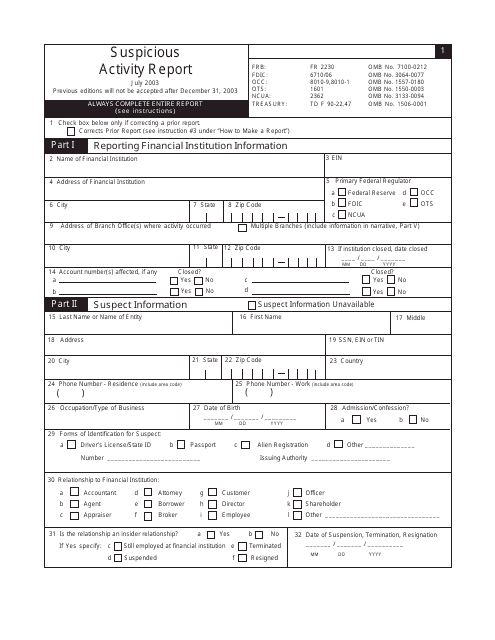

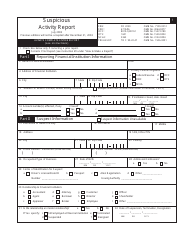

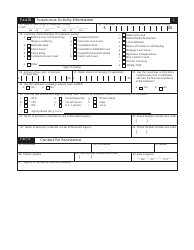

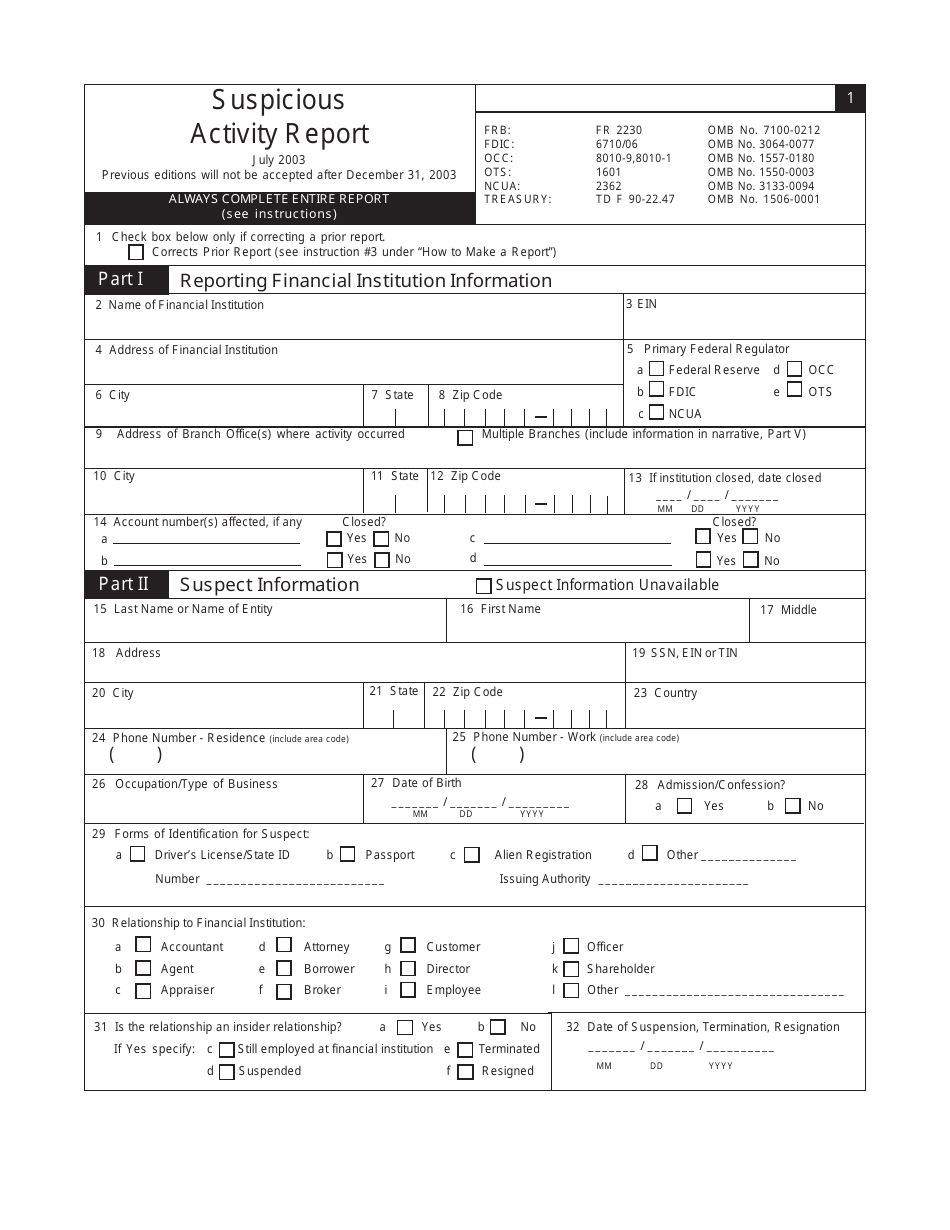

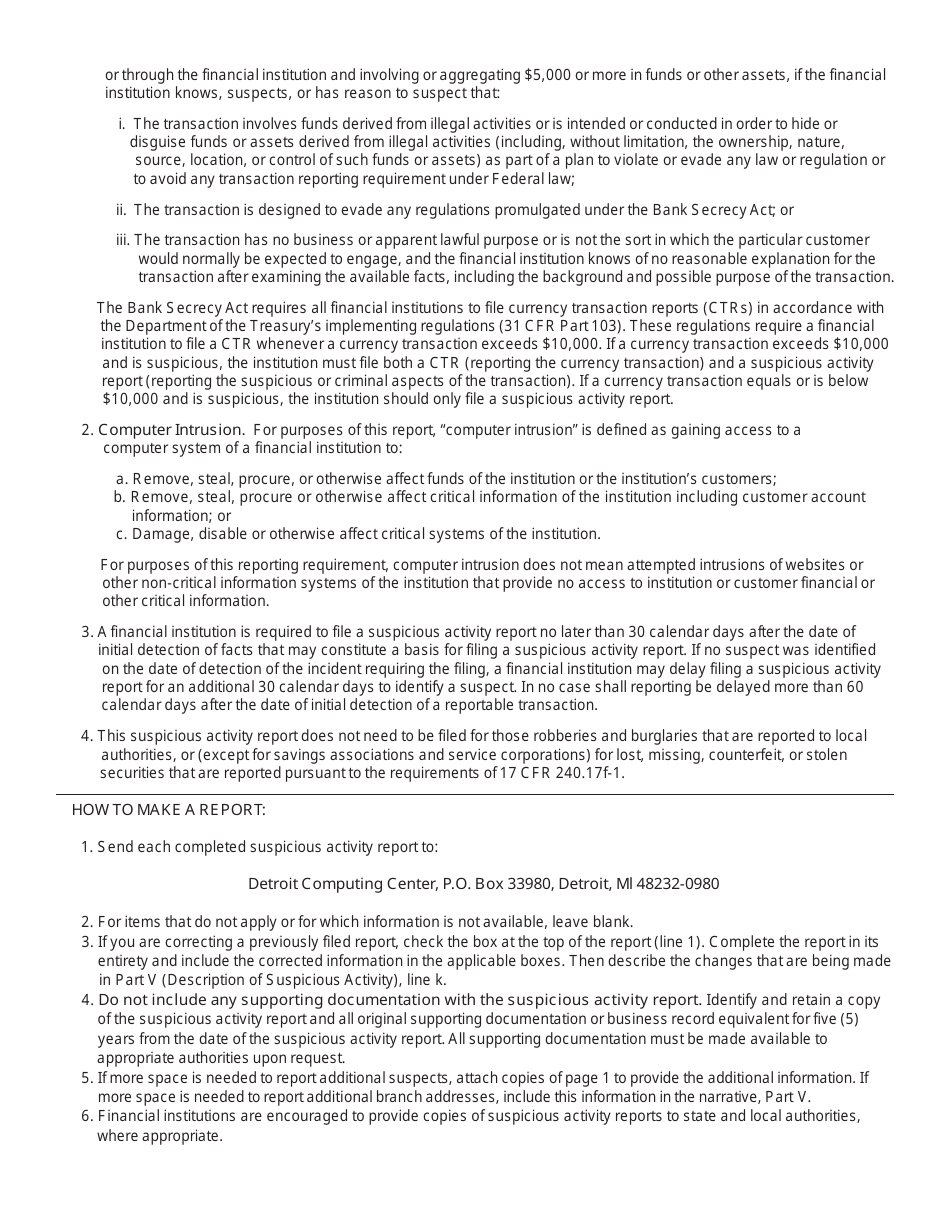

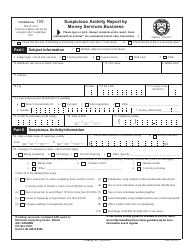

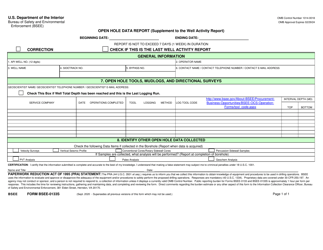

FDIC Form 6710 / 06 Suspicious Activity Report

What Is FDIC Form 6710/06?

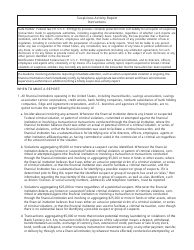

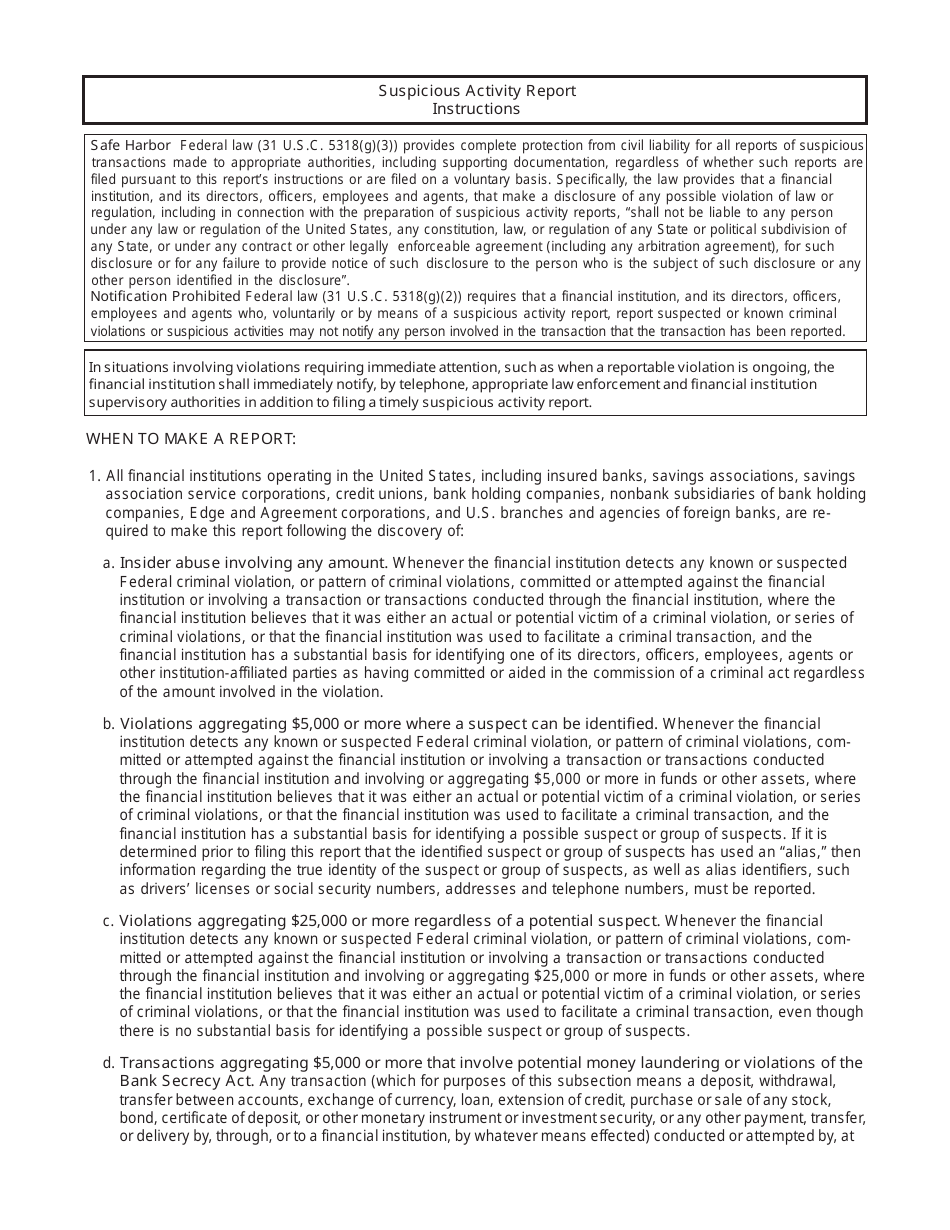

This is a legal form that was released by the Federal Deposit Insurance Corporation on July 1, 2003 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FDIC Form 6710/06?

A: FDIC Form 6710/06 is a Suspicious Activity Report (SAR) form.

Q: What is a Suspicious Activity Report (SAR)?

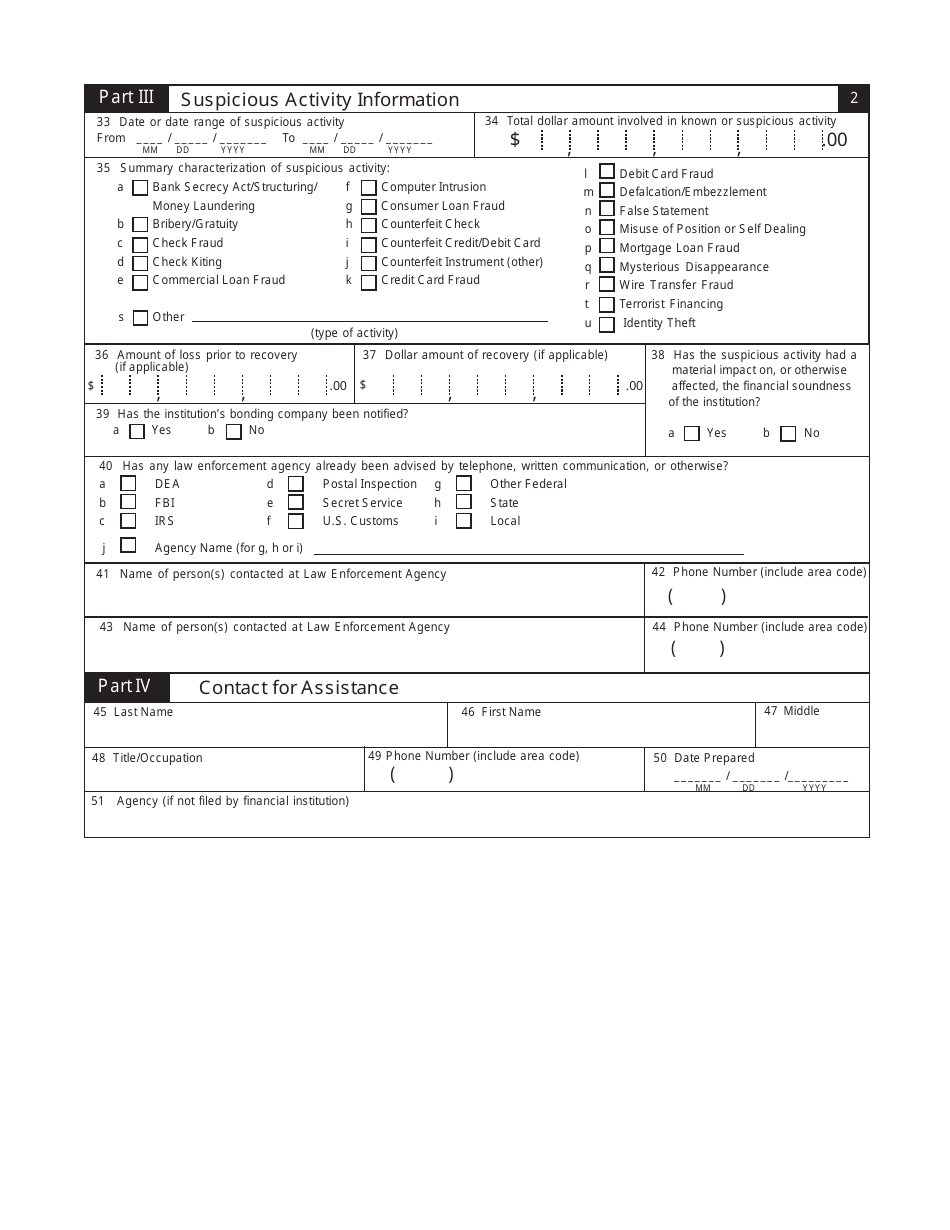

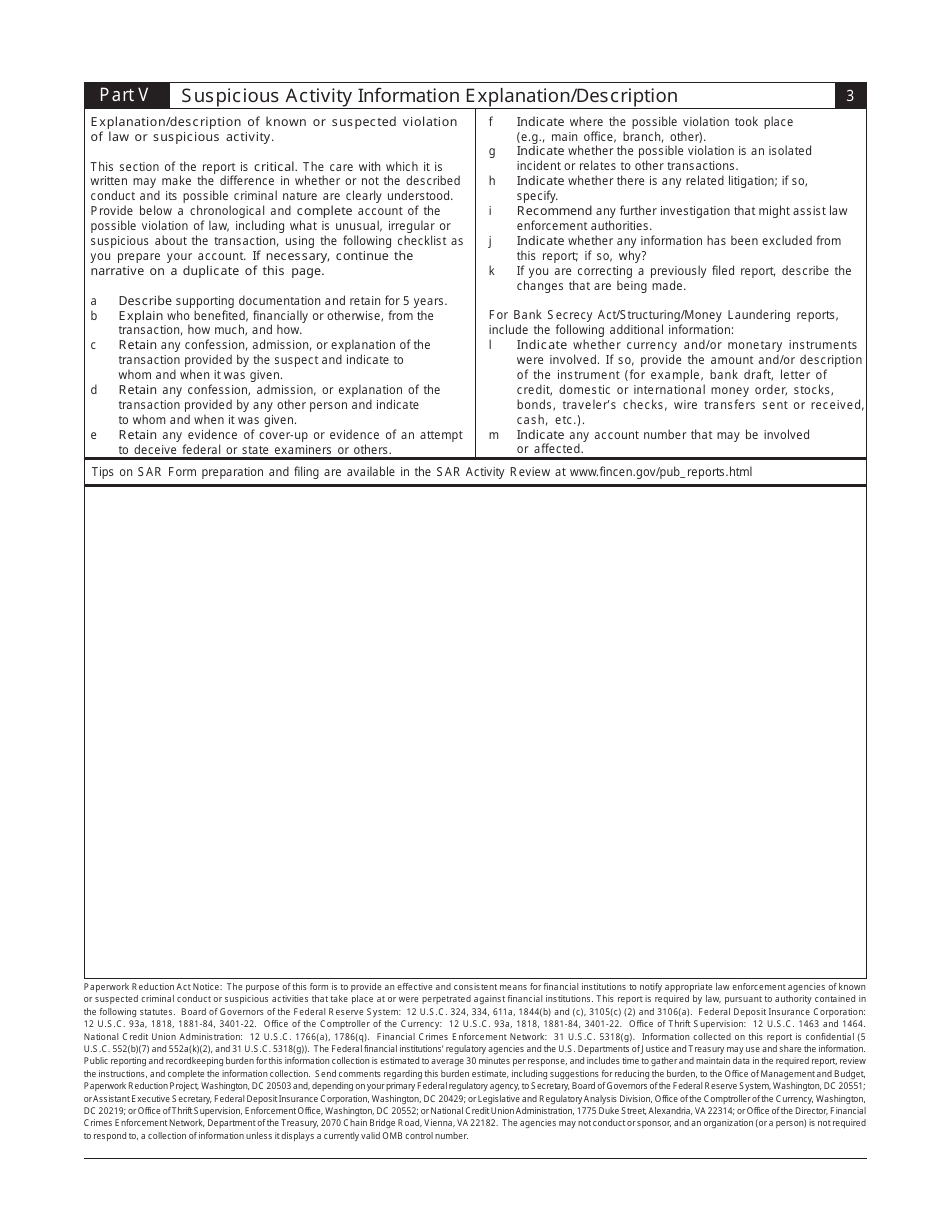

A: A Suspicious Activity Report (SAR) is a document that financial institutions use to report suspected illegal or fraudulent activities to the government.

Q: Who uses FDIC Form 6710/06?

A: Financial institutions, such as banks and credit unions, use FDIC Form 6710/06 to report suspicious activities.

Q: What type of activities are considered suspicious?

A: Activities that are considered suspicious include money laundering, fraud, terrorist financing, and other criminal activities.

Q: Why do financial institutions file Suspicious Activity Reports?

A: Financial institutions are required by law to file Suspicious Activity Reports to help identify and prevent illegal activities in the financial system.

Q: Is the information on FDIC Form 6710/06 confidential?

A: Yes, the information on FDIC Form 6710/06 is confidential and protected by privacy laws.

Q: What happens after a financial institution files a Suspicious Activity Report?

A: After a financial institution files a Suspicious Activity Report, the government may investigate the reported activity and take appropriate actions.

Q: Can individuals access FDIC Form 6710/06?

A: No, FDIC Form 6710/06 is not accessible to the general public.

Q: Are financial institutions required to file Suspicious Activity Reports for all suspicious activities?

A: Financial institutions are required to file Suspicious Activity Reports only for activities that meet certain criteria set by the government.

Form Details:

- Released on July 1, 2003;

- The latest available edition released by the Federal Deposit Insurance Corporation;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of FDIC Form 6710/06 by clicking the link below or browse more documents and templates provided by the Federal Deposit Insurance Corporation.