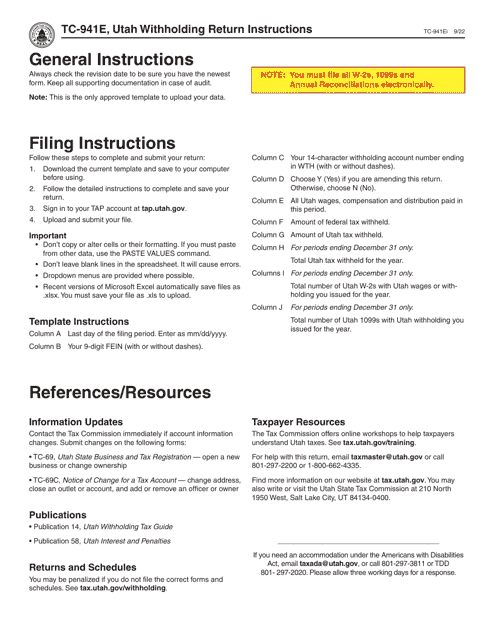

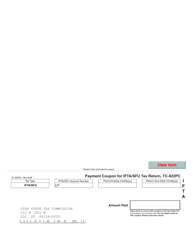

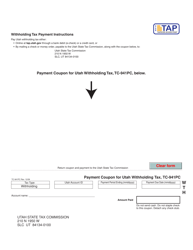

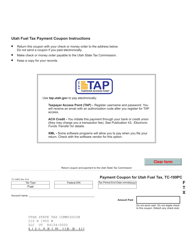

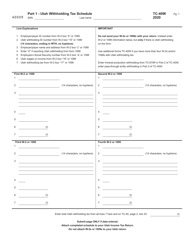

Instructions for Form TC-941E Template for Utah Withholding Tax - Utah

This document contains official instructions for Form TC-941E , Template for Utah Withholding Tax - a form released and collected by the Utah State Tax Commission.

FAQ

Q: What is Form TC-941E?

A: Form TC-941E is a template for Utah Withholding Tax.

Q: What is Utah Withholding Tax?

A: Utah Withholding Tax is the amount of money deducted from employees' wages to be paid to the state of Utah.

Q: Who uses Form TC-941E?

A: Employers in Utah use Form TC-941E to report and pay their withholding taxes.

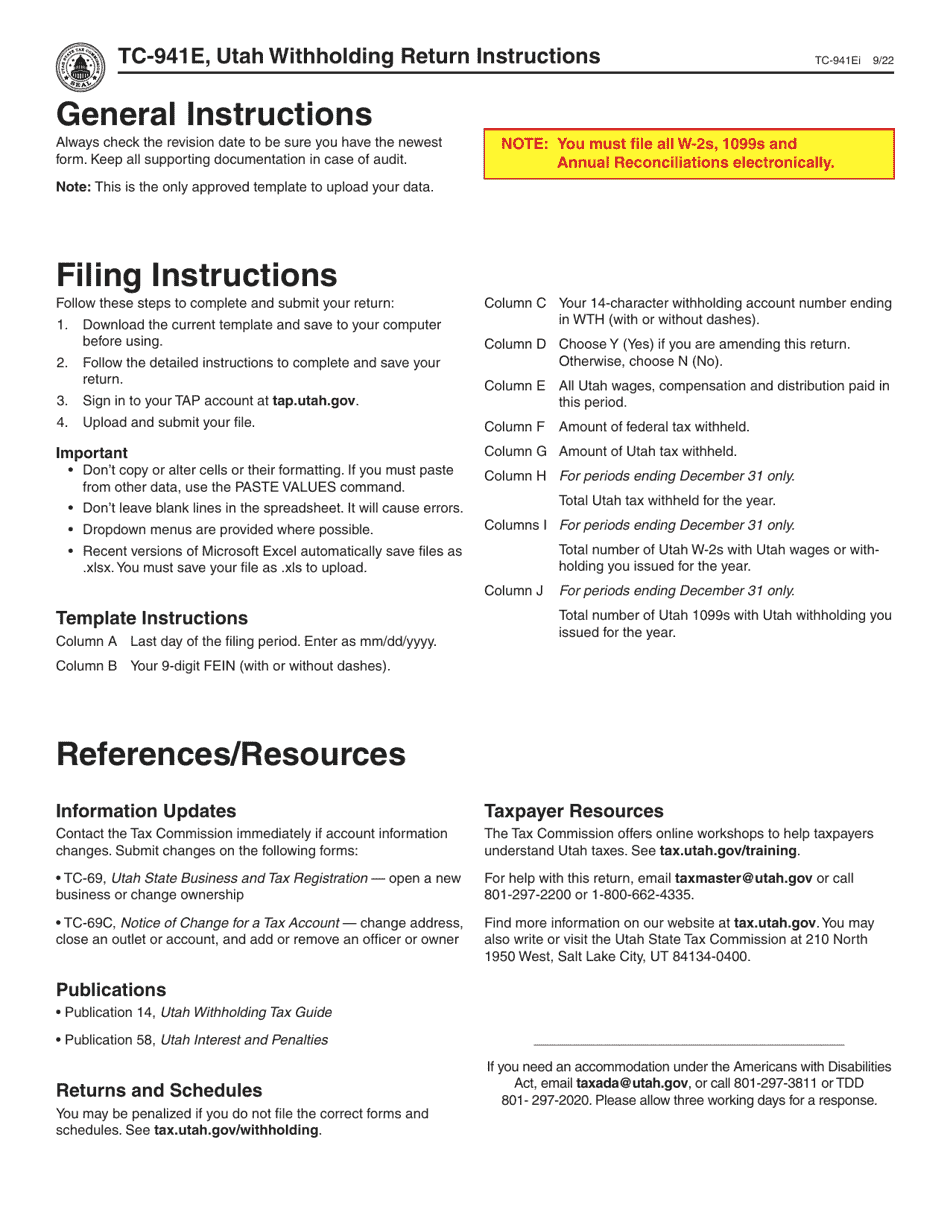

Q: What information do I need to fill out Form TC-941E?

A: You will need your business information, employee details, and the amount of withholding tax withheld.

Q: How often do I need to file Form TC-941E?

A: Form TC-941E must be filed quarterly, on or before the last day of the month following the end of each calendar quarter.

Q: Is there a penalty for late or incorrect filing of Form TC-941E?

A: Yes, there may be penalties for late or incorrect filing. It is important to file accurately and on time.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.