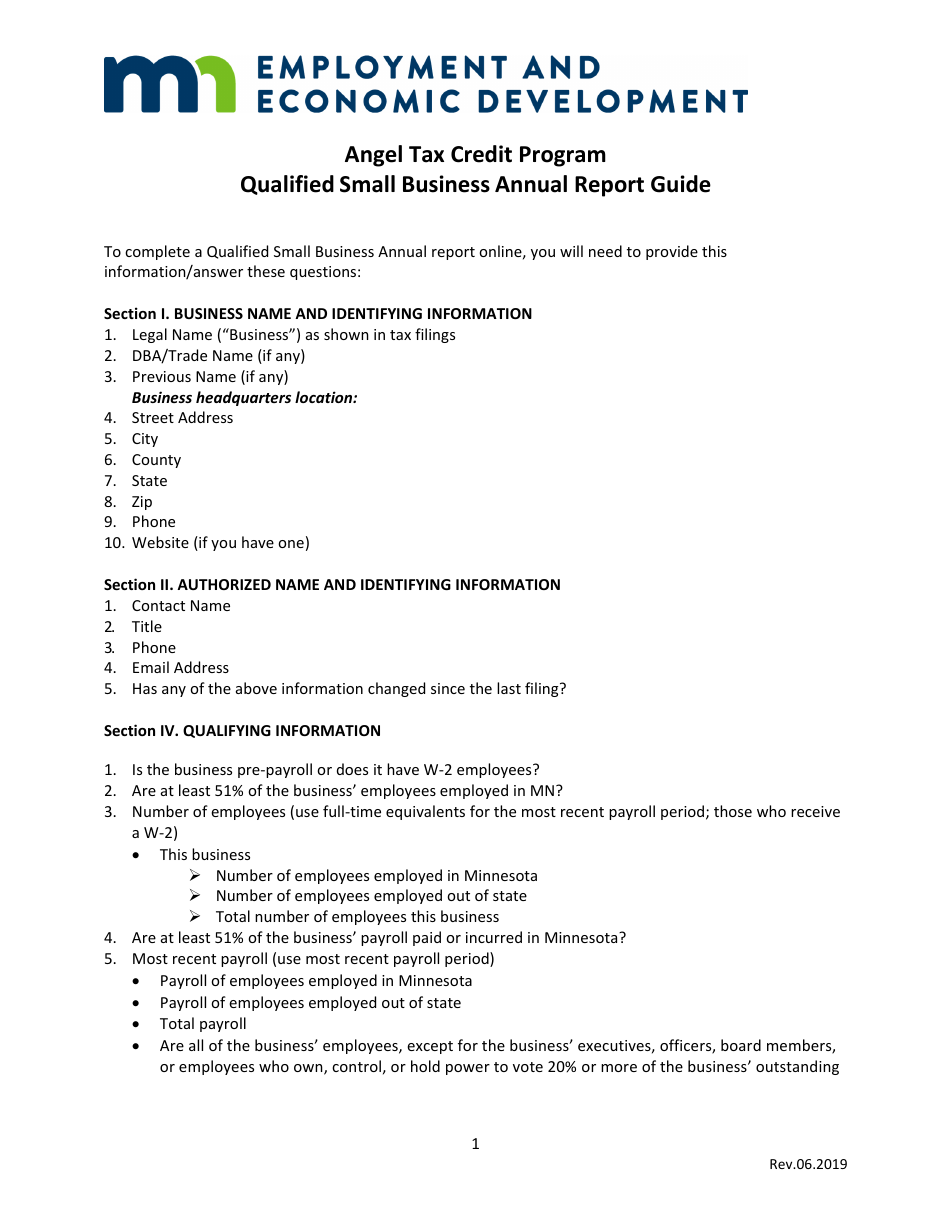

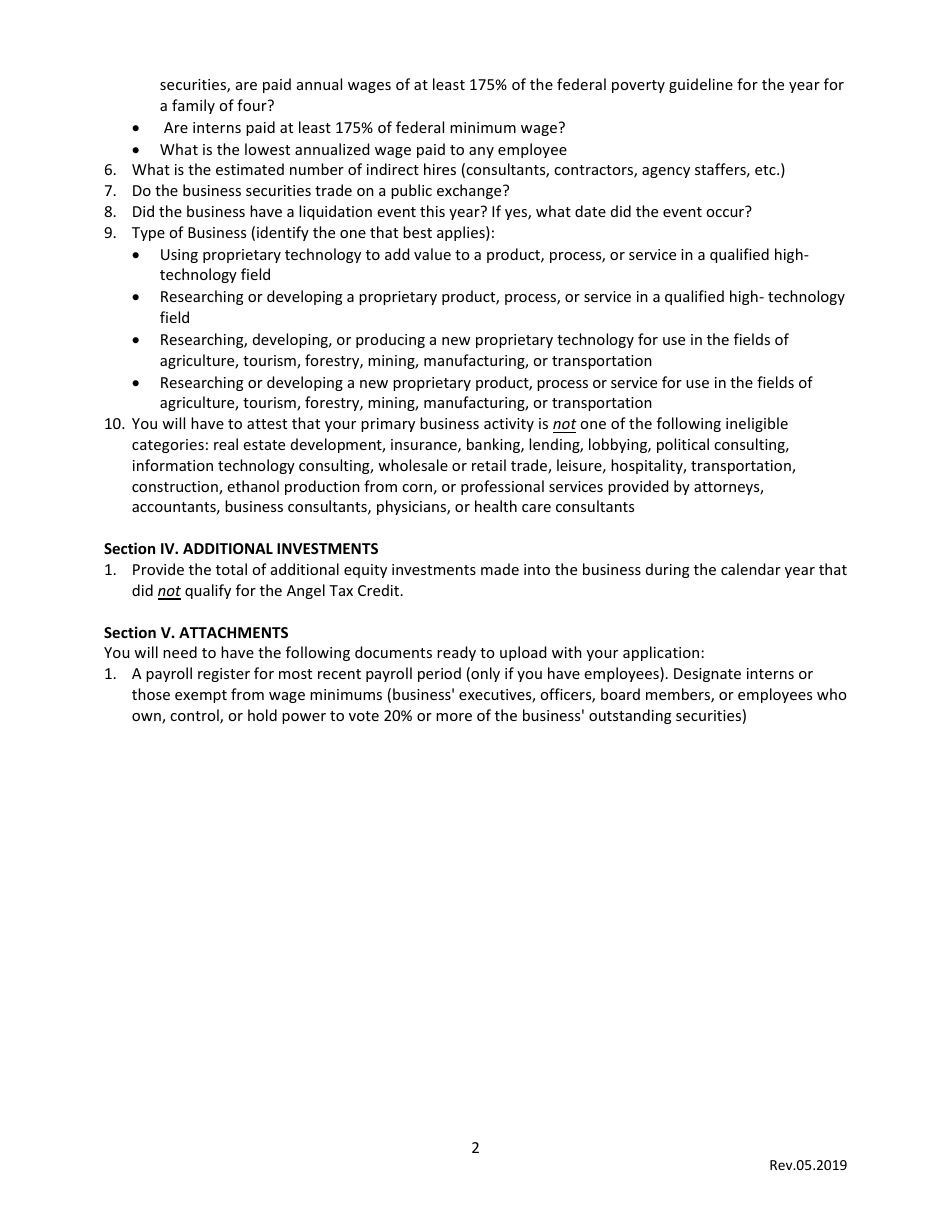

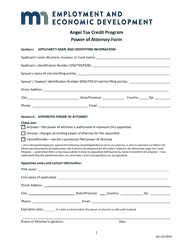

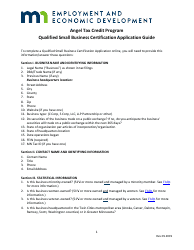

Instructions for Qualified Small Business Annual Report - Angel Tax Credit Program - Minnesota

This document was released by Minnesota Employment and Economic Development Department and contains the most recent official instructions for Qualified Small Business Annual Report - Angel Tax Credit Program .

FAQ

Q: What is the Qualified Small Business Annual Report for the Angel Tax Credit Program in Minnesota?

A: The Qualified Small Business Annual Report is a report that must be submitted by eligible businesses participating in the Angel Tax Credit Program in Minnesota.

Q: Who needs to submit the Qualified Small Business Annual Report?

A: Eligible businesses participating in the Angel Tax Credit Program in Minnesota need to submit the Qualified Small Business Annual Report.

Q: What is the purpose of the Qualified Small Business Annual Report?

A: The purpose of the report is to provide information on the progress of the business and its compliance with the Angel Tax Credit Program requirements.

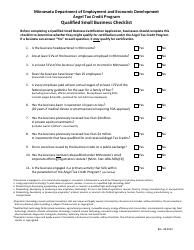

Q: What information is required in the Qualified Small Business Annual Report?

A: The report requires information such as the company's financial statements, details of the investment and job creation, and any changes in the ownership or control of the business.

Q: When is the deadline to submit the Qualified Small Business Annual Report?

A: The deadline to submit the report is usually within 120 days after the end of the fiscal year of the business.

Q: What happens if a business fails to submit the Qualified Small Business Annual Report?

A: Failure to submit the report may result in the revocation of the Angel Tax Credit and the business may be required to repay any credits previously claimed.

Q: Who can I contact for assistance with the Qualified Small Business Annual Report?

A: For assistance with the report, you can contact the Minnesota Department of Employment and Economic Development (DEED) or refer to the instructions provided with the form.

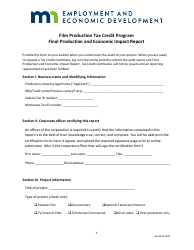

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Minnesota Employment and Economic Development Department.