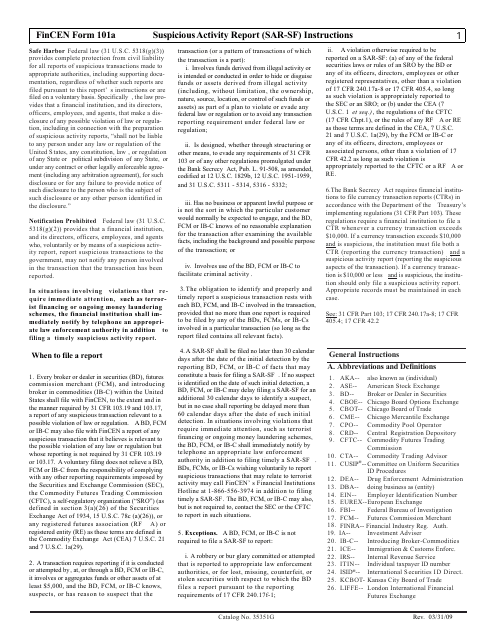

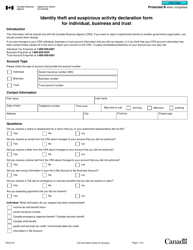

Instructions for FinCEN Form 101A Suspicious Activity Report (Sar-SF)

This document contains official instructions for FinCEN Form 101A , Suspicious Activity Report (Sar-SF) - a form released and collected by the U.S. Department of the Treasury - Financial Crimes Enforcement Network.

FAQ

Q: What is FinCEN Form 101A?

A: FinCEN Form 101A is the Suspicious Activity Report (SAR-SF).

Q: Who needs to file FinCEN Form 101A?

A: Financial institutions, including banks, must file FinCEN Form 101A if they suspect suspicious activity.

Q: What is the purpose of FinCEN Form 101A?

A: The purpose of FinCEN Form 101A is to report any suspicious activity that may indicate possible money laundering, terrorist financing, or other illegal activities.

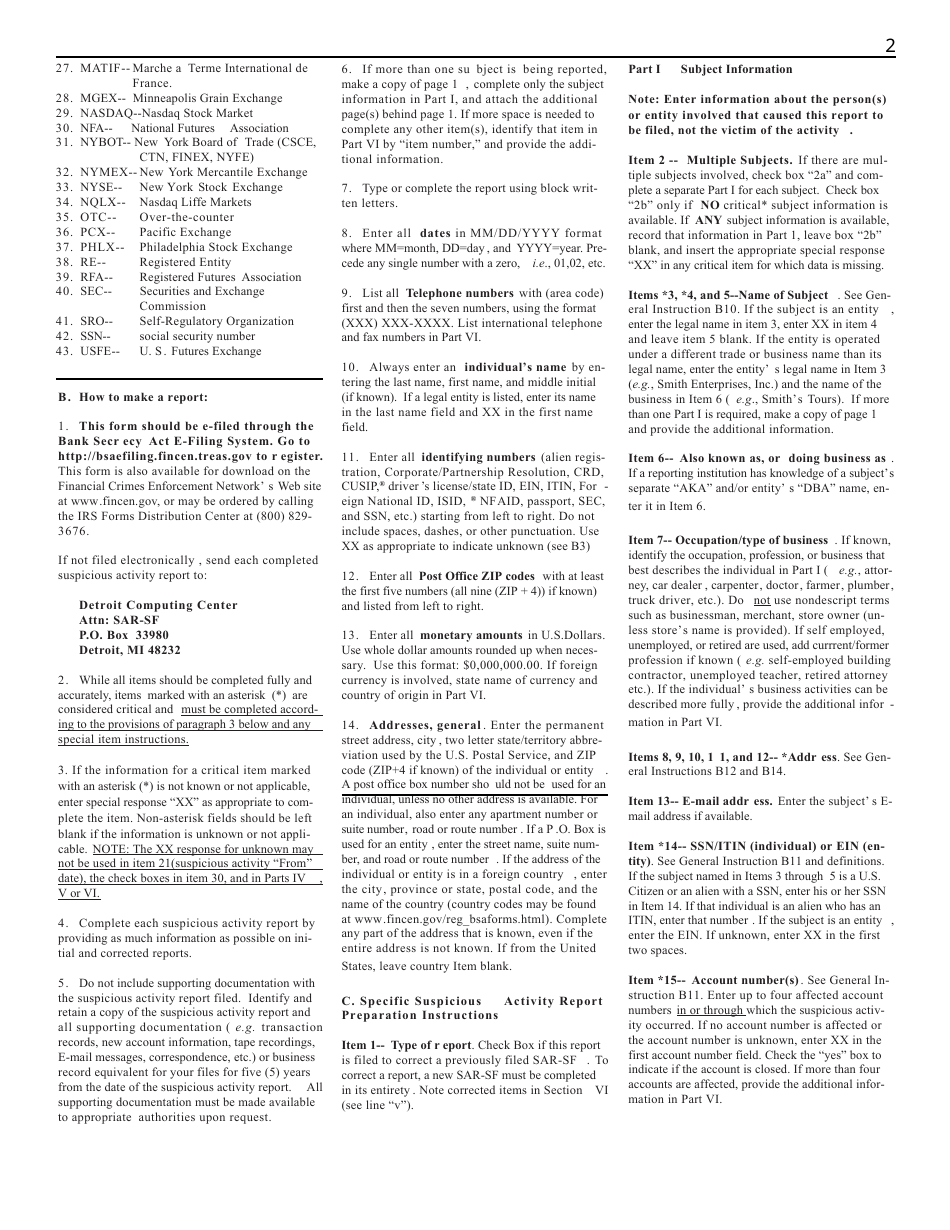

Q: How do I complete FinCEN Form 101A?

A: To complete FinCEN Form 101A, provide all requested information, including details about the suspicious activity, the individuals involved, and any supporting documents.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of the Treasury - Financial Crimes Enforcement Network.