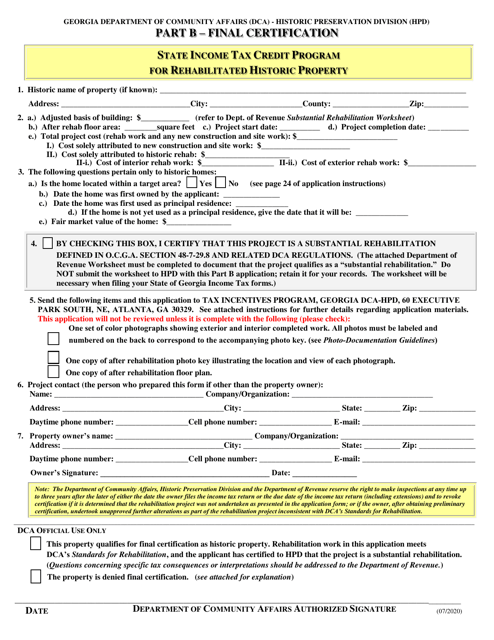

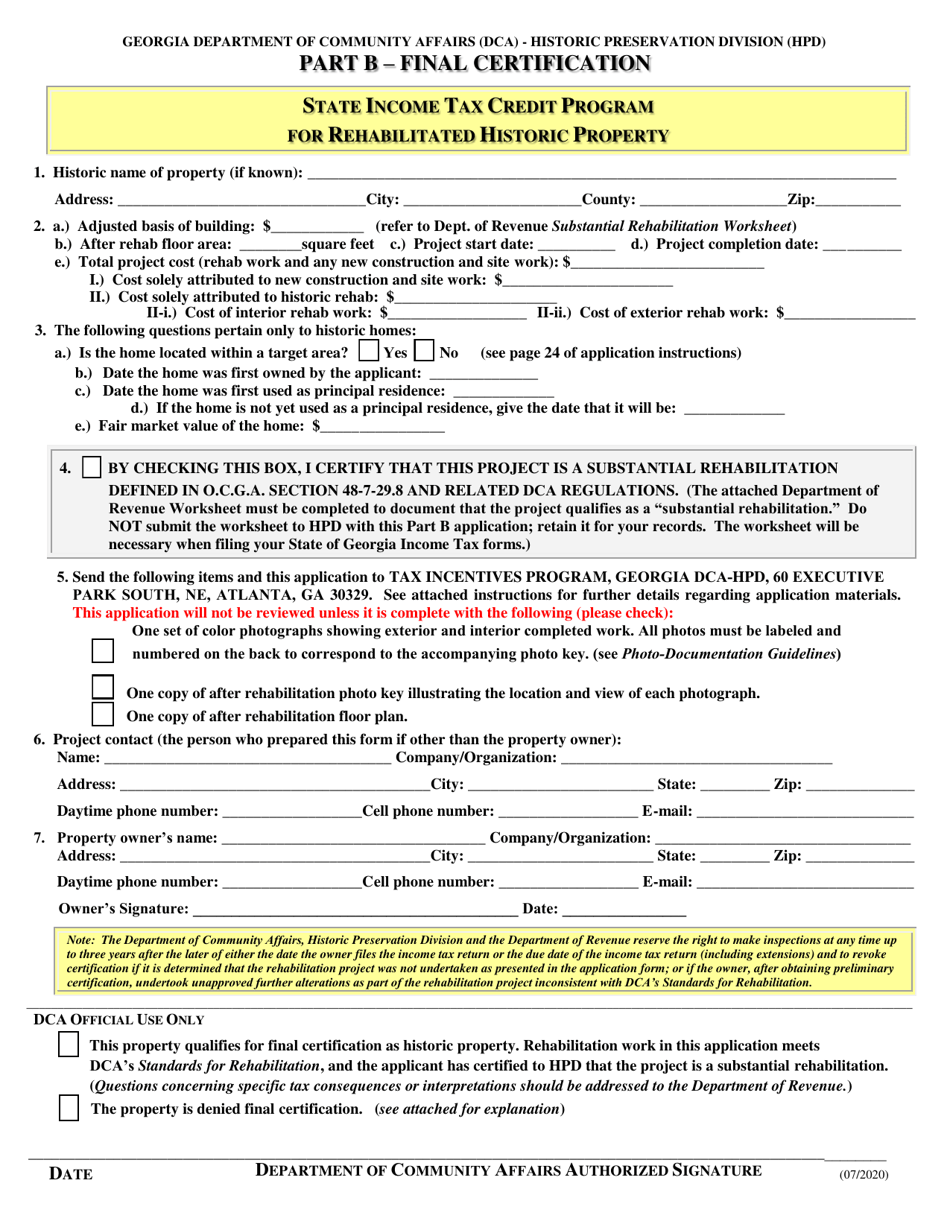

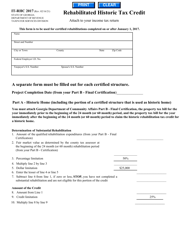

Part B Final Certification - State Income Tax Credit Program for Rehabilitated Historic Property - Georgia (United States)

What Is Part B?

This is a legal form that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the State Income Tax Credit Program for Rehabilitated Historic Property in Georgia?

A: The State Income Tax Credit Program for Rehabilitated Historic Property in Georgia is a program that provides tax credits to property owners who rehabilitate historic buildings.

Q: How does the program work?

A: Owners of rehabilitated historic properties in Georgia can receive tax credits equal to a percentage of their qualified rehabilitation expenses.

Q: Who is eligible for the program?

A: Property owners who have rehabilitated a historic property in Georgia and meet certain criteria are eligible for the program.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses include costs related to the rehabilitation of the historic property, such as labor, materials, and architectural fees.

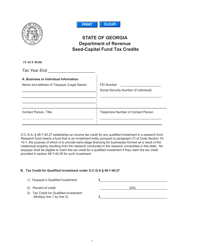

Q: How much tax credit can property owners receive?

A: Property owners can receive tax credits equal to 25% of their qualified rehabilitation expenses.

Q: Are there any limitations on the tax credits?

A: Yes, there is a cap of $300,000 per property for tax credits, and the program has a statewide cap of $10 million per year.

Q: Can tax credits be carried forward or transferred?

A: Yes, unused tax credits can be carried forward for up to 10 years, and they can also be transferred to another taxpayer.

Q: Are there any restrictions on the use of the tax credits?

A: Yes, tax credits can only be used to offset Georgia income taxes, and they cannot be used to reduce federal income tax liabilities.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Georgia Department of Community Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Part B by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.