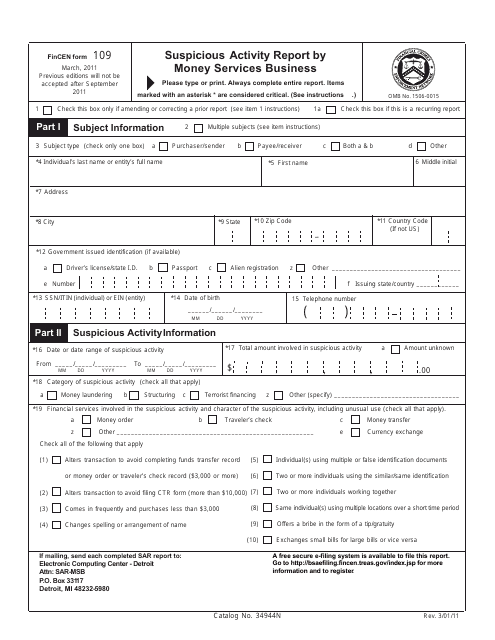

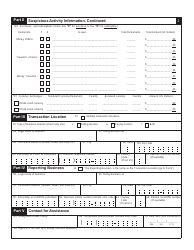

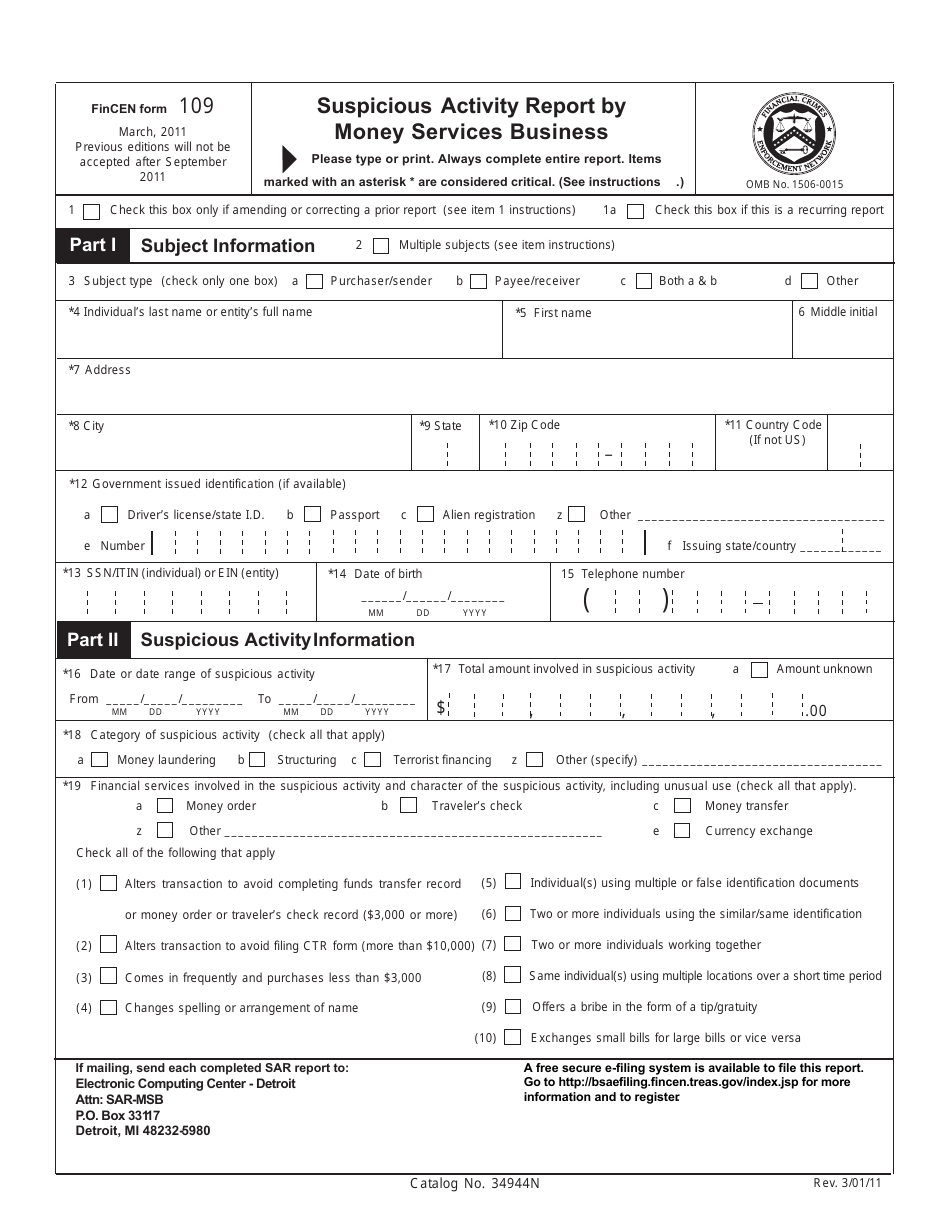

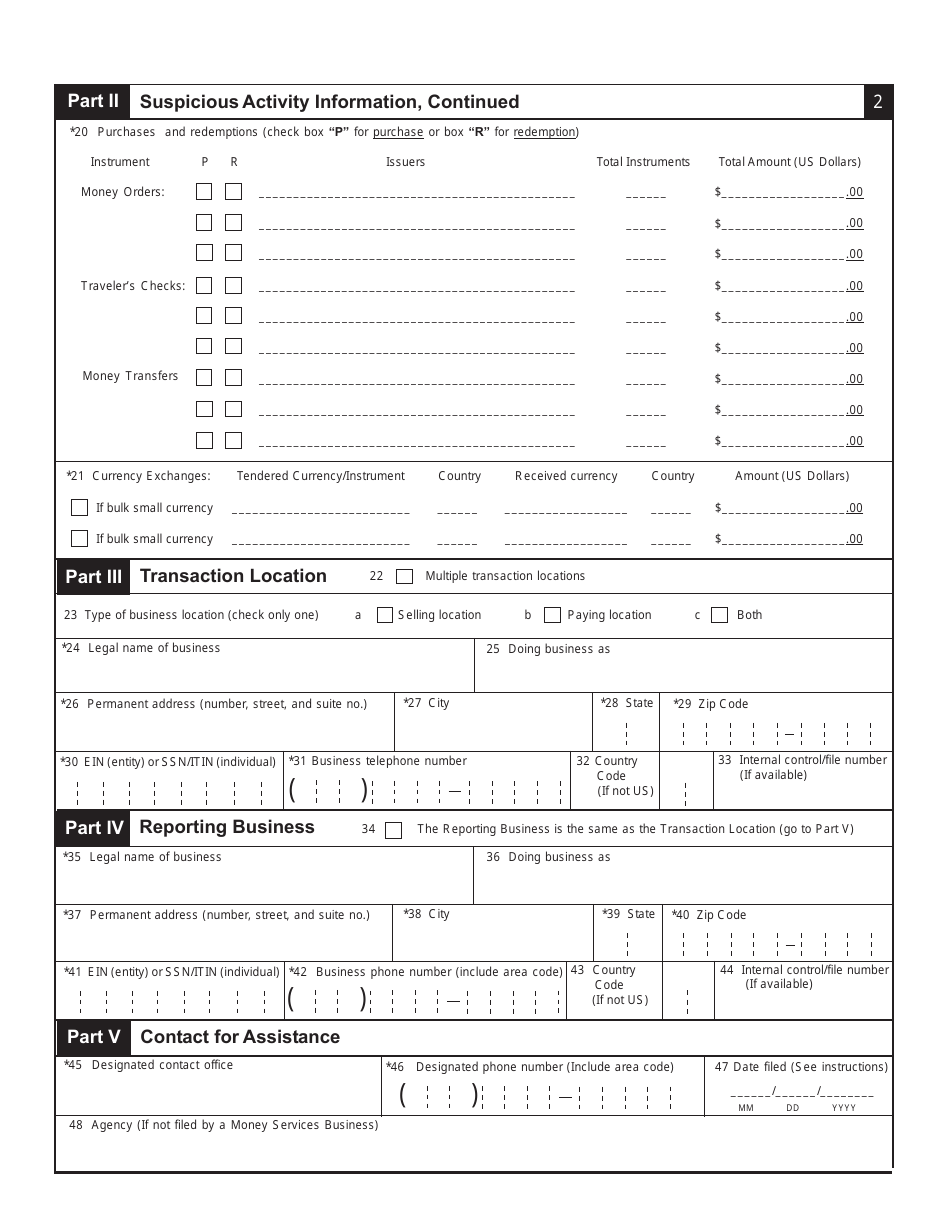

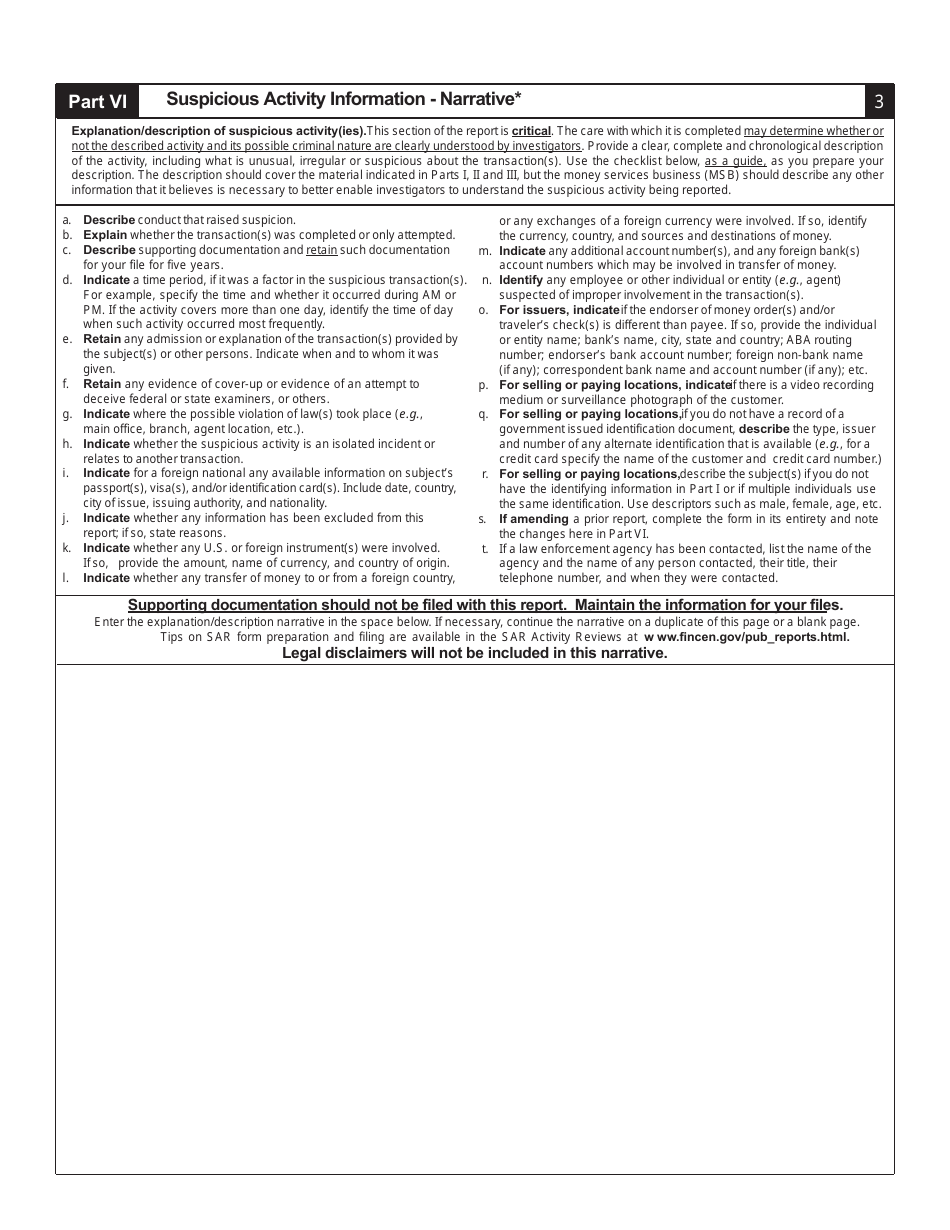

FinCEN Form 109 Suspicious Activity Report by Money Services Business

What Is FinCEN Form 109?

This is a legal form that was released by the U.S. Department of the Treasury - Financial Crimes Enforcement Network on March 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FinCEN Form 109?

A: FinCEN Form 109 is a Suspicious Activity Report (SAR) used by Money Services Businesses (MSBs) to report suspicious activities to the Financial Crimes Enforcement Network (FinCEN).

Q: Who is required to file FinCEN Form 109?

A: Money Services Businesses (MSBs) are required to file FinCEN Form 109 when they have reason to suspect that a transaction or series of transactions involve money laundering or other criminal activities.

Q: What kind of activities should be reported on FinCEN Form 109?

A: Activities such as structuring transactions to avoid reporting requirements, suspicious wire transfers, or transactions involving criminal proceeds should be reported on FinCEN Form 109.

Q: How do I file FinCEN Form 109?

A: FinCEN Form 109 can be filed electronically through the BSA E-Filing System or by mailing a paper copy to FinCEN.

Q: Is the information on FinCEN Form 109 confidential?

A: The information reported on FinCEN Form 109 is confidential and protected by law. It is used for law enforcement purposes and is not open to the public.

Q: What are the consequences of not filing FinCEN Form 109?

A: Failure to file FinCEN Form 109 when required can result in significant penalties, including civil and criminal penalties, as well as suspension or revocation of the MSB's license.

Form Details:

- Released on March 1, 2011;

- The latest available edition released by the U.S. Department of the Treasury - Financial Crimes Enforcement Network;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of FinCEN Form 109 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Financial Crimes Enforcement Network.