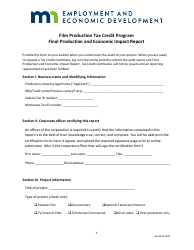

Instructions for Credit Allocation Application - Film Production Tax Credit Program - Minnesota

This document was released by Minnesota Employment and Economic Development Department and contains the most recent official instructions for Credit Allocation Application - Tax Credit Program .

FAQ

Q: What is the Film Production Tax Credit Program in Minnesota?

A: The Film Production Tax Credit Program is a program in Minnesota that provides tax incentives to filmmakers and production companies.

Q: How does the credit allocation application process work?

A: The credit allocation application process involves submitting an application to the Minnesota Film and TV Board, which will review the application and determine the amount of tax credits to be awarded.

Q: Who is eligible to apply for the Film Production Tax Credit?

A: Filmmakers and production companies that meet the eligibility requirements set by the Minnesota Film and TV Board are eligible to apply for the tax credit.

Q: What is the purpose of the Film Production Tax Credit?

A: The purpose of the Film Production Tax Credit is to attract and promote film production in Minnesota, thereby stimulating the local economy and creating job opportunities.

Q: What expenses are eligible for the tax credit?

A: Expenses such as wages, salaries, and fringe benefits paid to Minnesota residents, as well as certain production expenses incurred in Minnesota, are generally eligible for the tax credit.

Q: Is there a cap on the amount of tax credits that can be awarded?

A: Yes, there is a statutory cap on the total amount of tax credits that can be awarded each fiscal year, as determined by the Minnesota Legislature.

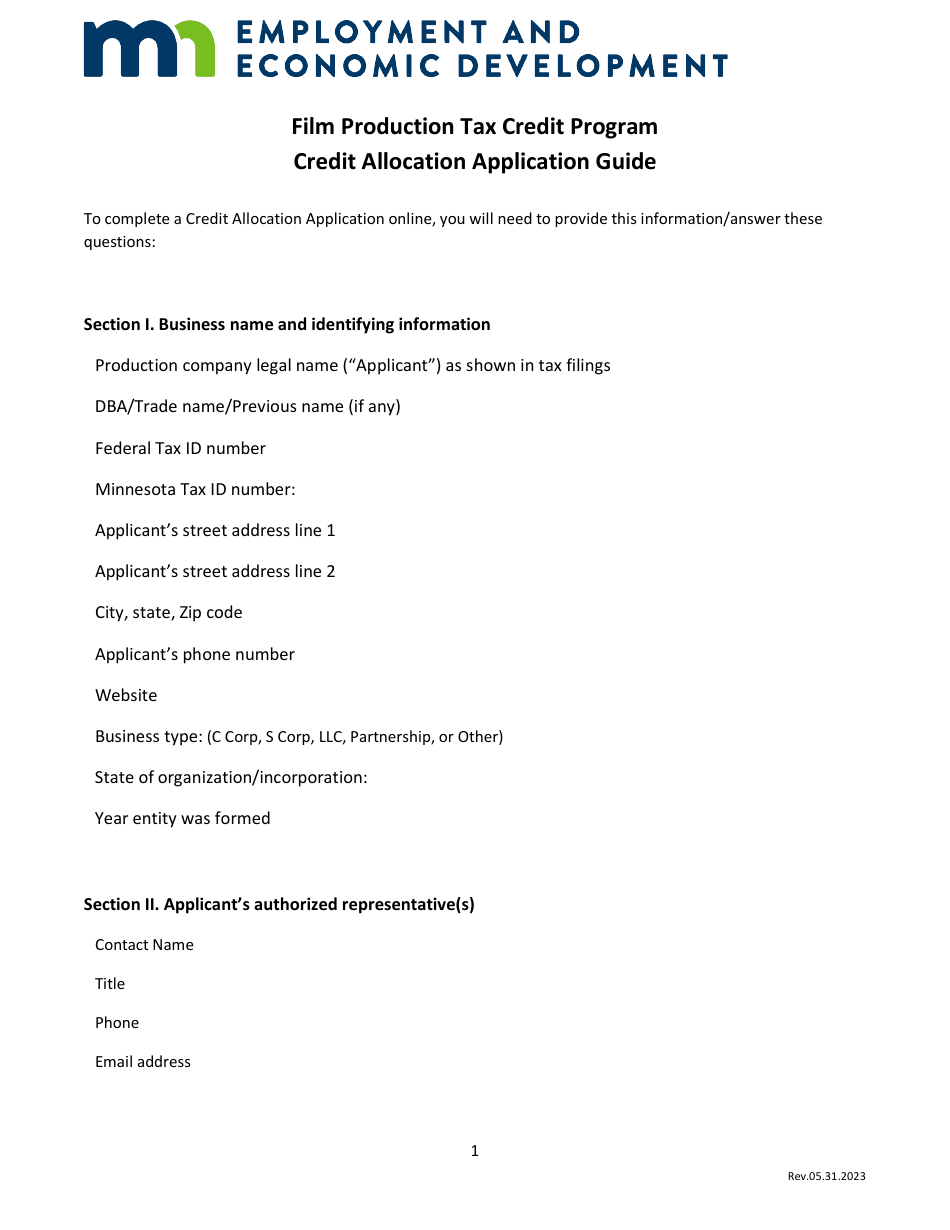

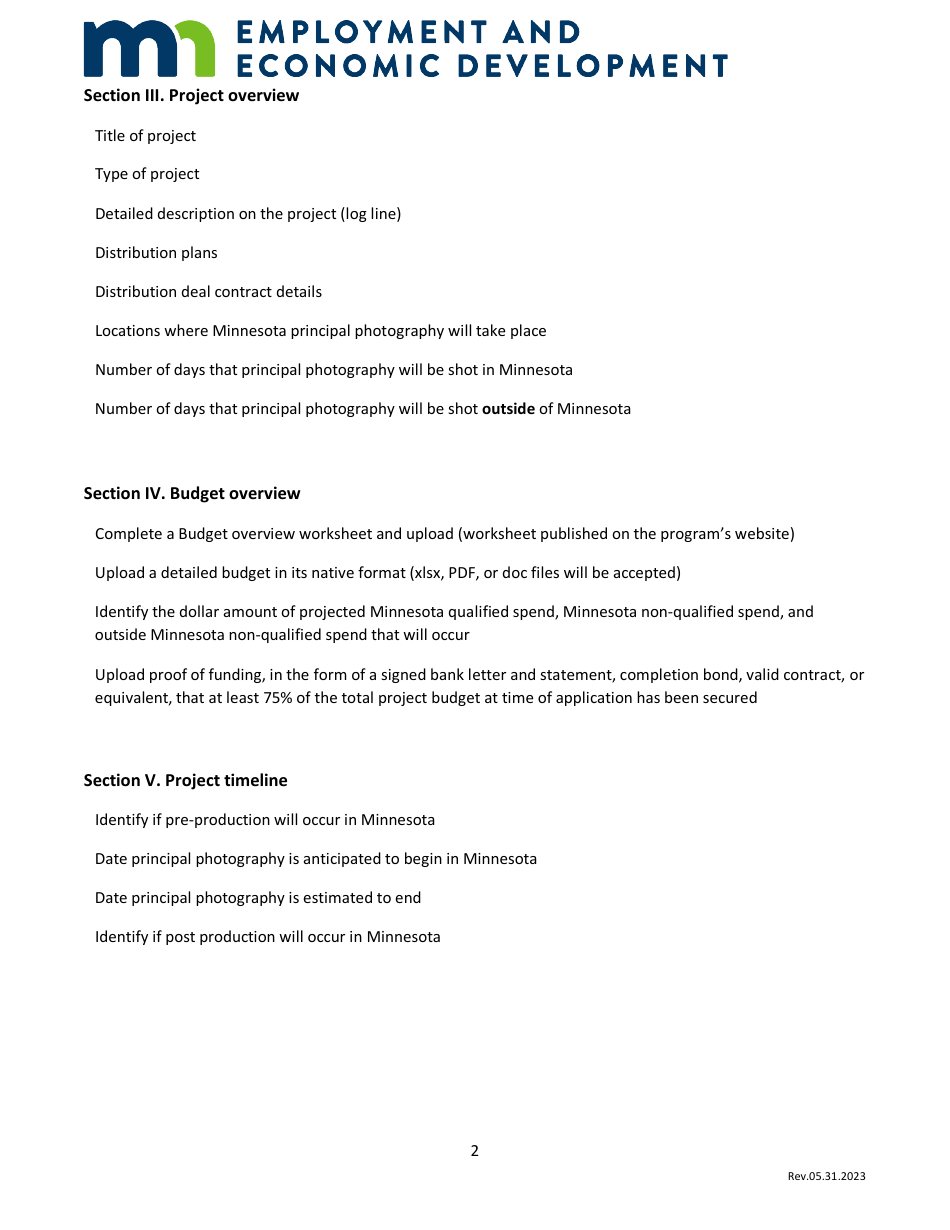

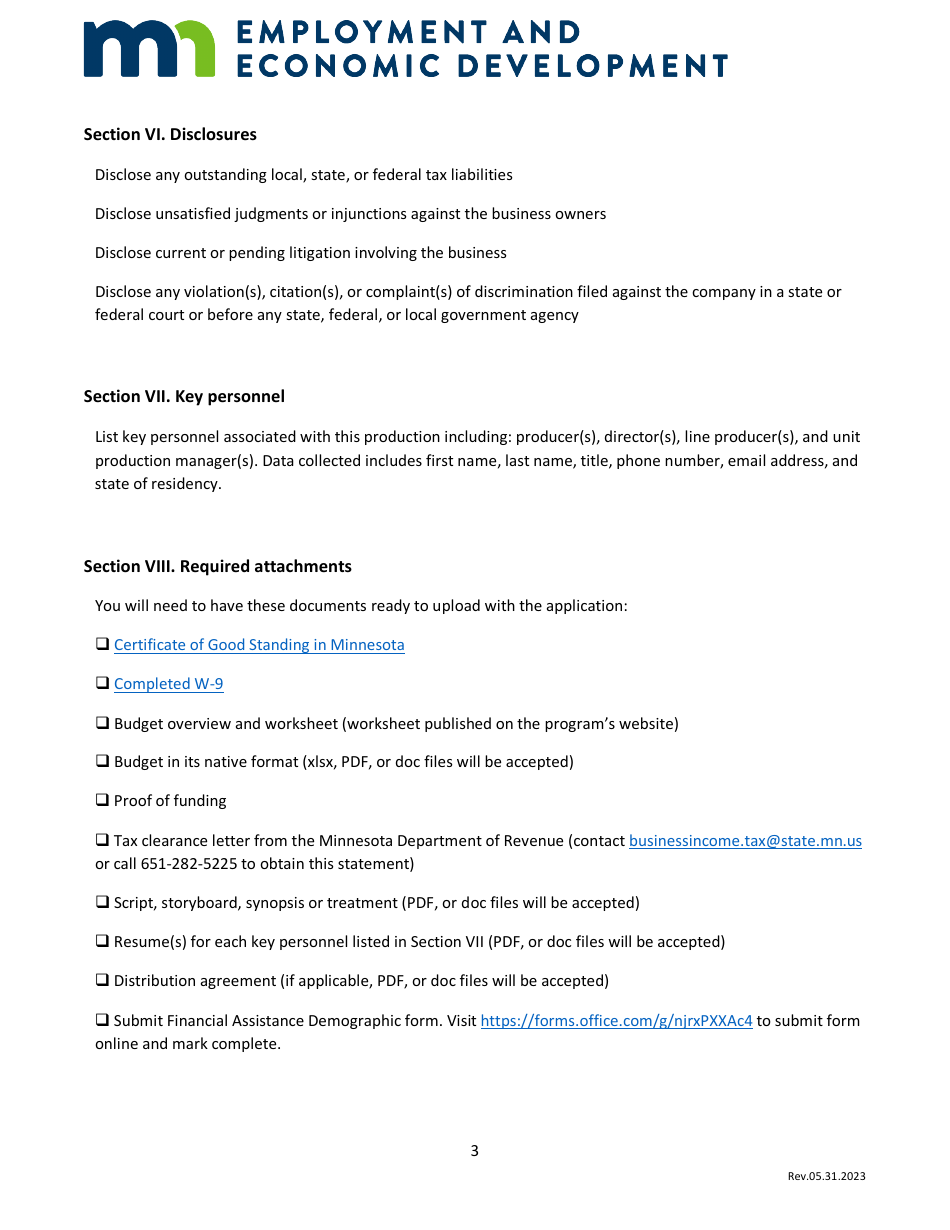

Q: What documentation is required to support the application?

A: Applicants are typically required to submit various supporting documents, such as production budgets, payroll records, and proof of expenditures.

Q: What is the deadline for submitting the credit allocation application?

A: The deadline for submitting the credit allocation application is typically set by the Minnesota Film and TV Board and can vary from year to year.

Q: How long does it take to receive a decision on the application?

A: The timeframe for receiving a decision on the application can vary, but it typically takes several weeks to several months.

Q: Can the tax credit be transferred or sold to another party?

A: Yes, the tax credit can be transferred or sold to another party, subject to certain restrictions and approval from the Minnesota Film and TV Board.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Minnesota Employment and Economic Development Department.