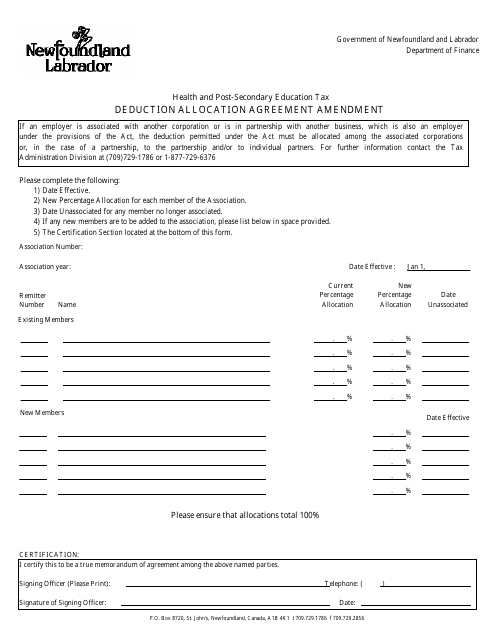

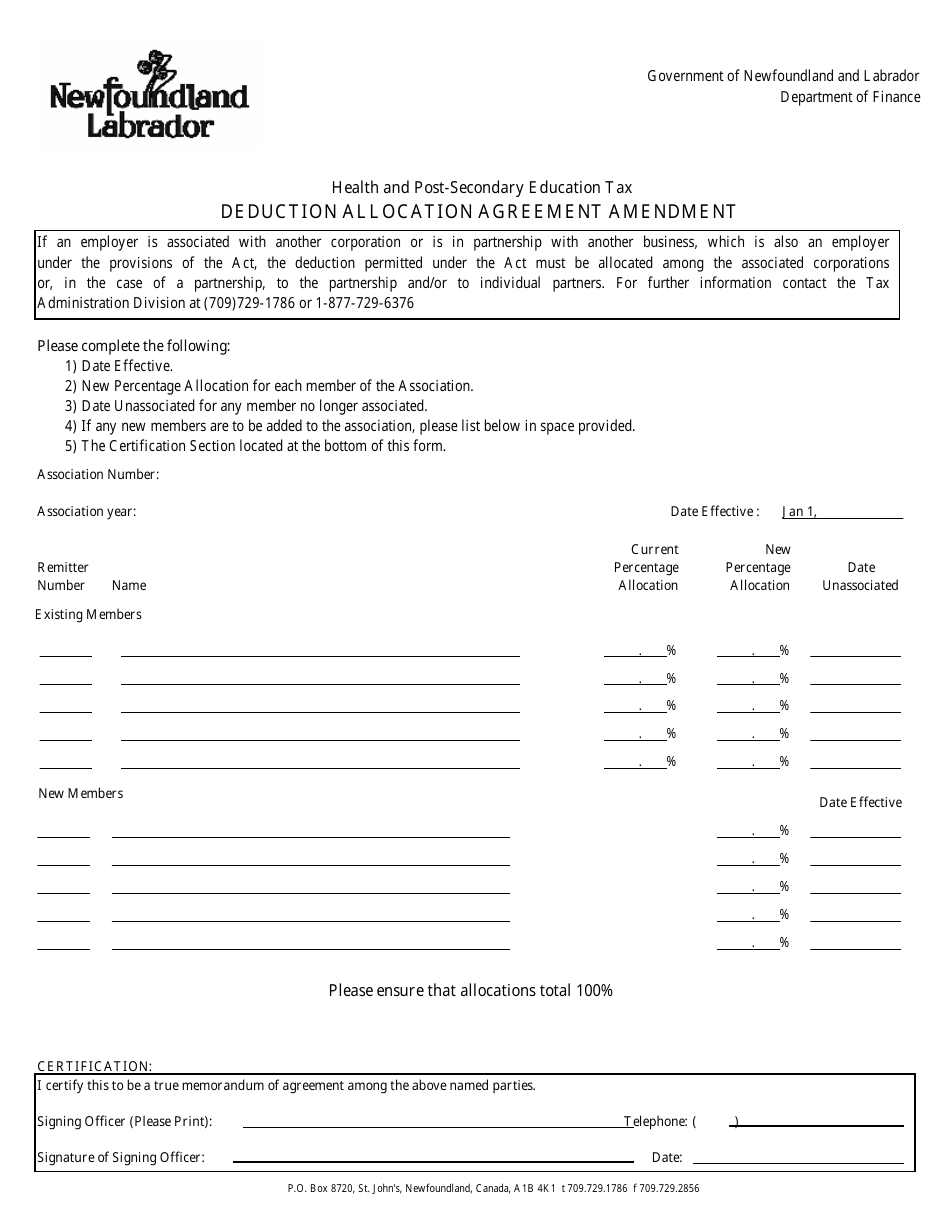

Health and Post-secondary Education Tax Deduction Allocation Agreement Amendment - Newfoundland and Labrador, Canada

The Health and Post-secondary Education Tax Deduction Allocation Agreement Amendment in Newfoundland and Labrador, Canada is an agreement that allows individuals to allocate their tax deductions between health and post-secondary education expenses. It helps taxpayers in Newfoundland and Labrador to better manage their tax benefits related to healthcare and education costs.

The Health and Post-secondary Education Tax Deduction Allocation Agreement Amendment in Newfoundland and Labrador, Canada, is typically filed by the taxpayer.

FAQ

Q: What is a Health and Post-secondary Education Tax Deduction Allocation Agreement Amendment?

A: It is a legal document that modifies the agreement on tax deductions for health and post-secondary education expenses.

Q: What does the Health and Post-secondary Education Tax Deduction Allocation Agreement cover?

A: It covers tax deductions for expenses related to health and post-secondary education.

Q: What does the Amendment do?

A: The Amendment makes changes to the original agreement.

Q: Who does the Health and Post-secondary Education Tax Deduction Allocation Agreement Amendment apply to?

A: It applies to residents of Newfoundland and Labrador in Canada.

Q: What is the purpose of the Amendment?

A: The purpose is to update and adjust the tax deductions for health and post-secondary education expenses in Newfoundland and Labrador.