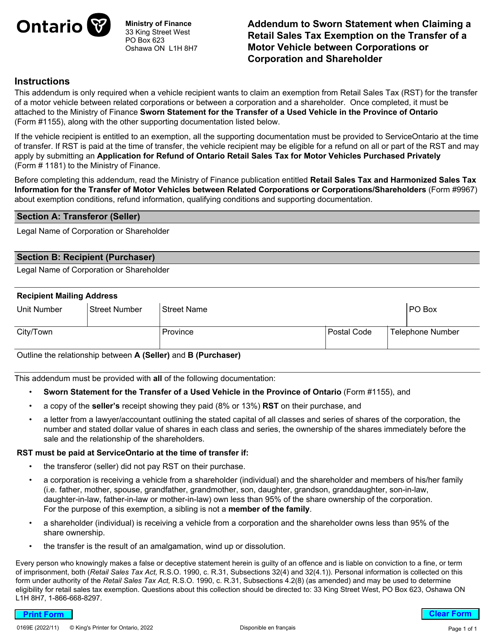

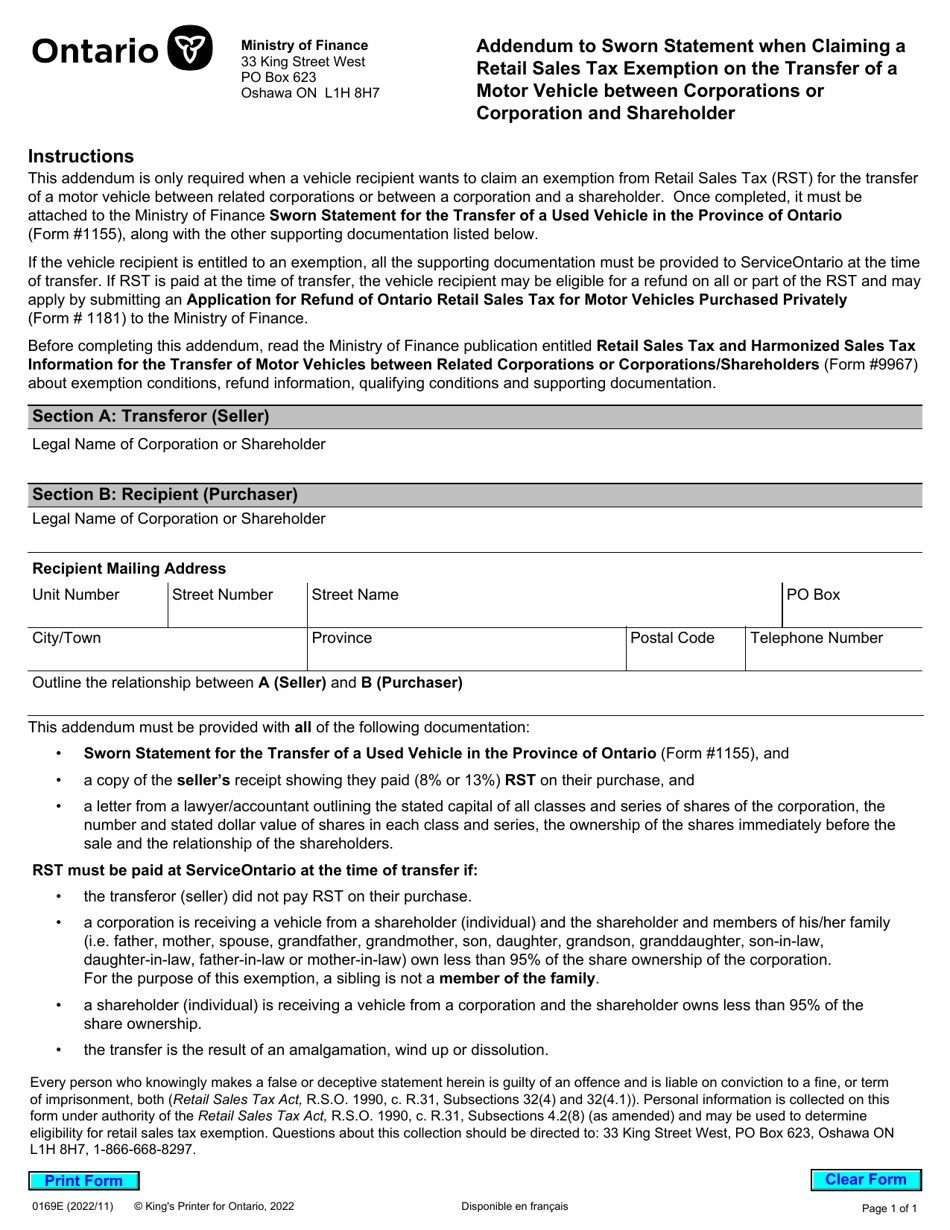

Form 0169E Addendum to Sworn Statement When Claiming a Retail Sales Tax Exemption on the Transfer of a Motor Vehicle Between Corporations or Corporation and Shareholder - Ontario, Canada

Form 0169E Addendum to Sworn Statement is used in Ontario, Canada for claiming a retail sales tax exemption on the transfer of a motor vehicle between corporations or between a corporation and its shareholder. It serves as additional documentation to support the tax exemption claim.

The Form 0169E Addendum to Sworn Statement is filed by the corporation or shareholder claiming a retail sales tax exemption on the transfer of a motor vehicle between corporations or between a corporation and shareholder in Ontario, Canada.

Form 0169E Addendum to Sworn Statement When Claiming a Retail Sales Tax Exemption on the Transfer of a Motor Vehicle Between Corporations or Corporation and Shareholder - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 0169E? A: Form 0169E is an Addendum to Sworn Statement for claiming a retail sales tax exemption on the transfer of a motor vehicle between corporations or corporation and shareholder in Ontario, Canada.

Q: Who needs to use Form 0169E? A: Form 0169E is to be used by individuals or corporations transferring a motor vehicle between corporations or corporation and shareholder in Ontario, Canada.

Q: What is the purpose of Form 0169E? A: Form 0169E is used to provide additional information and meet the requirements for claiming a retail sales tax exemption on the transfer of a motor vehicle in Ontario, Canada.

Q: Is Form 0169E specific to Ontario, Canada? A: Yes, Form 0169E is specific to Ontario, Canada. Other provinces may have different forms for similar purposes.