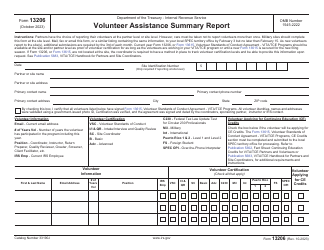

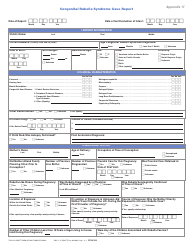

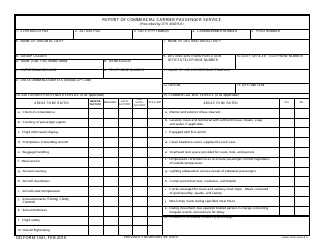

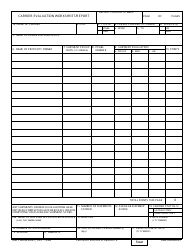

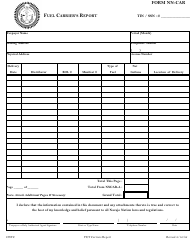

Instructions for IRS Form 720-CS Carrier Summary Report

This document contains official instructions for IRS Form 720-CS , Carrier Summary Report - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 720-CS is available for download through this link.

FAQ

Q: What is IRS Form 720-CS?

A: IRS Form 720-CS is the Carrier Summary Report.

Q: Who needs to file IRS Form 720-CS?

A: Certain businesses that provide indoor tanning services need to file IRS Form 720-CS.

Q: What information is reported on IRS Form 720-CS?

A: The report includes information about the number of services performed and the amount of tax owed.

Q: When is IRS Form 720-CS due?

A: IRS Form 720-CS is due quarterly, on the last day of the month following the calendar quarter.

Q: Are there any penalties for failing to file IRS Form 720-CS?

A: Yes, there are penalties for failing to file or for filing late, so it's important to meet the deadline.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.