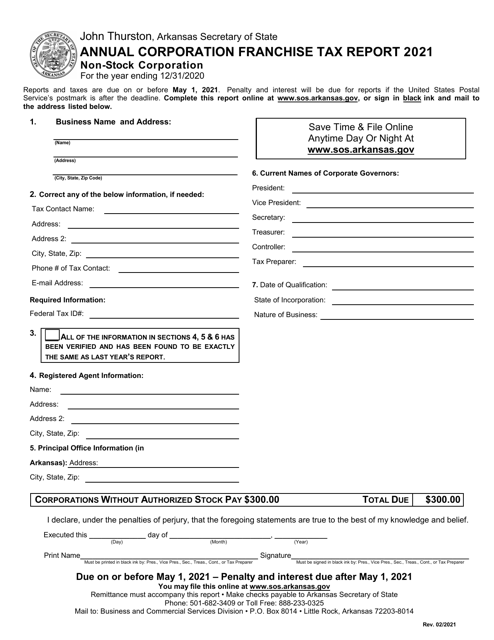

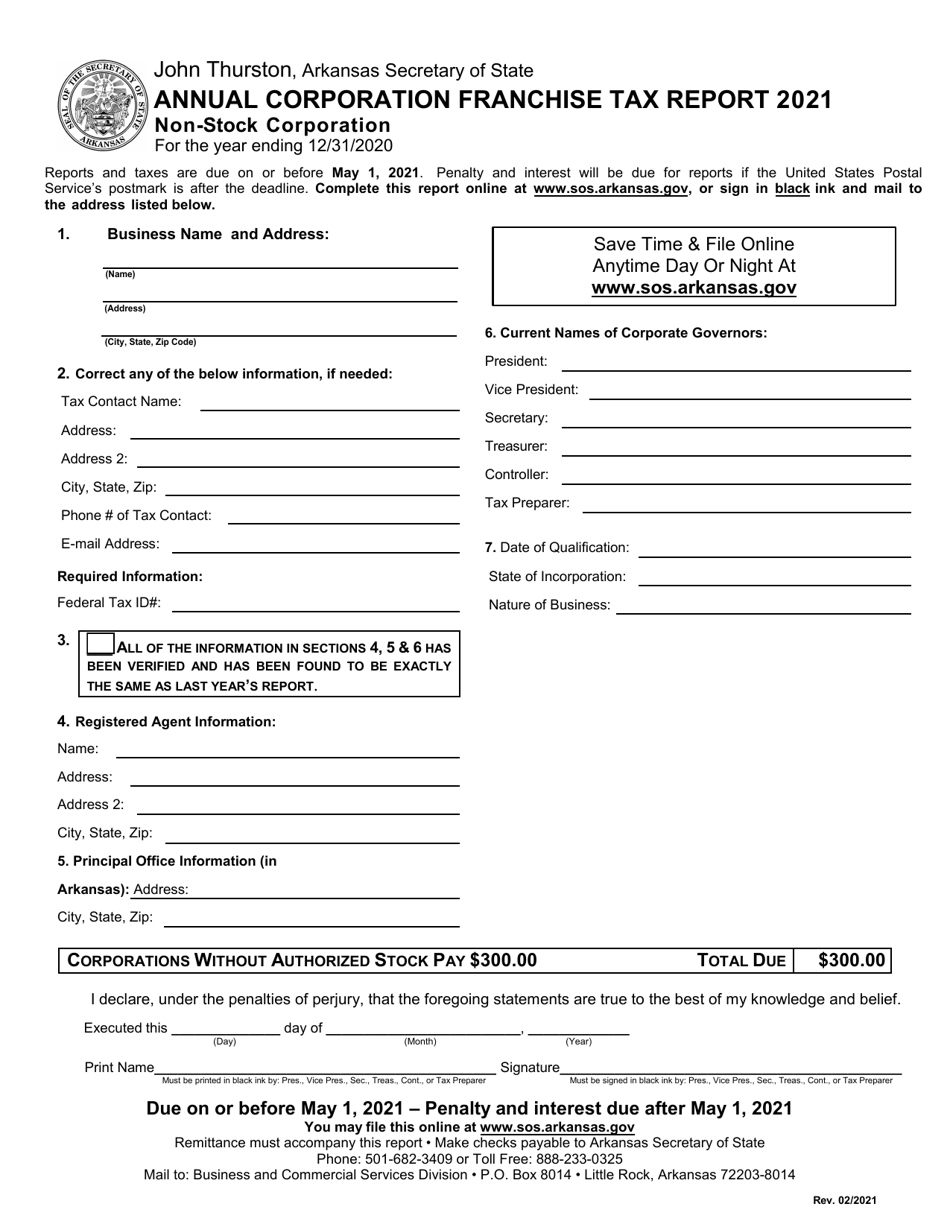

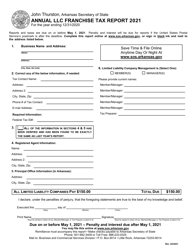

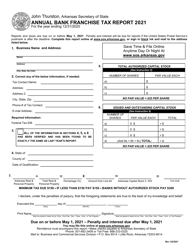

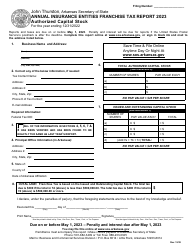

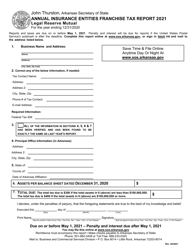

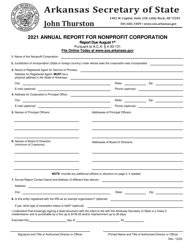

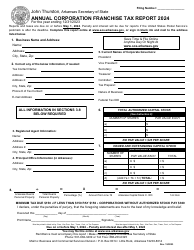

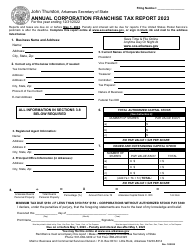

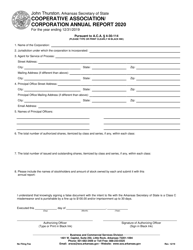

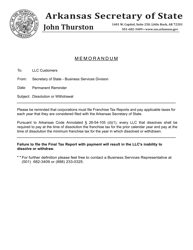

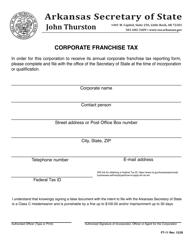

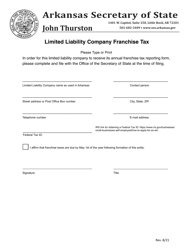

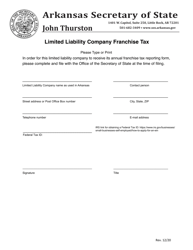

Annual Corporation Franchise Tax Report - Non-stock Corporation - Arkansas

Annual Corporation Franchise Tax Report - Non-stock Corporation is a legal document that was released by the Arkansas Secretary of State - a government authority operating within Arkansas.

FAQ

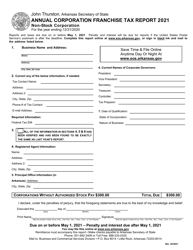

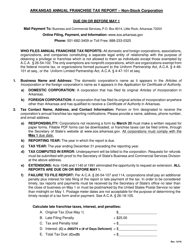

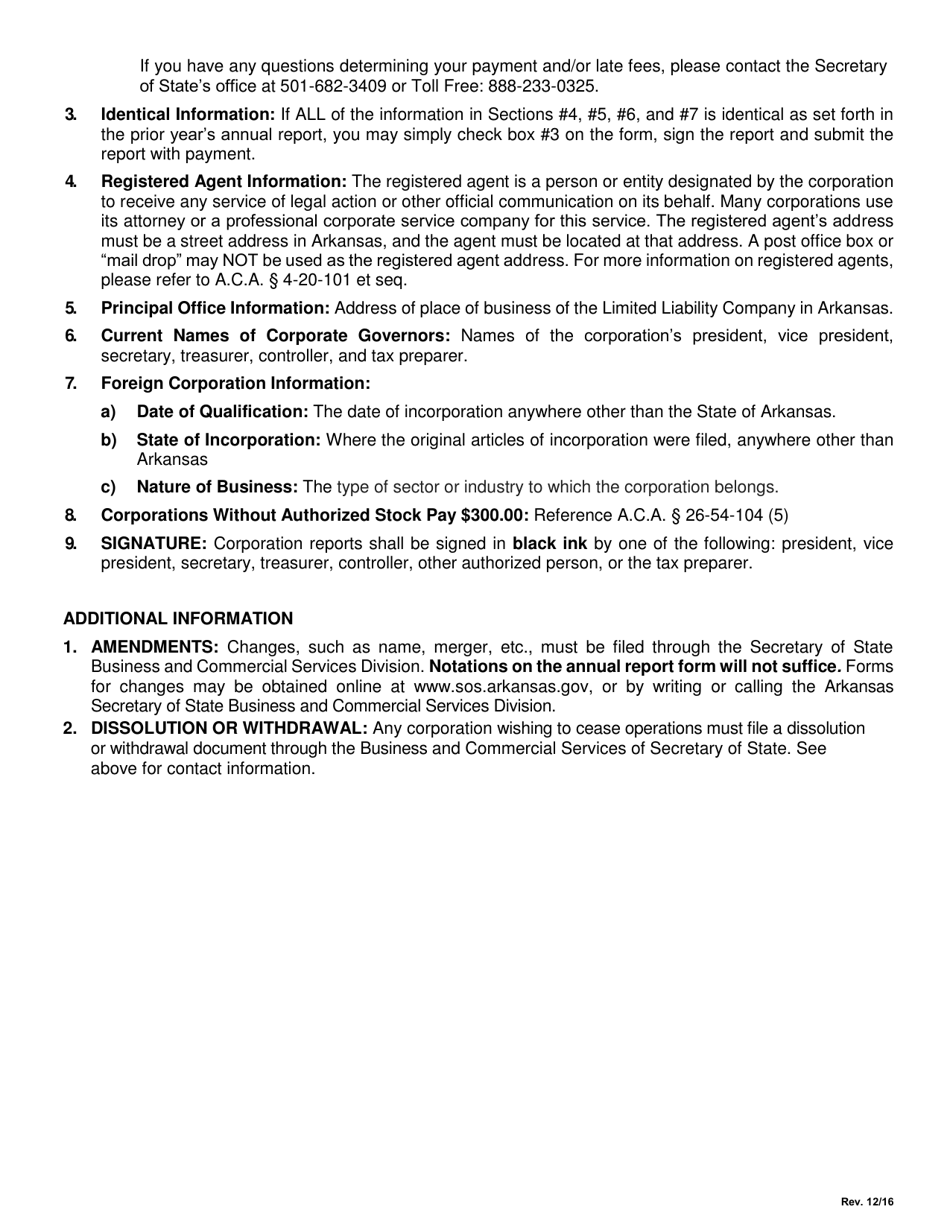

Q: Who needs to file the Annual Corporation Franchise Tax Report?

A: Non-stock corporations in Arkansas.

Q: What is the purpose of the Annual Corporation Franchise Tax Report?

A: To report and pay the annual franchise tax.

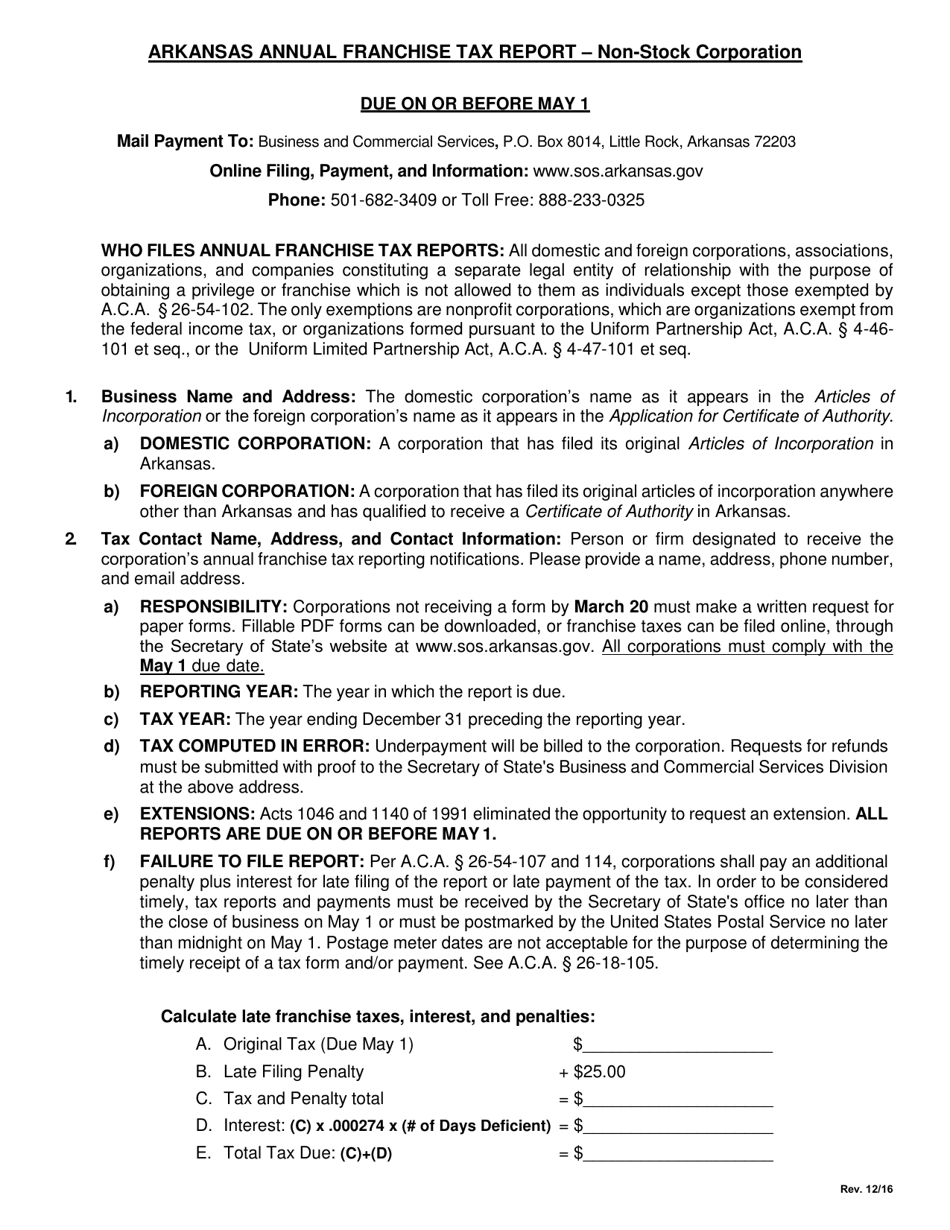

Q: When is the Annual Corporation Franchise Tax Report due?

A: It is due by May 1st of each year.

Q: What is the fee for filing the Annual Corporation Franchise Tax Report?

A: The filing fee is $45 for non-stock corporations.

Q: Are non-stock corporations exempt from paying franchise tax?

A: No, non-stock corporations are not exempt and are required to pay the franchise tax.

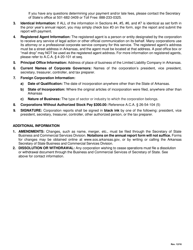

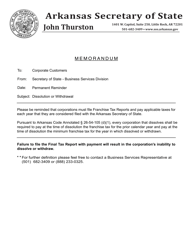

Q: What happens if I don't file the Annual Corporation Franchise Tax Report?

A: You may be subjected to penalties and interest.

Q: Can I request an extension to file the Annual Corporation Franchise Tax Report?

A: No, extensions are not granted for this report.

Form Details:

- Released on February 1, 2021;

- The latest edition currently provided by the Arkansas Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Secretary of State.