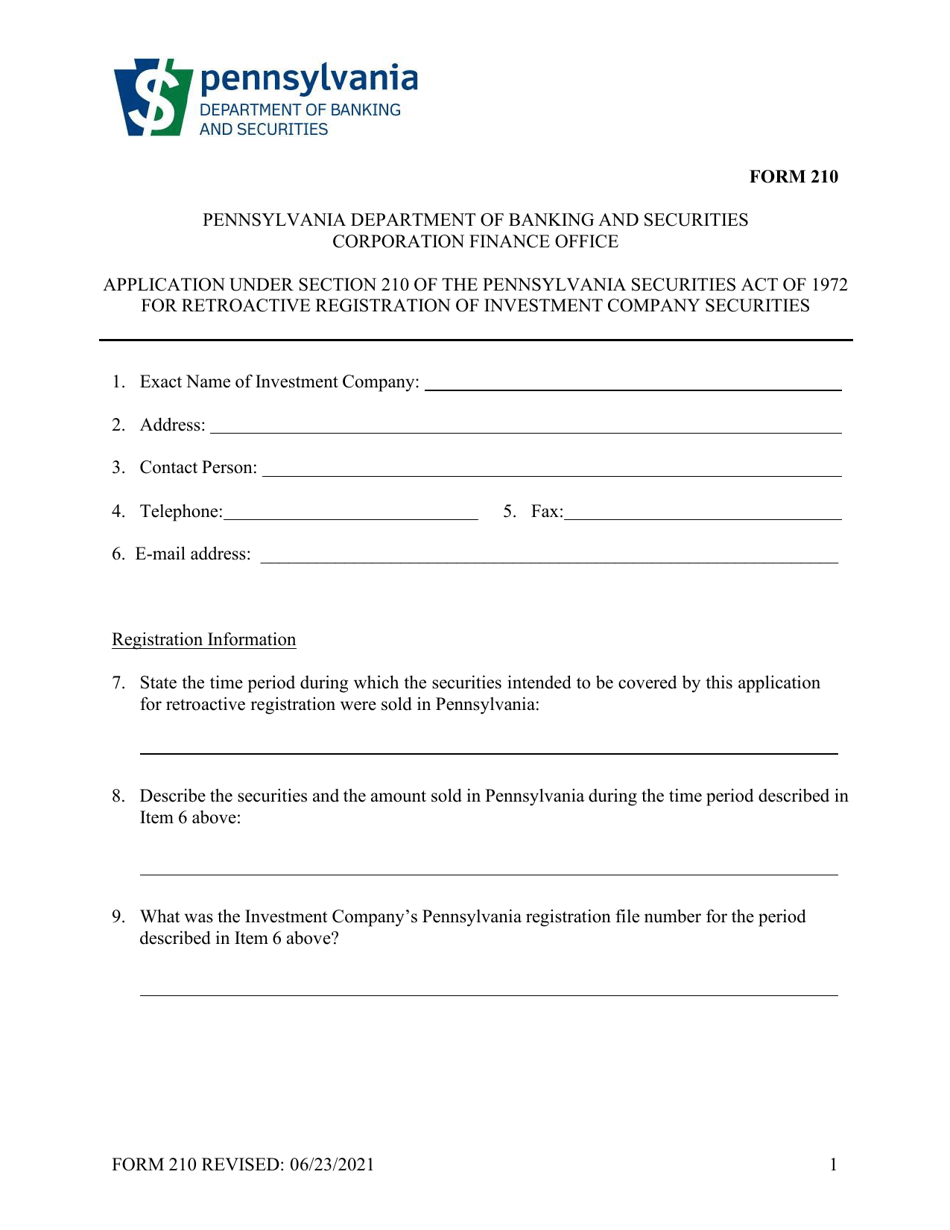

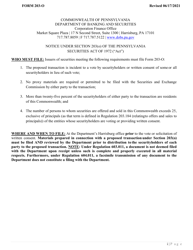

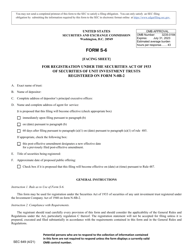

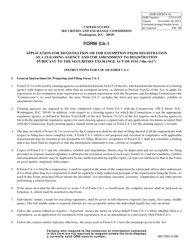

Form 210 Application Under Section 210 of the Pennsylvania Securities Act of 1972 for Retroactive Registration of Investment Company Securities - Pennsylvania

What Is Form 210?

This is a legal form that was released by the Pennsylvania Department of Banking and Securities - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 210?

A: Form 210 is an application under Section 210 of the Pennsylvania Securities Act of 1972.

Q: What does Form 210 apply to?

A: Form 210 applies to the retroactive registration of investment company securities in Pennsylvania.

Q: When was the Pennsylvania Securities Act of 1972 passed?

A: The Pennsylvania Securities Act of 1972 was passed in 1972.

Q: What is the purpose of retroactive registration?

A: The purpose of retroactive registration is to register investment company securities after they have been offered or sold in Pennsylvania.

Q: Who needs to file Form 210?

A: Any individual or entity that wants to retroactively register investment company securities in Pennsylvania needs to file Form 210.

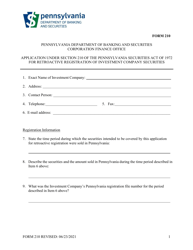

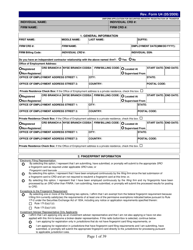

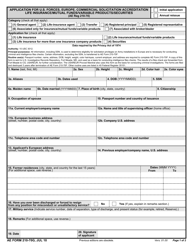

Q: What information is required on Form 210?

A: Form 210 requires information such as the name and address of the investment company, details about the securities being registered, and any other information required by the Pennsylvania Securities Commission.

Q: Is there a fee for filing Form 210?

A: Yes, there is a fee for filing Form 210. The fee amount is determined by the Pennsylvania Securities Commission.

Q: What happens after Form 210 is filed?

A: After Form 210 is filed, the Pennsylvania Securities Commission will review the application and may request additional information or documents.

Q: Is retroactive registration guaranteed?

A: Retroactive registration is not guaranteed. The Pennsylvania Securities Commission will determine whether to approve or deny the application based on the information provided.

Form Details:

- Released on June 23, 2021;

- The latest edition provided by the Pennsylvania Department of Banking and Securities;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 210 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Banking and Securities.