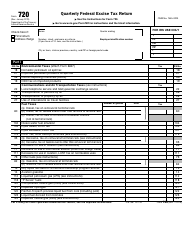

Instructions for IRS Form 720-TO Terminal Operator Report

This document contains official instructions for IRS Form 720-TO , Terminal Operator Report - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 720-TO?

A: IRS Form 720-TO, Terminal Operator Report, is a form used by terminal operators to report their liabilities for the use of certain taxable fuel.

Q: Who needs to file IRS Form 720-TO?

A: Terminal operators who are responsible for the bulk transfer of taxable fuel need to file IRS Form 720-TO.

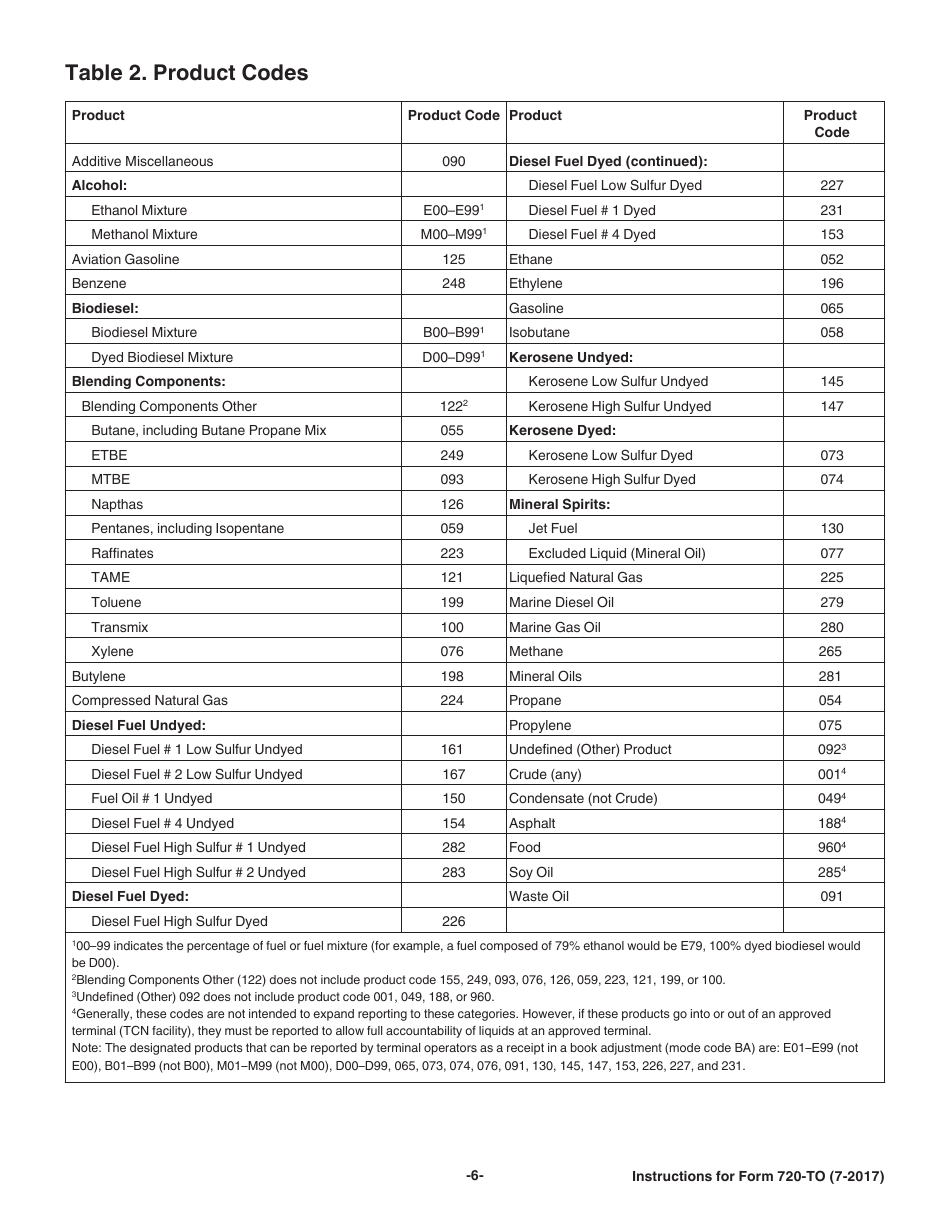

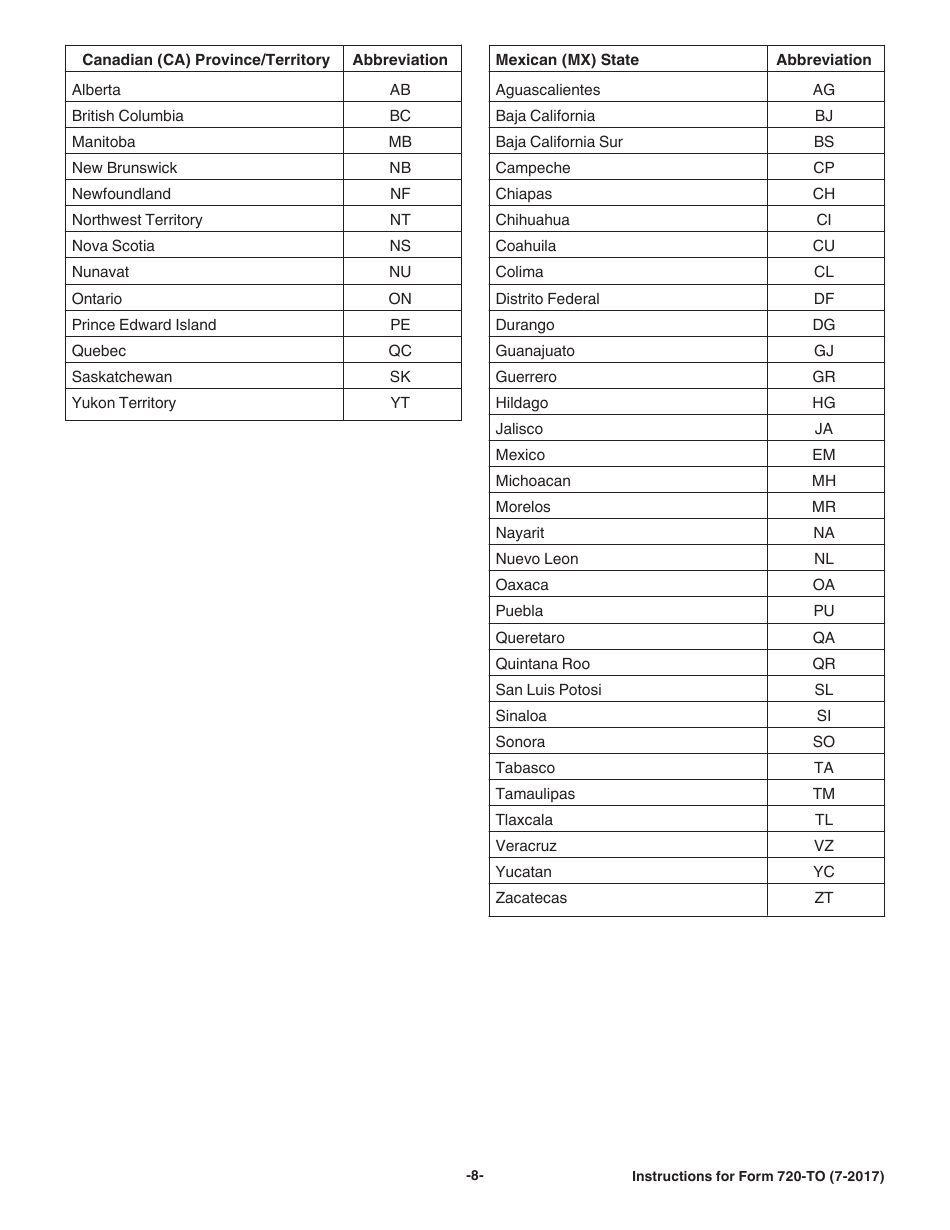

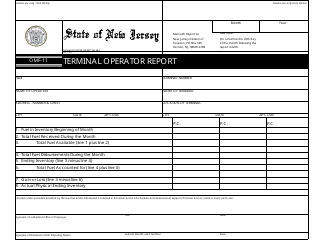

Q: What information is required on IRS Form 720-TO?

A: IRS Form 720-TO requires terminal operators to provide information about the gallons of taxable fuel received and removed, and the taxes due on such fuel.

Q: When is IRS Form 720-TO due?

A: IRS Form 720-TO is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.