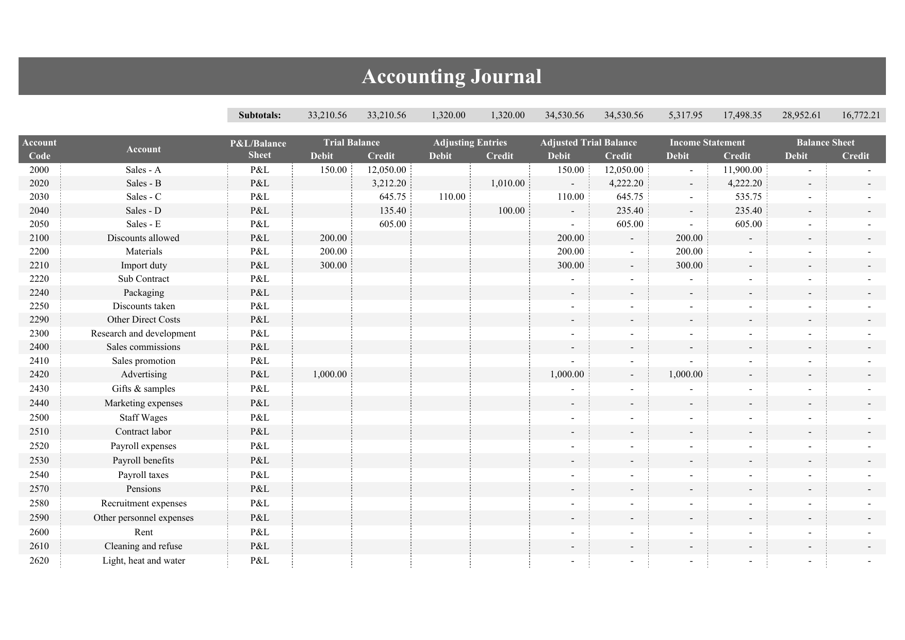

- Accounting Journal. Record all the financial transactions of your company to refer to them later and analyze your finances.

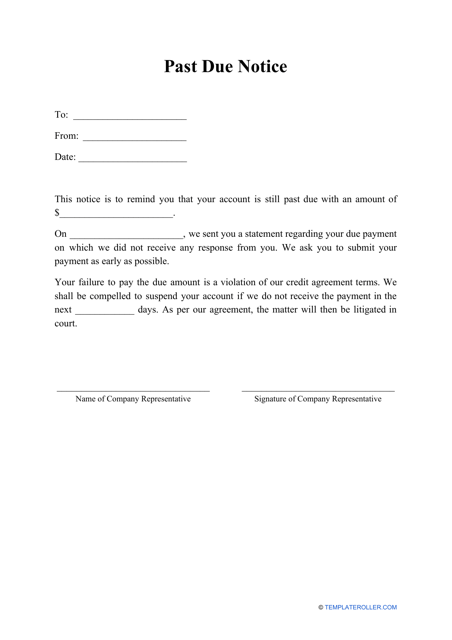

- Past Due Notice. It is completed to remind a customer they are behind on their payment and name a new deadline for this payment.

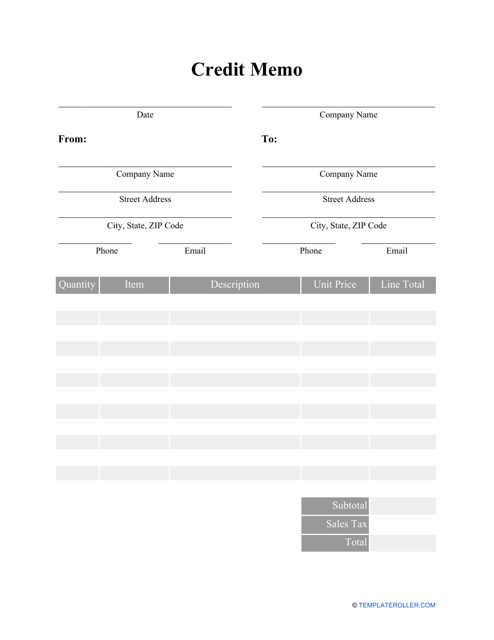

- Credit Memo. If you provided a customer with damaged goods or forgot to add an item to their order, this document will let you reduce the sum of money you are owed.

- Demand Letter. Use this statement to express your position on a certain matter and warn the recipient about possible legal action unless they comply with your demand to pay you your money, fulfill their contractual obligations, or cease the activity that infringes your rights.

- Payment Request Letter. Compose a letter to a client or business partner who owes you money to ask them for the payment in a polite way.

- Debt Collection Letter. This type of demand letter is drafted by creditors who ask their debtors to settle the bills in default.

Related Tags and Topics:

Related Articles

Documents:

13

This form is completed in order to ask any company or financial institution you have worked with at some point in time for a reference required to obtain credit from a third party.

The purpose of this notice is to inform a debtor about their late payment and to urge the responsible party to make a money transfer to correct the late payment.

Use this template to provide consent to a potential lender to learn more about the prospective borrower's credit history.

This form is completed by the retailer in order to reduce the amount of money owed by a customer from a sales invoice that was issued earlier.

A person can use this typed or handwritten document to confirm the lending capacity of a prospective borrower.

You can utilize this template to see how effectively your organization collects the financial assets provided to other companies and individuals.

This ledger will help you calculate are amounts due to vendors or suppliers for assets or services that you received but have not paid for yet.

This document acts as a record of cash inflow and outflow to help a business track its spending compared to its income.

Individuals may use this structured document that organizes their bills over a monthly period and helps the person who drafted it to pay the bills on time and avoid penalties or fines.

Individuals may use this type of tracker to make a list of all the bills they must deal with throughout the year and allows them to keep track of all the expenditures to avoid fines and penalties.

This is a written form used to keep an accurate record of all pf your medical costs and payments you have not dealt with whether you have a one-time medical emergency or a chronic illness.

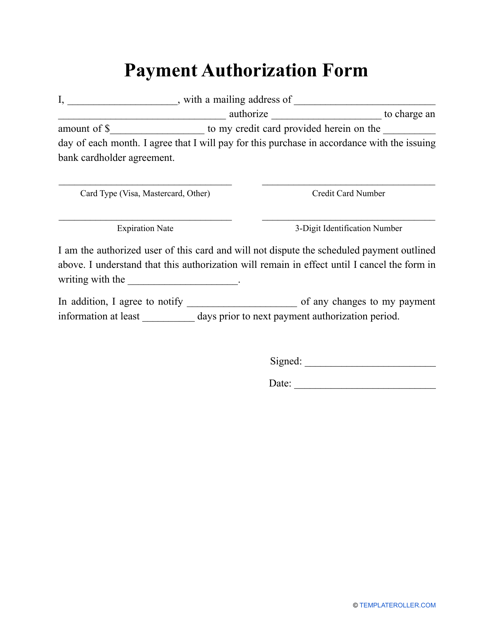

This document gives a company the permission to charge their customer (or their credit or debit card) recurring payments for a fixed amount of time.

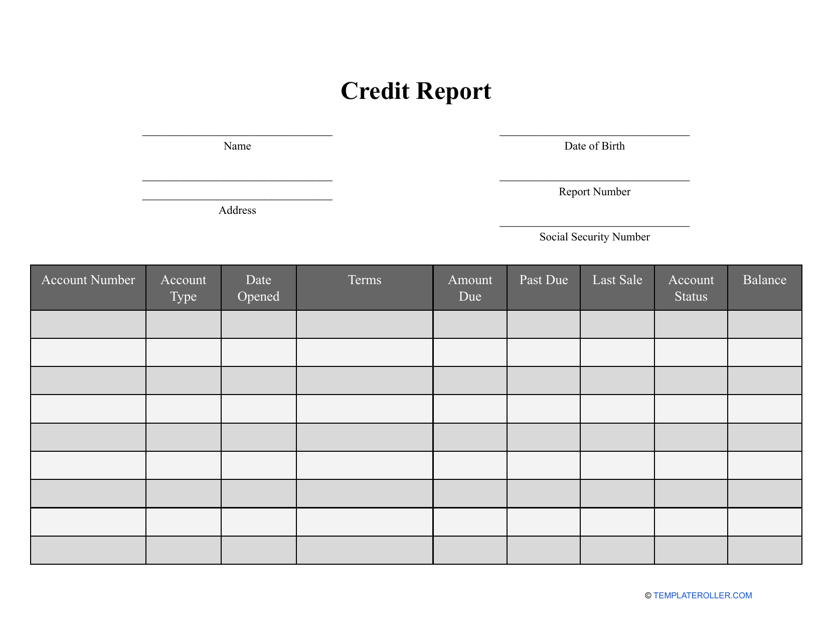

This type of template can be used to outline an individual's financial background and help potential lenders and credit card companies see how they have managed to repay debt in the past.