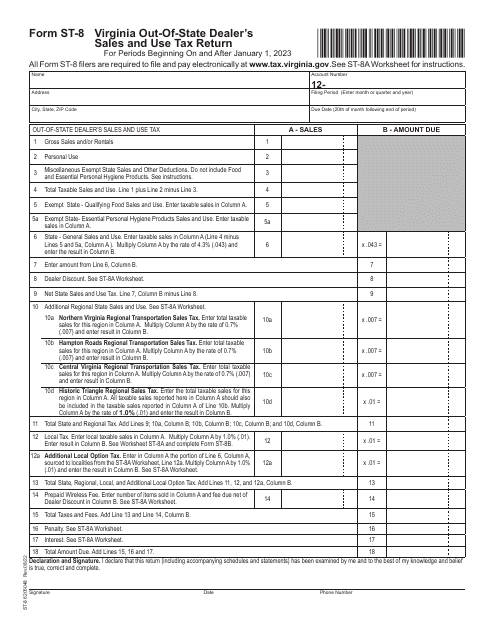

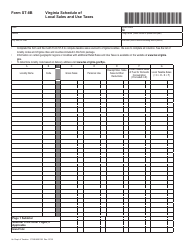

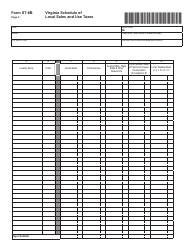

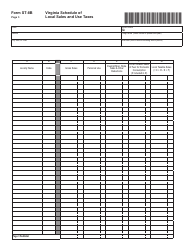

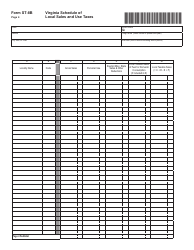

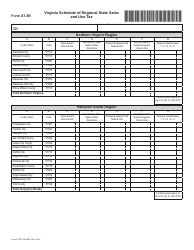

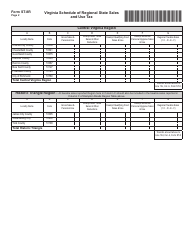

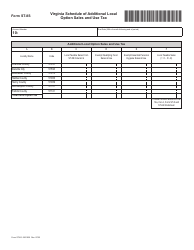

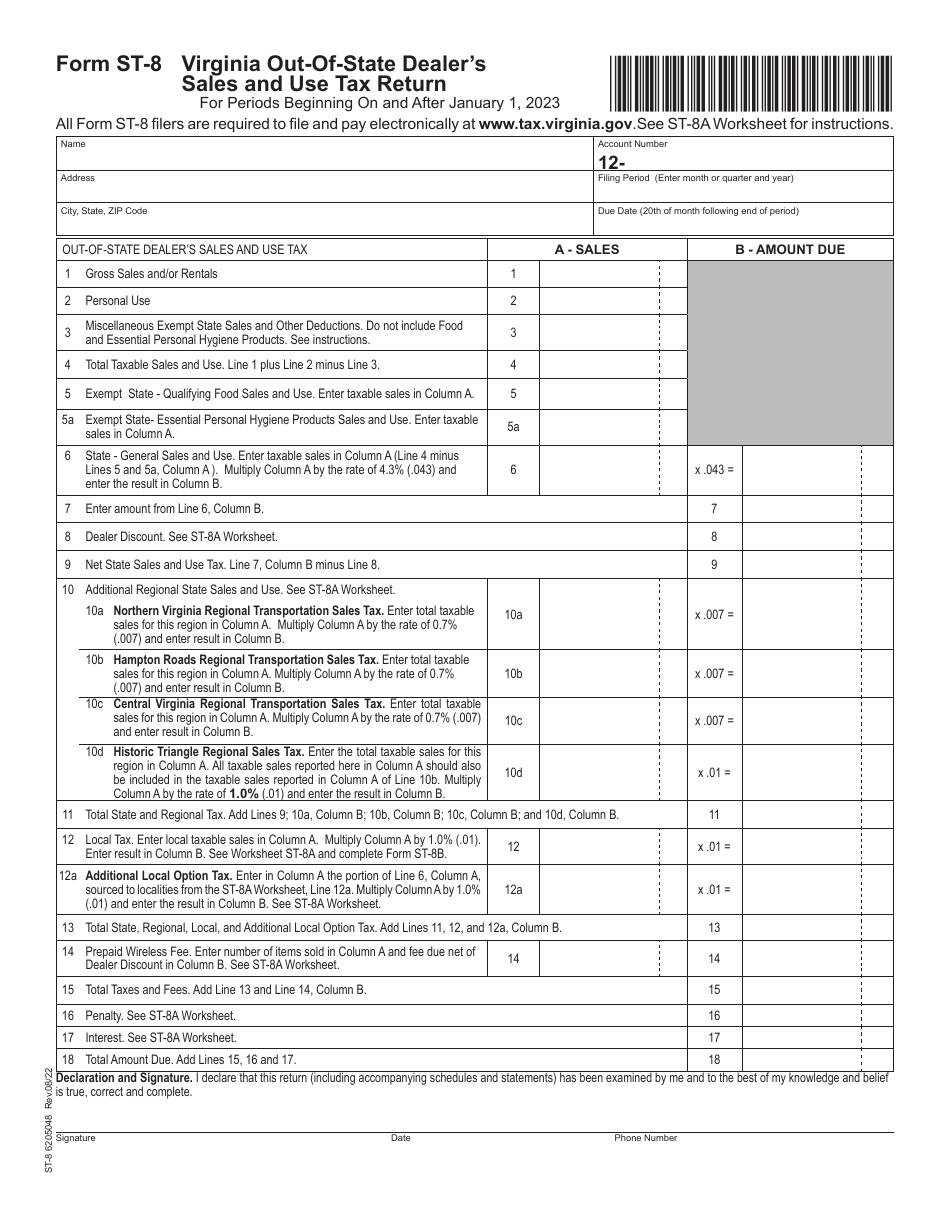

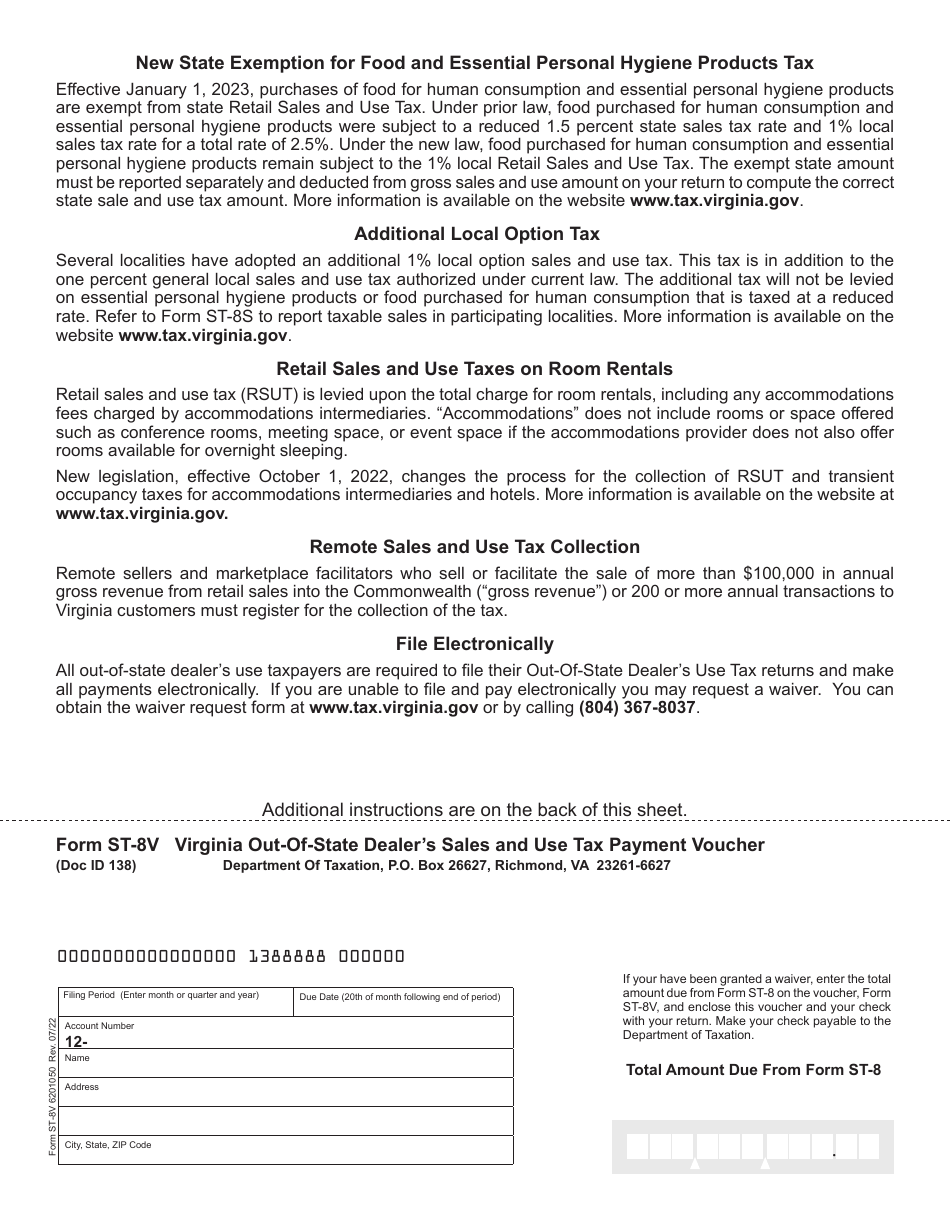

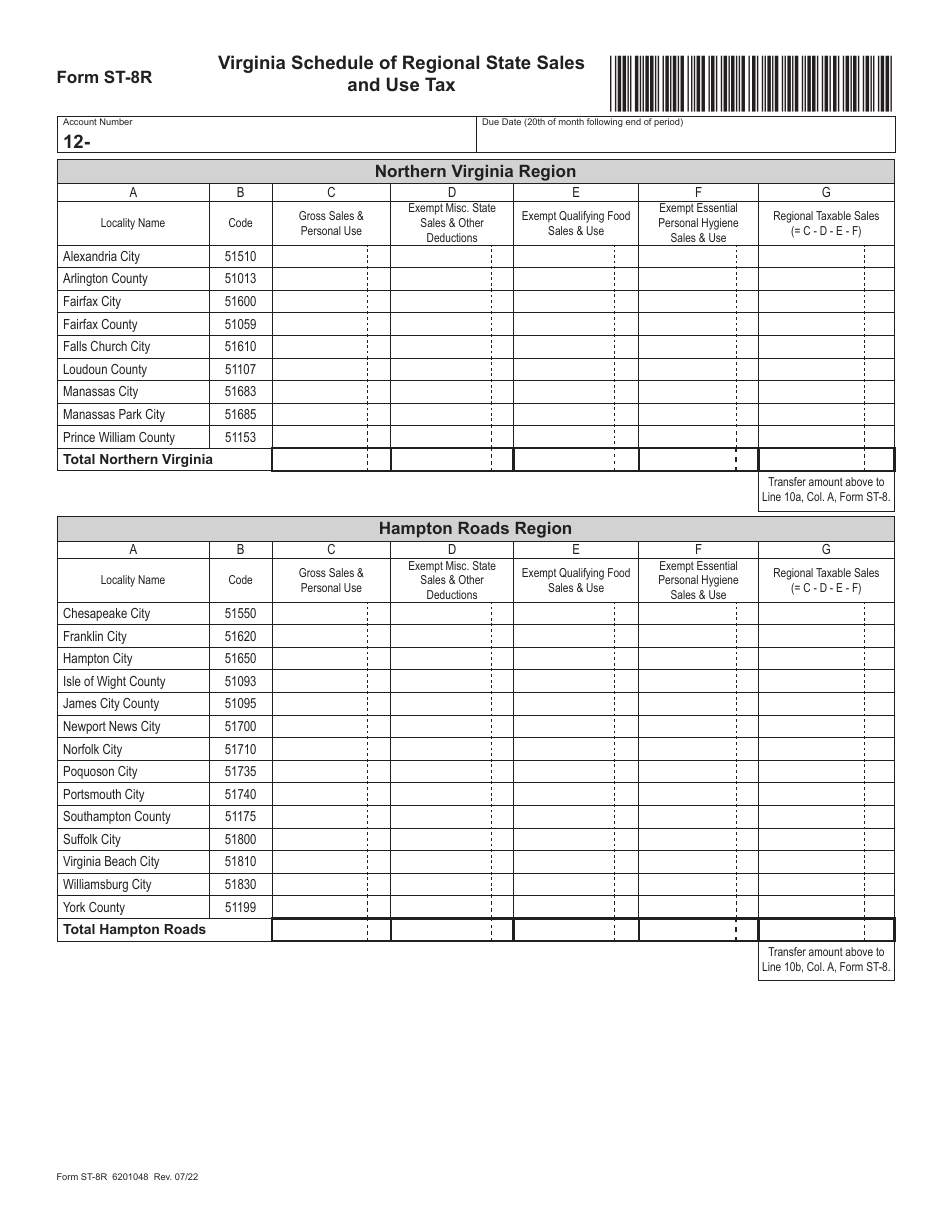

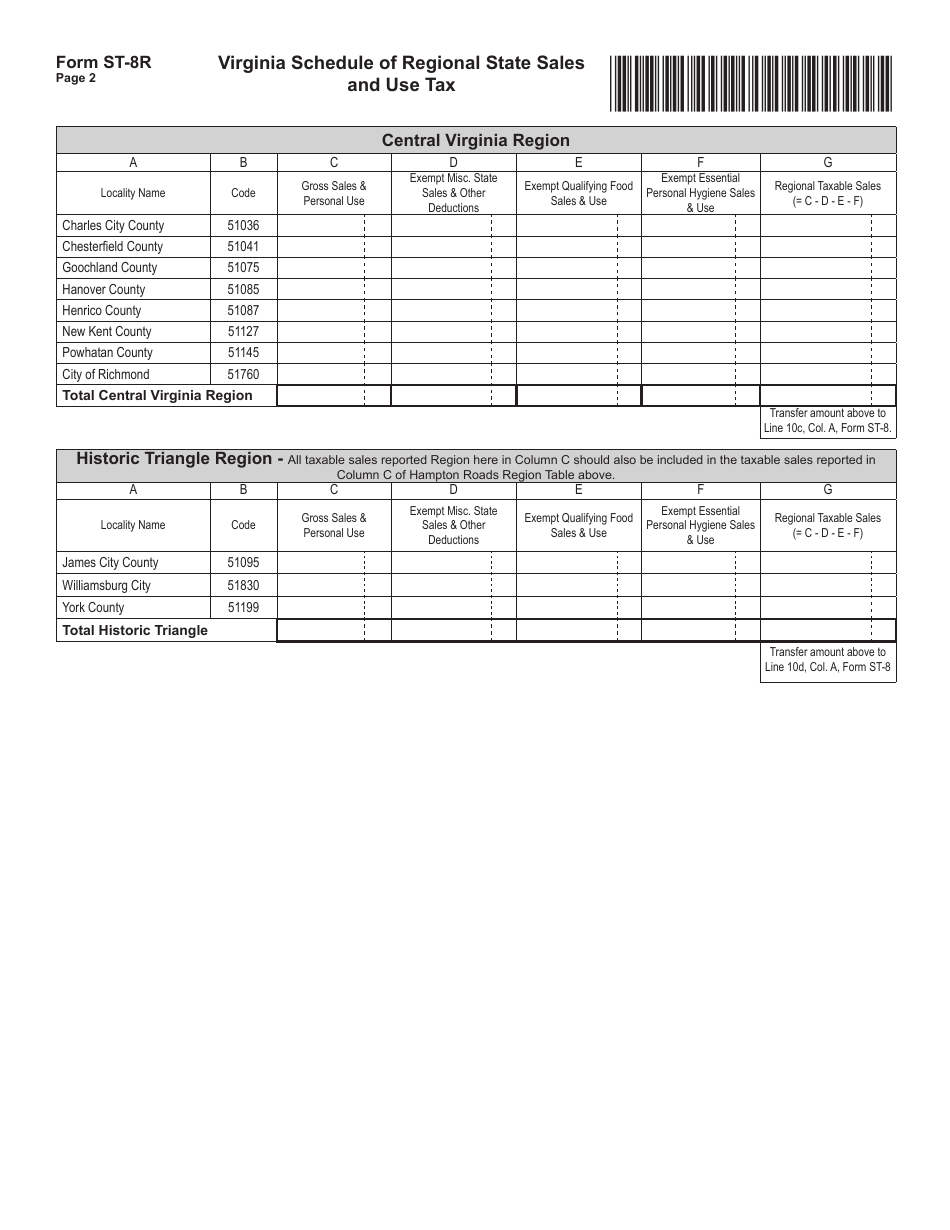

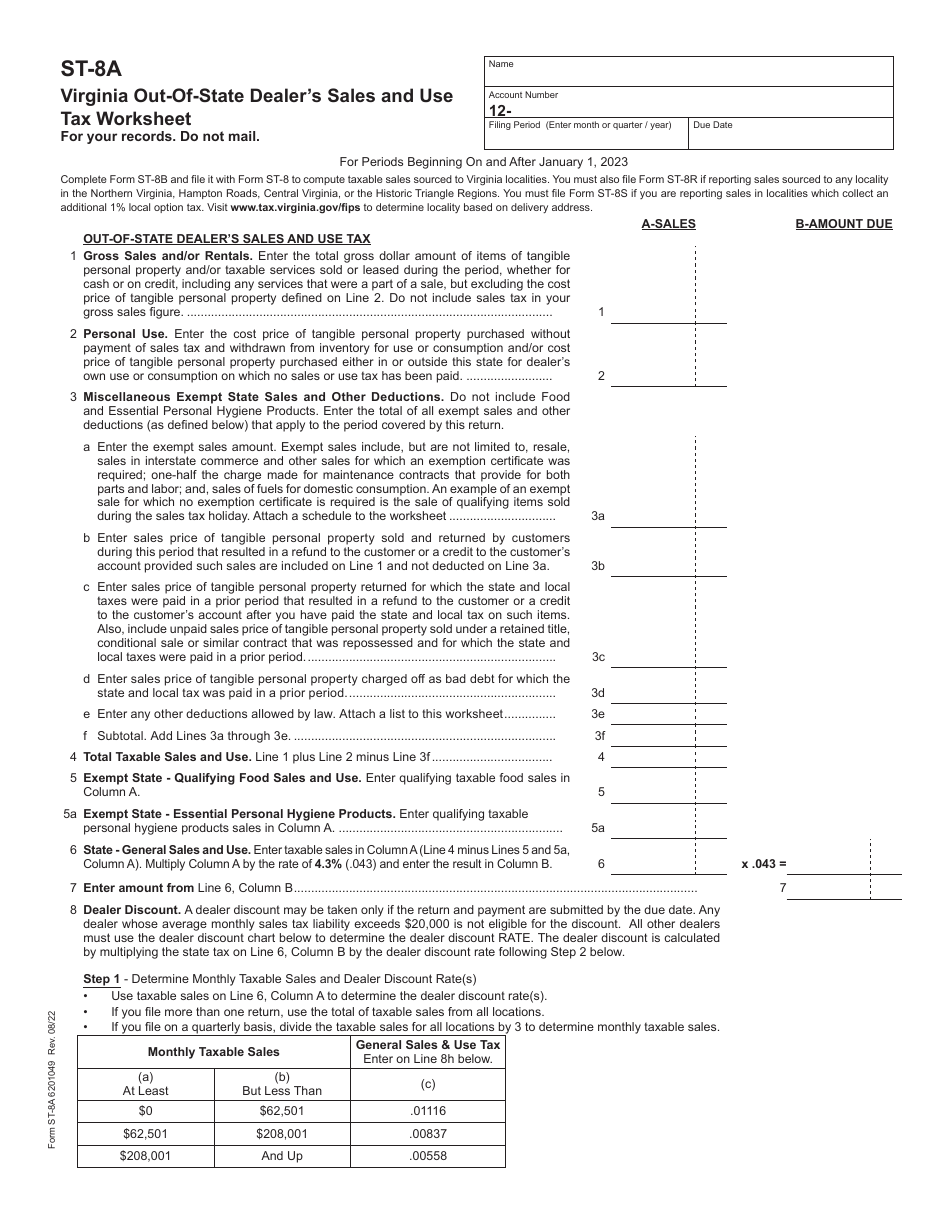

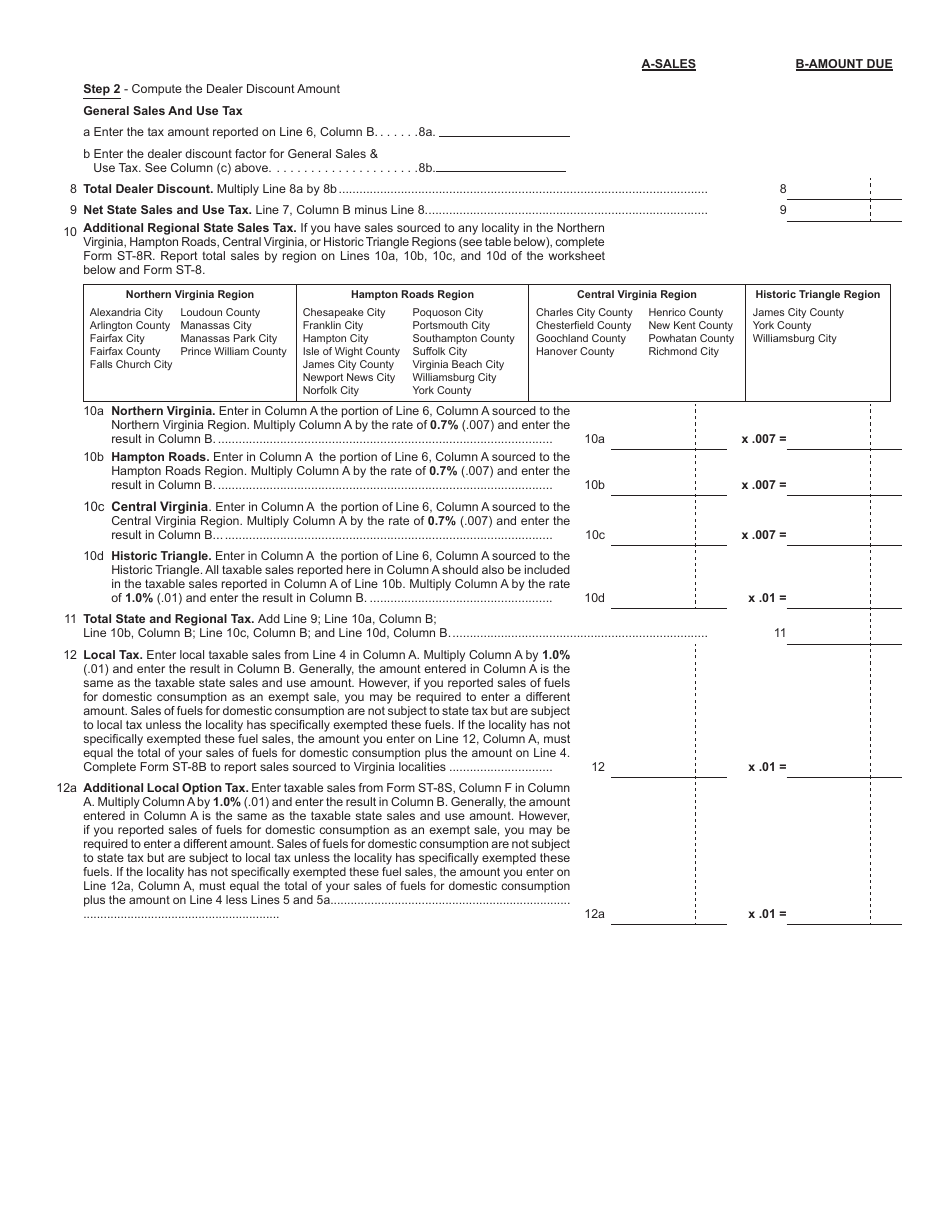

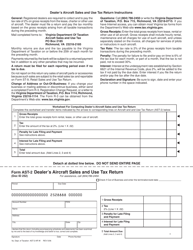

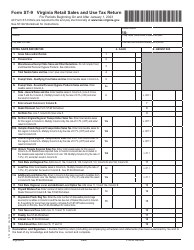

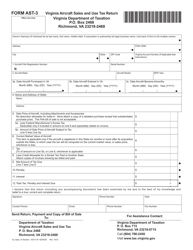

Form ST-8 Virginia Out-of-State Dealer's Sales and Use Tax Return - Virginia

What Is Form ST-8?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-8?

A: Form ST-8 is the Virginia Out-of-State Dealer's Sales and Use Tax Return.

Q: Who should use Form ST-8?

A: The Form ST-8 should be used by out-of-state dealers who have made sales in Virginia and are required to remit sales and use tax.

Q: What is the purpose of Form ST-8?

A: The purpose of Form ST-8 is to report and remit sales and use tax for out-of-state dealers who have made sales in Virginia.

Q: When is Form ST-8 due?

A: Form ST-8 is due on or before the 20th day of the month following the end of the reporting period.

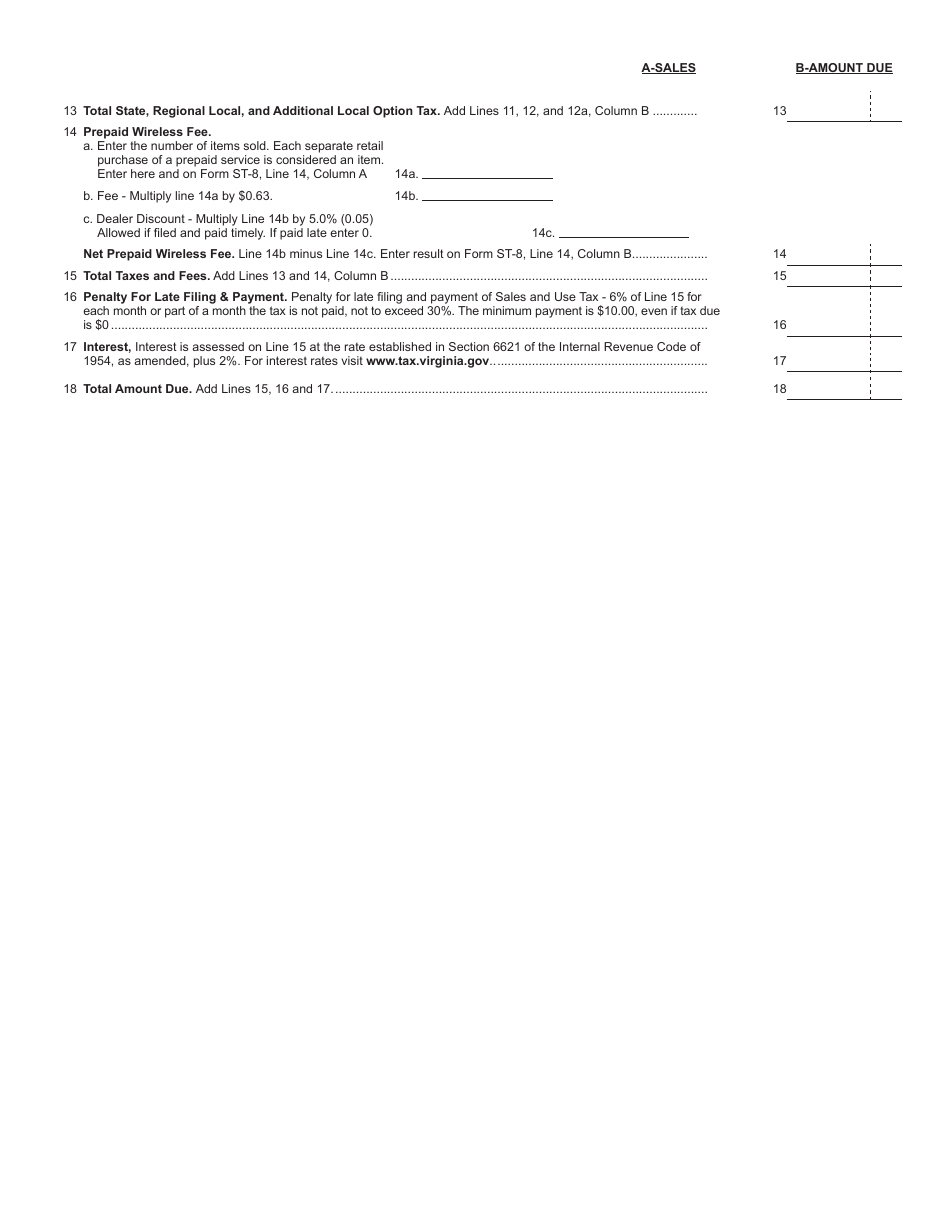

Q: Are there any penalties for late filing of Form ST-8?

A: Yes, there may be penalties for late filing of Form ST-8. It is important to file the return by the due date to avoid any penalties.

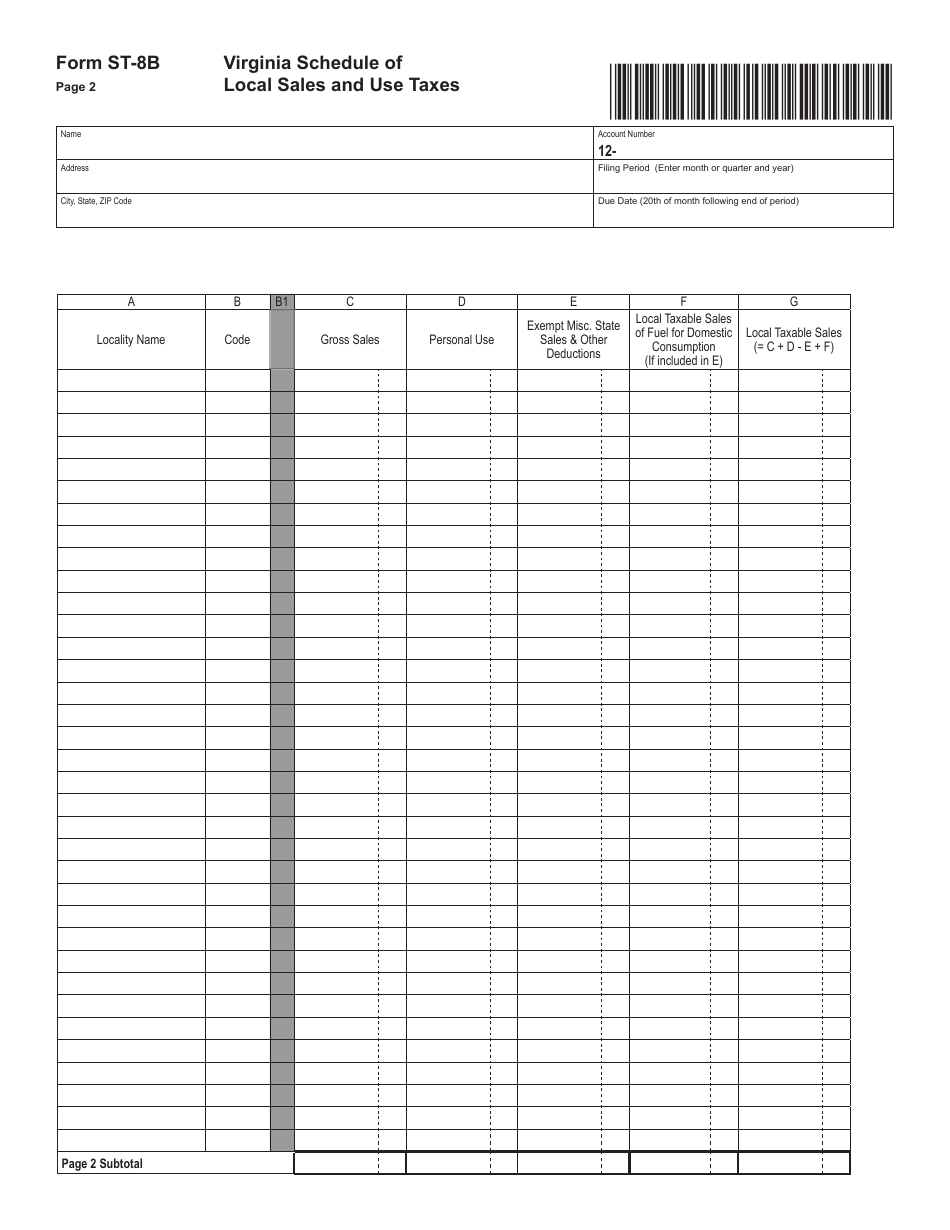

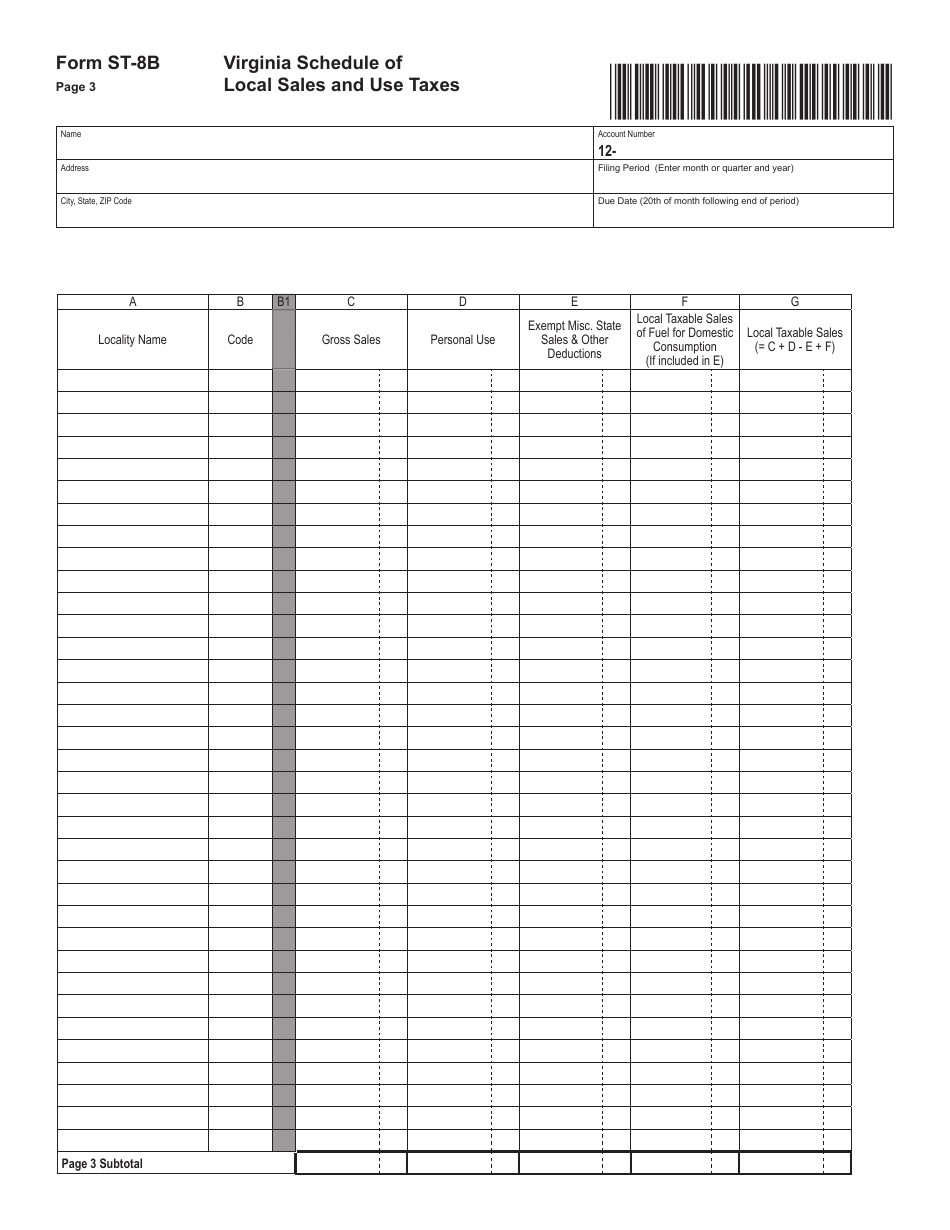

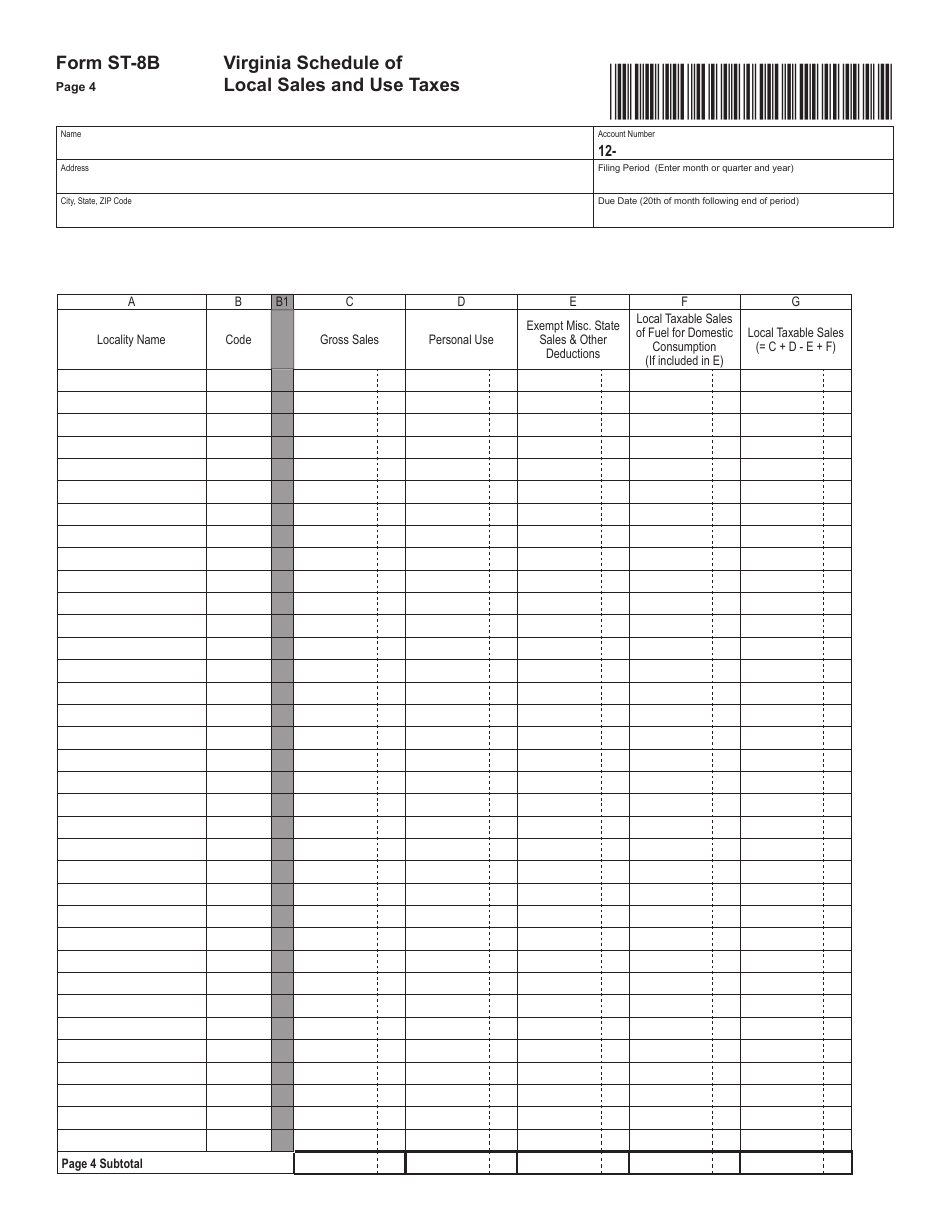

Q: What information do I need to provide on Form ST-8?

A: You will need to provide information about your sales in Virginia, including the total amount of sales and the amount of sales tax owed.

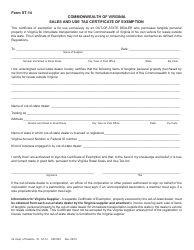

Q: Can I claim any exemptions on Form ST-8?

A: Yes, you can claim exemptions on Form ST-8 if you meet the eligibility requirements for any available exemptions.

Q: What should I do if I have questions about Form ST-8?

A: If you have questions about Form ST-8, you can contact the Virginia Department of Taxation's office for assistance.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-8 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.