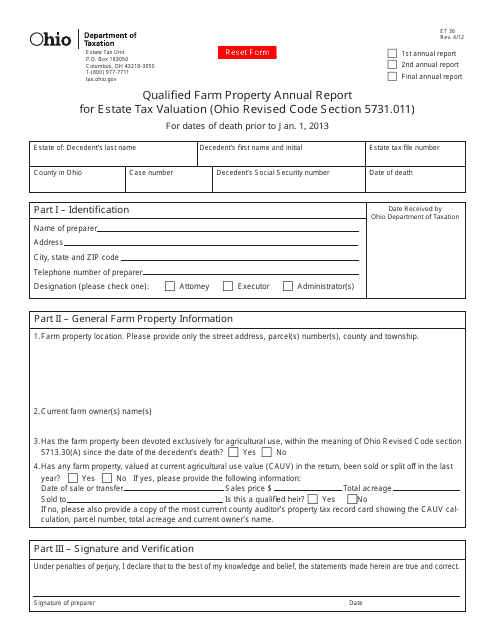

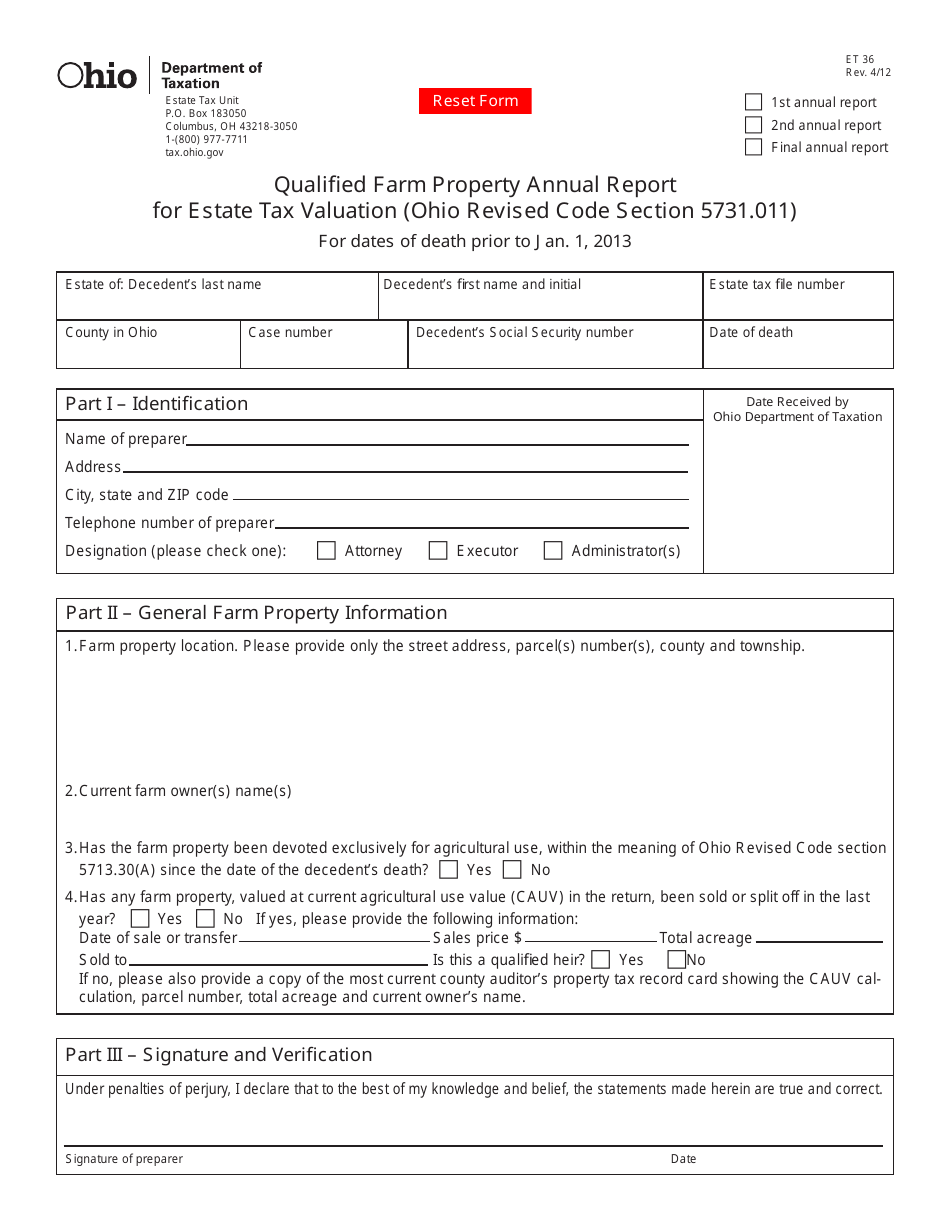

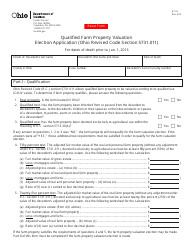

Form ET36 Qualified Farm Property Annual Report for Estate Tax Valuation - Ohio

What Is Form ET36?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ET36 form?

A: The ET36 form is the Qualified Farm Property Annual Report for Estate Tax Valuation in Ohio.

Q: Who needs to file the ET36 form?

A: The ET36 form needs to be filed by individuals who own qualified farm property in Ohio and have a taxable estate.

Q: What is qualified farm property?

A: Qualified farm property refers to property that is used for farming purposes and qualifies for certain tax benefits.

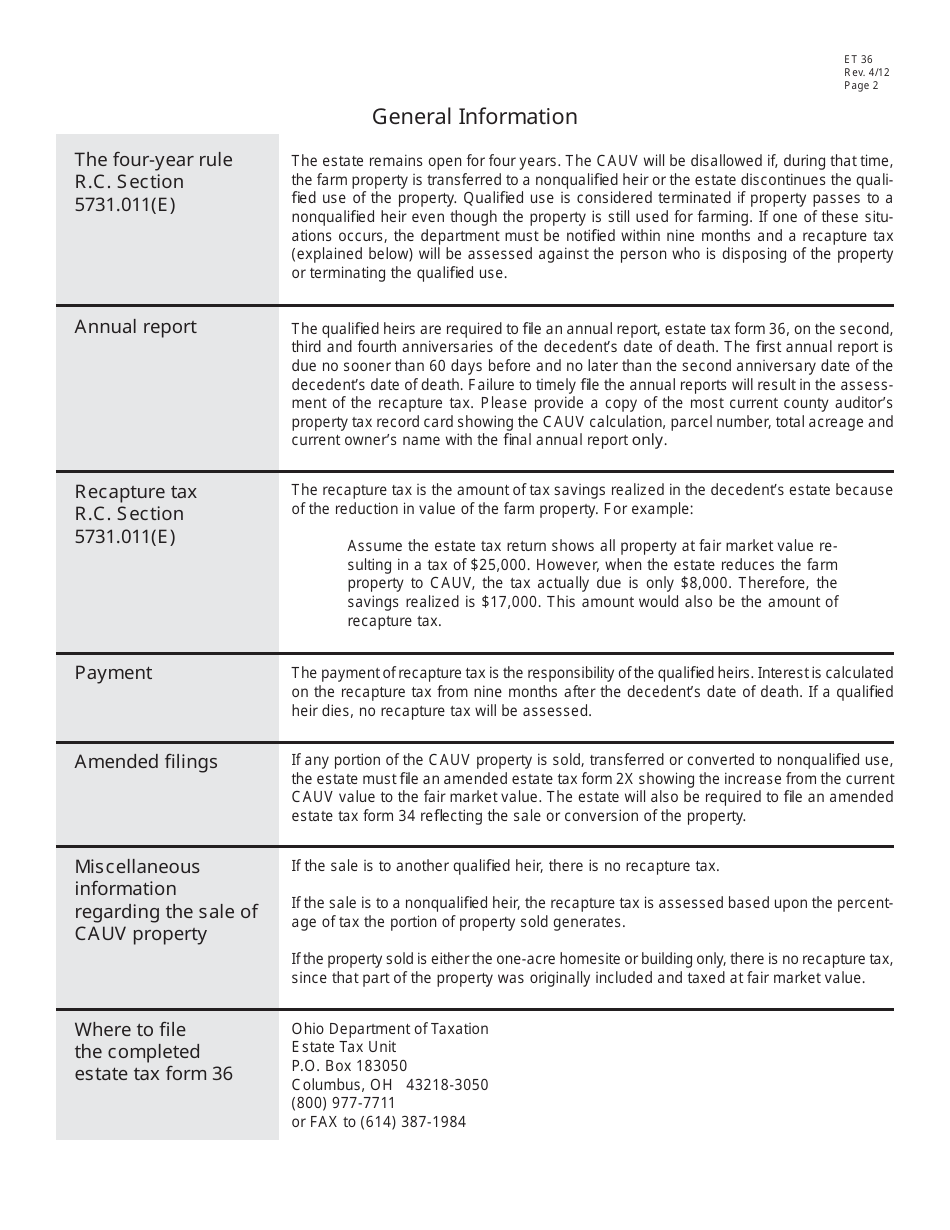

Q: When is the ET36 form due?

A: The ET36 form is due on the same date as the federal estate tax return, typically within 9 months after the decedent's death.

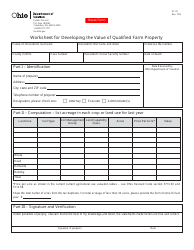

Q: What information is required on the ET36 form?

A: The ET36 form requires information about the decedent, the property, the farming activities, and the valuation of the property.

Q: Is there a filing fee for the ET36 form?

A: No, there is no filing fee for the ET36 form in Ohio.

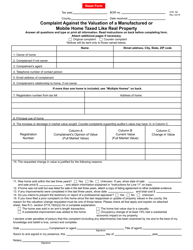

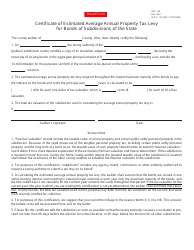

Q: What are the consequences of not filing the ET36 form?

A: Failure to file the ET36 form may result in the loss of certain tax benefits for qualified farm property.

Q: Can I amend the ET36 form if I make a mistake?

A: Yes, you can file an amended ET36 form to correct any errors or provide additional information.

Q: Are there any other forms that need to be filed along with the ET36 form?

A: Depending on the circumstances, other forms such as the federal estate tax return may need to be filed along with the ET36 form.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET36 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.