This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

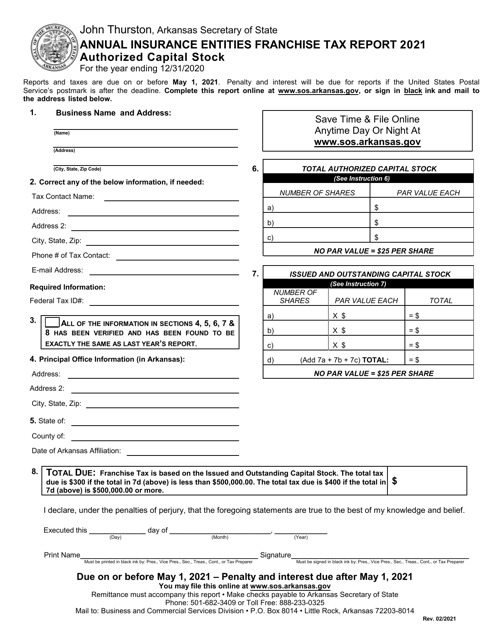

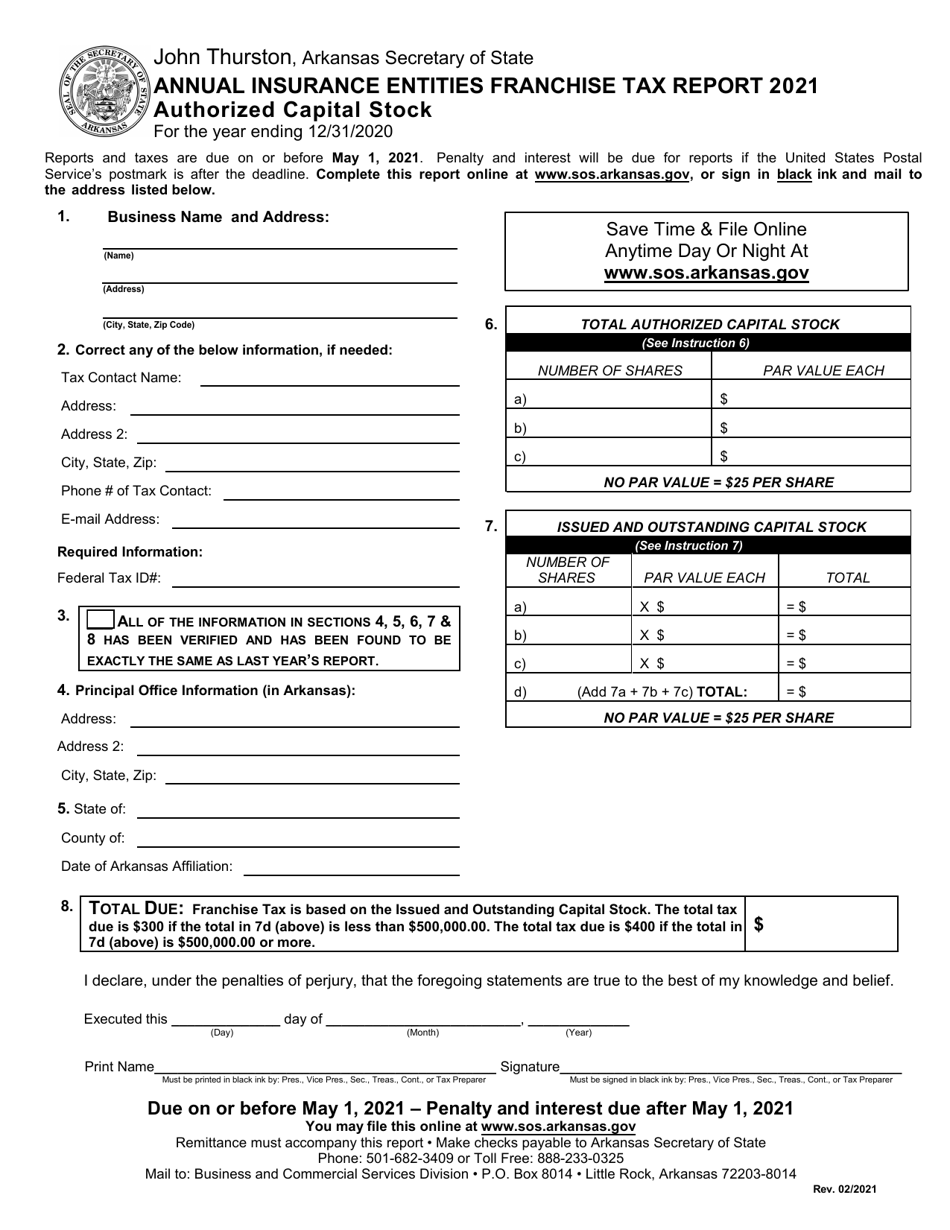

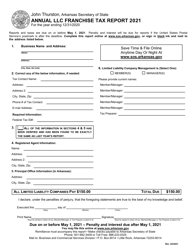

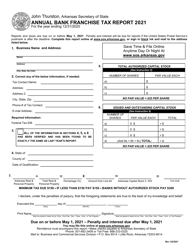

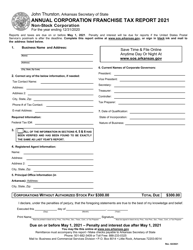

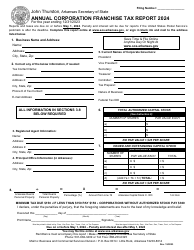

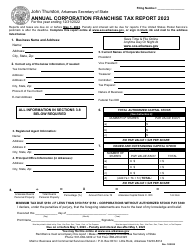

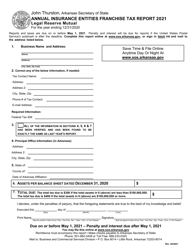

Annual Insurance Entities Franchise Tax Report - Authorized Capital Stock - Arkansas

Annual Insurance Entities Franchise Tax Report - Authorized Capital Stock is a legal document that was released by the Arkansas Secretary of State - a government authority operating within Arkansas.

FAQ

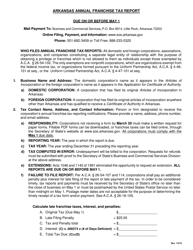

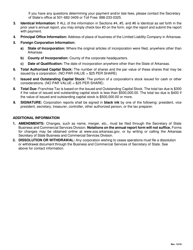

Q: What is the Annual Insurance Entities Franchise Tax Report?

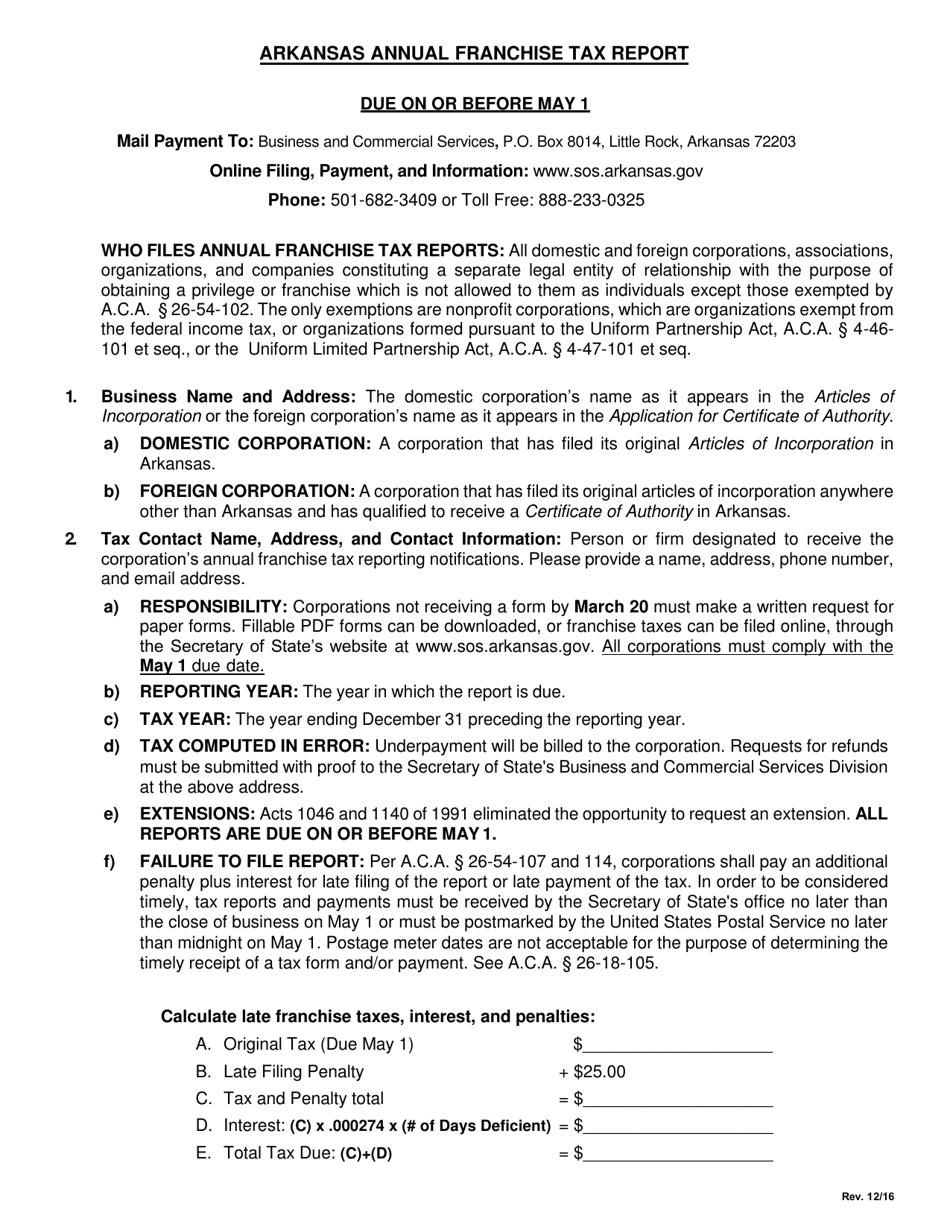

A: The Annual Insurance Entities Franchise Tax Report is a tax return that insurance companies in Arkansas must file annually.

Q: What is the Authorized Capital Stock?

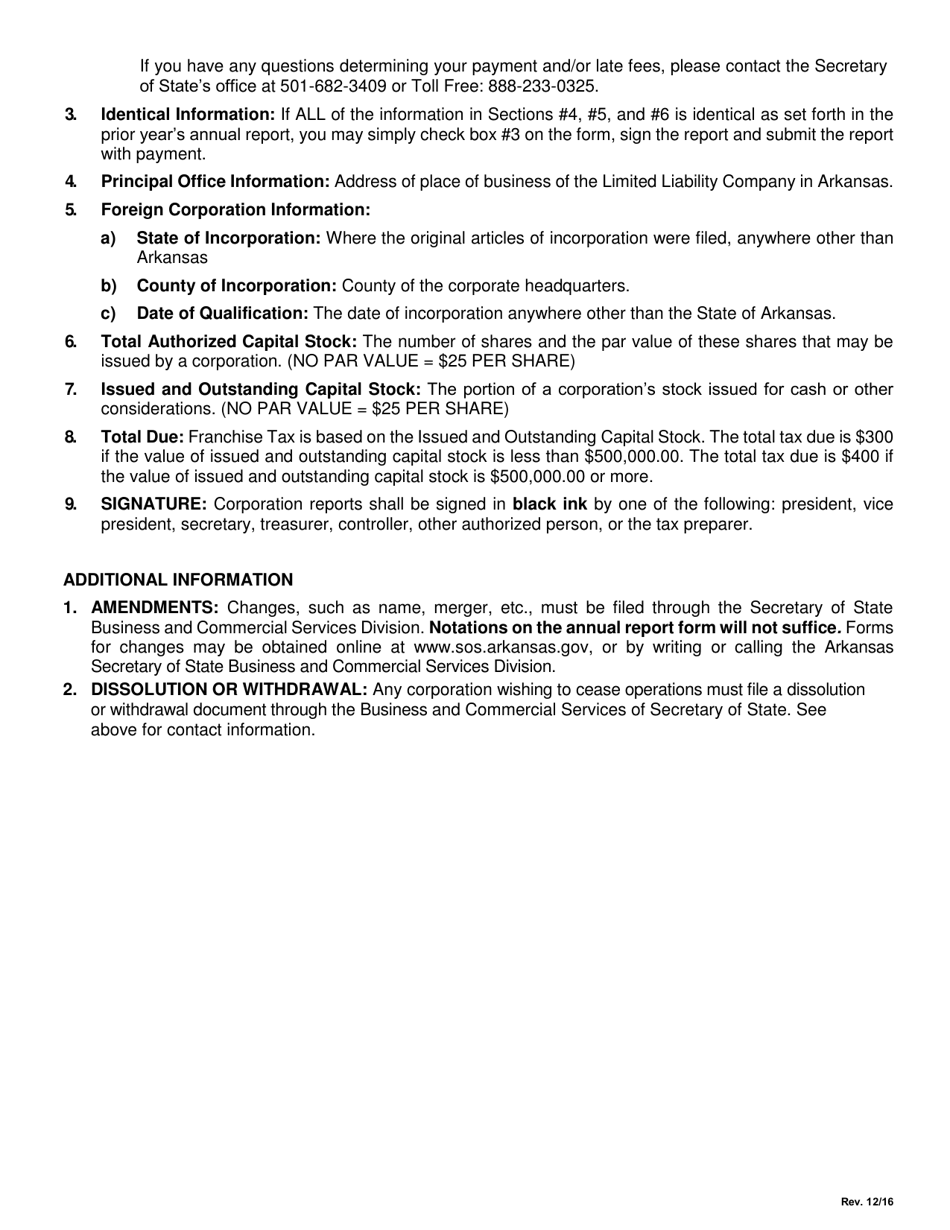

A: The Authorized Capital Stock refers to the total amount of shares of stock that a company is permitted to issue, as specified in its articles of incorporation.

Q: Why is the Authorized Capital Stock important for the Annual Insurance Entities Franchise Tax Report?

A: The Authorized Capital Stock is used to determine the tax liability of insurance companies in Arkansas. The higher the authorized capital stock, the higher the tax burden.

Q: How does the Annual Insurance Entities Franchise Tax Report affect insurance companies in Arkansas?

A: The report is used to calculate the franchise tax due from insurance companies based on their authorized capital stock. It is an important financial obligation for insurance companies operating in Arkansas.

Form Details:

- Released on February 1, 2021;

- The latest edition currently provided by the Arkansas Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Secretary of State.