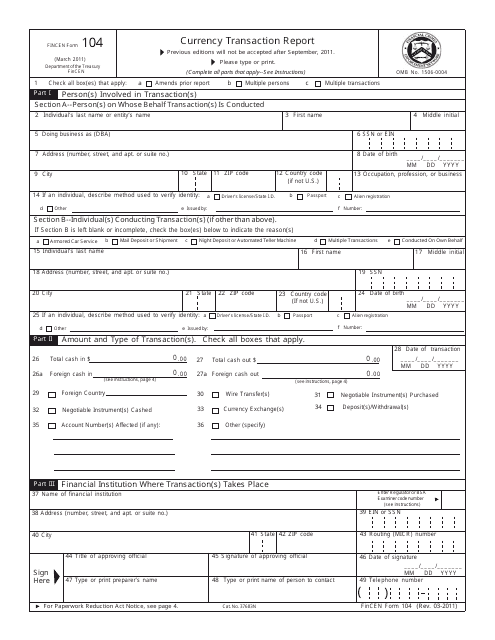

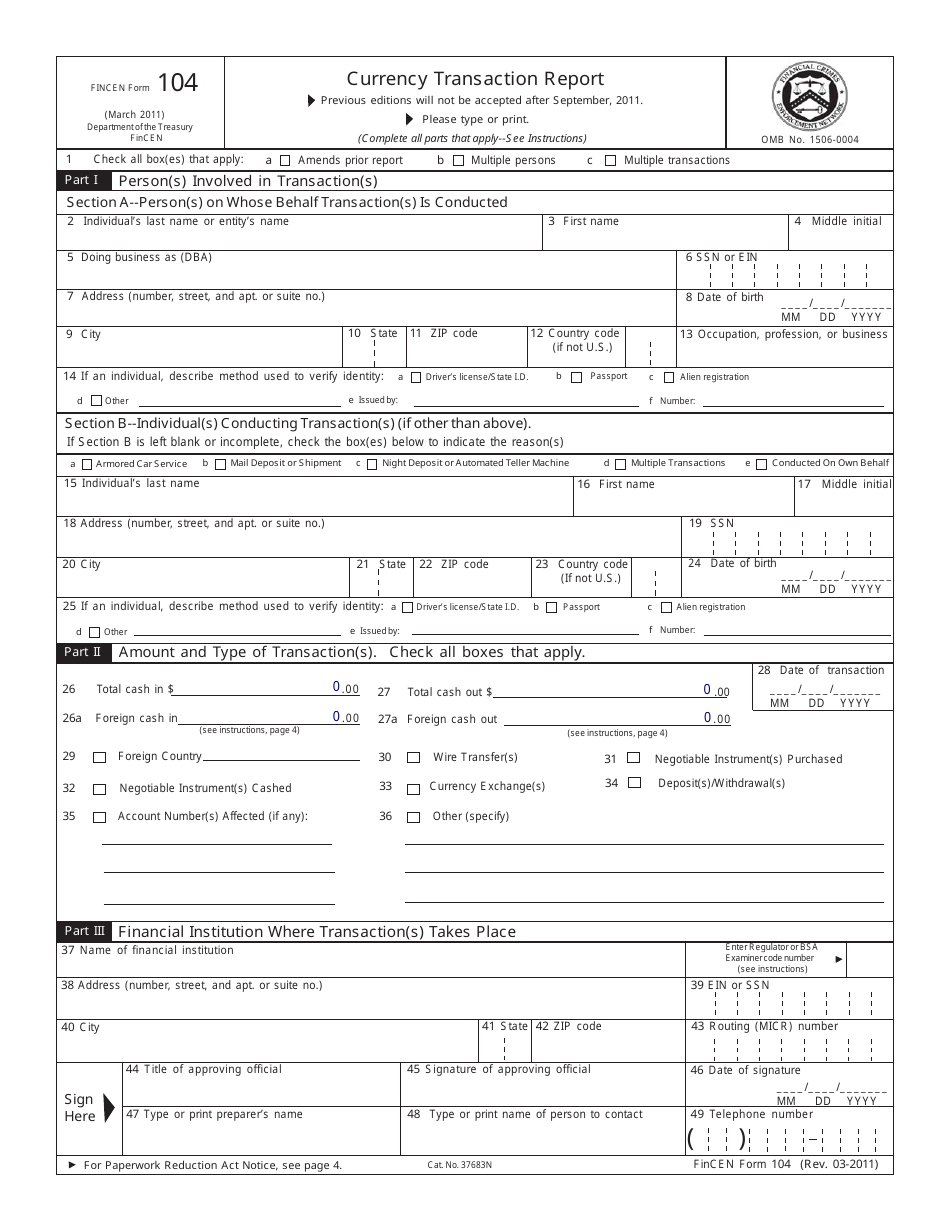

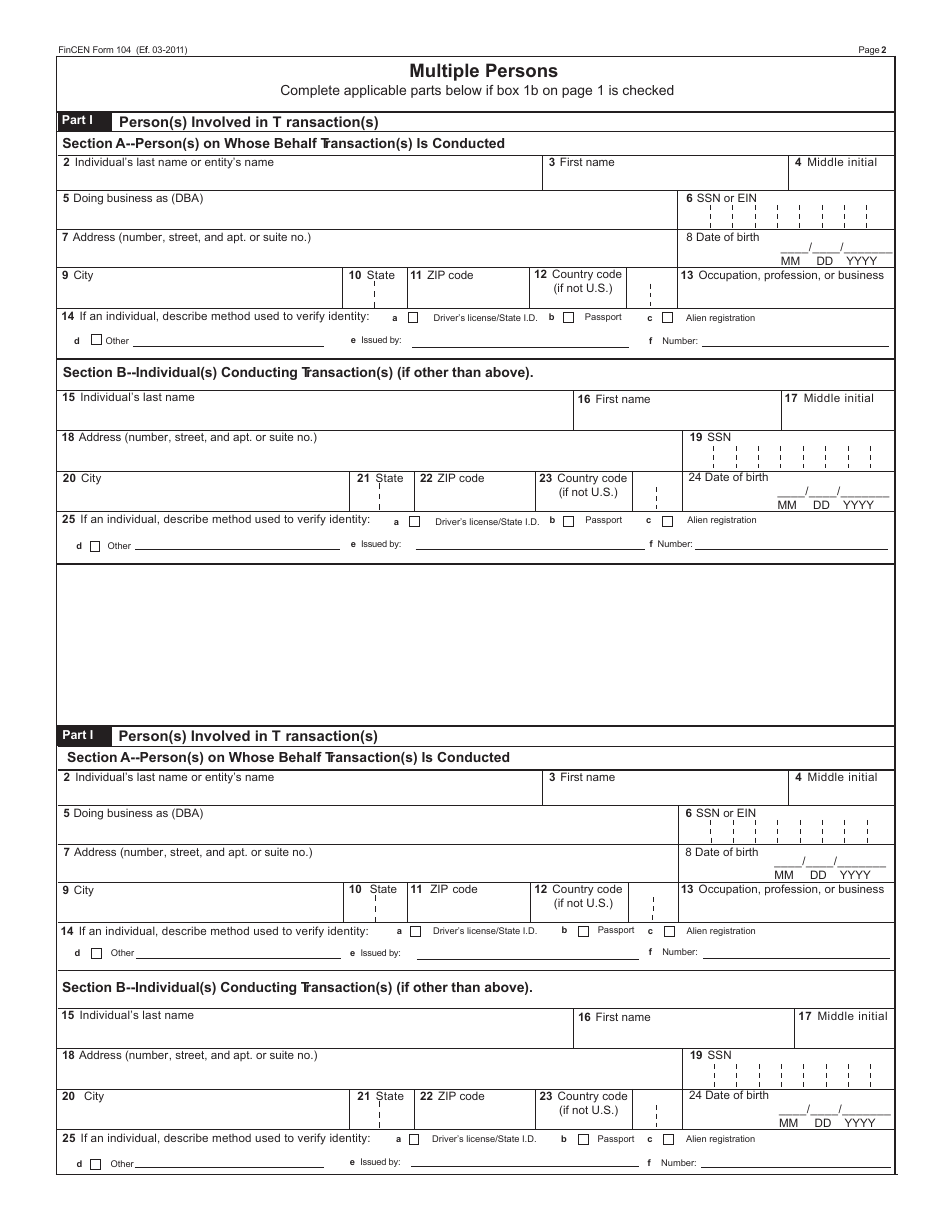

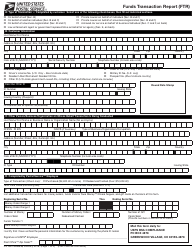

FinCEN Form 104 Currency Transaction Report

What Is FinCEN Form 104?

This is a legal form that was released by the U.S. Department of the Treasury - Financial Crimes Enforcement Network on March 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FinCEN Form 104?

A: FinCEN Form 104 is a Currency Transaction Report (CTR) that is used to report cash transactions over $10,000.

Q: Who needs to file FinCEN Form 104?

A: Financial institutions, including banks and credit unions, need to file FinCEN Form 104 when a customer conducts a cash transaction over $10,000.

Q: What information is required on FinCEN Form 104?

A: FinCEN Form 104 requires information such as the customer's name, address, and social security number, as well as details about the cash transaction.

Q: Why is FinCEN Form 104 important?

A: FinCEN Form 104 helps monitor and detect potential money laundering and other financial crimes by tracking large cash transactions.

Q: Are there any penalties for not filing FinCEN Form 104?

A: Yes, failing to file FinCEN Form 104 can result in serious penalties, including fines and potential criminal charges.

Form Details:

- Released on March 1, 2011;

- The latest available edition released by the U.S. Department of the Treasury - Financial Crimes Enforcement Network;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of FinCEN Form 104 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Financial Crimes Enforcement Network.