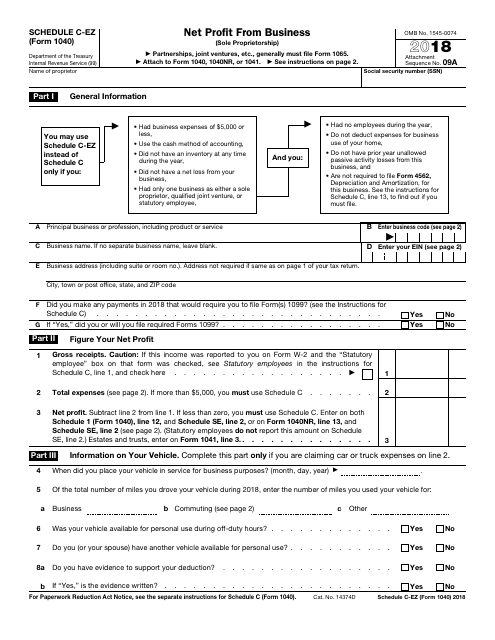

IRS Form 1040 Schedule C-EZ Net Profit From Business (Sole Proprietorship)

What Is IRS Form 1040 Schedule C-EZ?

IRS Form 1040 Schedule C-EZ, Net Profit from Business (Sole Proprietorship) is a form you complete to report income and loss from a business, qualified joint venture, or profession you practiced as a sole proprietor. It is a simplified variant of Schedule C, Profit or Loss from Business (Sole Proprietorship). The document is part of the IRS 1040 forms you fill out to report and deduct different types of income and loss.

The schedule - also known as the net profit from business form - was issued by the Internal Revenue Service (IRS) and is updated annually. The fillable version of Schedule C-EZ is available for download below.

You are eligible to complete Schedule C-EZ to report a profit from your business if you:

- Had no business expenses that exceed $5,000;

- Did not have a net loss for the tax year you report;

- Are a sole proprietor, qualified joint venture, or statutory employee who operates only one business;

- Apply cash method of accounting;

- Had neither employees no inventory for the tax year you report;

- Do not apply for a homeowner's deduction to deduct expenses for business use of your home;

- Had no unallowed passive activity losses from your business for the previous year;

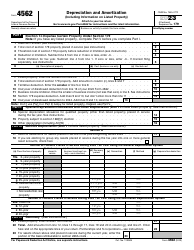

- Do not have to submit IRS Form 4562, Depreciation and Amortization.

Using this simplified form instead of the longer Schedule C can considerably reduce filing time and paperwork.

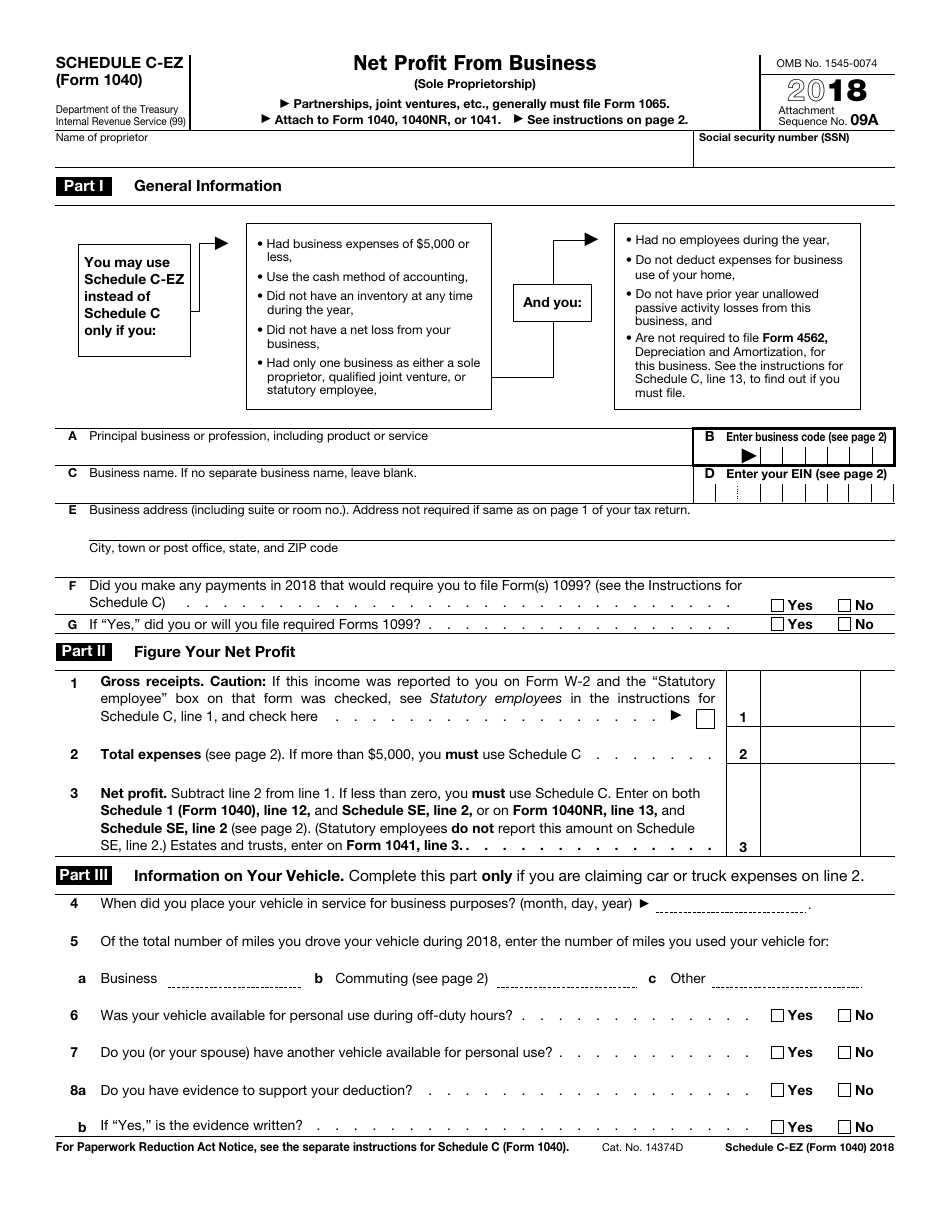

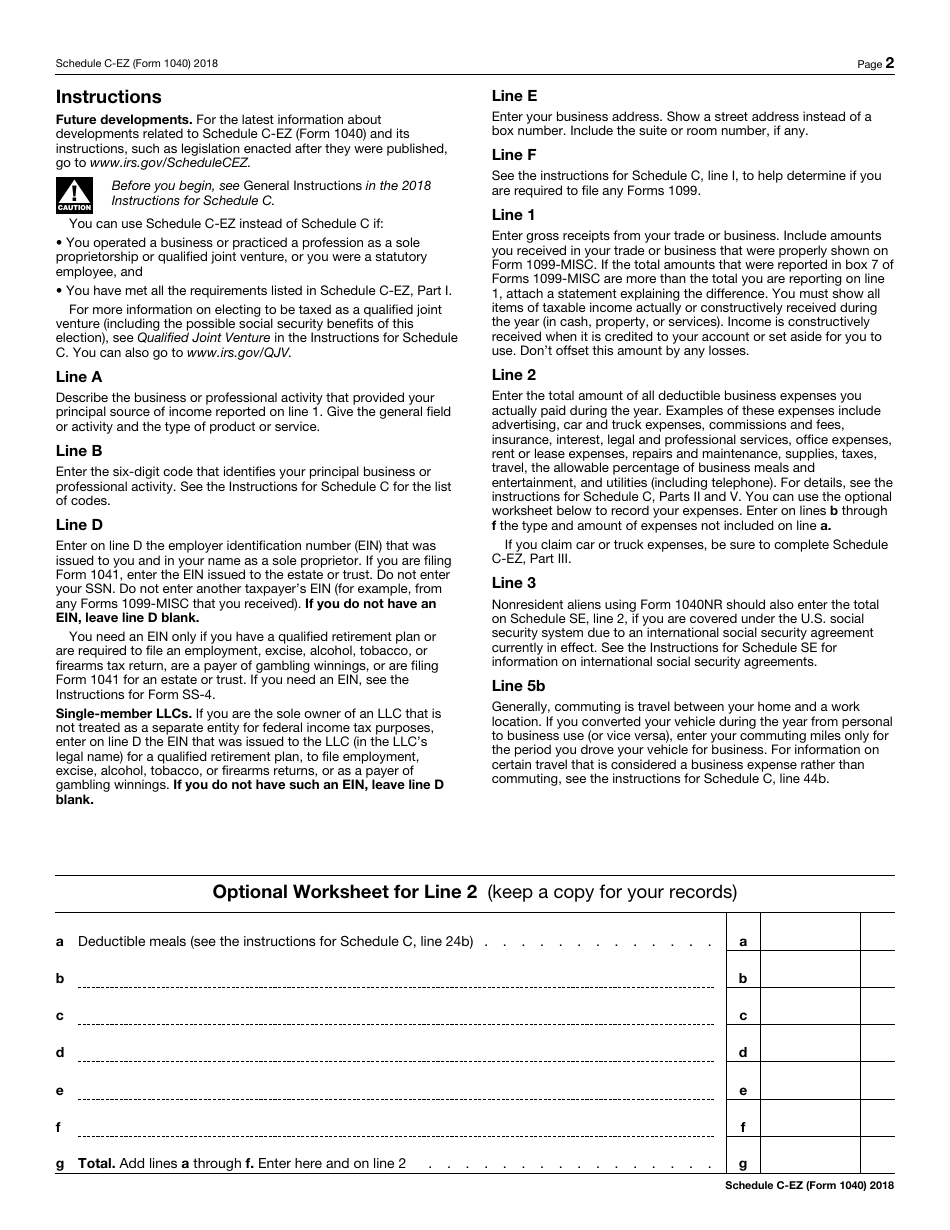

IRS Form 1040 Schedule C-EZ Instructions

Fill out the schedule as follows:

- Line A. Provide information about the business or activity that was the main source of the income you report on this schedule. Specify the general field and the type of product or service you provide;

- Line B. Enter the six-digit code to identify your business or activity. Find the list of codes in the IRS-distributed Instructions for Schedule C;

- Line C. Self-explanatory;

- Line D. If you are a sole proprietor, enter your employer identification number (EIN). If you are filing this schedule with IRS Form 1041, indicate the EIN issued to the estate or trust. If you have no EIN, skip this line. Do not enter your Social Security number instead;

- Line E. Self-explanatory;

- Lines F - G. Read the IRS-issued Instructions forSchedule C to find out if you need to file an IRS Form 1099;

- Line 1. Provide all taxable income you actually or constructively received during the reported tax year;

- Line 2. Indicate the full amount of business expenses you paid. Use the worksheet provided in the instructions to calculate your deductible expenses;

- Line 3. If you are nonresident foreigner using Form 1040NR, enter the total you provide on this line on Schedule SE, Line 2 as well;

- Part III. Lines 4 - 8. Fill out this part only if claiming vehicle expenses.

Find more information and the Optional Worksheet for Line 2 in the instructions attached to the form. Submit this schedule attached to IRS Form 1040, IRS Form 1040NR, or IRS Form 1041.