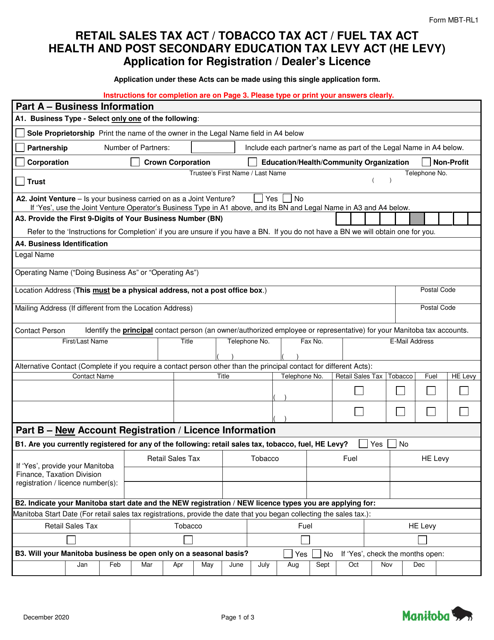

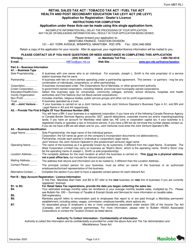

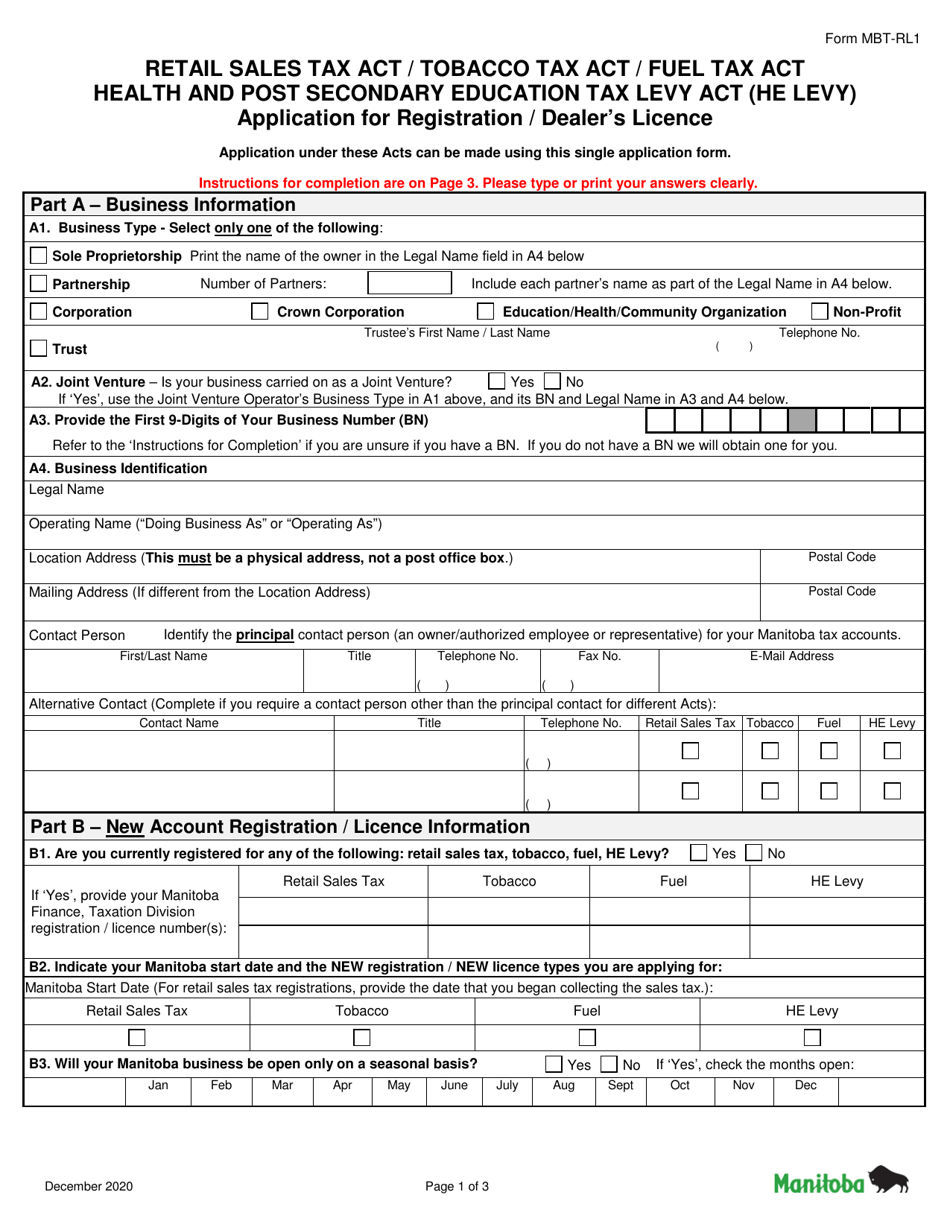

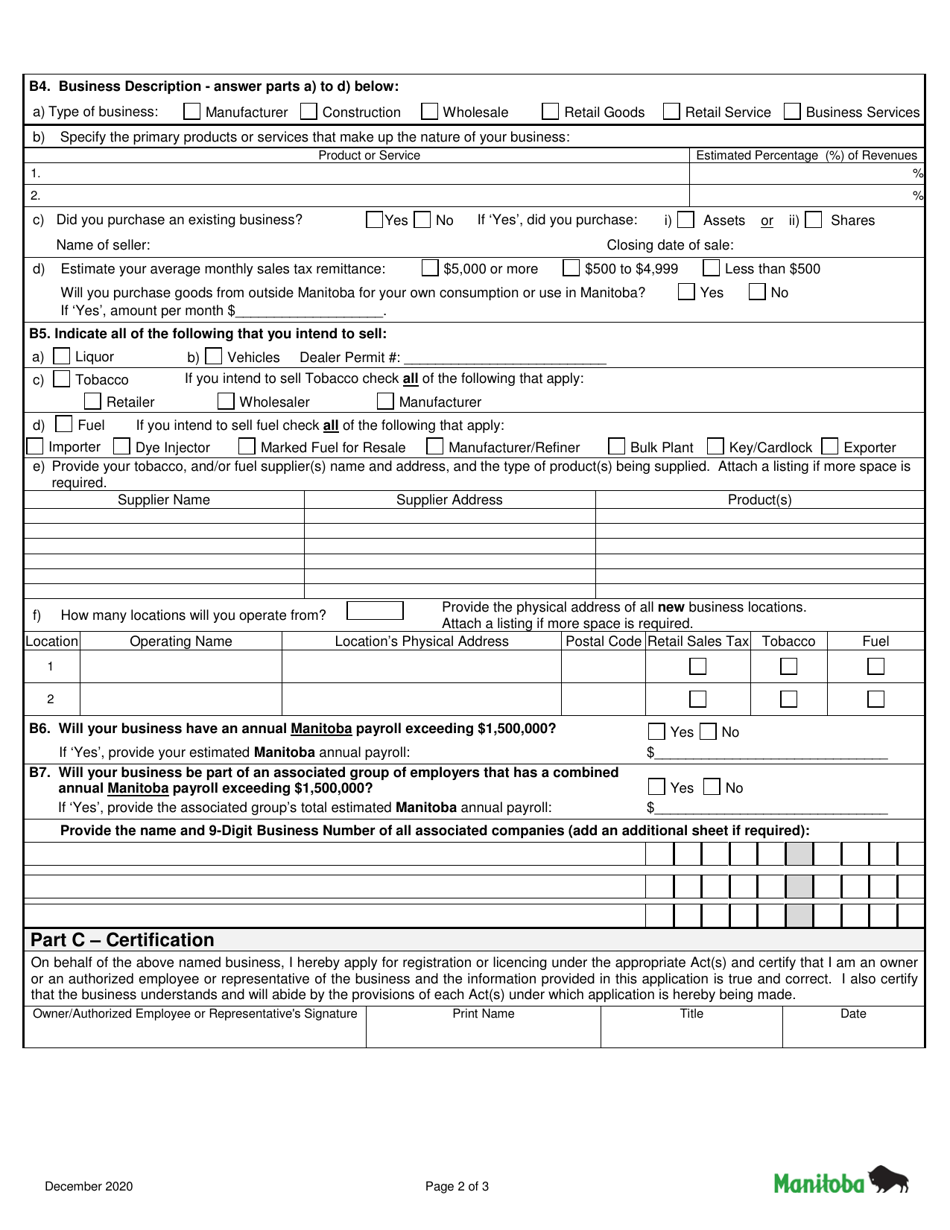

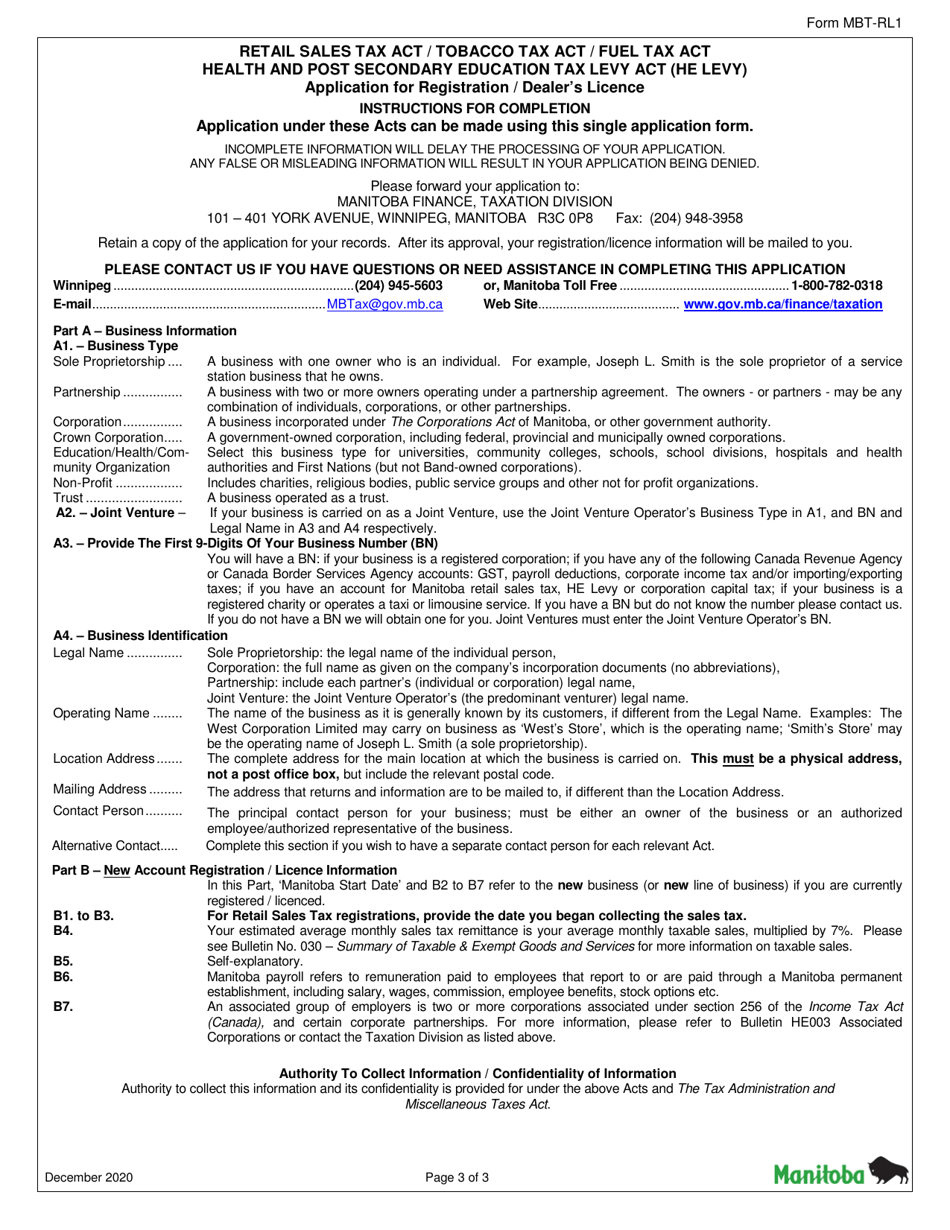

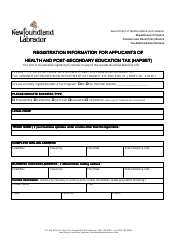

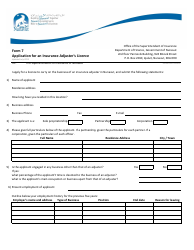

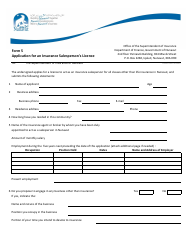

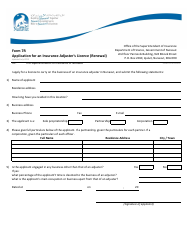

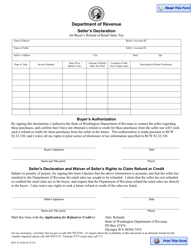

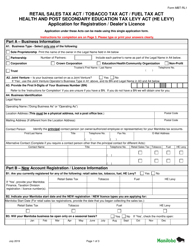

Form MBT-RL1 Application for Registration / Dealer's Licence - Retail Sales Tax Act / Tobacco Tax Act / Fuel Tax / Act Health and Post Secondary Education Tax Levy Act (He Levy) - Manitoba, Canada

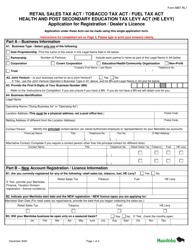

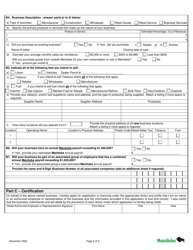

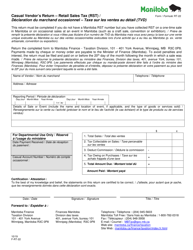

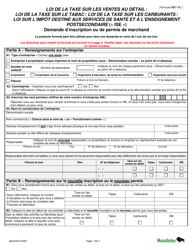

Form MBT-RL1 is an application form used in Manitoba, Canada for registering and obtaining a dealer's licence for various tax acts such as the Retail Sales Tax Act, Tobacco Tax Act, Fuel Tax Act, and Health and Post Secondary EducationTax Levy Act (He Levy). It is used by businesses to comply with the tax regulations and engage in retail sales or activities related to these tax acts in Manitoba.

In Manitoba, Canada, the Form MBT-RL1 Application for Registration/Dealer's Licence for the Retail Sales Tax Act, Tobacco Tax Act, Fuel Tax Act, and Health and Post Secondary Education Tax Levy Act (He Levy) is filed by the individual or business applying for the registration/dealer's license.

Form MBT-RL1 Application for Registration/Dealer's Licence - Retail Sales Tax Act/Tobacco Tax Act/Fuel Tax/Act Health and Post Secondary Education Tax Levy Act (He Levy) - Manitoba, Canada - Frequently Asked Questions (FAQ)

Q: What is Form MBT-RL1?

A: Form MBT-RL1 is an application for registration and a dealer's license under various tax acts in Manitoba, Canada.

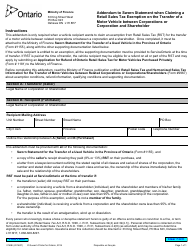

Q: Which tax acts are covered by Form MBT-RL1?

A: Form MBT-RL1 covers the Retail Sales Tax Act, Tobacco Tax Act, Fuel Tax Act, and Health and Post Secondary Education Tax Levy Act (He Levy).

Q: What is the purpose of Form MBT-RL1?

A: The purpose of Form MBT-RL1 is to apply for registration and obtain a dealer's license for retail sales tax, tobacco tax, fuel tax, and the He Levy in Manitoba.

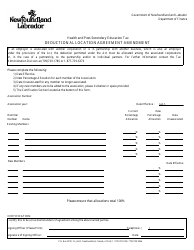

Q: Do I need to fill out Form MBT-RL1 if I am not a dealer?

A: No, Form MBT-RL1 is only required for individuals or businesses who want to become registered dealers for the specified tax acts in Manitoba.

Q: Are there any fees associated with Form MBT-RL1?

A: Yes, there may be fees associated with the registration and dealer's license application, depending on the specific tax act.

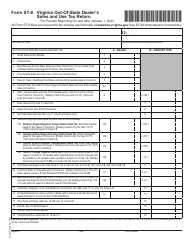

Q: Is Form MBT-RL1 applicable in other provinces of Canada?

A: No, Form MBT-RL1 is specific to Manitoba and is not applicable in other provinces of Canada.