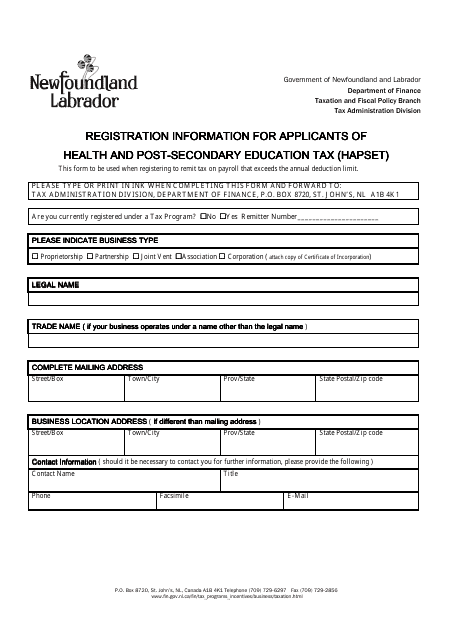

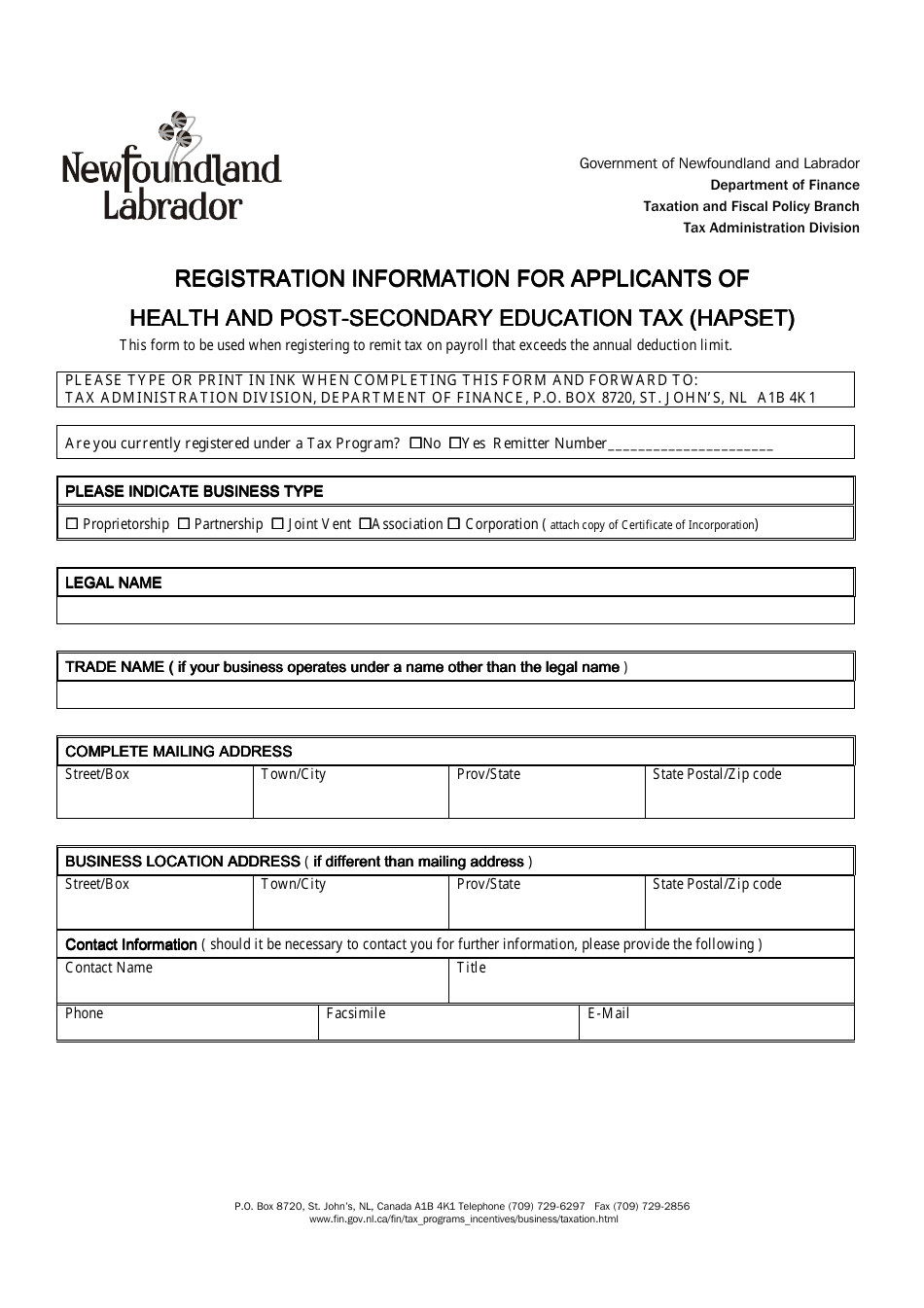

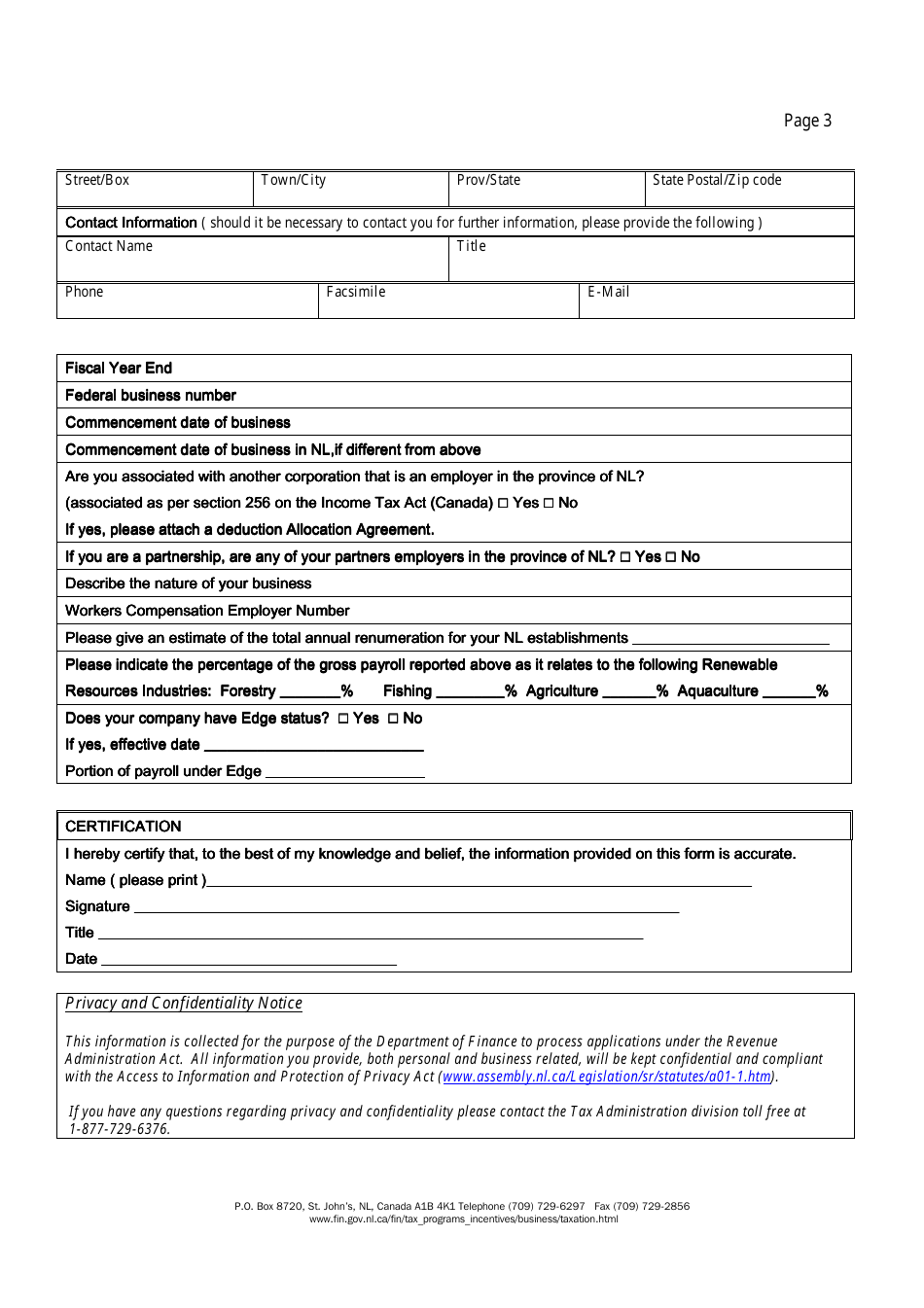

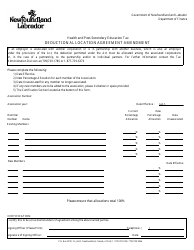

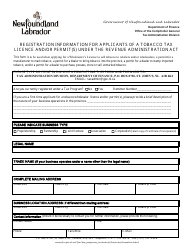

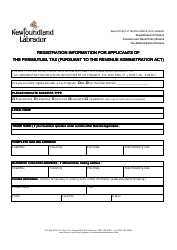

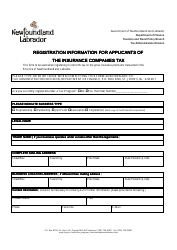

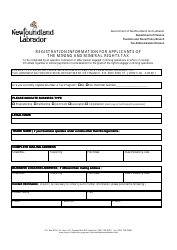

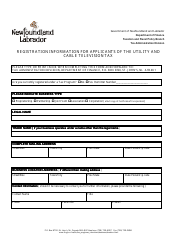

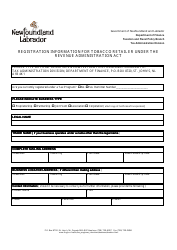

Registration Information for Applicants of Health and Post- Health and Post-secondary Education Tax (Hapset) - Newfoundland and Labrador, Canada

This Newfoundland and Labrador-specific " Registration Information For Applicants Of Health And Post- Health And Post-secondary Education Tax (hapset) " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Hapset?

A: Hapset stands for Health and Post-Secondary Education Tax.

Q: Who needs to register for Hapset?

A: Applicants of health and post-secondary education tax in Newfoundland and Labrador, Canada need to register for Hapset.

Q: What is the purpose of Hapset?

A: The purpose of Hapset is to collect tax from applicants who receive health and post-secondary education benefits in Newfoundland and Labrador.

Q: Do I need to register for Hapset if I don't receive health and post-secondary education benefits?

A: No, you only need to register for Hapset if you receive health and post-secondary education benefits.

Q: Is there a deadline to register for Hapset?

A: Yes, you must register for Hapset within 60 days of becoming eligible to receive health and post-secondary education benefits.

Q: What happens if I fail to register for Hapset?

A: If you fail to register for Hapset, you may be subject to penalties and interest on unreported amounts.

Q: Can I cancel my Hapset registration?

A: Yes, you can cancel your Hapset registration by submitting a written request to the Newfoundland and Labrador government.

Q: Do I need to re-register for Hapset every year?

A: No, once you are registered for Hapset, you do not need to re-register every year, unless you cancel your registration or your eligibility changes.