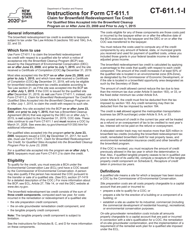

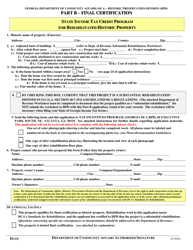

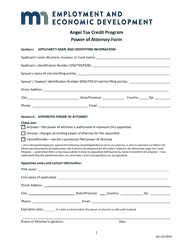

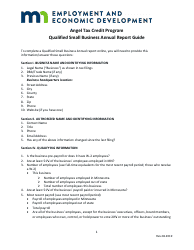

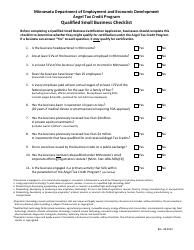

Instructions for Qualified Small Business Certification Application - Angel Tax Credit Program - Minnesota

This document was released by Minnesota Employment and Economic Development Department and contains the most recent official instructions for Qualified Small Business Certification Application - Angel Tax Credit Program .

FAQ

Q: What is the Angel Tax Credit Program in Minnesota?

A: The Angel Tax Credit Program in Minnesota is a program that provides tax credits to qualified investors who invest in eligible small businesses.

Q: What is the purpose of the Qualified Small Business Certification Application?

A: The purpose of the Qualified Small Business Certification Application is to certify that a business meets the eligibility criteria for the Angel Tax Credit Program.

Q: Who is eligible to apply for the Angel Tax Credit Program?

A: Qualified investors who invest in eligible small businesses are eligible to apply for the Angel Tax Credit Program.

Q: How can I apply for the Qualified Small Business Certification?

A: To apply for the Qualified Small Business Certification, you need to complete and submit the application form along with the required supporting documents.

Q: What supporting documents are required for the application?

A: The application requires various supporting documents, including financial statements, copies of securities offerings, and proof of eligibility for certain tax credits.

Q: Are there any fees associated with the application?

A: No, there are no fees associated with submitting the Qualified Small Business Certification Application.

Q: What is the deadline for submitting the application?

A: The deadline for submitting the application varies and is typically specified in the program guidelines or application instructions.

Q: How long does it take to process the application?

A: The processing time for the application can vary, but it generally takes several weeks to months to complete.

Q: What happens after the application is approved?

A: Once the application is approved, the business will receive a certification letter that can be used to claim the Angel Tax Credit on their tax return.

Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision within a certain timeframe as outlined in the program guidelines.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Minnesota Employment and Economic Development Department.