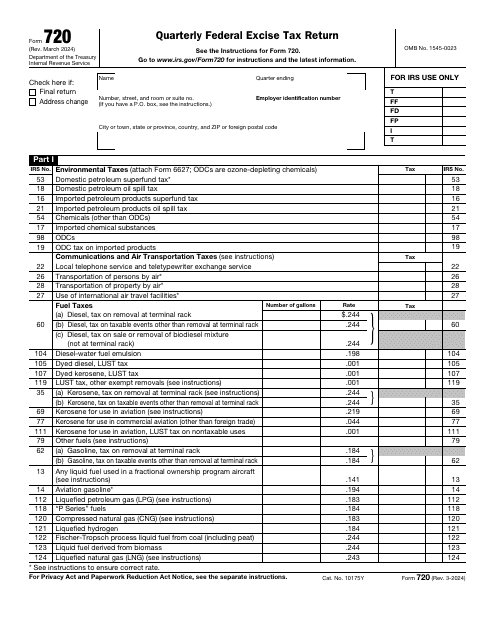

IRS Form 720 Quarterly Federal Excise Tax Return

What Is IRS Form 720?

IRS Form 720, Quarterly Federal Excise Tax Return , is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

Alternate Names:

- Tax Form 720;

- 720 Excise Tax Form.

The purpose of this instrument is not just to comply with the rules established by tax authorities for all businesses but also to ensure you are making your contribution in different industries and activities - taxpayers are encouraged to calculate excise taxes correctly to qualify for tax deductions and credits.

This document was released by the Internal Revenue Service (IRS) on March 1, 2024 , making previous editions obsolete. You may download an IRS Form 720 fillable version through the link below.

What Is Form 720 Used For?

Fiscal organs pay close attention to specific services and products by imposing excise tax on them - the responsibility of the seller or service provider is to make sure the government collects the right amount of excise tax, and Tax Form 720 serves this purpose. Whether you are selling coal, gasoline, or fishing equipment or rendering tanning services indoors or transportation services via ships, you have to inform the IRS about those operations after every quarter of the year is over.

Who Needs to File Form 720?

You are obliged to submit Form 720 to tax authorities if your business sells goods or provides services while incurring excise taxes - taxes imposed by the government on certain goods and services. The type of business structure does not matter - as long as you sell goods and provide services for which you must pay excise taxes, every retailer, manufacturer, importer, tanning salon, or airline company has to file 720 Tax Form before the deadline comes every three months.

Form 720 Instructions

The IRS Form 720 Instructions are as follows:

-

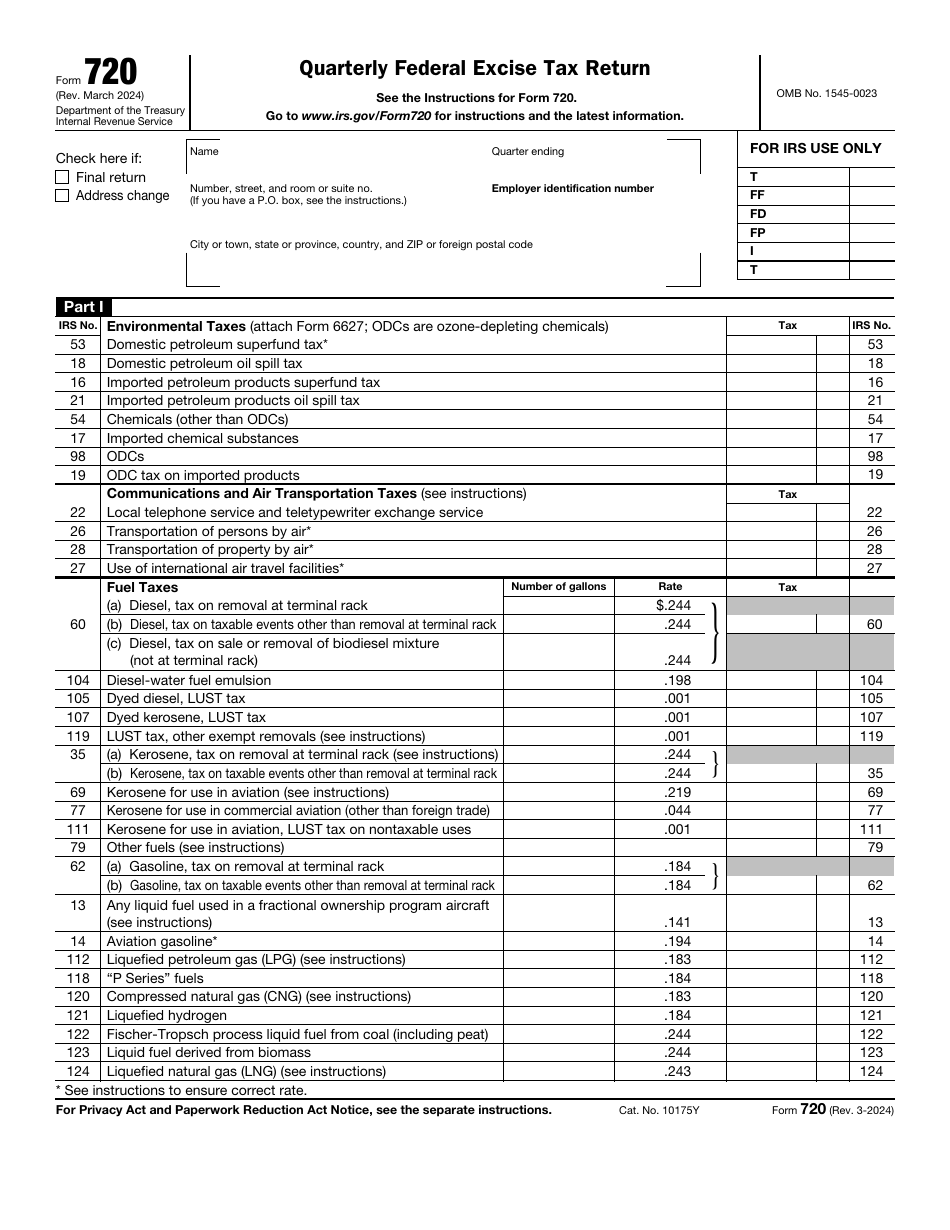

Indicate the name of your business, add your employer identification number and address, and specify the last day of the quarter you describe in the form . Check the boxes if necessary to confirm the version of the tax return is final and your organization has changed its address during the previous quarter.

-

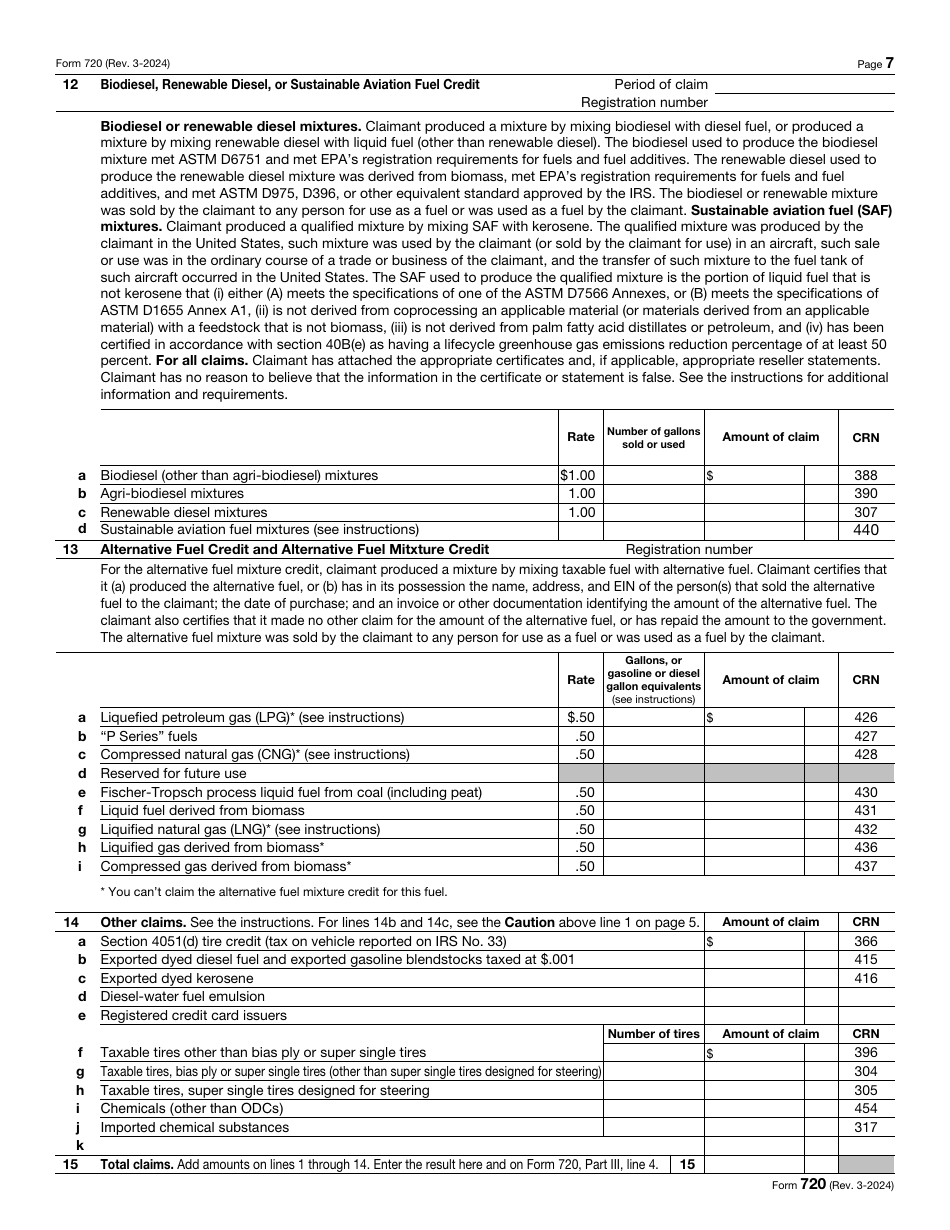

Provide information about the different types of excise taxes your company is supposed to pay . The document divides the taxes into several categories - from environment and fuel to foreign insurance and communications. You will have to indicate the number of gallons of taxable fuel and tons of coal subject to tax, explain how many insurance premiums you paid, record the amount of obligations that do not fall under specified categories of taxes, enter the sales price of coal, and apply appropriate rates.

-

It is important to fill out the form in accordance with the guidelines provided to taxpayers - for instance, if you are paying environmental taxes, you will have to complete IRS Form 6627, Environmental Taxes, as well. Once you have calculated all tax amounts, combine them to write down the total result.

-

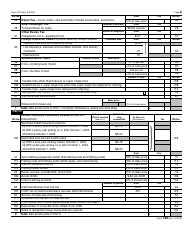

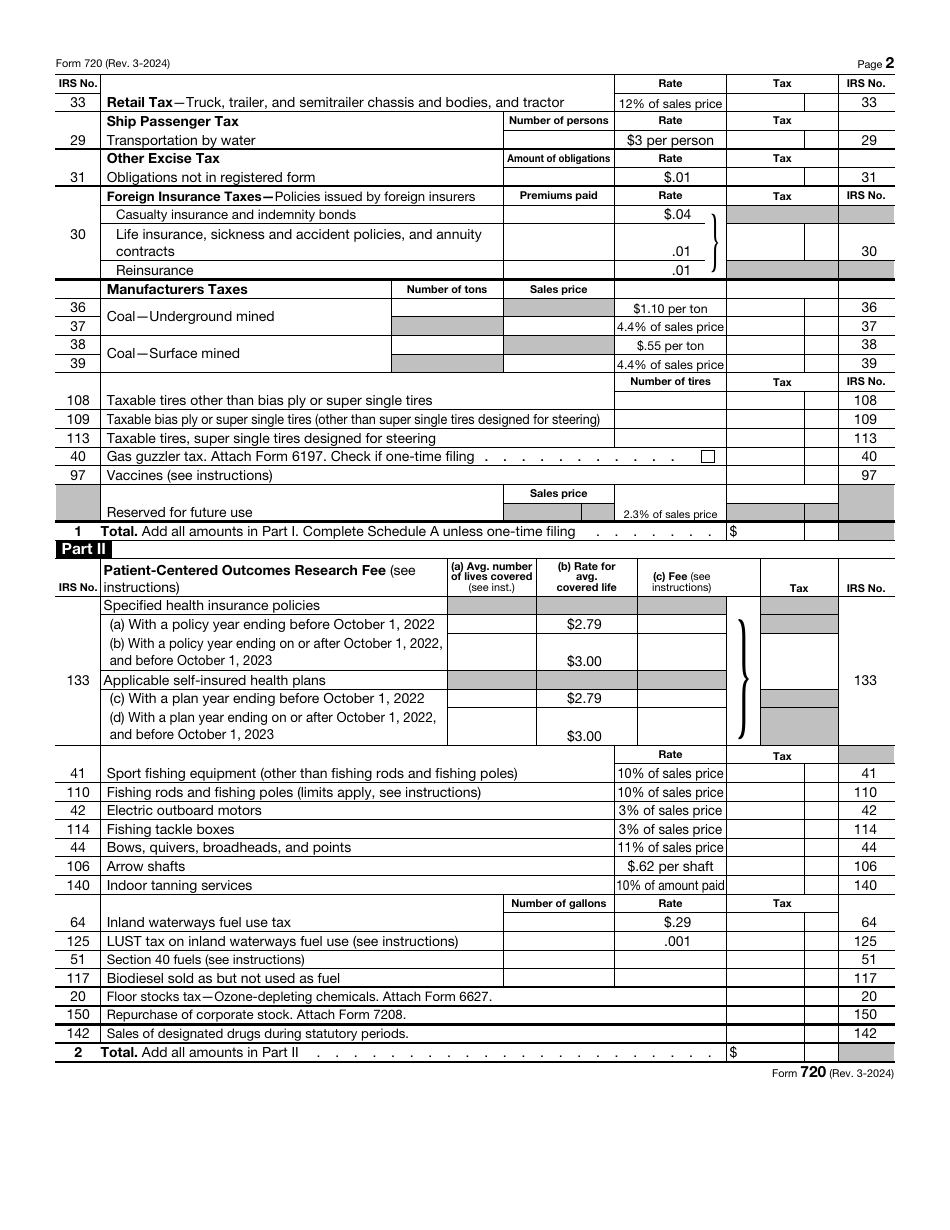

Fill out the second section of the document to focus on specific excise taxes you are expected to pay after selling biodiesel, arrow shafts, bows, electric motors, various equipment designed for sport fishing, and health plans and insurance policies . If you are an insurance provider, you have to know the average number of lives the policies cover during the year in question, apply the rate listed in the form, and enter the fee for every category the form mentions. As for different items you sell, state the amount of tax you owe after taking the rate into account.

-

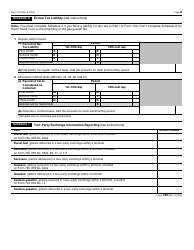

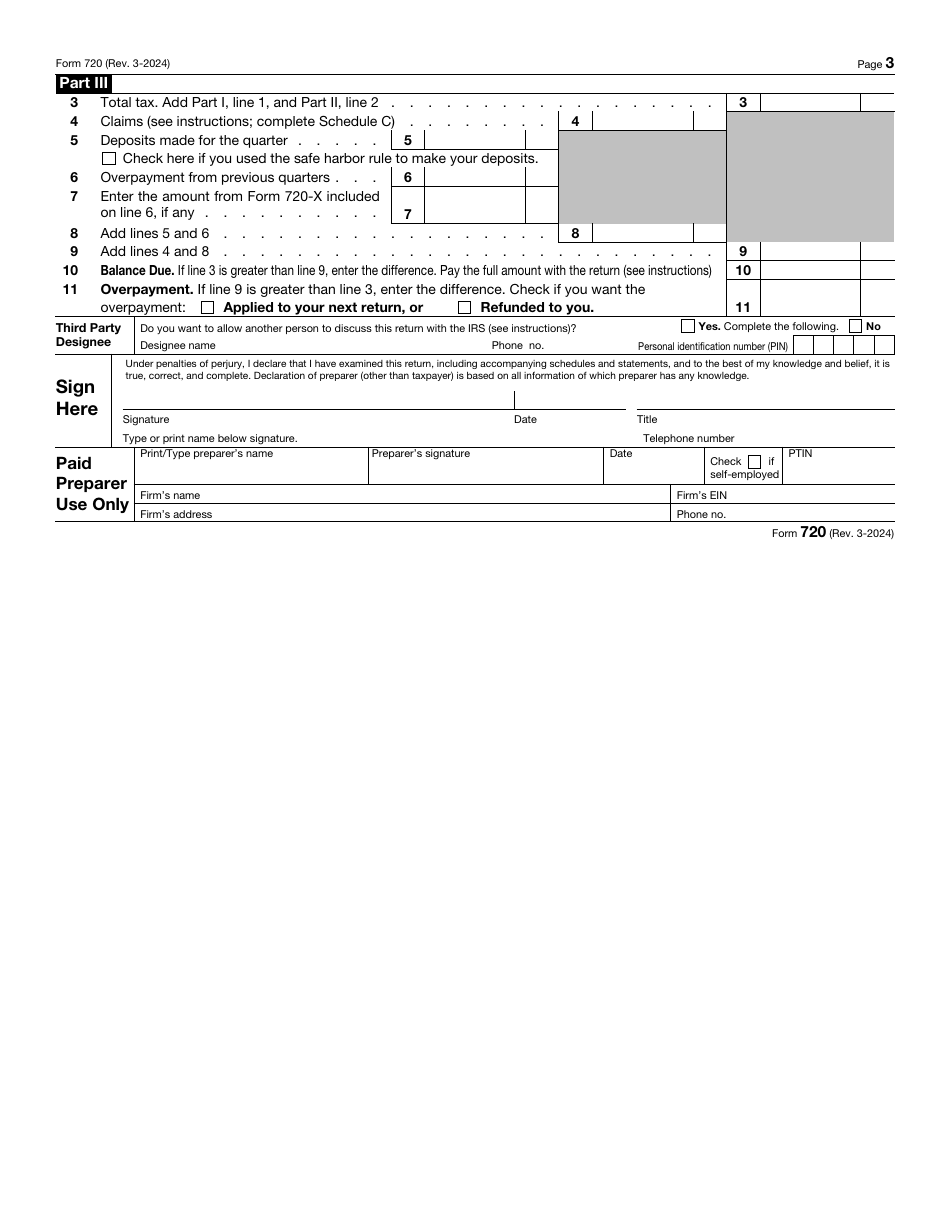

Compute the tax calculations in the third part of the form to inform the IRS about the tax you owe . It is necessary to specify whether you made deposits during the quarter covered in the form and elaborate on the possible overpayment - you are permitted to request a refund right away or agree to apply the overpayment to the next return you file.

-

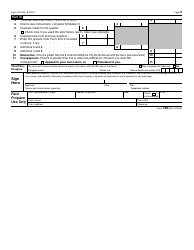

Certify the paperwork - you have to state your title, telephone number, and actual date before signing the document . You can authorize a representative to communicate with tax organs about the details you have submitted in writing - make sure the form includes their name, telephone number, and identification number. In case you hired a tax professional to fill out and file the tax return on your behalf, they must identify themselves as well.

-

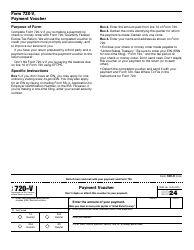

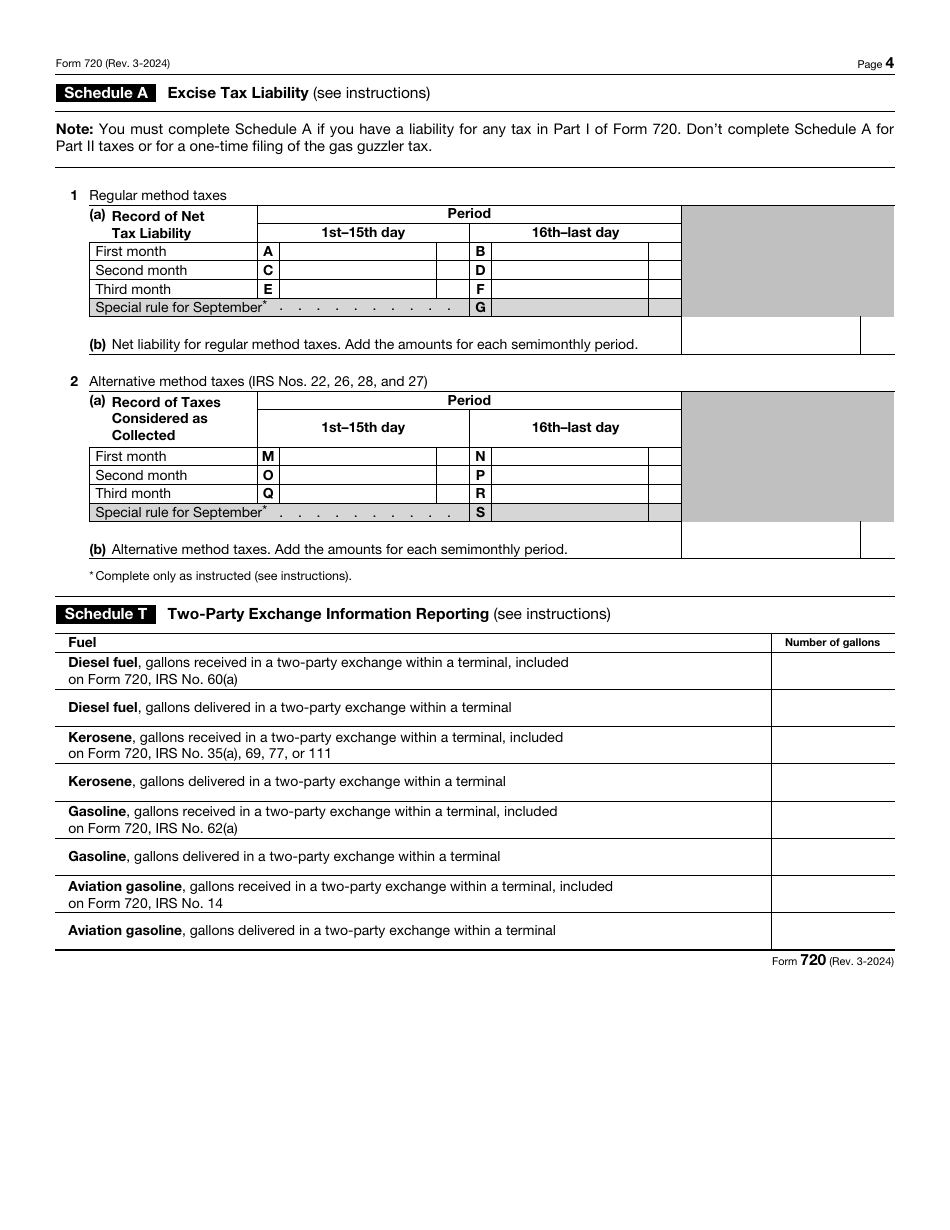

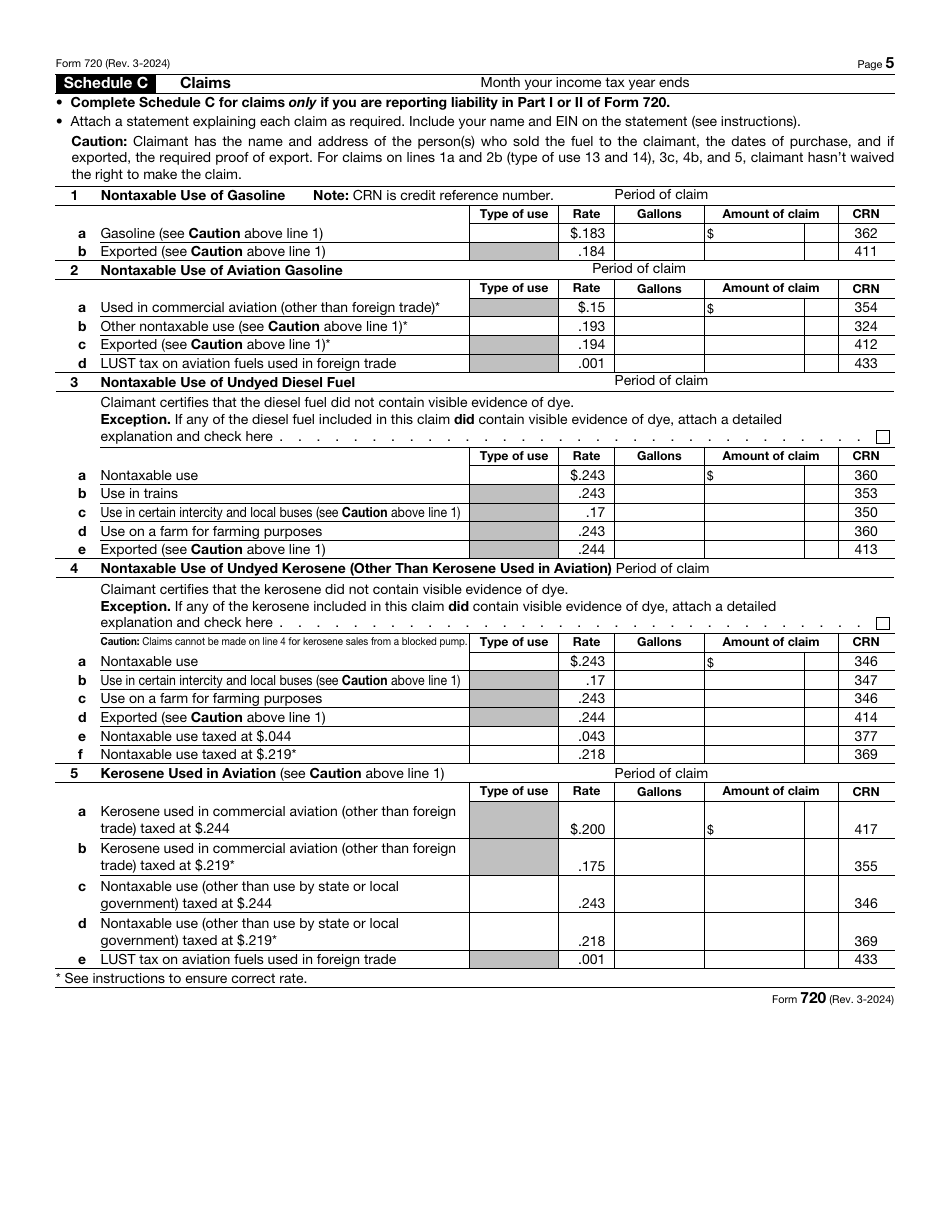

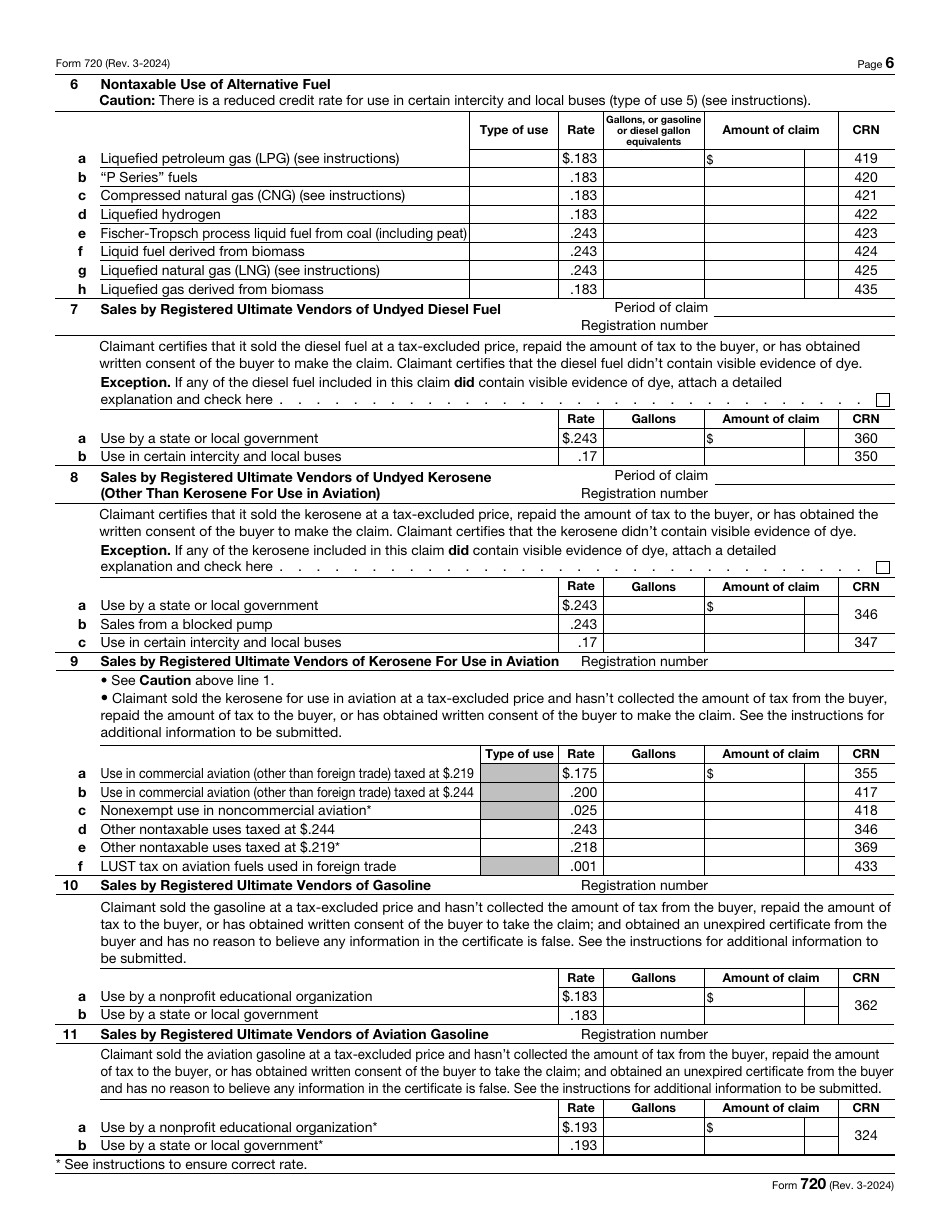

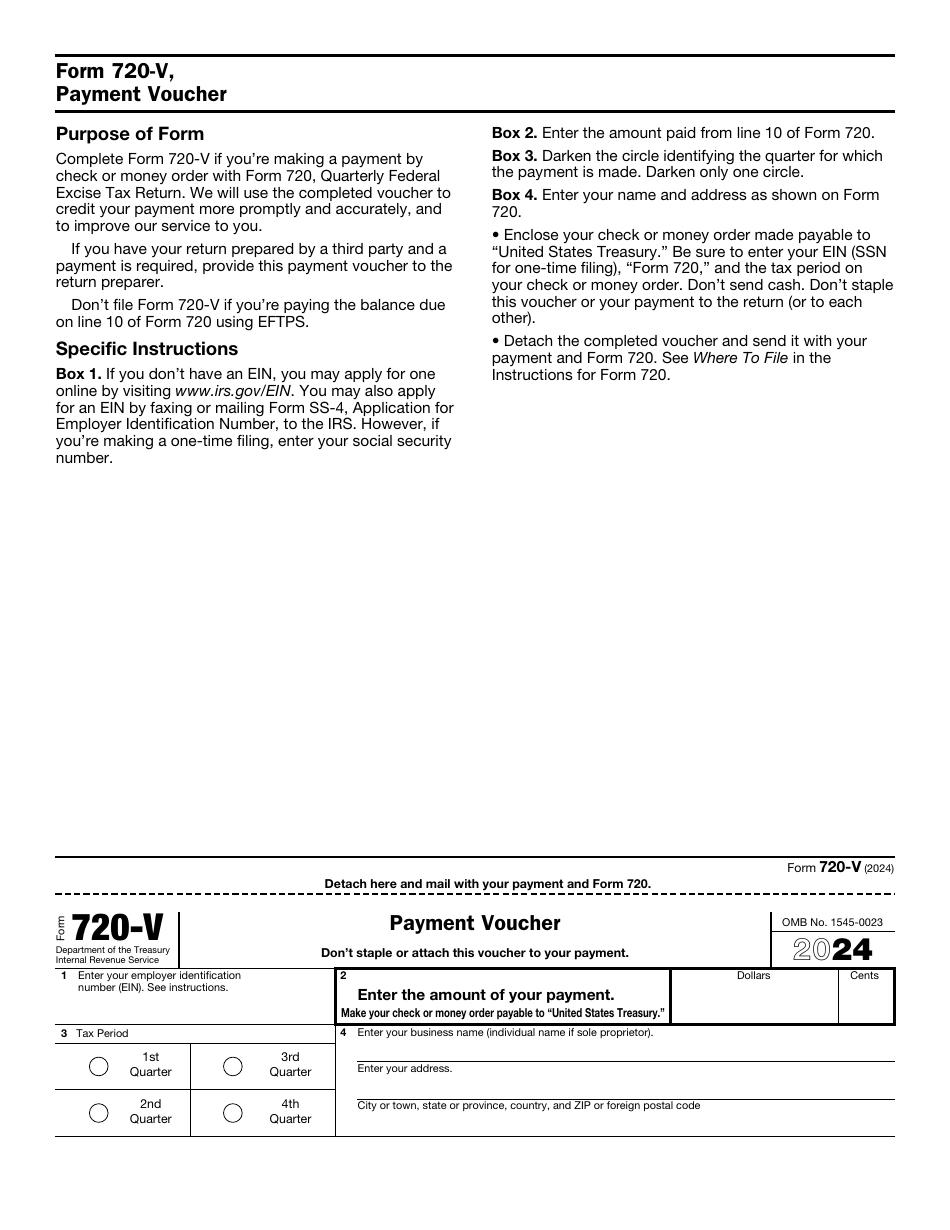

Check out the three schedules you need to enclose with the main form - record your excise tax liability, report how much fuel you have received or delivered is taxable, and claim tax credits in order to lower your tax liability . Complete the last page of the form - the payment voucher - if you are attaching a money order or check to the tax return. Specify your business details, the payment amount, and the tax period.

Where to Mail Form 720?

IRS Form 720 mailing address is Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0009 . Note that you are required to submit this document every three months to report and pay excise tax - there are four deadlines to comply with during the year. File Form 720 by April 30, July 31, October 31, and January 31 - basically, the last day of the month that comes after the last month covered in every tax return.