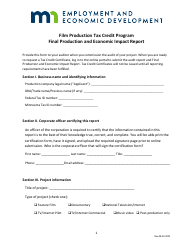

Final Production and Economic Impact Report - Film Production Tax Credit Program - Minnesota

Final Production and Film Production Tax Credit Program is a legal document that was released by the Minnesota Employment and Economic Development Department - a government authority operating within Minnesota.

FAQ

Q: What is the Film ProductionTax Credit Program in Minnesota?

A: The Film Production Tax Credit Program in Minnesota is a program that offers tax incentives to encourage film production in the state.

Q: What is the purpose of the Final Production and Economic Impact Report?

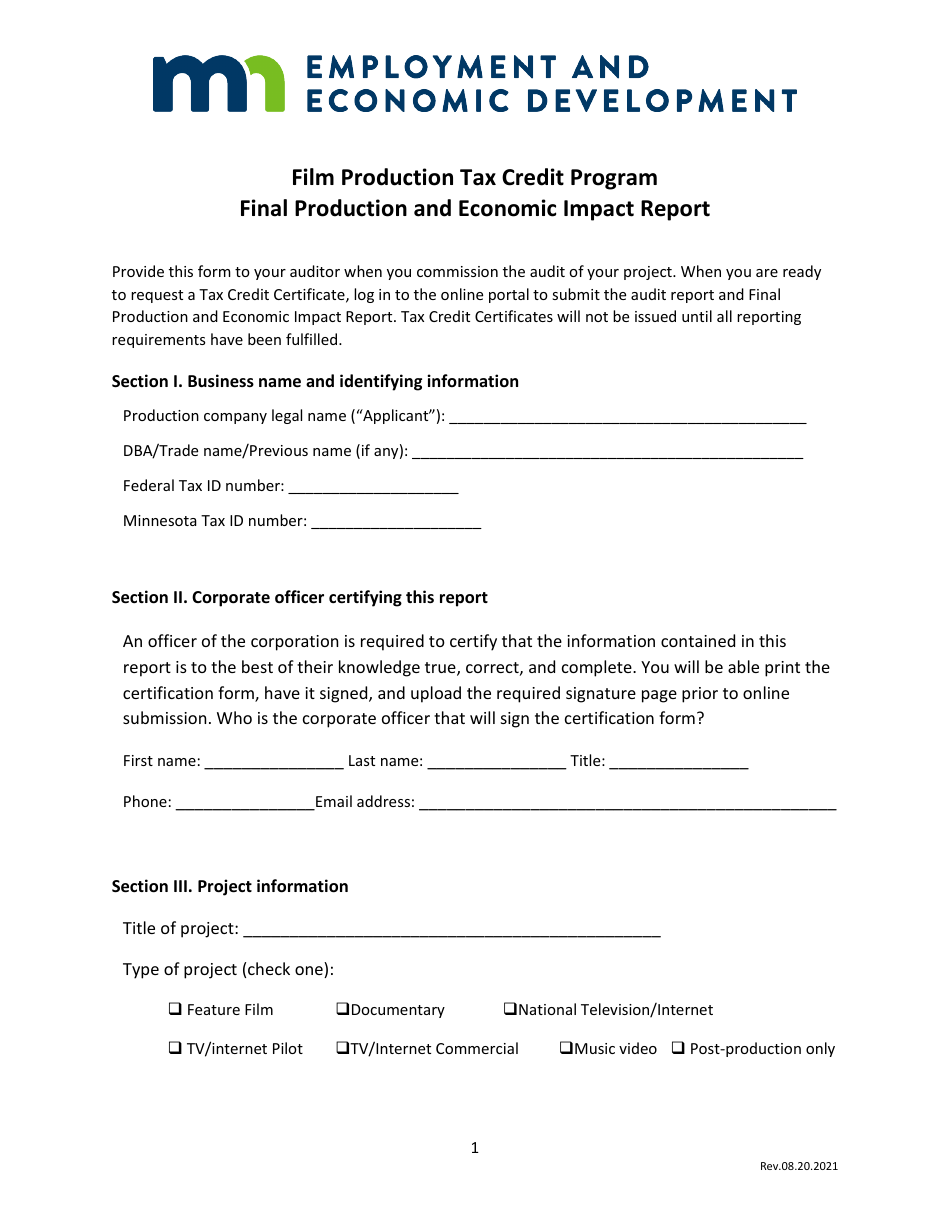

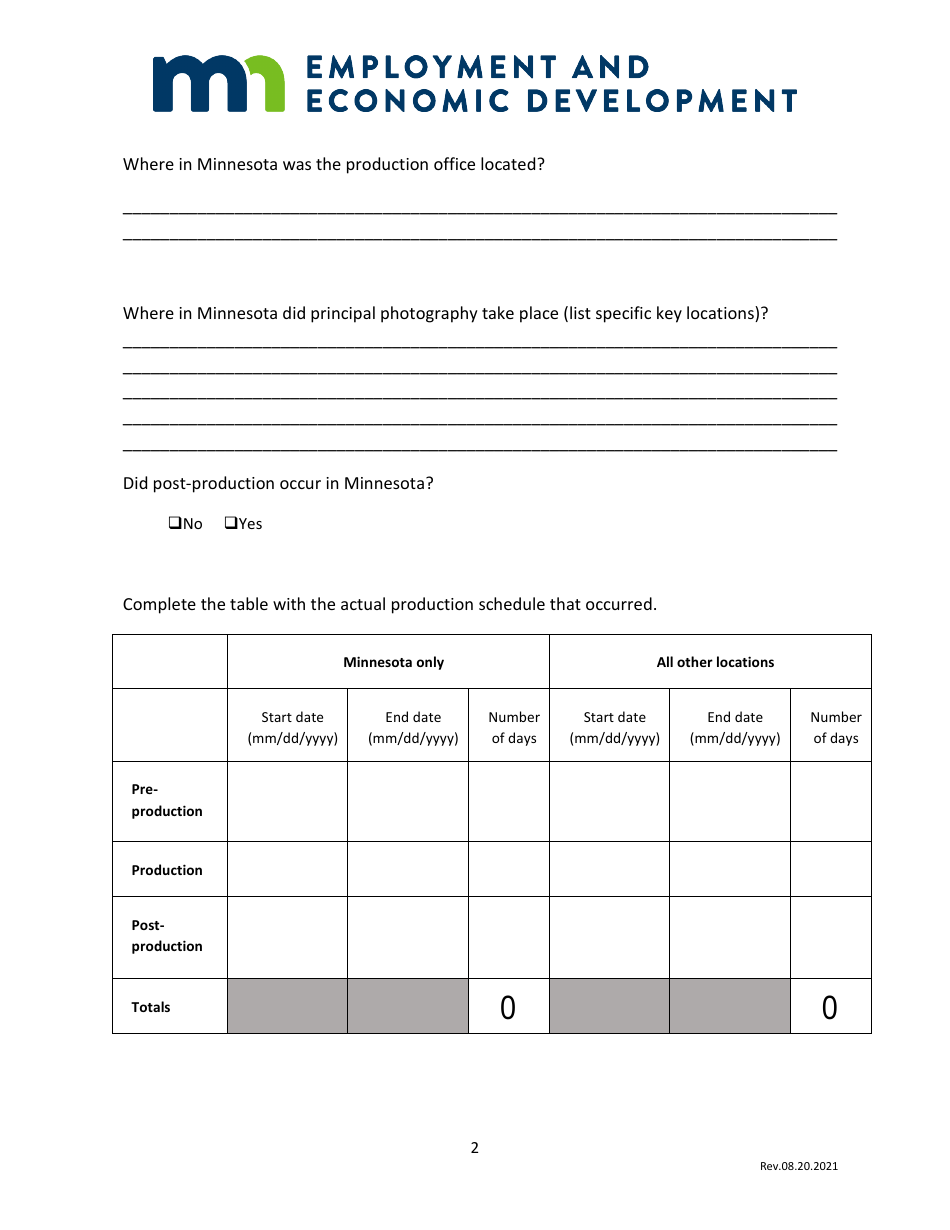

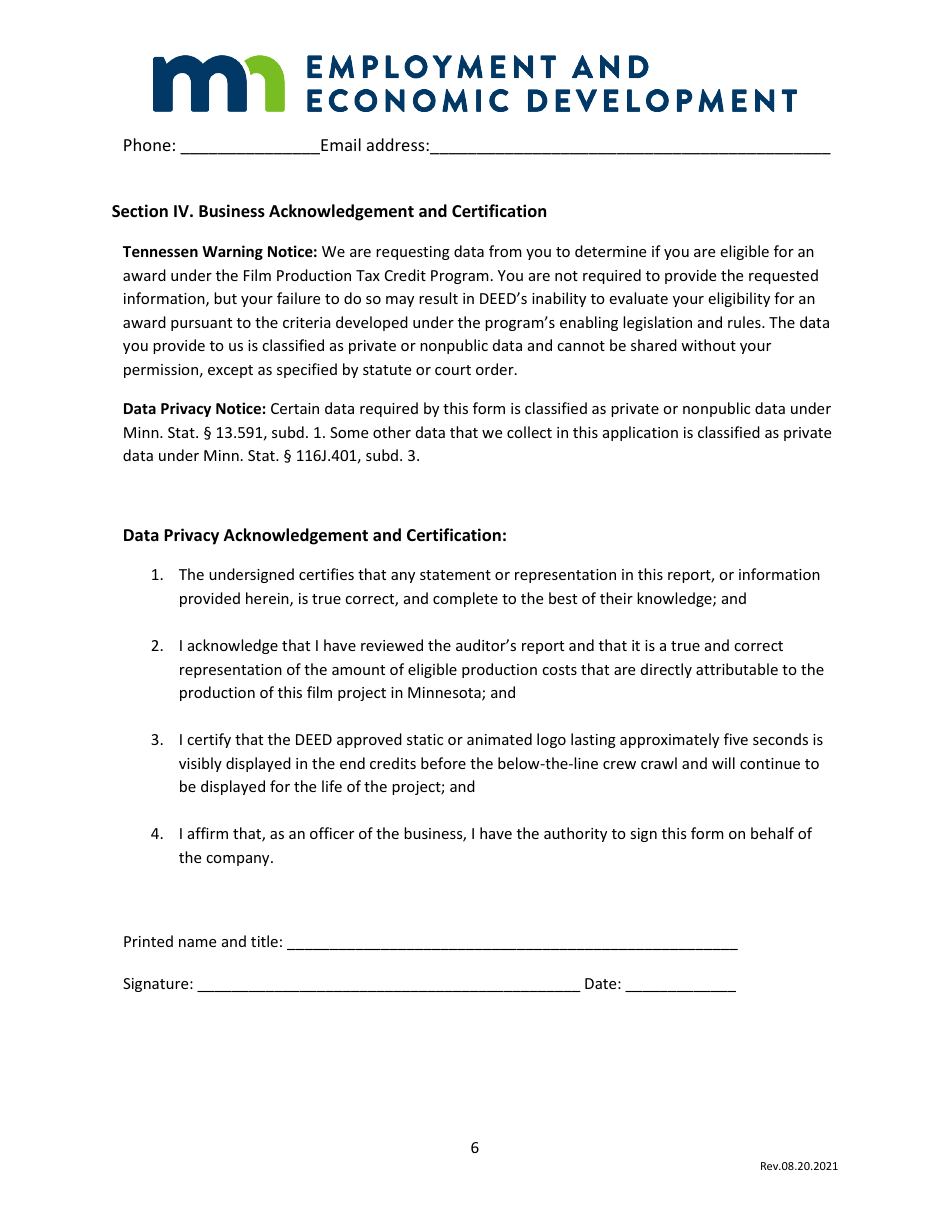

A: The purpose of the Final Production and Economic Impact Report is to assess the economic benefits and impact of the Film Production Tax Credit Program in Minnesota.

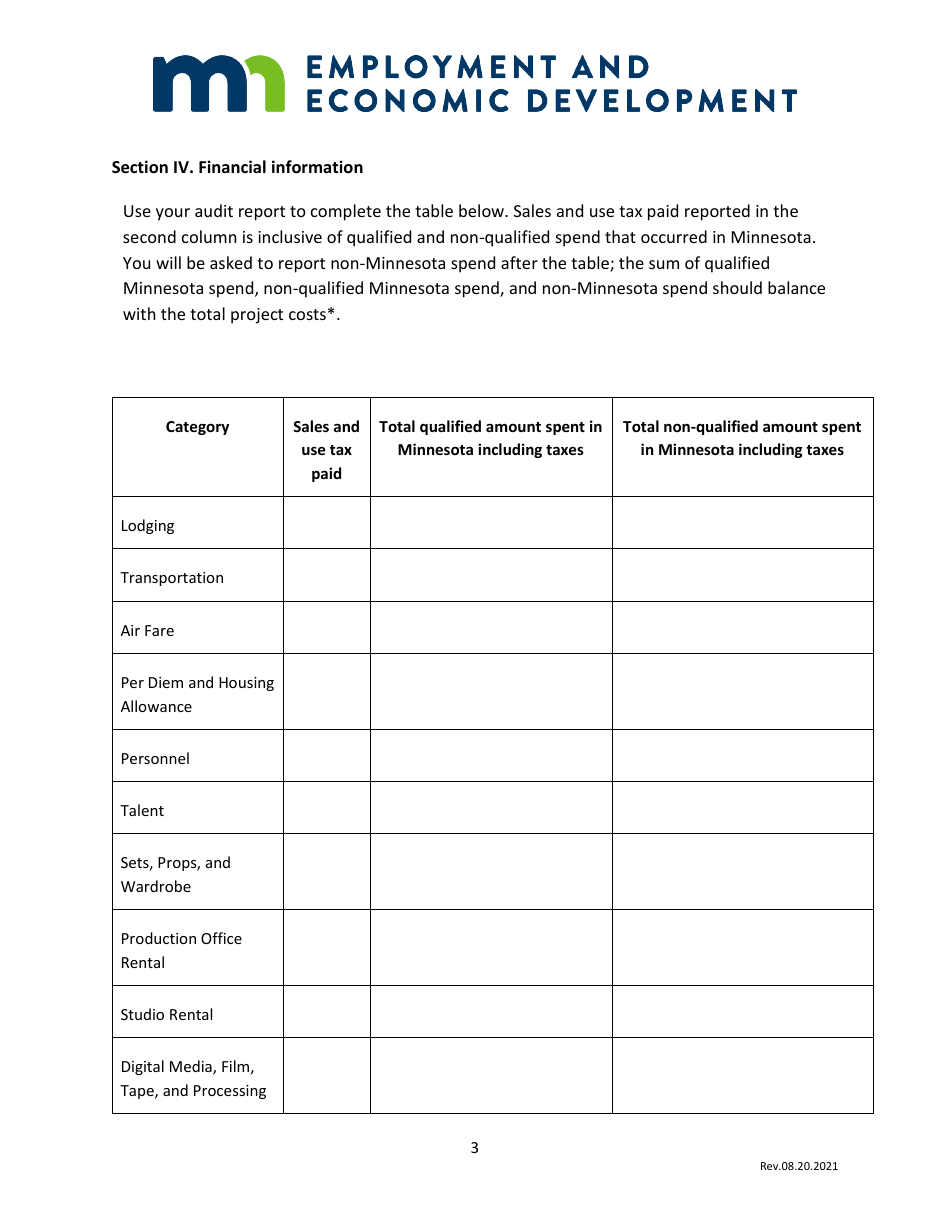

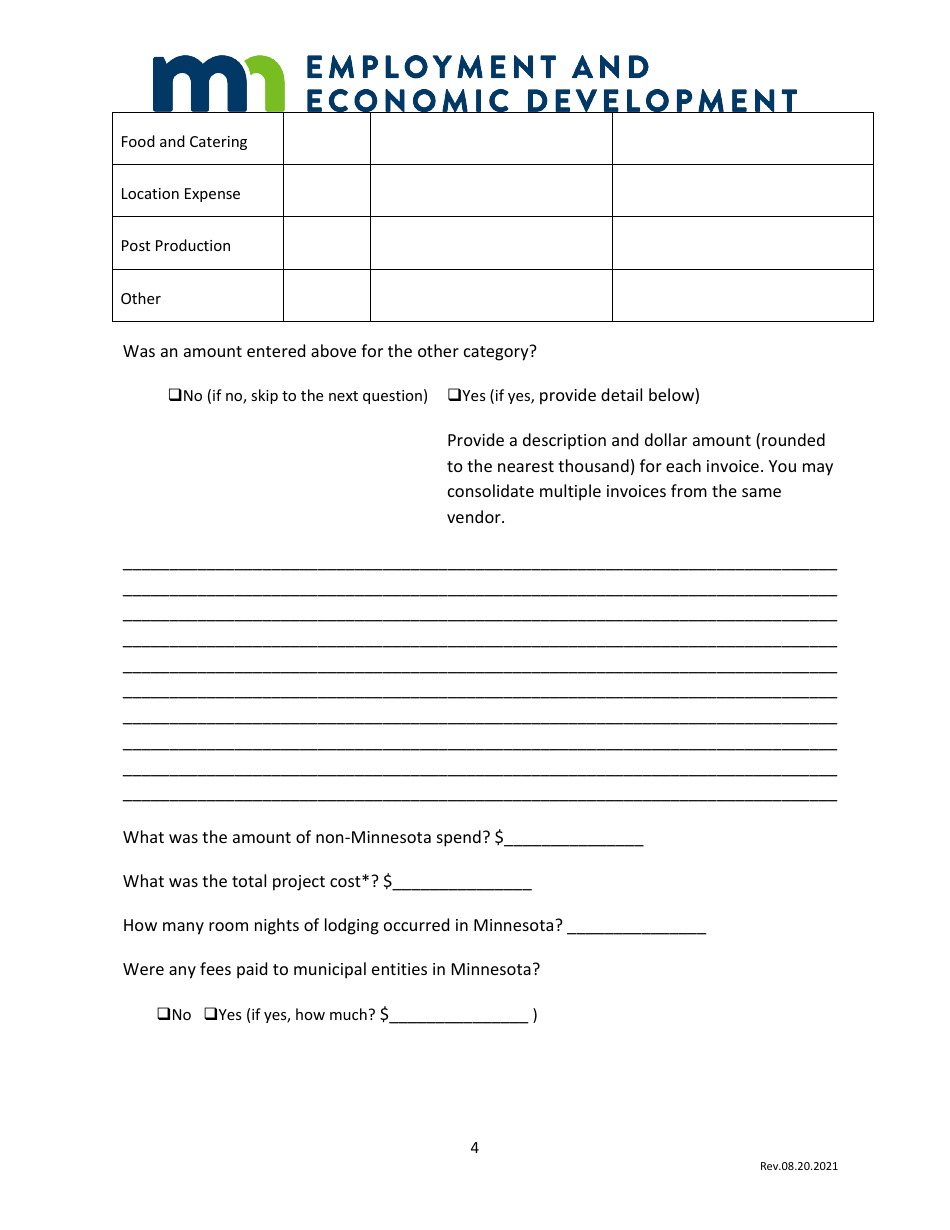

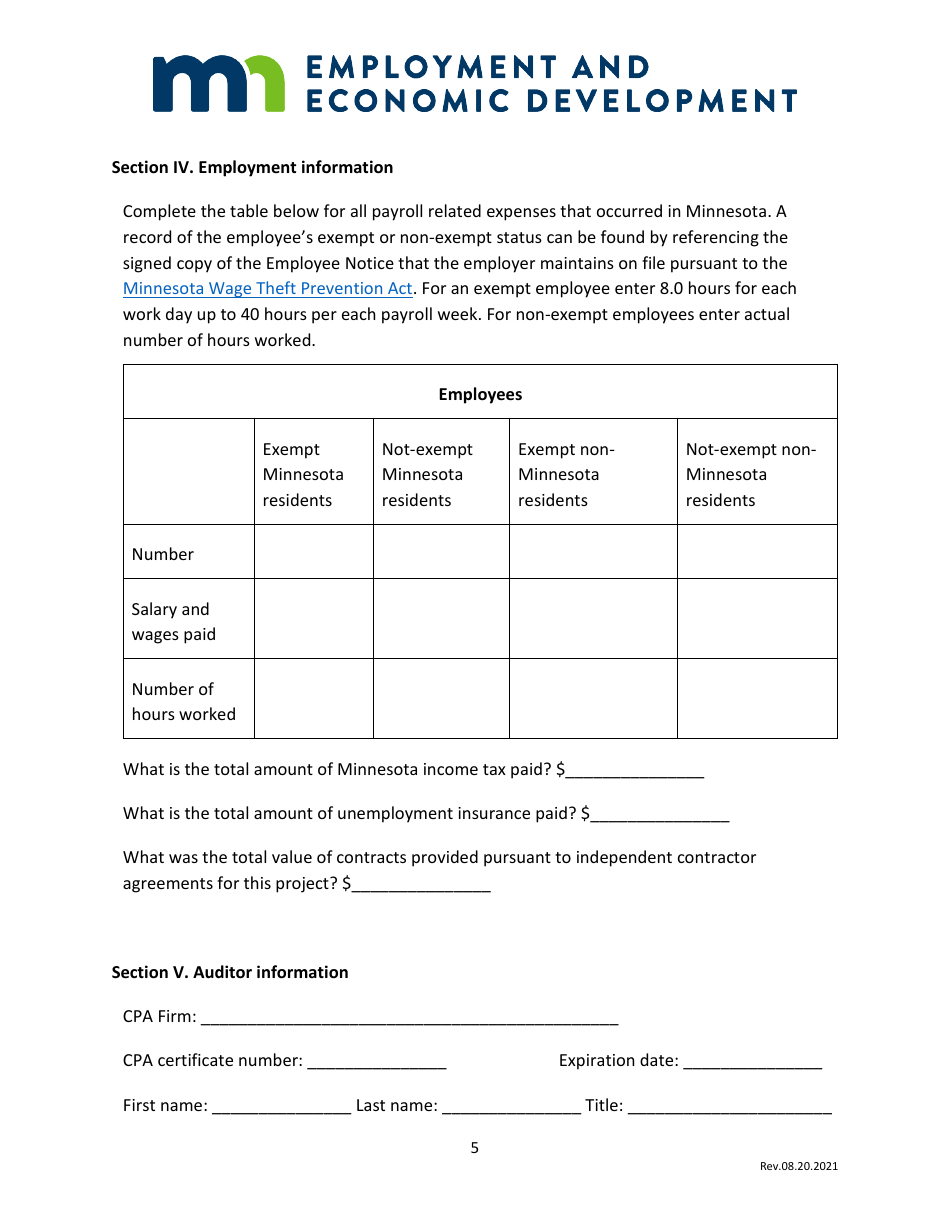

Q: What does the report evaluate?

A: The report evaluates the final production spending, employment opportunities, and economic activity generated by film productions that received tax credits.

Q: Why is the economic impact important?

A: The economic impact is important as it helps to determine the success and effectiveness of the Film Production Tax Credit Program in attracting and retaining film productions in Minnesota.

Q: What are some of the key findings of the report?

A: Some key findings of the report may include the total production spending, number of jobs created, and the overall economic output attributed to the film productions.

Q: How does the tax credit program benefit the economy?

A: The tax credit program benefits the economy by stimulating economic activity, creating jobs, and attracting investment in the film industry in Minnesota.

Q: Are there any recommendations provided in the report?

A: The report may provide recommendations for improving the effectiveness and efficiency of the Film Production Tax Credit Program based on its findings.

Q: Who can access the Final Production and Economic Impact Report?

A: The report is typically made available to government officials, industry stakeholders, and the public to assess the impact of the Film Production Tax Credit Program.

Form Details:

- Released on August 20, 2021;

- The latest edition currently provided by the Minnesota Employment and Economic Development Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Employment and Economic Development Department.