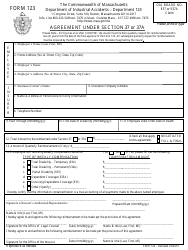

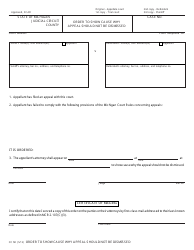

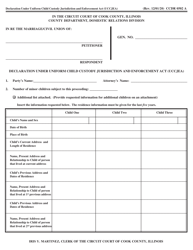

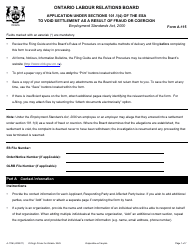

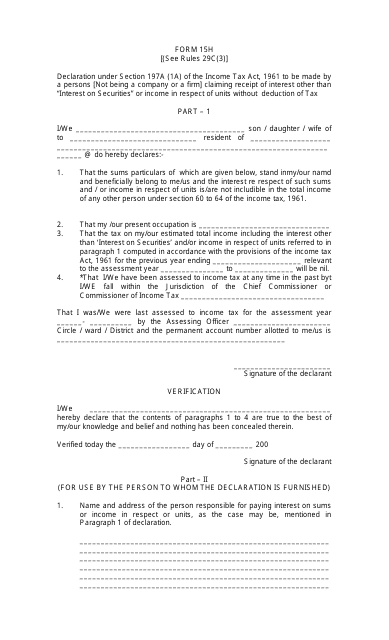

Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India

Form 15H is a declaration form for individuals (excluding companies or firms) in India to claim receipt of interest or income in respect of units without deduction of tax. It is filed under Section 197A(1A) of the Income Tax Act, 1961. The purpose of this form is to certify that the individual's total income is below the taxable limit, and therefore, no tax should be deducted from the interest or income received.

Individuals who are not a company or a firm, and who are claiming receipt of interest other than "interest on securities" or income in respect of units without deduction of tax, are required to file the Form 15H declaration under Section 197A(1A) of the Income Tax Act, 1961 in India.

FAQ

Q: What is Form 15H?

A: Form 15H is a declaration under Section 197A(1A) of the Income Tax Act in India.

Q: Who can file Form 15H?

A: Individuals who are not a company or a firm and are claiming receipt of interest other than "interest on securities" or income in respect of units without deduction of tax.

Q: What is the purpose of filing Form 15H?

A: The purpose of filing Form 15H is to declare that the individual's income is below the taxable limit and hence, no tax should be deducted at source.

Q: What is the benefit of filing Form 15H?

A: By filing Form 15H, individuals can avoid tax deduction at source on the specified interest or income, provided they fulfill certain conditions.

Q: Are there any conditions to file Form 15H?

A: Yes, individuals must fulfill certain conditions like being above a certain age and their estimated total income for the financial year should be below the taxable limit.

Q: Is Form 15H applicable to companies and firms?

A: No, Form 15H is applicable only to individuals who are not a company or a firm.

Q: What is the penalty for false declaration in Form 15H?

A: If an individual makes a false declaration in Form 15H, a penalty may be imposed as per the provisions of the Income Tax Act.

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India](https://data.templateroller.com/pdf_docs_html/32/322/32275/page_1_thumb.png)

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India, Page 2](https://data.templateroller.com/pdf_docs_html/32/322/32275/page_2_thumb.png)

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than interest on Securities or Income in Respect of Units Without Deduction of Tax - India, Page 1](https://data.templateroller.com/pdf_docs_html/32/322/32275/page_1_thumb_950.png)

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than interest on Securities or Income in Respect of Units Without Deduction of Tax - India, Page 2](https://data.templateroller.com/pdf_docs_html/32/322/32275/page_2_thumb_950.png)