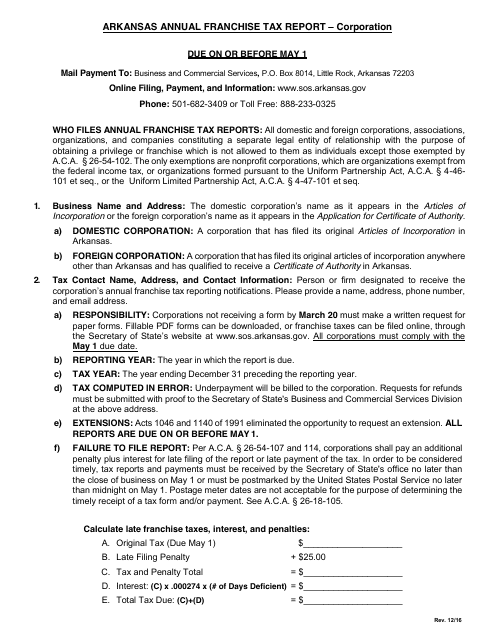

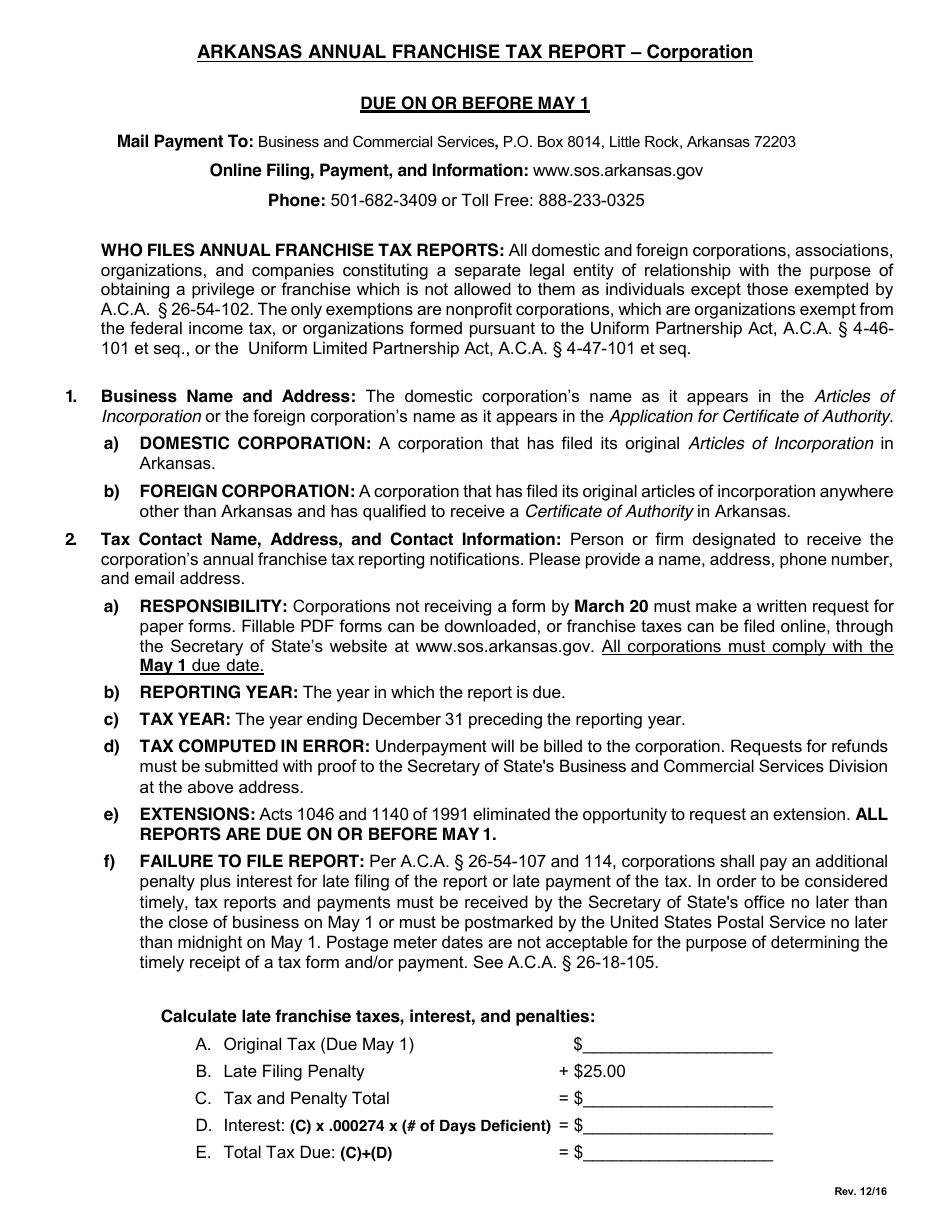

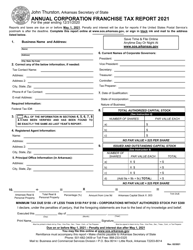

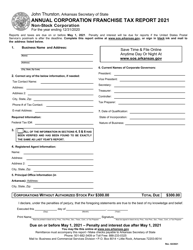

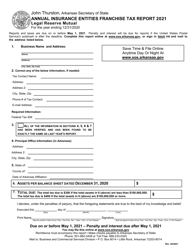

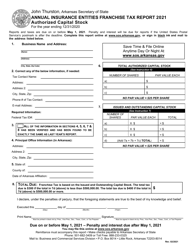

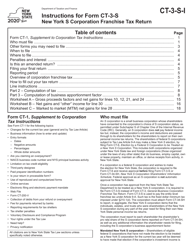

Instructions for Annual Corporation Franchise Tax Report - Arkansas

This document was released by Arkansas Secretary of State and contains the most recent official instructions for Annual Corporation Franchise Tax Report .

FAQ

Q: What is the Annual Corporation Franchise Tax Report?

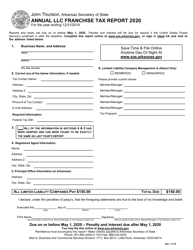

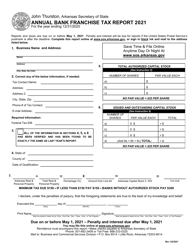

A: The Annual Corporation Franchise Tax Report is a tax report that corporations in Arkansas are required to file annually.

Q: Who needs to file the Annual Corporation Franchise Tax Report?

A: Corporations that are registered in Arkansas need to file the Annual Corporation Franchise Tax Report.

Q: What is the deadline for filing the Annual Corporation Franchise Tax Report?

A: The deadline for filing the Annual Corporation Franchise Tax Report in Arkansas is May 1st.

Q: Are there any fees associated with filing the Annual Corporation Franchise Tax Report?

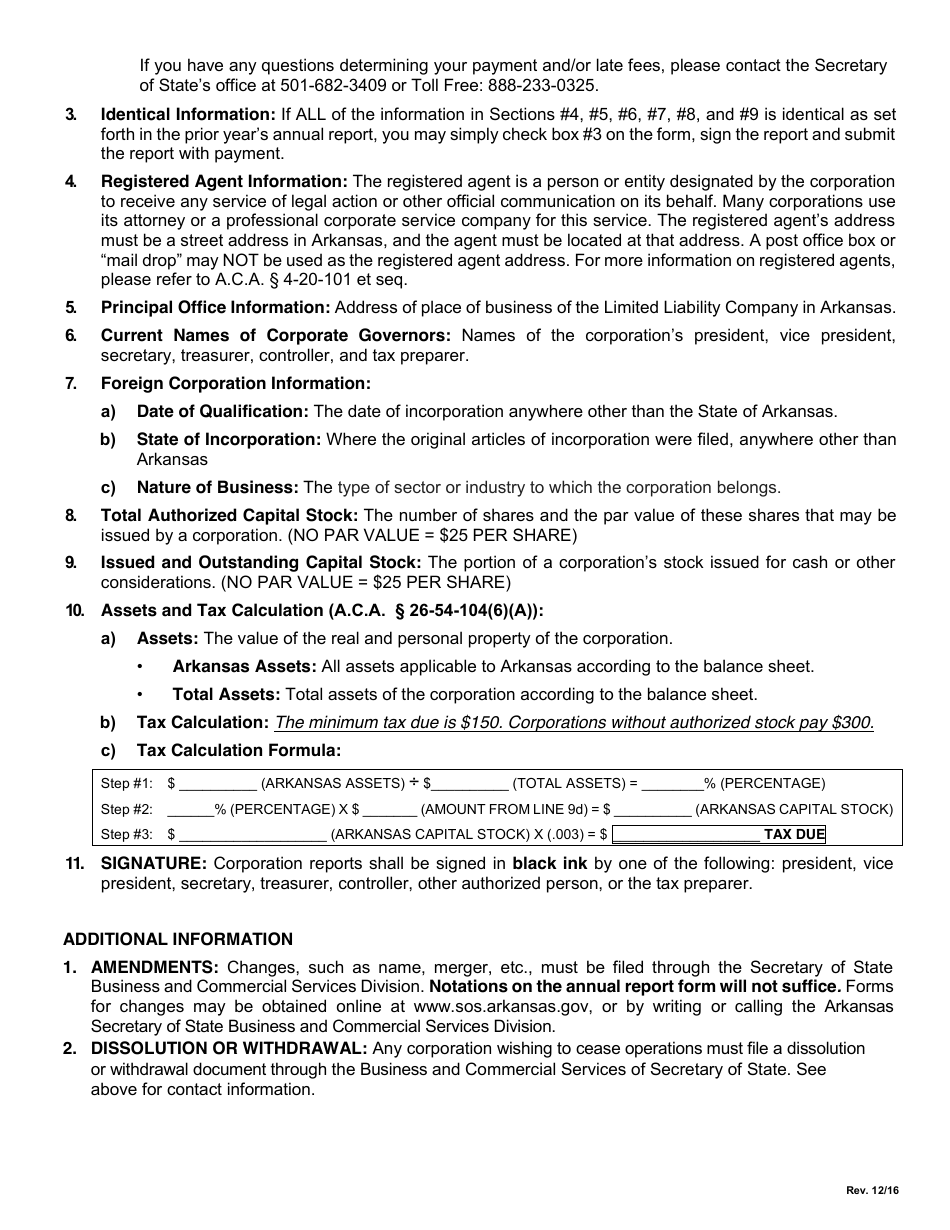

A: Yes, there is a filing fee of $150 for the Annual Corporation Franchise Tax Report in Arkansas.

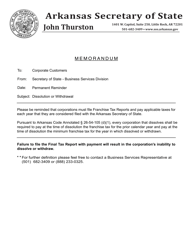

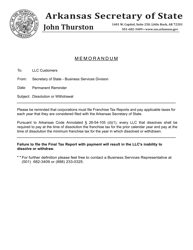

Q: What happens if the Annual Corporation Franchise Tax Report is not filed on time?

A: If the Annual Corporation Franchise Tax Report is not filed on time, there may be penalties and interest imposed on the corporation.

Q: Are there any exemptions from filing the Annual Corporation Franchise Tax Report?

A: Certain corporations, such as nonprofit organizations, are exempt from filing the Annual Corporation Franchise Tax Report.

Q: Can the Annual Corporation Franchise Tax Report be amended?

A: Yes, the Annual Corporation Franchise Tax Report can be amended if there are errors or changes that need to be made.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Arkansas Secretary of State.