How to Pay a PayPal Invoice?

PayPal is the largest international payment processor that allows its users to send and receive money from other parties all across the world in a flash. In addition to being a worldwide household name and an everyday platform for many businesses and individuals, PayPal also provides its users with sophisticated and convenient invoicing software.

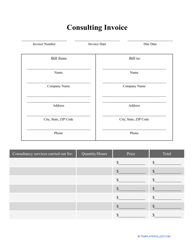

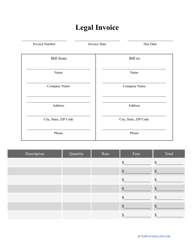

PayPal invoices are sent directly via the PayPal platform, accessed either through their website or mobile app. Invoicing clients through PayPal holds several benefits for both small business owners and self-employed entrepreneurs: the service allows you to generate professional-looking and auditable invoices and quickly withdraw money you receive to your card or bank account.

You can save recurring invoices as templates - this comes in handy if you’re frequently invoicing clients for the same services or goods. A PayPal invoice template can be saved when it’s still blank or already populated with any details you may need in the future (including your client’s billing details or contact information).

Creating an invoice in PayPal is quick and easy: all taxes and fees are pre-calculated within the system, the client can select any suitable method of payment, and the invoices you send out are highly customizable and allow tailoring all information to each specific customer.

Canceling a PayPal invoice is just as easy: just log in to your PayPal account and click “Cancel” on an invoice that’s awaiting payment.

What Is the Fee for PayPal Invoice?

PayPal can prove to be extremely useful for freelancers and self-employed individuals. The software is free to use: you only pay a percentage of the transaction when you send out or receive money. PayPal invoice fees are fixed and can be found on the website’s homepage. The fees for sending money across the United States currently range from 3.5% to 8% depending on the method of payment.

International users will often have to pay additional fixed fees depending on their location and local legislature. Use a PayPal invoice fee calculator for a more specific estimation of costs.

There’s no set maximum for how much money can be transferred through the app or how often payments can be made. You can opt out of using the service at any time without any penalties.

How to Pay an Invoice on PayPal App?

You will receive a notification in your PayPal app every time you get sent an invoice. Once you click on the notification, you’ll be directed to your invoice to complete your payment.

- Click on the “Pay Now” button to view the payment options you have available to you.

- You'll have the option of paying the invoice with your PayPal funds or your debit or credit card.

- Enter your card details along with your billing and contact information to finalize the payment.

How to Pay a PayPal Invoice With a Credit Card?

Any customer that receives an invoice through PayPal has the option of paying it with a credit, debit, or cheque card. Here’s what you’ll need to pay an invoice with a credit card:

- Open the email with the invoice.

- Click on “Pay Online” - the link will open in a new browser tab. If you cannot open the link, download and open the PDF in your browser.

- Select “Pay with Debit or Credit Card,” enter your credentials, and click on the orange button at the bottom of the page to transfer the funds.

How to Pay a PayPal Invoice Without a PayPal Account?

As previously mentioned, you don’t need to sign up for a PayPal account in order to pay an invoice that was issued through the PayPal platform.

- Open your invoice in any browser on your computer or mobile device.

- Select the amount you’d like to pay and click on “Pay Now.”

- Click on “Pay with Debit or Credit Card” and enter your card details as requested.

If the option to pay as a guest is desibled or unavailable, this may be due to a country-based restriction. Contact PayPal support if the problem persists.

Related Topics: