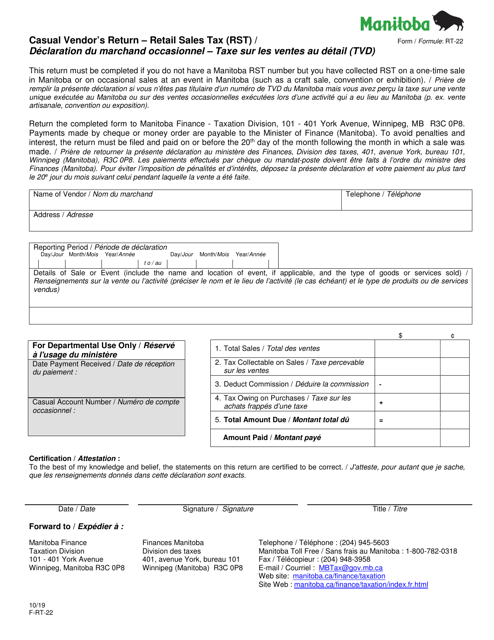

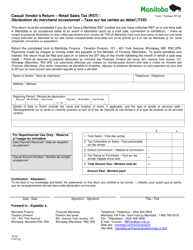

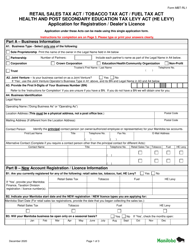

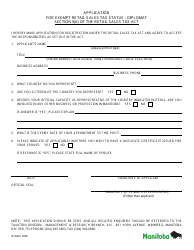

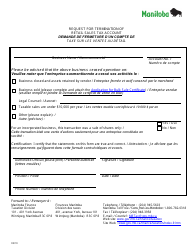

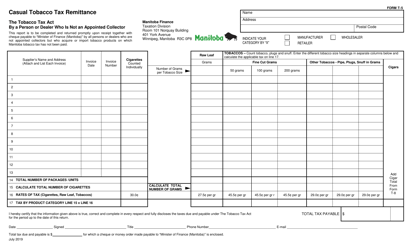

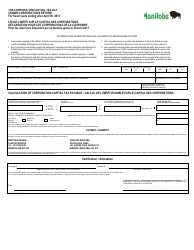

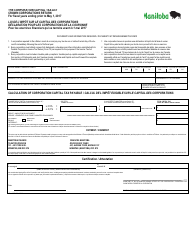

Form RT-22 Casual Vendor's Return - Retail Sales Tax (Rst) - Manitoba, Canada (English / French)

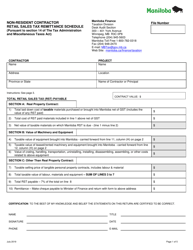

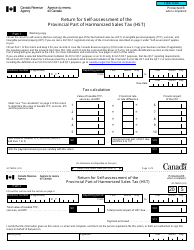

Form RT-22 Casual Vendor's Return - Retail Sales Tax (RST) in Manitoba, Canada is used for reporting and remitting sales tax by casual vendors who are not regular businesses. Casual vendors refer to individuals or organizations that engage in occasional or infrequent selling activities in Manitoba but are not registered for the Retail Sales Tax (RST) program. This form allows them to fulfill their tax obligations and provide the necessary information in either English or French, the official languages of Canada.

The Form RT-22 Casual Vendor's Return - Retail Sales Tax (RST) in Manitoba, Canada can be filed by individuals or businesses that qualify as casual vendors and have made taxable sales in the province. The form is available in both English and French to accommodate the official languages of Canada.

FAQ

Q: What is form RT-22 Casual Vendor's Return?

A: Form RT-22 Casual Vendor's Return is a form used to report retail sales tax (RST) for casual vendors in Manitoba, Canada.

Q: Who needs to file form RT-22 Casual Vendor's Return?

A: Casual vendors who are not registered for RST purposes and do not have an established place of business in Manitoba need to file form RT-22 Casual Vendor's Return.

Q: What is the purpose of form RT-22?

A: The purpose of form RT-22 is to report the retail sales tax (RST) collected by casual vendors in Manitoba.

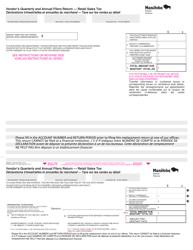

Q: How often should form RT-22 be filed?

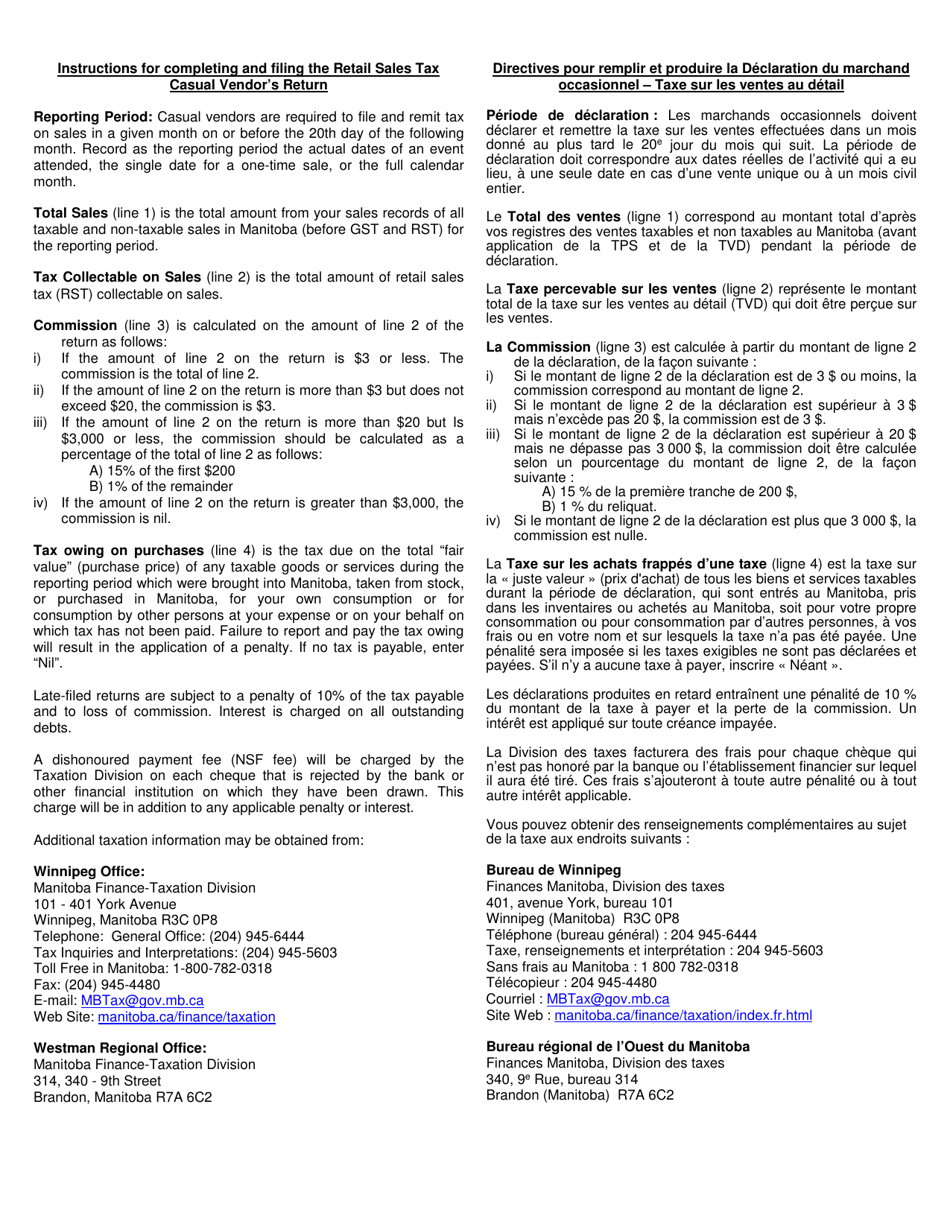

A: Form RT-22 should be filed on a regular basis, typically on a monthly or quarterly basis.

Q: Is form RT-22 available in both English and French?

A: Yes, form RT-22 Casual Vendor's Return is available in both English and French to accommodate the official languages of Manitoba.

Q: What information is required on form RT-22?

A: Form RT-22 requires information such as the vendor's name, address, contact information, sales details, and the amount of RST collected.

Q: Are there any penalties for not filing form RT-22?

A: Yes, there may be penalties for not filing form RT-22 or for filing it late. It is important to comply with the filing requirements to avoid these penalties.