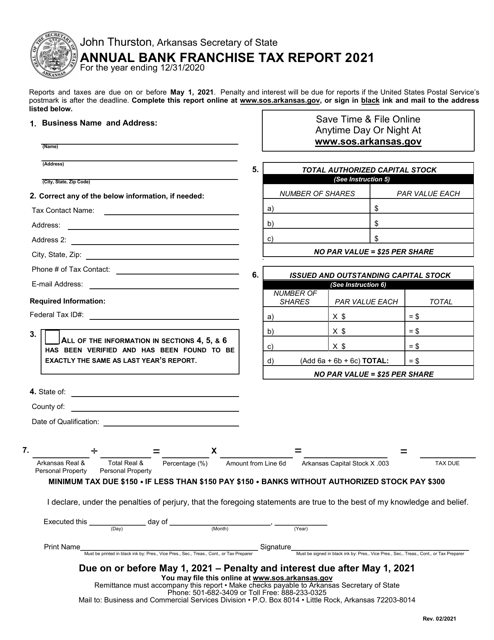

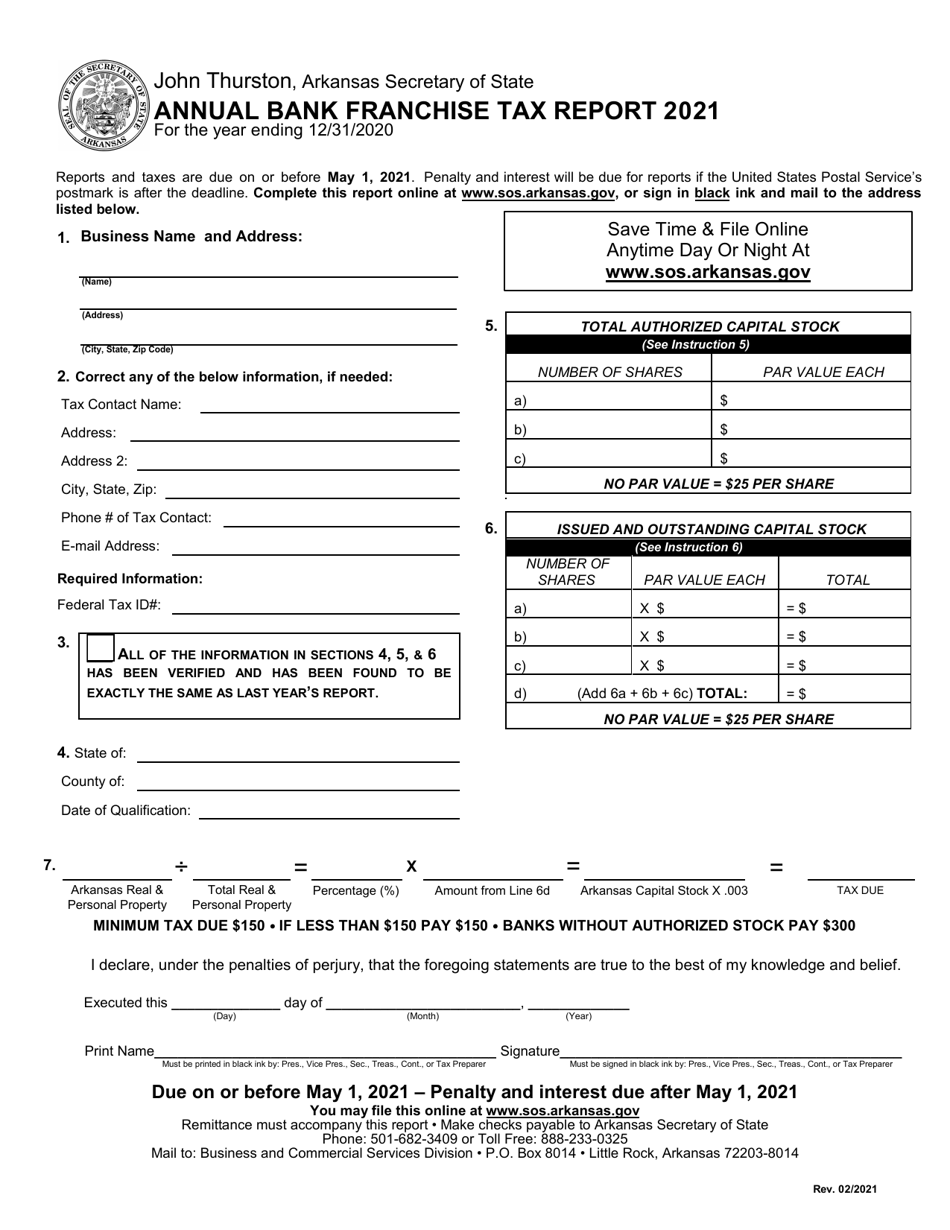

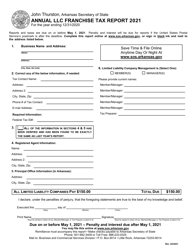

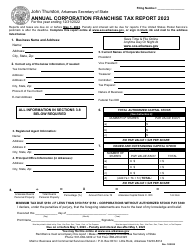

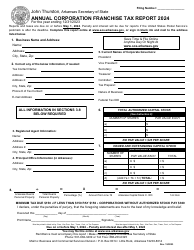

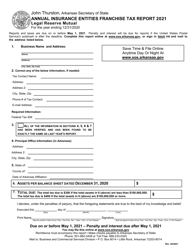

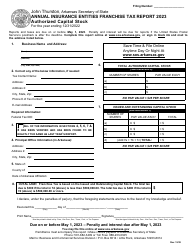

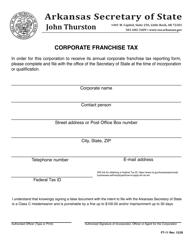

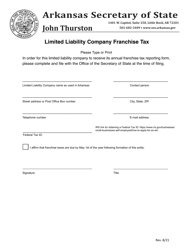

Annual Bank Franchise Tax Report - Arkansas

Annual Bank Franchise Tax Report is a legal document that was released by the Arkansas Secretary of State - a government authority operating within Arkansas.

FAQ

Q: What is the Annual Bank Franchise Tax Report?

A: The Annual Bank Franchise Tax Report is a reporting requirement for banks in Arkansas.

Q: Who needs to file the Annual Bank Franchise Tax Report?

A: Banks operating in Arkansas are required to file the Annual Bank Franchise Tax Report.

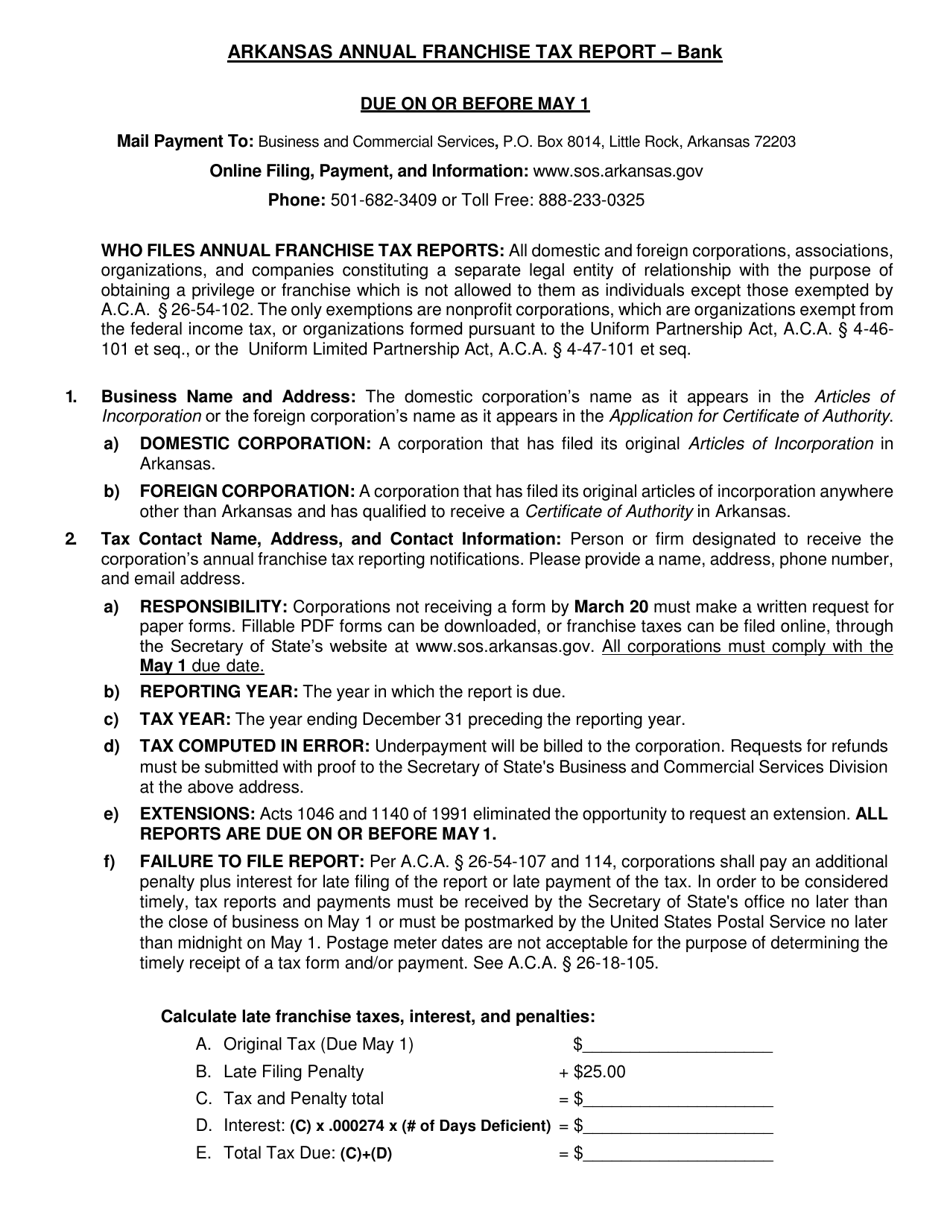

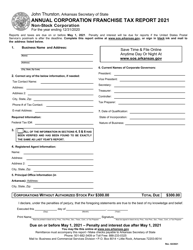

Q: When is the deadline for filing the Annual Bank Franchise Tax Report?

A: The deadline for filing the Annual Bank Franchise Tax Report in Arkansas is generally April 15th of each year.

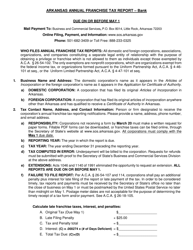

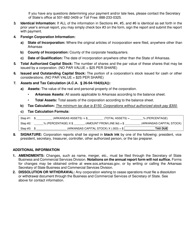

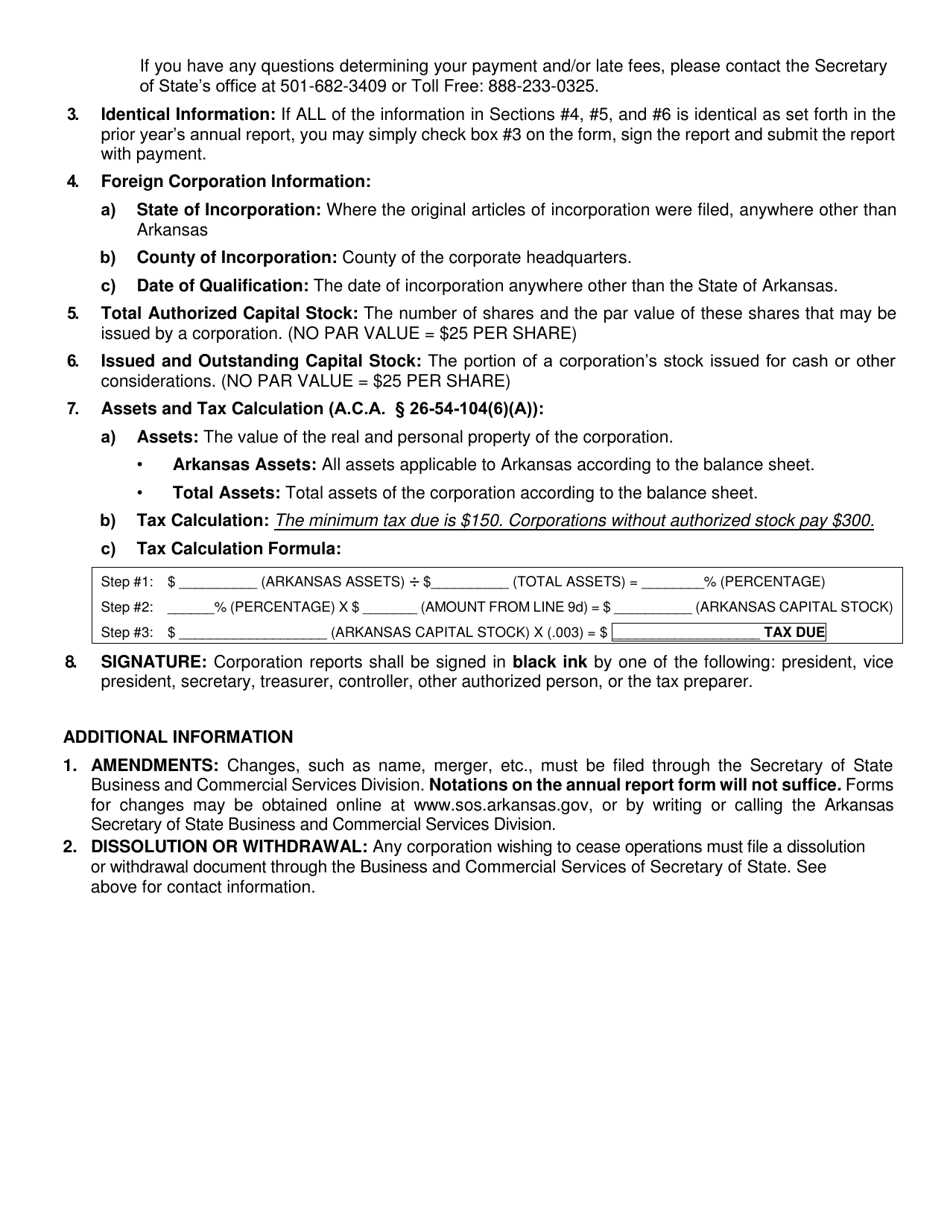

Q: What information is required on the Annual Bank Franchise Tax Report?

A: The Annual Bank Franchise Tax Report requires banks to provide information on their net worth and total assets in Arkansas.

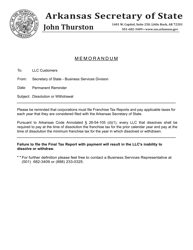

Q: Are there any penalties for late filing of the Annual Bank Franchise Tax Report?

A: Yes, there are penalties for late filing of the Annual Bank Franchise Tax Report. The exact penalty amount may vary based on the specific circumstances.

Form Details:

- Released on February 1, 2021;

- The latest edition currently provided by the Arkansas Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Secretary of State.