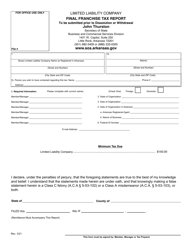

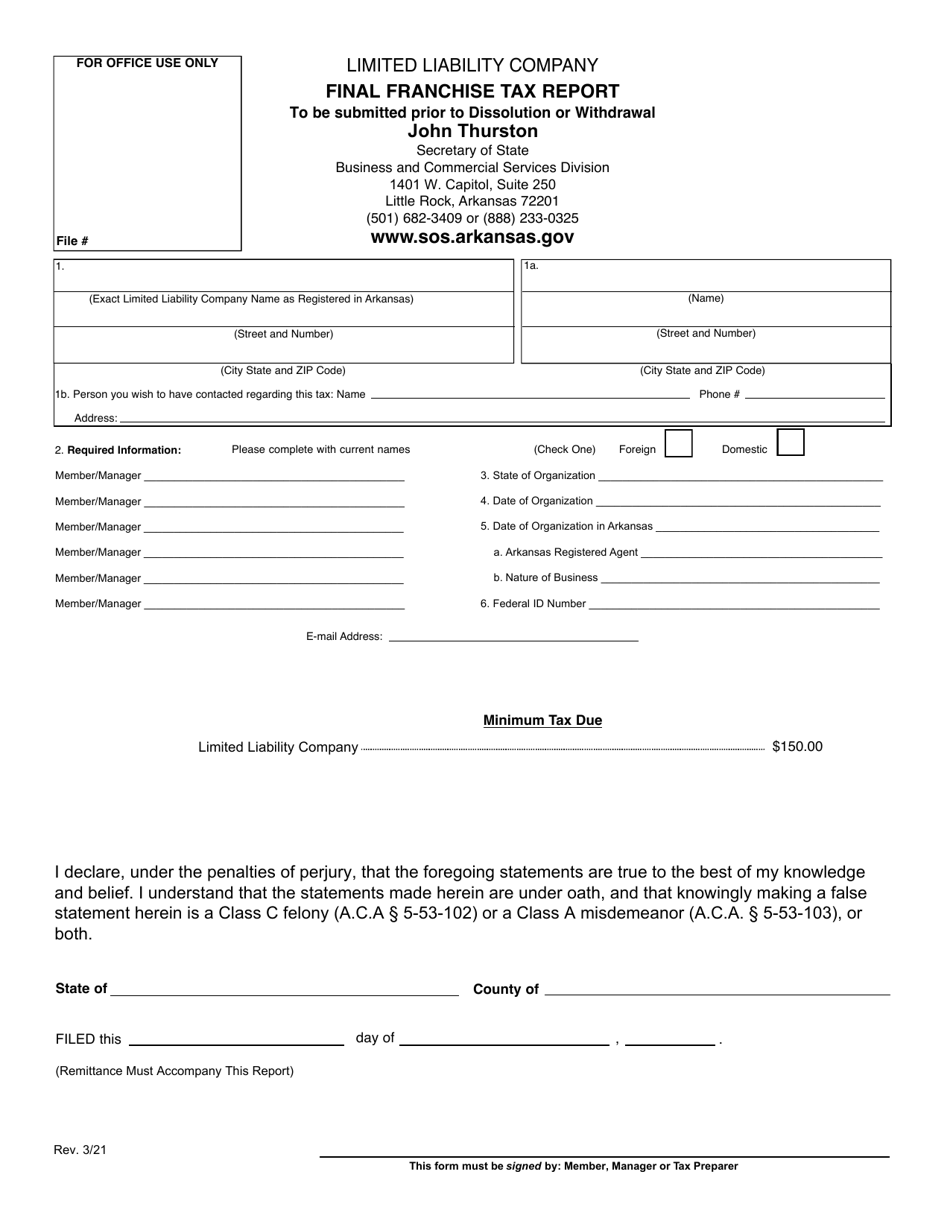

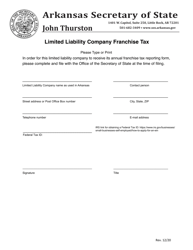

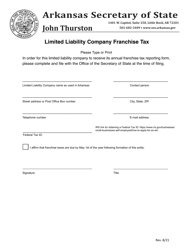

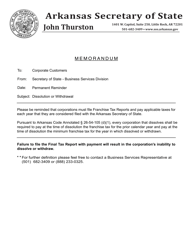

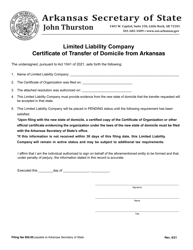

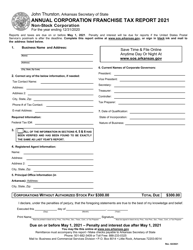

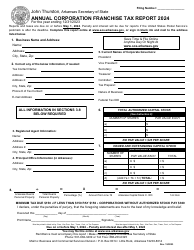

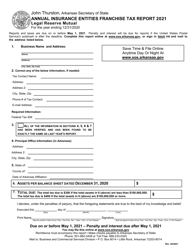

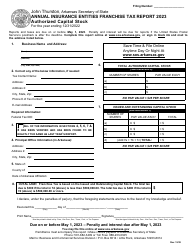

Limited Liability Company Final Franchise Tax Report - Arkansas

Limited Liability Company Final Franchise Tax Report is a legal document that was released by the Arkansas Secretary of State - a government authority operating within Arkansas.

FAQ

Q: What is a Limited Liability Company (LLC)?

A: An LLC is a type of business entity that combines the legal protections of a corporation with the flexibility and tax benefits of a partnership.

Q: What is the Final Franchise Tax Report in Arkansas?

A: The Final Franchise Tax Report is a required report for LLCs in Arkansas to finalize and close their tax obligations.

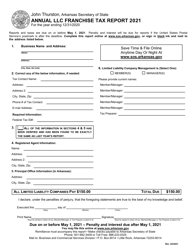

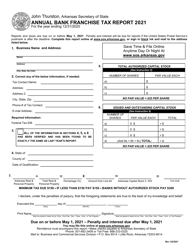

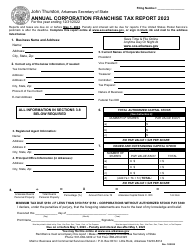

Q: When is the deadline to file the Final Franchise Tax Report in Arkansas?

A: The deadline to file the Final Franchise Tax Report in Arkansas is typically May 1st each year.

Q: What information is required to complete the Final Franchise Tax Report?

A: The Final Franchise Tax Report requires information about the LLC's income, expenses, and any assets or property owned by the LLC.

Q: Is there a filing fee for the Final Franchise Tax Report in Arkansas?

A: Yes, there is a filing fee associated with the Final Franchise Tax Report in Arkansas. The fee amount may vary.

Q: What happens if the Final Franchise Tax Report is not filed?

A: If the Final Franchise Tax Report is not filed, the LLC may face penalties and late fees, and its status may be considered delinquent.

Q: Can an LLC change its filing status after submitting the Final Franchise Tax Report?

A: Yes, an LLC can change its filing status after submitting the Final Franchise Tax Report. Please consult with a tax professional or the Arkansas Secretary of State for more information.

Q: Are there any exemptions or credits available for the Final Franchise Tax Report?

A: There may be exemptions or credits available for certain LLCs filing the Final Franchise Tax Report. It is recommended to review the Arkansas tax laws or consult with a tax professional for more information.

Form Details:

- Released on March 1, 2021;

- The latest edition currently provided by the Arkansas Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Secretary of State.