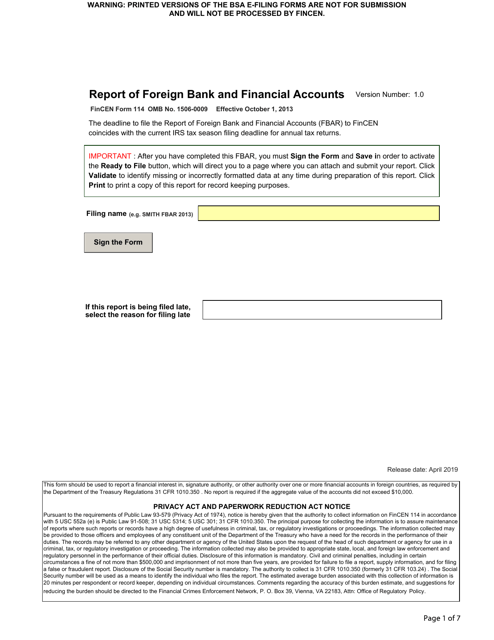

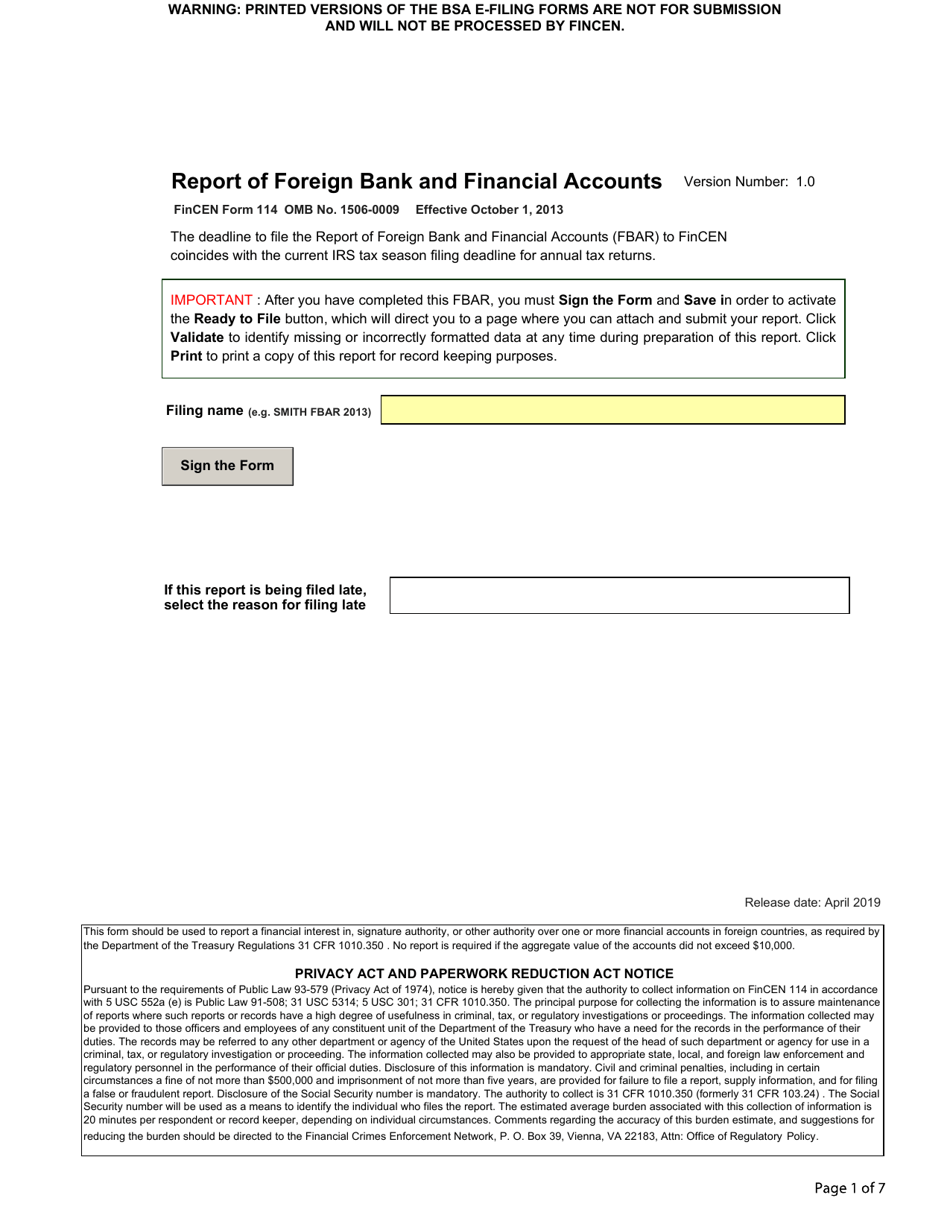

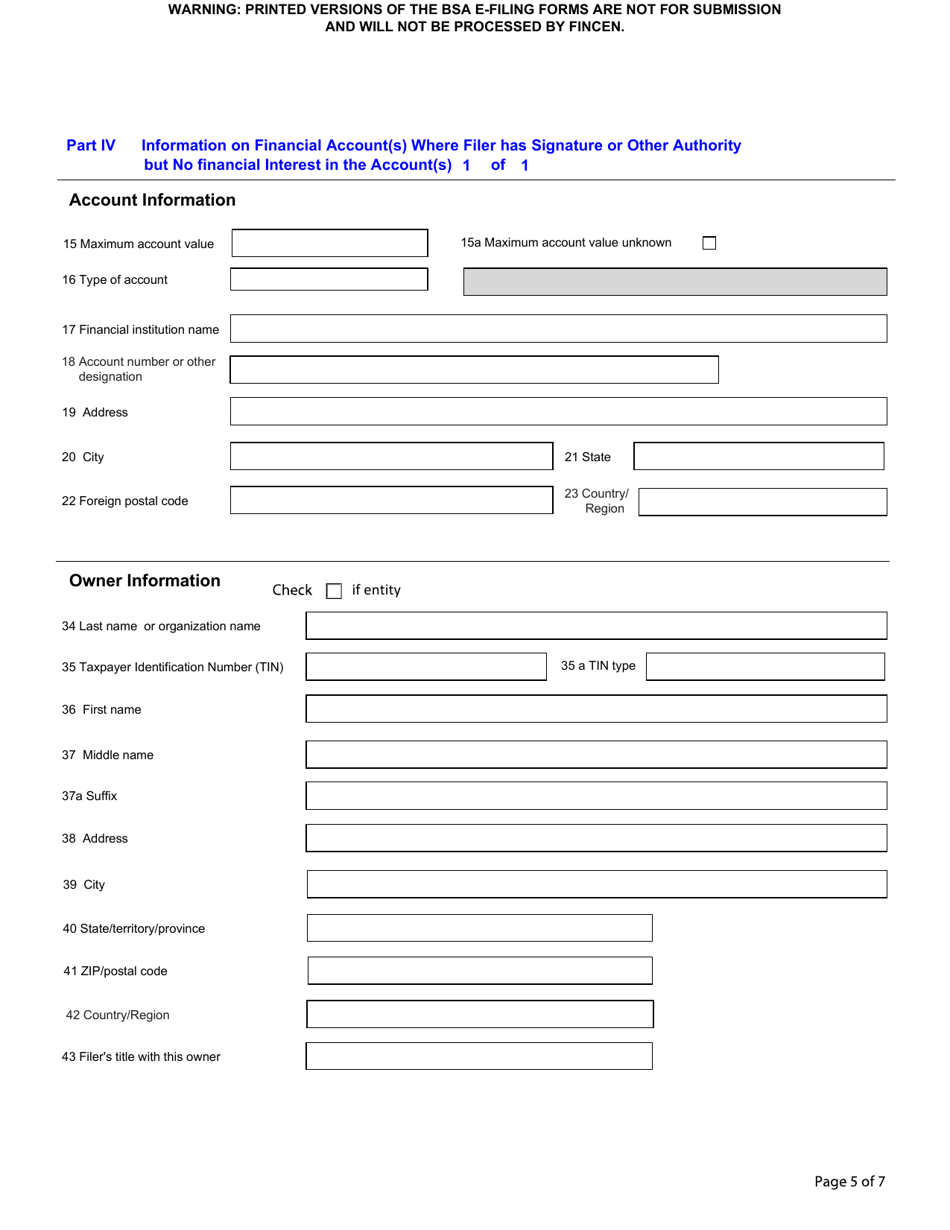

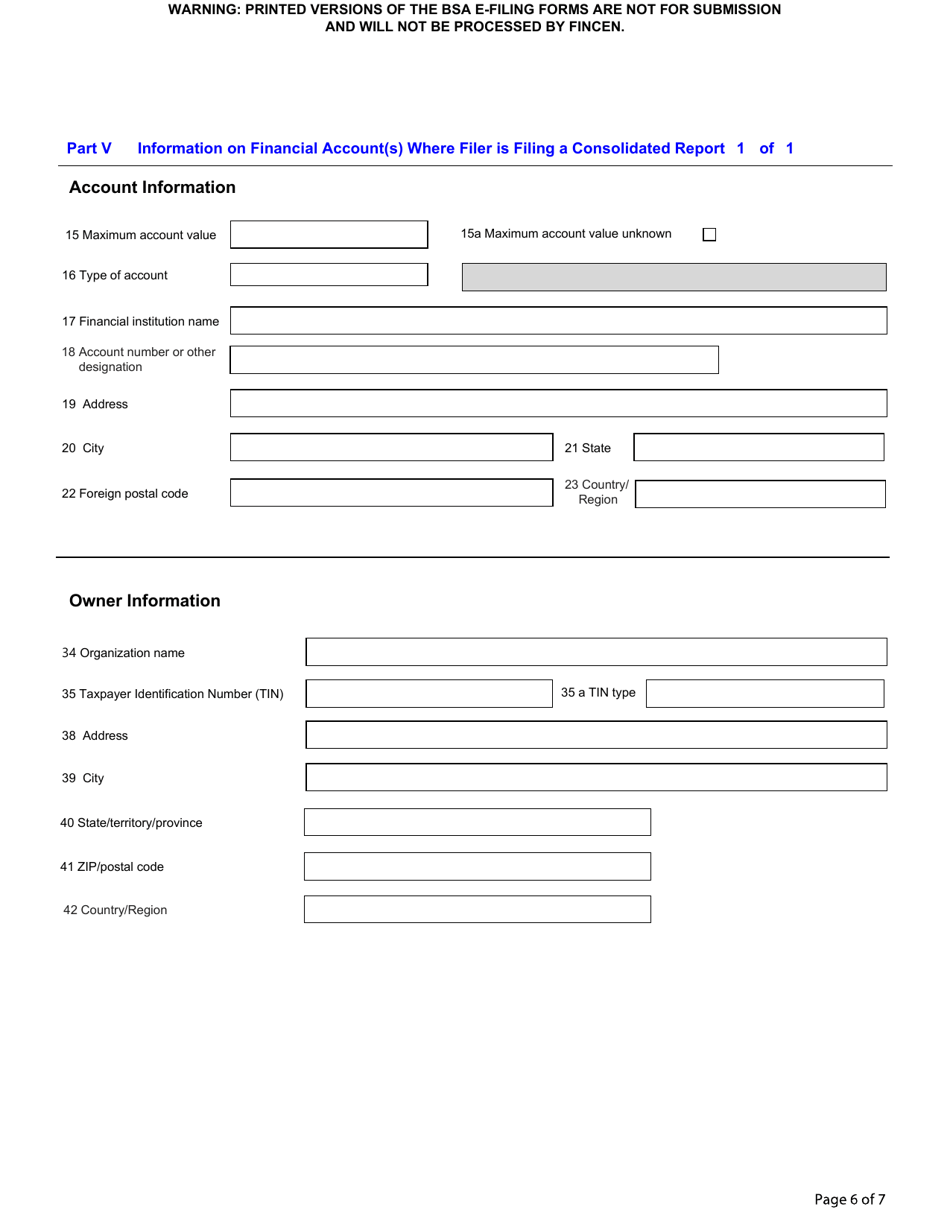

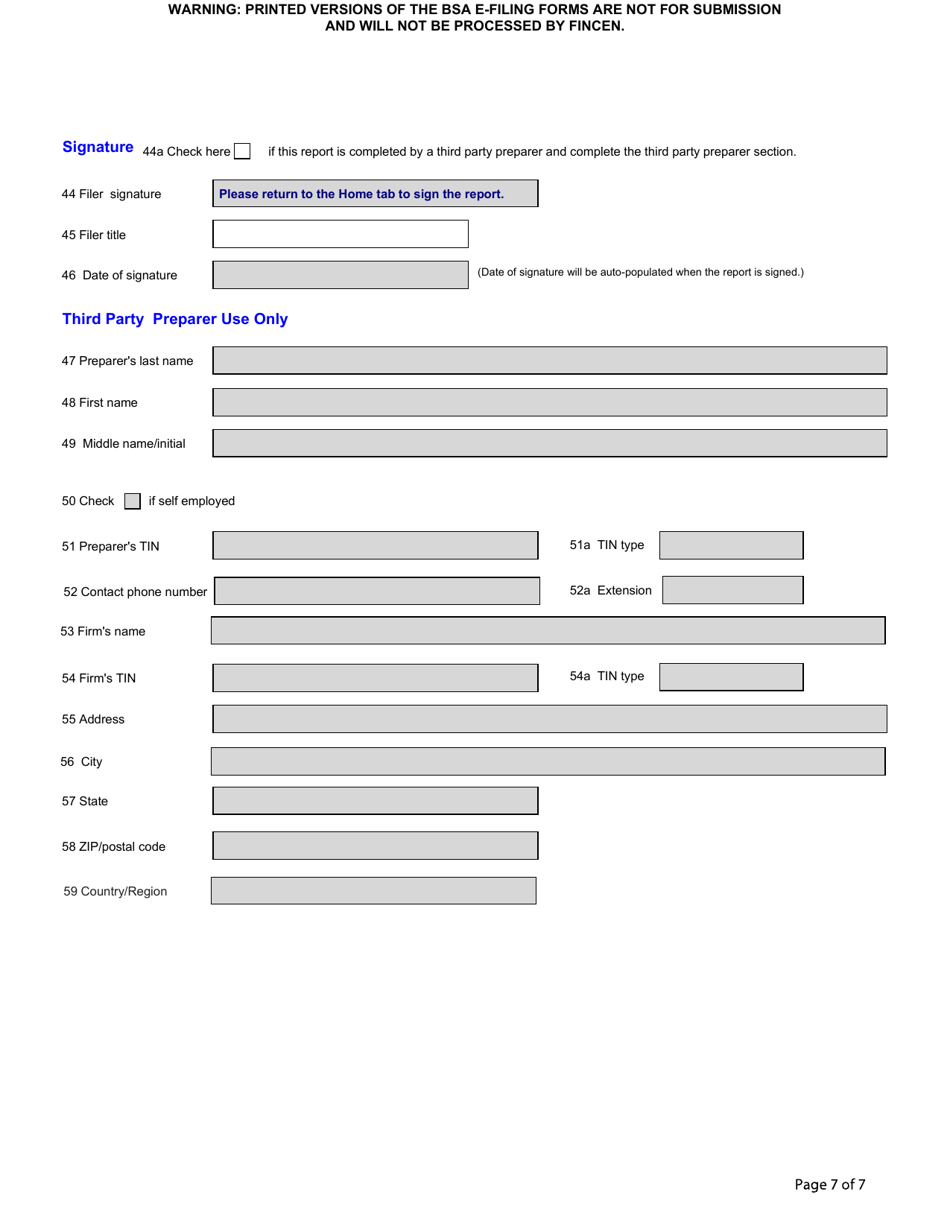

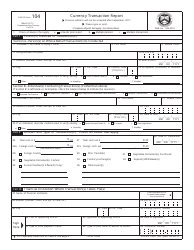

FinCEN Form 114 Report of Foreign Bank and Financial Accounts

What Is FinCEN Form 114?

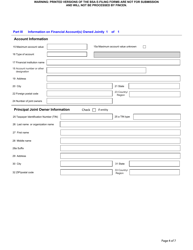

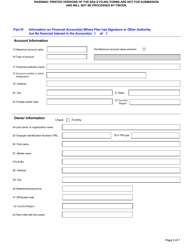

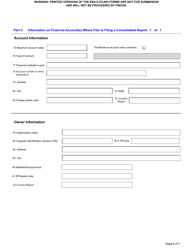

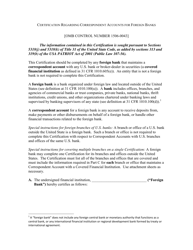

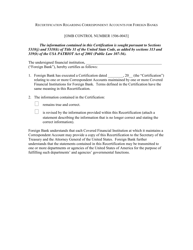

FinCEN Form 114, Report of Foreign Bank and Financial Accounts is a document you need to fill out if you have a financial interest in any foreign financial account or signature authority over it. The term "financial account" includes a brokerage account, bank account, trust, mutual fund, or any other foreign financial account. The FinCEN Form 114 - also known as the FBAR Form 114 - was issued by the Financial Crimes Enforcement Network (FinCEN) . It was last revised on October 1, 2013 .

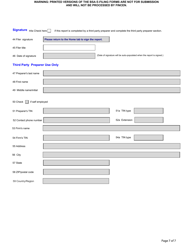

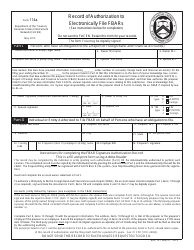

The report can be completed and submitted either by the owner of the account or by a third party. To authorize the third party to fill out the report or to submit the report jointly with a spouse, you need to complete the related FinCEN Form 114a, Record of Authorization to Electronically File FBARs. Keep the completed form for your records and do not send it to FinCEN unless they ask you to do so.

Download an up-to-date FinCEN Form 114 in PDF-format down below or look it up on the FinCEN website.

When Is Form FinCEN 114 Due?

According to the FinCEN Form 114 requirements, the report must be filled out every year. The new due date is April 15, 2019. It was changed in order to concur with the federal incometax filing season. If you were not able to meet the filing deadline, the FinCEN grants you with an automatic six-month extension. Therefore, the FinCEN 114 due date will be extended to October 15 and you do not have to make any specific request for this extension.

Report of Foreign Bank and Financial Accounts Instructions

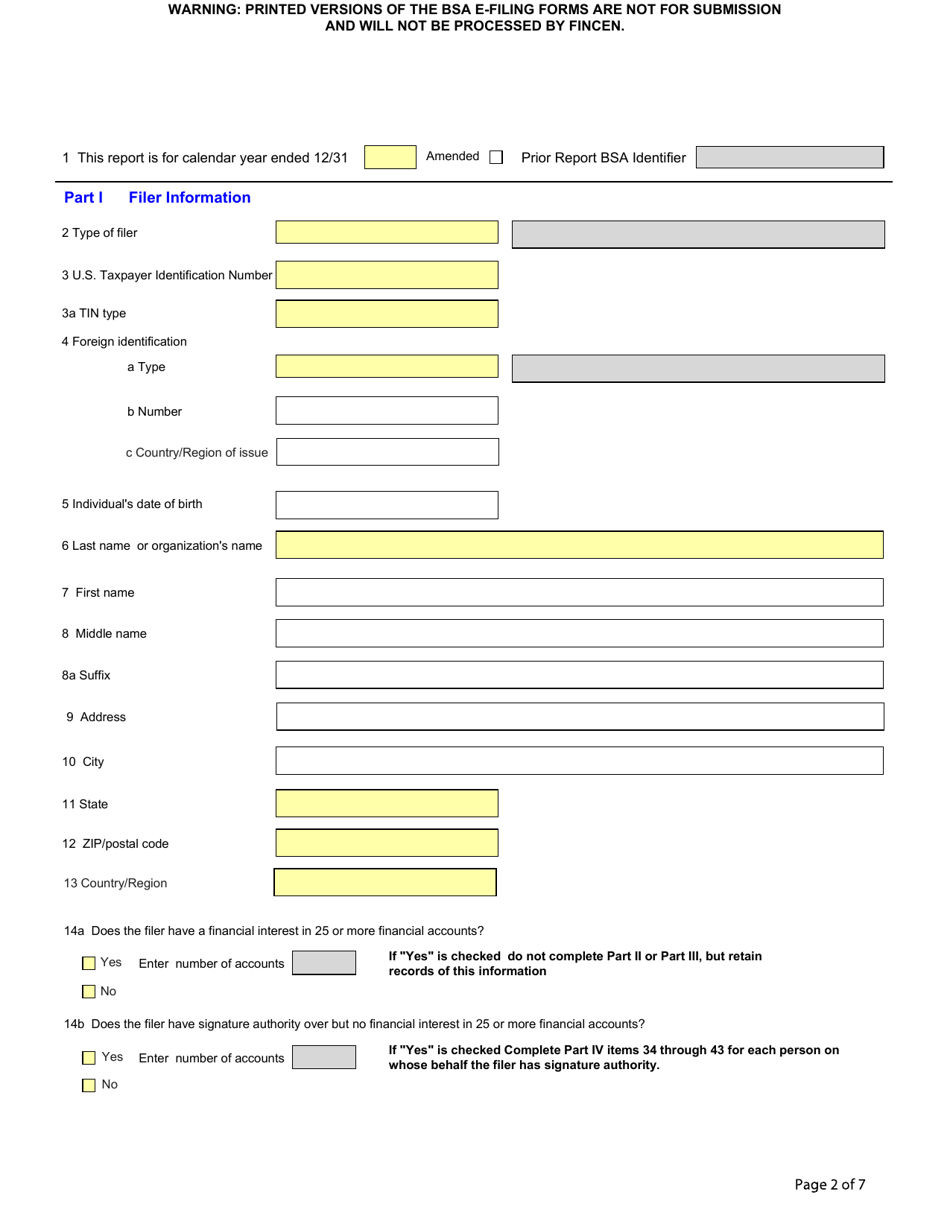

The general Report of Foreign Bank and Financial Accounts (FBAR) instructions are as follows:

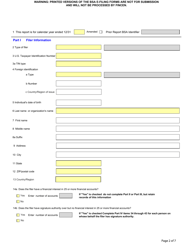

- The FBAR must be filled out by a United State person that has a financial interest in a foreign financial account or a financial authority over them. The aggravated value of the accounts has to exceed $10,000 at any time during the calendar year;

- United States person includes not just U.S. citizens and residents, but also entities (e.g., partnerships, corporations, or limited liability companies);

- The child's account is generally reported by the child. However, if the child is not able to complete the FinCEN 114 Form, it must be done by the parent, guardian, or any other legally responsible person. In this case, Item 45 should contain the phrase "Parent/Guardian filing for a child";

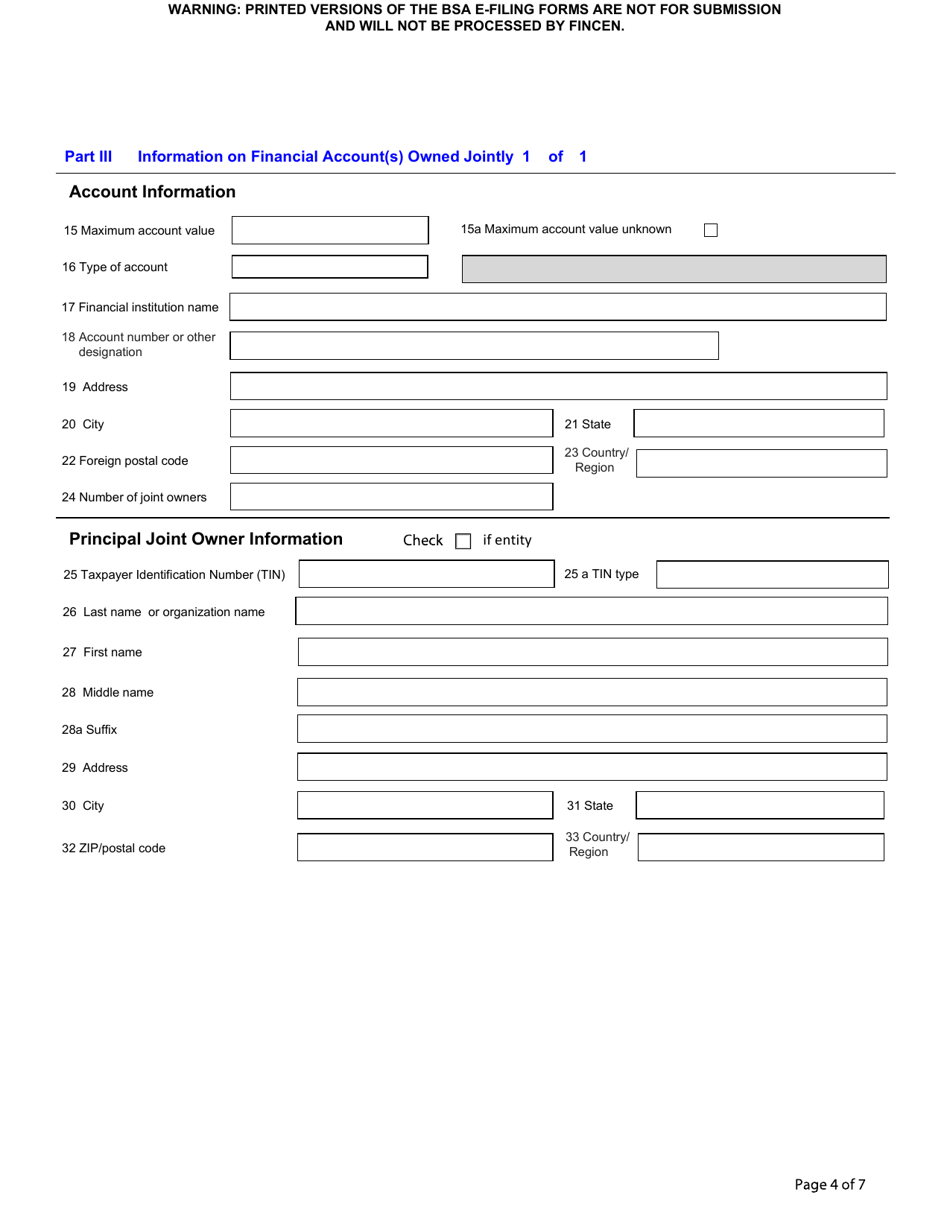

- If the spouses have a jointly owned accounts, only one of them can file the report if they have completed and signed Form 114a, all the reported accounts are jointly owned, and the filing spouse timely files the electronically signed FBAR;

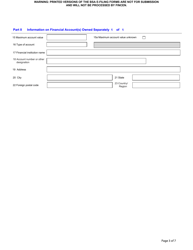

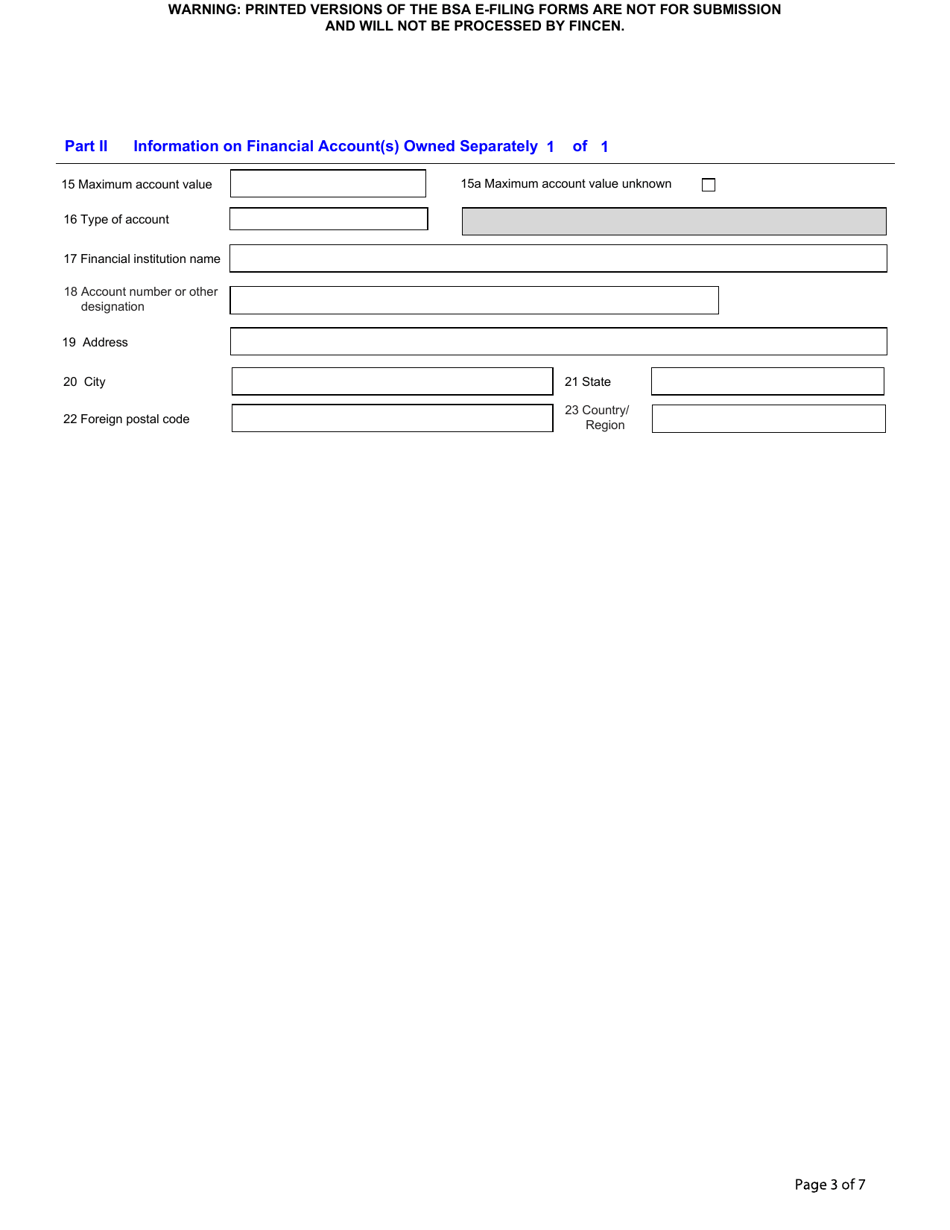

- Keep the records that contain the number or another designation of the account, name in which the account is opened, type of account, name, and address of the foreign institution that maintains the account, and the maximum account value during the reporting period;

- Retain all the records for 5 years from the date you have filed the FinCEN 114 Form and be ready to provide them for inspection upon request;

- The form consists of 59 items. However, only the items marked with an asterisk (*) are required;

- To file the report for an institution, you must first register for a User ID and password. The individuals can file the FinCEN Form 114 without prior registration;

- Provide as much information as possible in every report you file;

- Give a unique name for every report you file;

- If you need to change any information in your report, submit a new FBAR and check the box Amend in Item 1;

- Both the phone numbers and the identifying numbers must be entered as a single number string. No spaces, parentheses, or hyphens are allowed;

- Reporting the maximum account value, round it up to the next whole dollar;

- If you fail to file the form properly, you may be subjected to a fine up to $10,000 per violation. If you fail to report due to a valid reason and the balance in the account is reported properly, you will be exempted from a penalty. If you willfully fail to report an account, you may be subjected to a fine greater than $100,000 or 50% of the account balance at the time of the violation. In some cases, willful violations lead to criminal penalties.

How to File FinCEN Form 114?

The FinCEN Report 114 must be filled out electronically and submitted through the FinCEN's BSA E-Filing System. Though the due date for this form coincides with the federal tax return filing season, these two documents are not filed together. If the Internal Revenue Service extends filing deadlines for a taxpayer's income tax return, it has no consequences for the filing deadlines of the form.