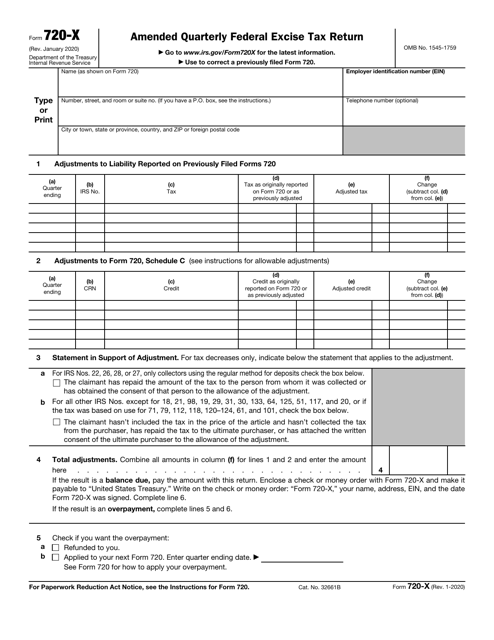

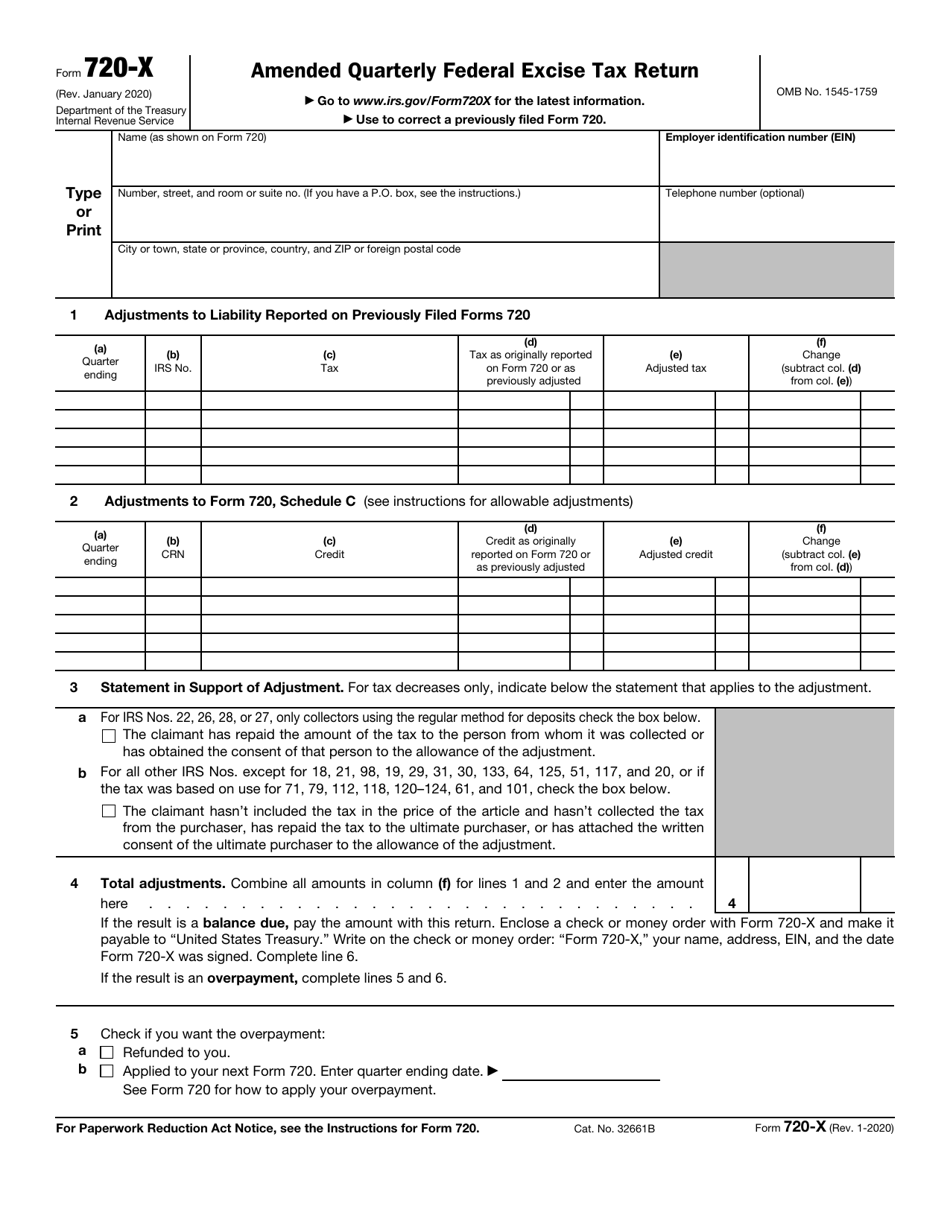

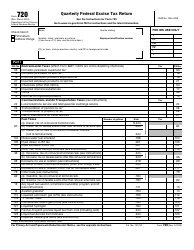

IRS Form 720-X Amended Quarterly Federal Excise Tax Return

What Is IRS Form 720-X?

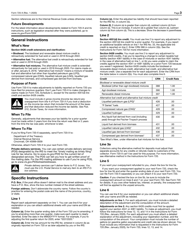

IRS Form 720-X, Amended Quarterly Federal Excise Tax Return , is a supplementary document taxpayers are expected to use to modify the initial version of the return they submitted to report the excise tax they owe to the fiscal authorities.

Alternate Name:

- Tax Form 720-X.

If you noticed an error in the IRS Form 720, Quarterly Federal Excise Tax Return, that you already filed, you have an opportunity to fix your mistake by filing this form - you may file the paperwork within three years from the time a tax return for a quarter was sent to the tax organs.

This statement was released by the Internal Revenue Service (IRS) on January 1, 2020 - older editions of the form are now obsolete. An IRS Form 720-X fillable version is available for download below.

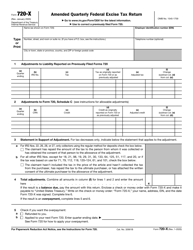

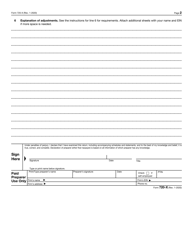

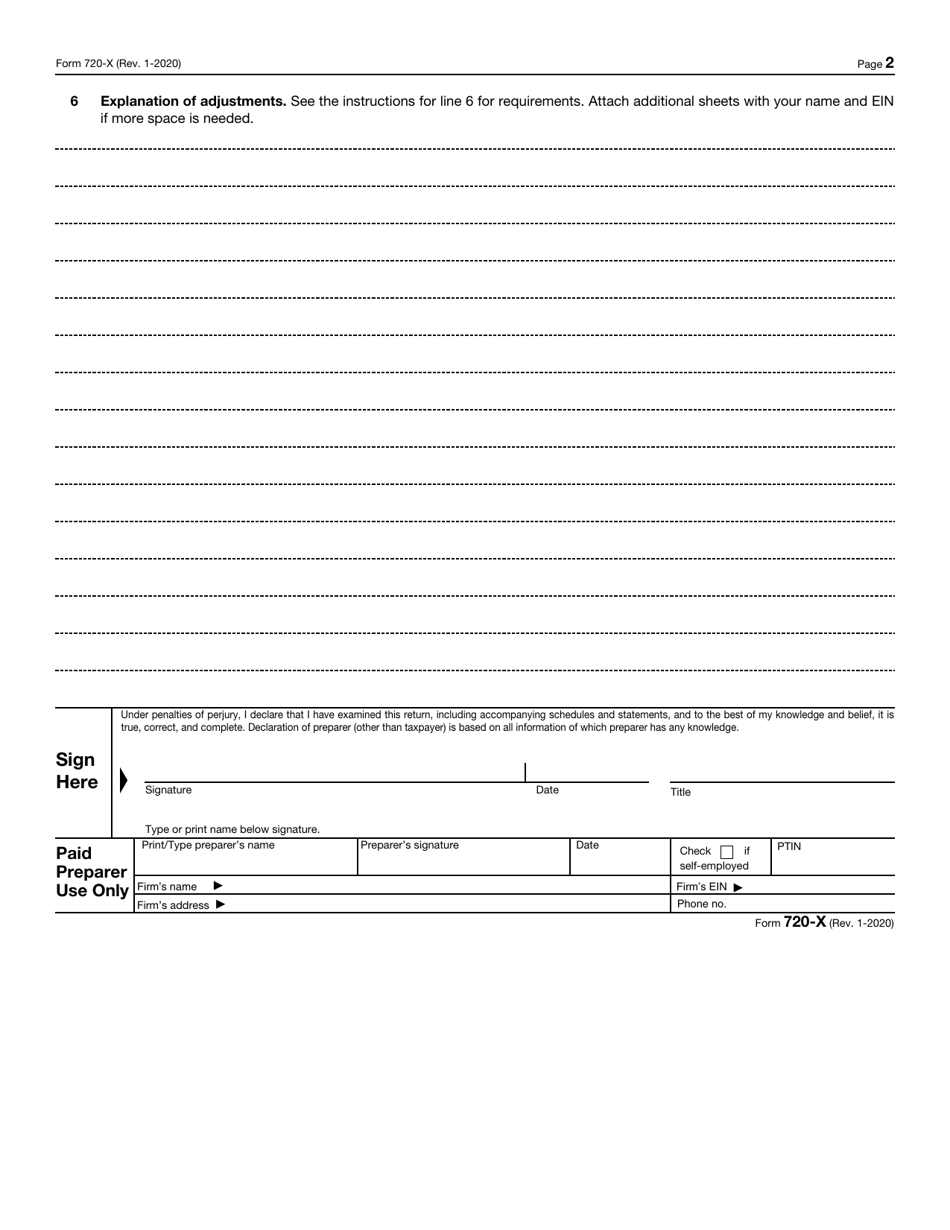

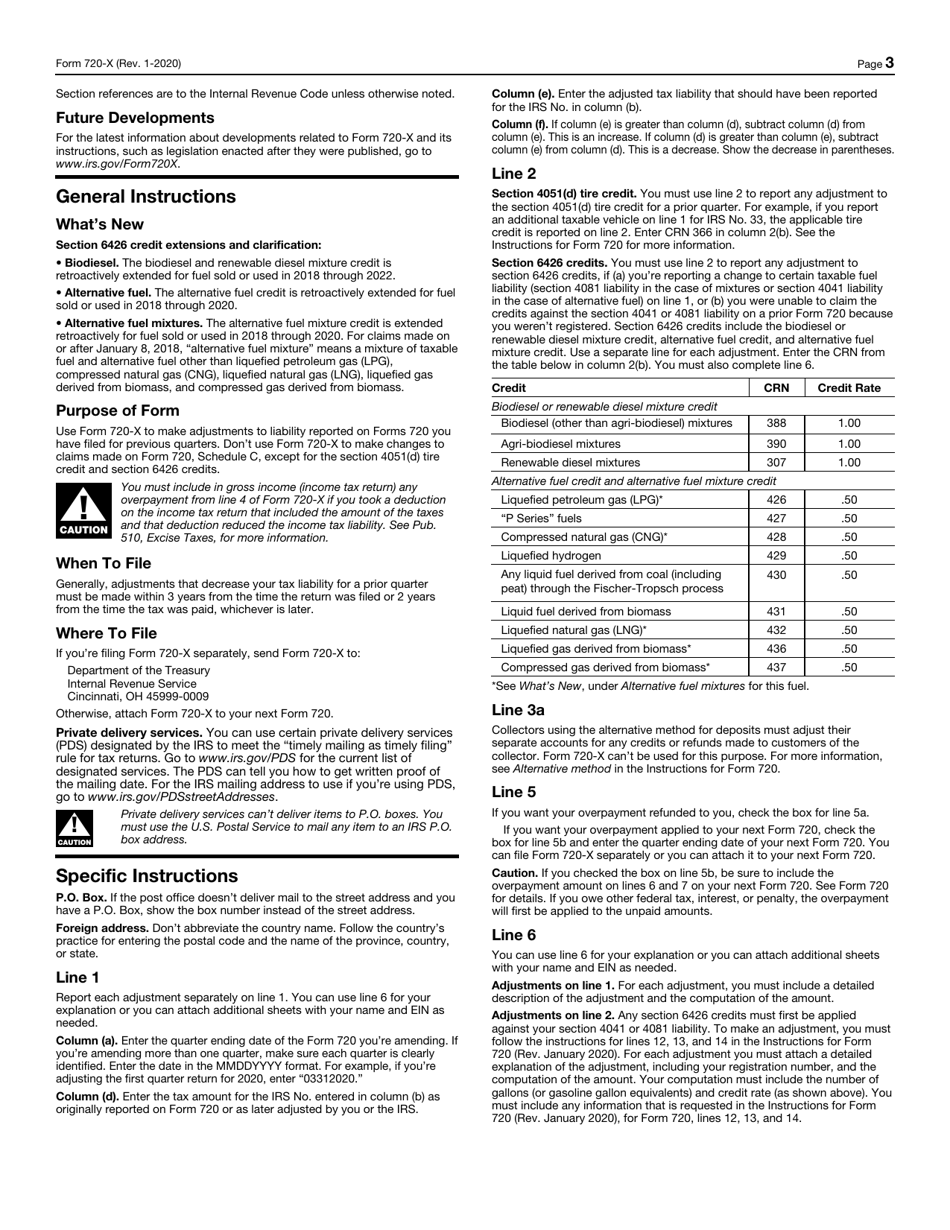

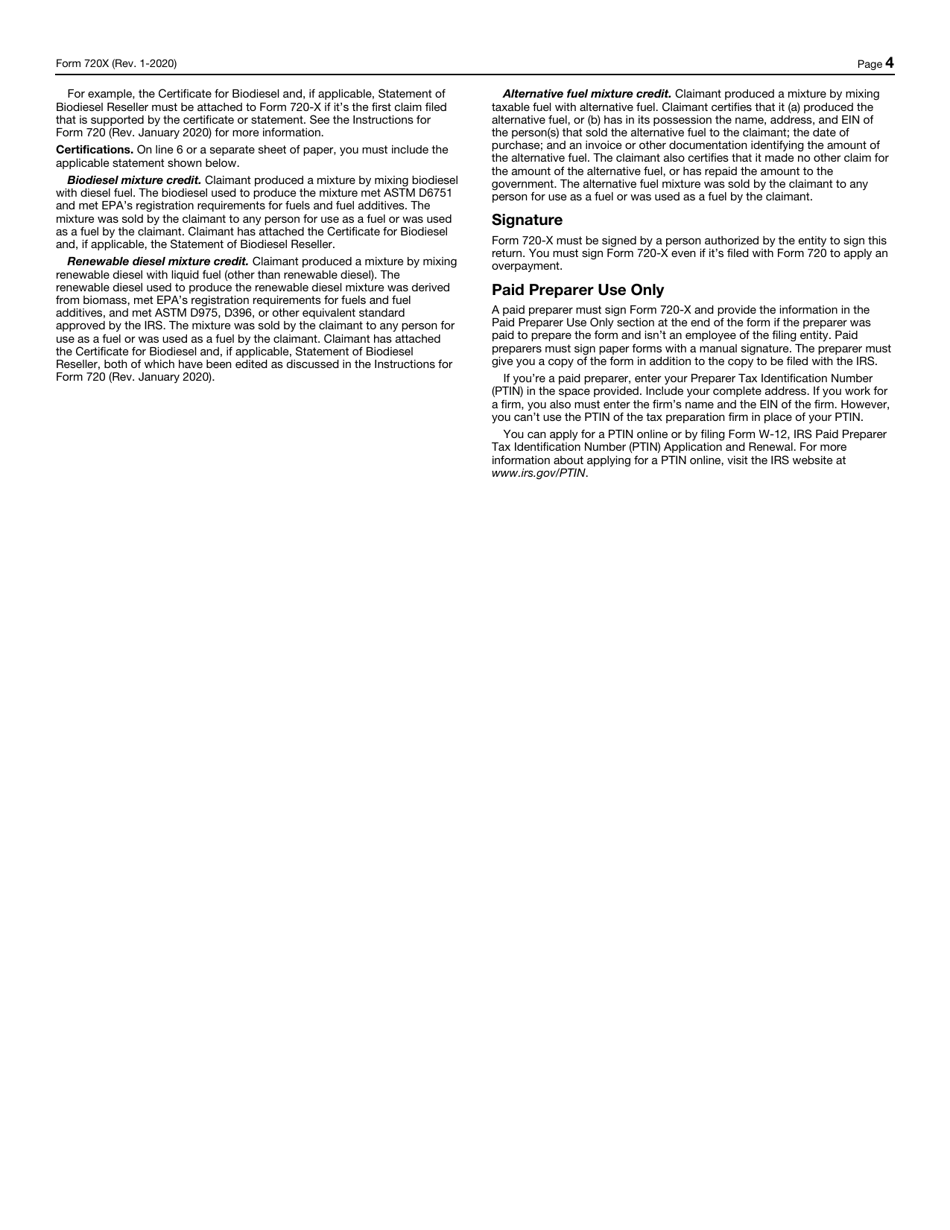

To report the alterations to a previously filed instrument, you have to state your name and contact details, list the adjustments to liability you described before, record the adjustment to Schedule C separately, check the box to confirm you repaid the tax or you make amends with the purchaser to whom you need to repay the tax, state whether you request a refund of the overpayment or you want it to apply to the next form you file, calculate the total amount of adjustments, explain the changes to the original document, and certify the information in the form is true and accurate. It is also required to obtain the signature of the individual you hired to prepare the paperwork on your behalf.