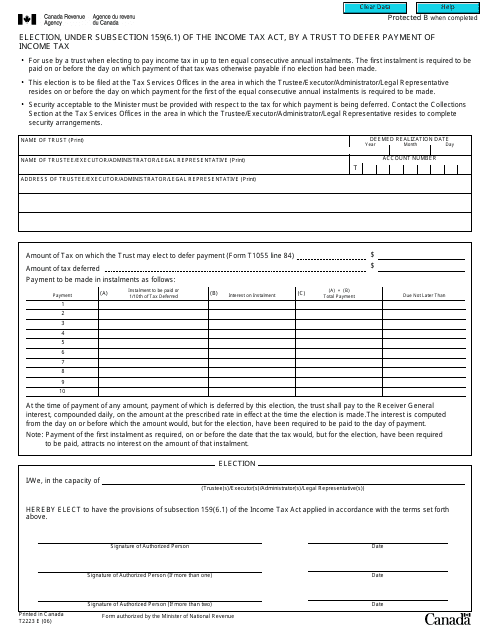

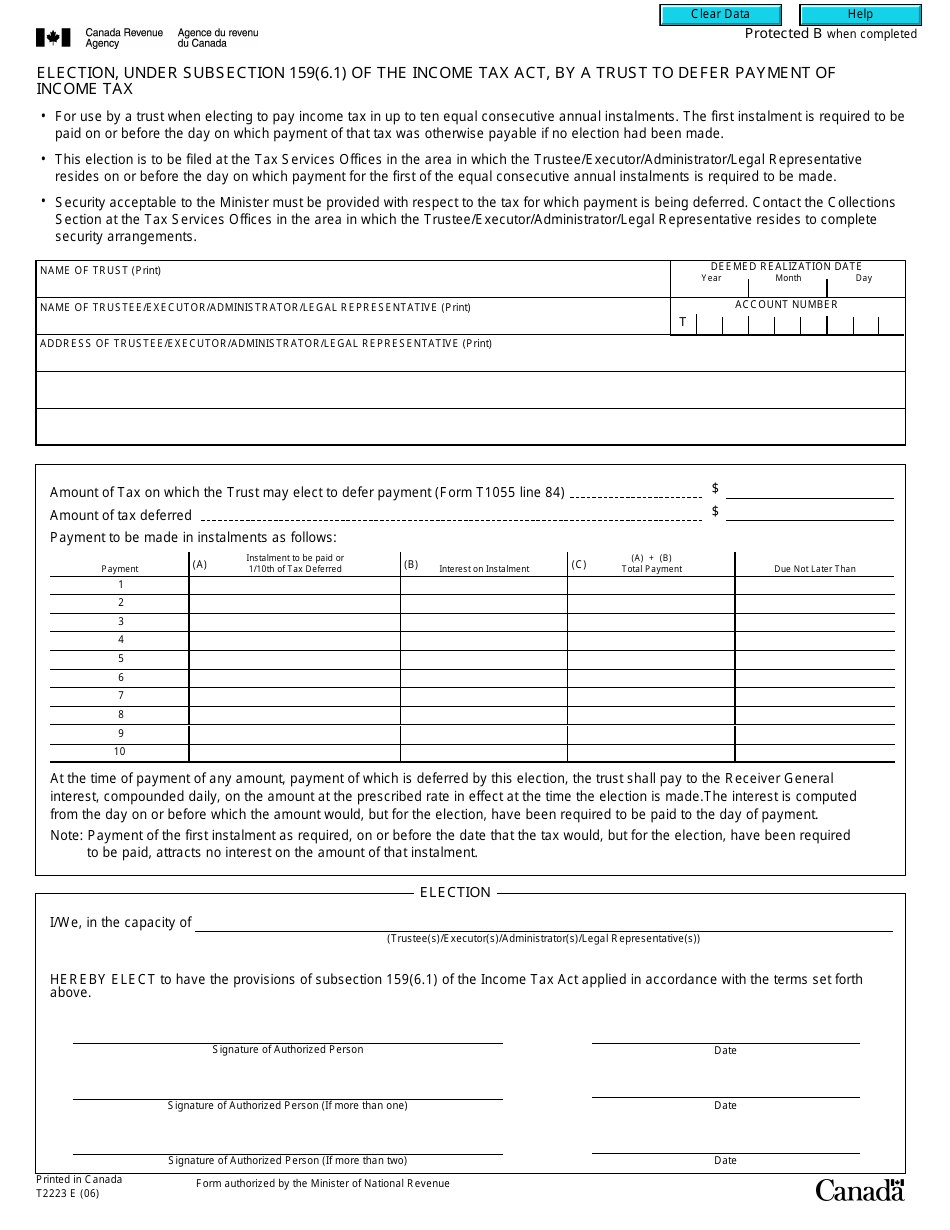

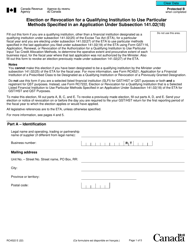

Form T2223 Election Under Subsection 159(6.1) of the Income Tax Act by a Trust to Defer Payment of Income Tax - Canada

Form T2223 Election Under Subsection 159(6.1) of the Income Tax Act allows a trust in Canada to defer the payment of income tax under certain circumstances. By filing this form, the trust can elect to defer the tax liability to a future date, providing them with more flexibility in managing their finances.

The Form T2223 is filed by a trust in Canada to elect to defer payment of income tax.

FAQ

Q: What is Form T2223?

A: Form T2223 is a form used by a trust in Canada to elect to defer the payment of income tax.

Q: Who can use Form T2223?

A: Trusts in Canada can use Form T2223 to defer the payment of income tax.

Q: What is the purpose of Form T2223?

A: The purpose of Form T2223 is to allow a trust to defer the payment of income tax.

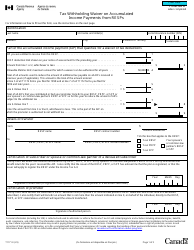

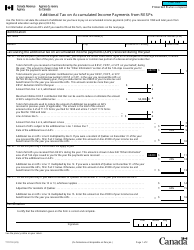

Q: What does subsection 159(6.1) of the Income Tax Act refer to?

A: Subsection 159(6.1) of the Income Tax Act refers to the provision that allows trusts to elect to defer the payment of income tax.

Q: How does Form T2223 work?

A: Form T2223 works by allowing a trust to defer the payment of income tax by making an election under subsection 159(6.1) of the Income Tax Act.

Q: Is Form T2223 specific to Canada?

A: Yes, Form T2223 is specific to Canada and is used for trust tax purposes.