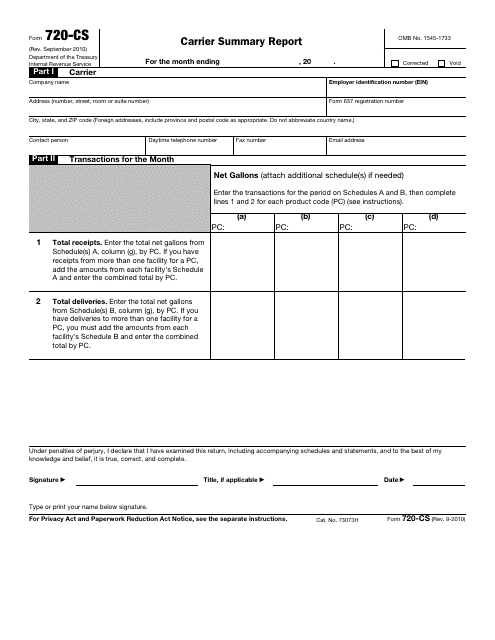

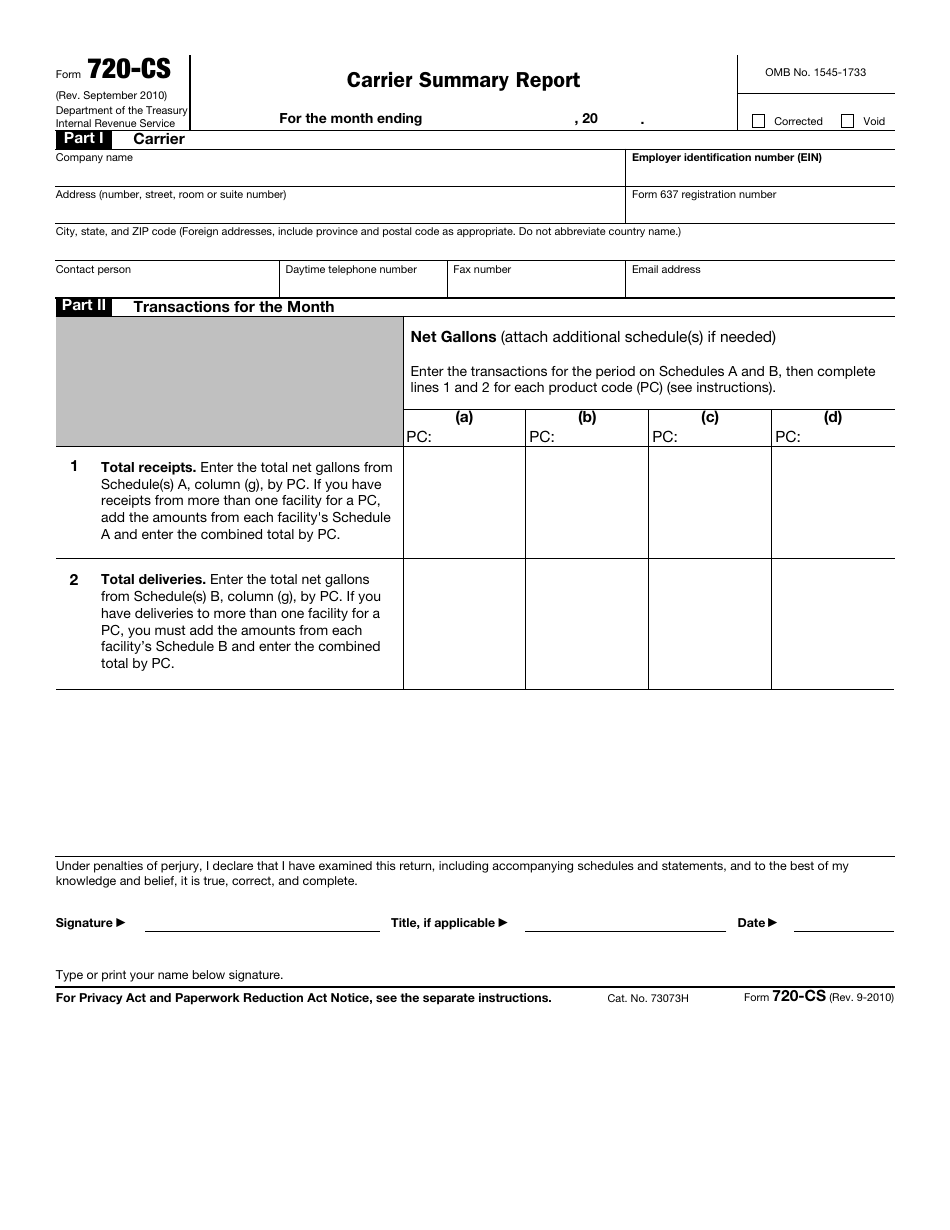

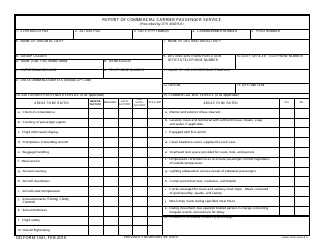

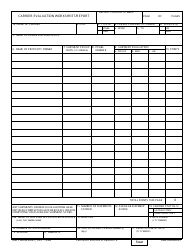

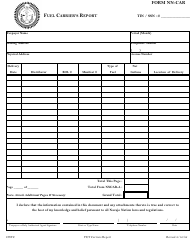

IRS Form 720-CS Carrier Summary Report

What Is IRS Form 720-CS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2010. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 720-CS?

A: IRS Form 720-CS is the Carrier Summary Report.

Q: What is the purpose of IRS Form 720-CS?

A: The purpose of IRS Form 720-CS is to report excise taxes for certain businesses, such as those in the transportation industry.

Q: Who needs to file IRS Form 720-CS?

A: Businesses in the transportation industry who are liable for excise taxes need to file IRS Form 720-CS.

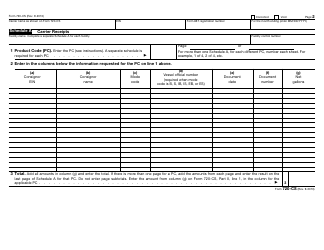

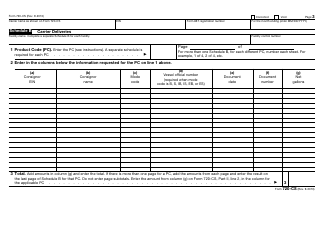

Q: What information is required on IRS Form 720-CS?

A: IRS Form 720-CS requires information about the type and amount of excise taxes paid by the carrier.

Q: When is the deadline to file IRS Form 720-CS?

A: IRS Form 720-CS must be filed on a quarterly basis by the last day of the month following the end of each quarter.

Form Details:

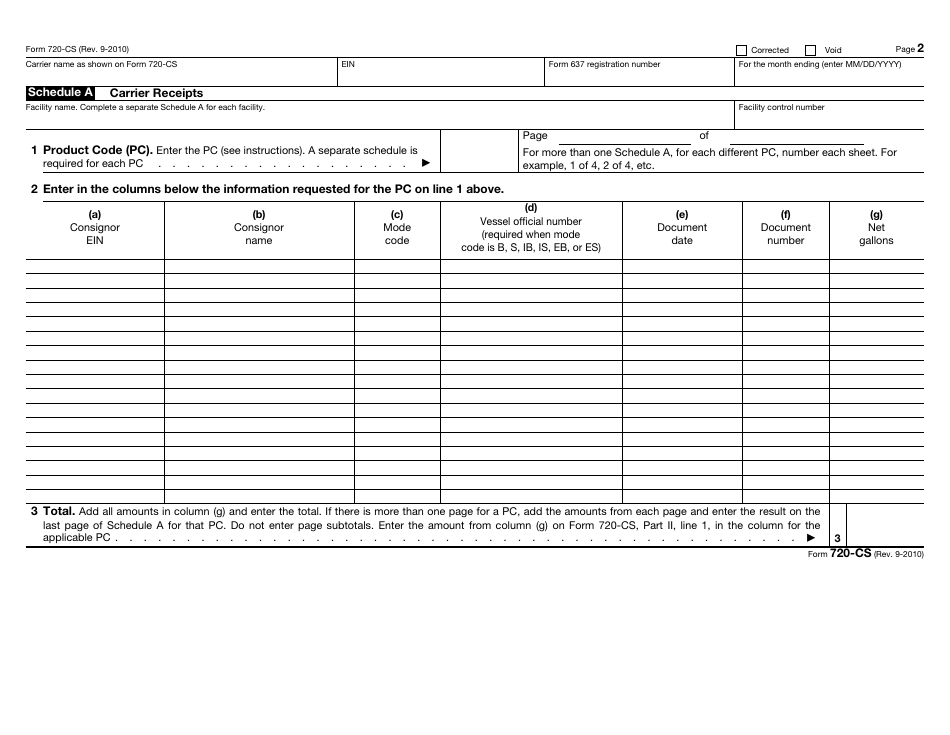

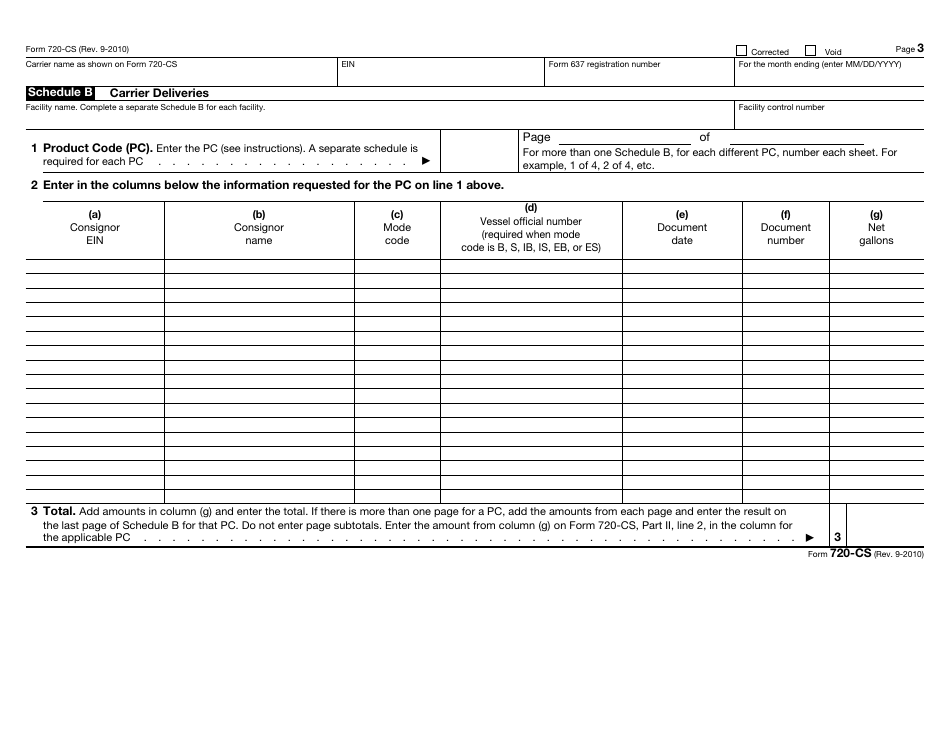

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 720-CS through the link below or browse more documents in our library of IRS Forms.